A group of Calgary energy entrepreneurs has a novel idea – that could have much lower capital costs and much lower operating costs – for getting Canadian natural gas to Korea and other Asian markets.

Building LNG (Liquid Natural Gas) terminals on tidewater in western North America has been a tough sell. High costs, environmental impact concerns and activism have caused regulatory delays in both Canada and the United States.

What can you do when you can’t get an LNG terminal built on tidewater?

The answer for tiny TSX Venture company ArcPacific (ACP – TSVX) is simple: you build it inland and transport the LNG to the coast. In Asia and Europe, using existing rail and large river barge infrastructure is a common way to move commodities—including LNG—to markets.

Arc Pacific calls its project “WESCO LNG” , and it’s bringing together major

What they are moving forward is the WESCO LNG project. This is a very early stage project. But it is pursuing a novel idea – an LNG production terminal located inland in a sparsely populated area away from the most active opponents of large energy projects, with the ability to tie into an existing underutilized, long-haul pipeline and use existing infrastructure to transport the LNG to the coast.

Getting the Gas (LNG) to Tidewater

WESCO plans to use an existing pipeline to transport the feed gas to the production facility. By avoiding the high cost of a major new pipeline, the project saves billions in capital cost.

So it SHOULD be able to deliver the LNG to the coast at a much lower cost than any other proposed West Coast projects. And this means that the project can be phased-in to meet market demand. This is not an option for other LNG projects in Western North America which must cover the pipeline development cost – up to $7 billion — from Day 1.

Management says that WESCO’s approach also saves years and tens of millions of dollars of permitting time and expense. Long-haul pipelines by definition cross many jurisdictions and so have a significant environmental and landowner impact.

This means that the process involves countless government agencies and the land rights of many property owners plus exposure to many First Nations land ownership claims.

West Coast energy projects have been plagued with

- The cost of construction,

- extensive regulatory oversight, and

- political complications associated with new pipelines

Having an inland LNG terminal has the potential to avoid that.

Once the LNG is near the coast, WESCO will then transfer the LNG to large, standard LNG tanker vessels which will transport the LNG to Asian markets. This transfer process is referred to as a Ship to Ship transfer

This is not new technology. Privately owned Excelerate Energy has done over 1,500 such ship-to-ship (STS) transfers with more than 171 million cubic meters of LNG transferred. Complete STS technology solutions are now available on the market and STS operations are becoming routine in both Europe and Asia.

Source: Company Presentation

Getting Canadian NatGas to Market Cheaper

Building an LNG terminal inland has its advantages.

First off, investors are saving the capital cost of the pipeline. The Coastal GasLink pipeline from Dawson Creek to Kitimat, which would serve a competing, proposed LNG project, has an estimated cost of $6.6 billion. It will transport 2.1 Bcf/d with further expansion potential. In contrast, on a per Bcf/d basis, WESCO’s approach will require only a fraction of that capital investment.

A second advantage is cheap power. WESCO has easy access to abundant, low-cost renewable hydro and wind power which already exists in its region. This power is in surplus and that surplus is expected to increase.

Management says that by using renewable energy for nearly 100% of its energy input, WESCO will be one of the “greenest” LNG projects in the world.

Transportation and operating costs for WESCO should compare favorably to other West Coast LNG projects – total input costs are ~1/3 t0 50% of other West Coast LNG projects according to the company.

Sourcing Gas from North America’s Cheapest Hub – AECO

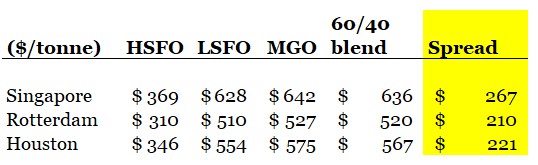

Still, transportation costs to tidewater are higher than the Gulf Coast. But a couple of factors more than make up for that expense:

- Lower natural gas costs from AECO-priced supply

- Cheaper shipping costs to Asia

AECO pricing has lagged US Henry Hub natural gas pricing for years. As increasing US shale gas production has taken more market share there, the AECO price discount versus Henry Hub has only increased—a pattern which could last for decades.

Source: Arc Energy

Even with recent mandated changes to the operation of the Nova Gas transmission line (a topic we covered in the blog post: How Cheap are NatGas Stocks), AECO prices still trail Henry Hub . The futures price shows the AECO price trailing the Henry Hub price for the year 2024 by over $US.80/MMBtu.

What’s more, the market is not enthusiastic as you look further out – the current futures price for the year 2024 shows AECO at US$1.69/MMBtu while Henry Hub is at US$2.51MMBtu.

To get the gas from British Columbia and Alberta gas production fields to their LNG terminal, WESCO will use the existing TC Energy pipeline system. Traditional natural gas markets that used natural gas for power generation are increasingly turning to renewable energy. As a result the company expects no problems accessing capacity on these pipelines.

Asian Shipping Costs

And of course, the US west coast is MUCH closer to Asia than the US Gulf Coast. LNG from the Gulf Coast must travel 10,000 nautical miles compared to 5000 nautical miles for a West Coast project; plus a Gulf Coast project must first transit through the Panama Canal which causes an additional delay and incurs a hefty Canal fee.

LNG from the US Gulf Coast either must travel through the Panama Canal or along a long, expensive route via the Cape of Good Hope in South Africa.

Last year the Canadian Energy Research Institute (CERI) compared various Canadian LNG export options to Gulf Coast LNG and to LNG from Australia.

Source: CERI Competitive Analysis of Canadian LNG, 2018

Shipping costs from Western Canada to Asia are much cheaper than US Gulf Coast gas, and only 9% more expensive than LNG from Australia (where capital costs and costs of gas production are substantially higher than in North America).

Keep in mind the CERI report is looking at LNG terminal costs off the coast of British Columbia that include the full transportation cost.

The shipping method proposed by WESCO lowers costs even further.

Contracts are expected to be primarily a blend of low-risk, fixed-price tolling contracts and take-or-pay offtake agreements that provide more upside from LNG prices. A small amount of capacity is expected to be allocated to merchant sales that will capture the full upside in price.

This leads us to the other reason for the inland terminal. The belief is twofold:

- Inland communities tend to have less opposition to development than coastal communities—most inland areas are not as wealthy and embrace regional economic improvement

- Transportation of LNG to the coast eliminates the need for any major pipeline development.

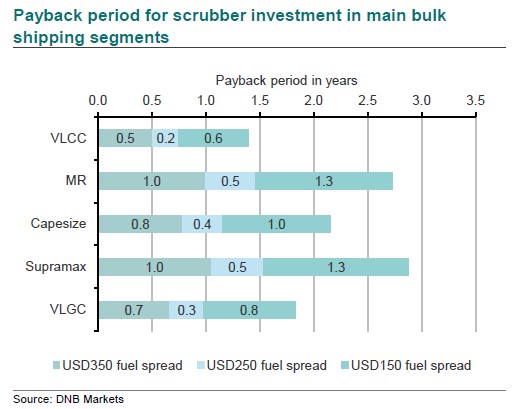

Final Investment Decision Not Until 2023

The project is calling for a 6 MTPA liquefaction facility located inland. One MTPA (million tons per annum is approximately 135,000 MMBtu/day). The project can be built in three phases of 2 MTPA at a time.

The project will use a floating LNG terminal. This minimizes onshore land use and reducesA LOT of the environmental impact – again making permitting much easier and quicker.

Floating LNG terminals (which can largely be built in Asian shipyards) also typically have much lower capital costs versus traditional “stick-built” LNG plants built onshore which are prone to cost overruns and labor shortages.

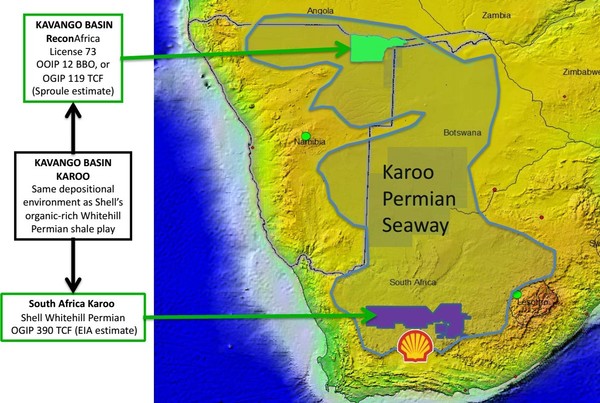

As the map below shows, Western North America has an extensive existing pipeline grid that links all major supply basins. An inland project can tie into this highly integrated pipeline grid to ensure supply security and competitive feed gas prices.

WESTERN NORTH AMERICA SUPPLY BASINS AND PIPELINE GRID

Source: NWGA

The only pipeline requirements for WESCO is a short lateral pipe connecting the project terminal with an existing major long-haul pipeline mainline. The company says this line would not pose any significant environmental concerns. A short electrical transmission line to the site will also be built—all in a very sparsely populated, rural area.

Capital expenditures for WESCO are expected to come in around $4 billion for the full 6 MTPA (million tons per annum) build out (mgmt. suggests it could actually be $3 billion; $4 billion is playing it safe), which includes the terminal and the transport barges. A conservative estimate pegs that price tag on a 4 MTPA terminal, but the company believes they can deliver 6 MTPA for the cost.

Source: Sprott Korea Presentation

The Final Investment Decision (FID) is expected in 2023, which gives a little over 3 years for permitting approvals and construction financing to be arranged. Final permitting approval is expected June 2022.

ArcPacific can earn up to 75% in the project by spending $50 million on the development over the next 3 years.

The remaining equity of WESCO would be split 50/50 between the project originators and a Sprott Korea affiliate.

Subsequent construction capital will come from the market, but could be guaranteed by the Korean Export-Import Bank. The guarantee would bring down the cost of capital significantly. It is expected that debt to equity will be around 75/25.

Project Economics

If management can pull this off, the WESCO project should have some excellent economics.

The combination of cheap, abundant Western Canadian gas, no pipeline and a relatively short and direct path to Asia make the project competitive with any global LNG project.

Source: Company Presentation

Compare these costs to LNG Canada. The CDN$40 billion price tag on LNG Canada includes a CDN$17 billion LNG plant at Kitimat and a CDN$6.2 billion Coastal GasLink pipeline.

LNG Canada is expected to process 1.7 bcf/d of natural gas into 14 MTPA of LNG.

With a $4 billion cost estimate, WESCO is a virtual bargain in comparison. WESCO’s capital costs per ton of LNG production capacity are only about half of LNG Canada’s, and WESCO’s operating costs per ton of LNG are also likely to be lower than LNG Canada’s.

CONCLUSION – A Unique Angle to LNG

This is a really early stage project and there are lots of hurdles ahead. The regulatory environment will have its pitfalls, as it always does.

That said, the unique approach makes this a development project worth keeping an eye on.

Given the stigma around pipelines these days, a model that removes the requirement for a large-scale pipeline project could have an important leg up.

What remains to be seen is how the environmental opposition organizes against the project. Clearly this project has been designed to manoeuvre through the most contentious aspects of the West Coast permitting maze; however, any major fossil fuel energy project these days can expect opposition.

Nevertheless, the early estimates show compelling economics. The capital required for river transport is a fraction of what a pipeline would cost. And the capital cost reduction (and cost control) achievable with a floating LNG production facility versus an onshore facility is substantial.

The West Coast is the natural location to transport gas to Asia. That the Korean government is open to backing the debt from the project shows their interest level is high.

Finally, any project that will find new markets for Western Canadian Sedimentary Basin gas will certainly have the support of a Canadian natural gas industry that is desperate for more markets and takeaway capacity.

Many stakeholders stand to benefit. Just a matter of getting through the regulatory maze.

EDITORS NOTE: The Market believes US oil production in the Permian basin will rollover – plateau and maybe even decline. If that happens, oil stocks will soar – and this fully covered 13% yield could go to 30% – GET THE NAME AND SYMBOL OF THIS STOCK RIGHT HERE.