Gold is trading very near its All-Time-High(ATH) in almost every major currency right now.

The US dollar gold price has held up remarkably well for over FIVE YEARS now, starting a 65% run up in 2018—as interest rates rose (Dow is up 58% since then). Then it peaked at US$2000 per ounce in late 2020—as interest rates plummeted.

And since then, it has stayed within a whisker of—and a few times it was OVER US$2000/ounce—as interest rates rose again.

I hope you get the picture here. Gold has, and is, doing well through ALL markets, currencies & economies right now. And this is a very bullish consolidation chart—right at the top of its recent range.

As gold breaks out this fall, a trifecta of good news will help propel gold stocks:

- a rising N A V because the gold price is rising

- as gold moves up, investors will give it a better multiple of N A V—Net Asset Value

- a higher gold price makes more of your reserves economic.

So investors get this triple benefit of higher multiples on more ounces that are valued at a higher level.

That’s really powerful. I think there is a lot of asymmetry built in to gold equities right now. And that’s a characteristic that I really like.

And of course, almost nobody owns gold anymore:

-It now only makes up 0.5% of the S&P 500

-Even with gold near ATH in every currency, investors continue to redeem the gold ETFs

The smallest bit of investor interest will make a BIG difference—another asymmetry that makes gold stocks a low risk bet here.

NOBODY IS LISTENING

TO GOLD—EXCEPT….

Gold is up 40% in the last 10 years in USD, but it’s up

- 68% vs the Chinese yuan

- 73% vs the pound in the UK

- 80% against Canada’s loonie

- 100% in Japan,

- 133% in Swedish krona,

- 200% in Brazil

See this Bloomberg story from just last Thursday:

Gold has been sending its message to the world—loudly—in many languages FOR THE LAST DECADE.

I told you earlier—investors aren’t listening to gold. Gold stocks underperformed bullion by 20% last year–setting up one of the most asymmetric trades I have ever seen.

It’s like buying oil stocks in March 2020 when oil pricing went negative.

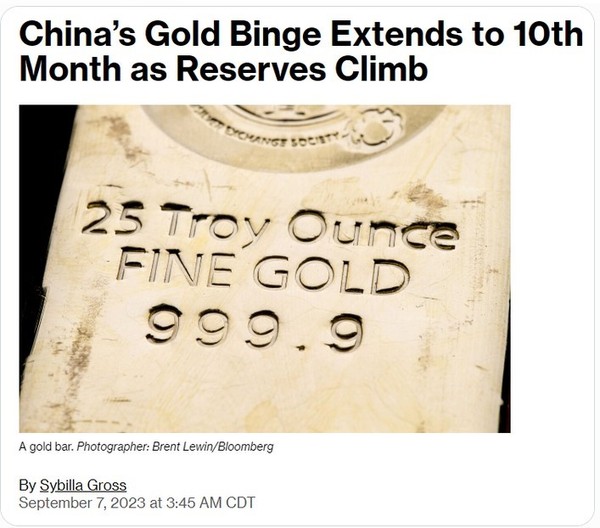

The only people listening to gold—are central bankers. They have been buying gold in increasing amounts for years now. Look at this chart:

Look—governments know how fast their own currency gets devalued through deficit budgets; overspending.

Other central bankers now REALLY see the writing on the wall:

– they all see the US budget deficits soaring

– they see the US freeze the assets of countries that the Americans don’t agree with. The BRICS nations are making a much bigger to organize themselves right now for this very reason.

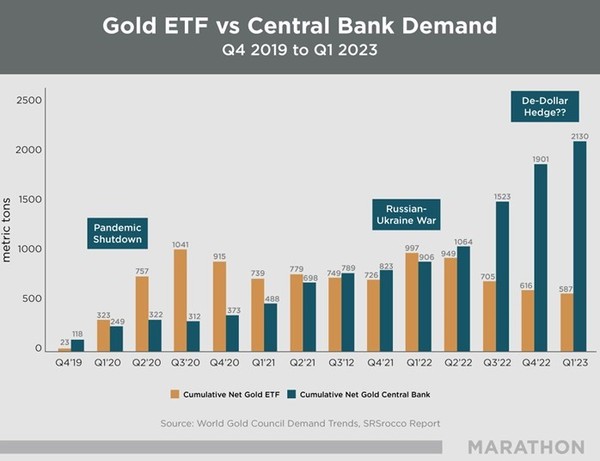

In the last 20 years, the chart below shows that US deficits are clearly trending larger:

SOURCE–https://www.statista.com/statistics/200410/surplus-or-deficit-of-the-us-governments-budget-since-2000/

The US actually ran a budget SURPLUS from 1998-2001. Folks, it is no co-incidence that gold bottomed during that same 1998-2001. Do you remember the talk about the end of the US bond market? Well, the supply is about to become larger, almost overwhelming.

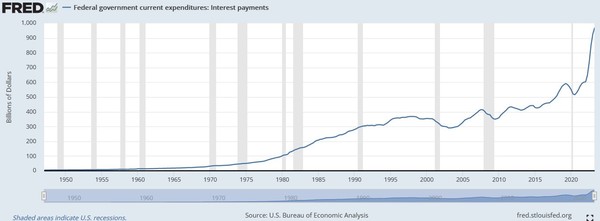

This deficit issue is why gold will go higher now, regardless of interest rates. The US fiscal house is getting rickety, getting riskier with all this debt. See how fast US interest payments have skyrocketed?

THE FINAL REASON GOLD MAKES SENSE

The ONLY time bonds could be used as a real defence against declining stocks was 1999 to 2020, when central banks lowered interest rates to counter every decline in stocks. Then bonds did well. But 2022 was a sharp kick in the groin to that thesis.

So gold has a VERY good chance at moving up from zero to something like 3-5% of a balanced portfolio again.

People, this gold market is coming sooner and bigger than you think.

The Asymmetric Gold Stock

That I Love

My favorite Gold Stock for the next year—next 3 years really—has a huge deposit, high grade, and will be able to produce huge annual cash flows for a very small amount of money. That’s asymmetry at work.

Last year, one of the top gold entrepreneurs in history sensed a coming change in gold (his market timing in gold going back almost 30 years is incredible).

He wanted a team and an asset—in North America—that could be the cornerstone of a new major gold company. He started his last one at 40 cents (I was there, I know) and built it up through organic production growth and several M&A deals—more than 15 years later it sold for US$10 billion.

He was able to use his reputation, his network and his wallet to buy a former producer—in North America–that had $350 million spent on underground workings and an operating mill—all in the last few years—for just CAD$6.5 million, a royalty and some down-the-road payments that will get paid out of cash flow.

For upfront costs—that’s less than 2%! This mine truly cost pennies on the dollar. That’s where the Low-Risk comes from. This mill is in one of the highest grade gold camps in the world, with lots of skilled labour, and supply infrastructure all around.

And not to mention 2.8 million ounces of gold that are “43-101 compliant”, meaning the securities regulators recognize them as real.

This is not a historical asset—it’s a recent producer with a warm-stacked asset that could go back into production tomorrow—if that was the plan.

Then he found:

-a CEO whose last gold company went from $4 – $16/share in just over two years

-a board member who was CEO of a gold producer that went from $1 billion to $13 billion market cap in 5 years—and who knows this first mining project.

This blue-blood team have already added huge shareholder value with just their first M&A deal.

The two factors I like the stock the most for:

- There’s lots of high-grade exploration going on

- $50-$70 million in annual cash flow when this asset gets back into production

You may appreciate gold, or you may not. But gold is near All-Time-Highs in almost every currency; it is on the cusp of a breakout. It doesn’t need to go much higher—it’s within $70 of $2000—for interest in gold stocks to have a dramatic turn. Investors’ interest rate in gold can only go up.

Interest in gold is asymmetric. The huge cash flows from small improvements make this stock asymmetric.

Tomorrow morning, 30 minutes before market open, I’m giving you the name, symbol and story of this 50 cent stock—for free. With September as THE BEST seasonal month for gold, my timing could not be better.