Abitibi Metals Corp (AMQ-CSE / AMQFF-OTC)already has 400 million pounds of high-grade copper—but I believe that is about to get much bigger. You see, they just released one of the highest grade copper holes I have even seen in Canada this morning:

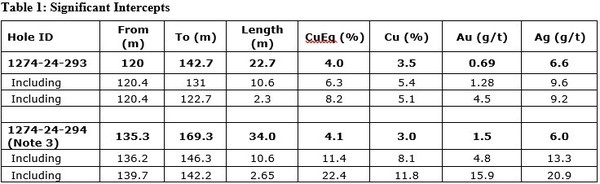

10.6 meters—over 34 feet–of 11.4% copper equivalent…at their B26 deposit in the prolific Abitibi greenstone belt.

In 30 years covering exploration stocks–I have NEVER seen a drill hole with that high a grade EVER. This is going to draw A LOT of attention from investors and major mining companies.

The Super High Grade is one thing…but over 10 meters? That is JUST as important—because it shows The Big Mining Companies that this deposit is big enough be BULK MINED. Bulk = low cost. This is not a narrow vein system with such high grade—those are BIG widths; big enough for bulk mining.

And that result was within a much larger zone—34 meters of 4.1% copper equivalent.

A second hole released today was also very good—10.6 meters of 6.3% copper equivalent.

Copper Equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Metal recoveries of 100% are applied in the copper equivalent calculation.

So for sure I want you to understand high-grade, low cost—but I would also point out something else that most investors don’t know: in the best deposits, management keeps finding even better grade than the discovery hole.

And the original holes put together 11 million tonnes of 2.96% copper equivalent—basically 3%. These grades are MUCH better. That’s what you like to see as these projects get developed.

Silver and zinc are also inside all these drill holes. This is the same type of polymetallic copper deposit that took Foran Mining from pennies per share to $4+ in just three years.

These are the first of MANY drill holes that Abitibi CEO Jon Deluce will be releasing in the coming months.

Freshly funded with $15 million in working capital, he has the potential to duplicate this kind of result many times over in the near term. They have already completed the first 20 holes with more assays pending.

And with no warrant overhang on the stock, investors can get full benefit of these super-high grades.

Investissement Quebec subsidiary SOQUEM did a great job getting B26 to 400 million pounds of copper—but now the private sector—Abitibi—will take a more aggressive approach, just because they can.

They have the budget, and they can afford to do the best kind of assaying—that can more accurately test for higher grades.

And they can test for near surface potential, giving B26 an open pit potential that—with such high grades—wasn’t necessary.

So there’s a very good chance that Abitibi can make B26 not only bigger, but better.

With these grades, you can see why the Deluce family behind Abitibi worked hard to be the public company that got to develop it. Again, their history in creating value for Quebec businesses and working with First Nations—Air Creebec—made them a great choice for SOQUEM.

HUGE GOLD CREDIT THAT CAN

BE MORE AGGRESSIVELY DEVELOPED

Did you catch the high grade gold in the chart of those results—2.65 metres of 15.9 grams per tonne gold—over half an ounce! Deluce and Abitibi can go after the high-grade gold that is now CLEARLY evident on the property.

Over 200 million ounces of gold have been discovered in the Abitibi Greenstone belt, which straddles the Ontario-Quebec border. And that has resulted in over $12 BILLION in buyouts in the last decade.

Grades like this will add a lot of value for investors, and for whatever company puts B26 into production.

So I expect LOTS of industry interest as Abitibi develops the B26 deposit. There’s power lines, sub-stations and 4-season roads in the area. The old Selbaie Mine—a very similar deposit to B26—is only 7 km away and produced 52 million tonnes over 20 years. All the regional and local infrastructure that’s needed is already in place—including skilled labour.

“We’re going to set up tightly spaced holes around this, because at this grade, if we can even keep connecting at 10 to 20 meters, it is going to build up a lot of high grade tonnage,” says CEO Jon Deluce.

“And these were only the rushed intervals as well. There’s still quite a few assay intervals to come from these holes that we could see additional results; these holes were drilled down to 300 meters.

“These were certainly the top intercepts, but there’s still more assays to come from these two holes.

“So it is a great start and this is just the beginning of over 40 holes to come.”

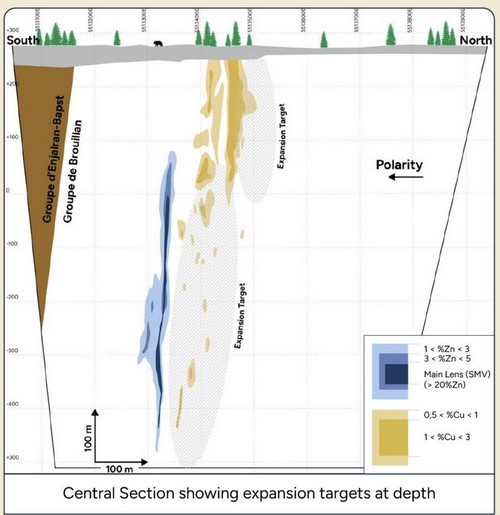

You can see LOTS of expansion potential here.

Nobody should think that all the next few holes are coming back with 11.4% copper equivalent—but this hole does show that lenses of higher grade material are possible.

But there’s a good chance that these super-high grade lenses will continue to be sporadically found—adding valuable tonnes.

And with B26 now in the hands of a well-funded, publicly traded company, the Market may have to decide quickly how big and how high grade it could be—which is great for shareholders.

This is the first day of the rest of the life of B26 and this stock. Abitibi showed beyond a shadow of a doubt that B26 was even better than they thought when they struck their deal with SOQUEM.

With widths and grades like this, The Street will have to adjust, and fast. This is a new Day 1 for investors.

Reference to Foran Mining is for information only and no assurances that the company will achieve the same results at its projects.

Abitibi Metals has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.