Investors have made billions of dollars from high grade epithermal gold deposits up and down the west coast of the Americas—the Andes in the south and the Rockies in the north. Epithermal gold deposits can be very high grade, and very big. Epithermal deposits are 12% of all gold mined in the world.

So when a team led by gold geologist Chico Azevedo—whose previous team had two multi-million ounce gold discoveries in South America already discovers a new epithermal gold system up in the Andes Mountains of Argentina, I pay attention! He was a key part of the GoldFields team that discovered the 4.3 million gold ounce Salares Norte deposit in Chile, now entering in production, and also that developed the Chucapaca (now San Gabriel) deposit in Peru.

Azevedo—who has worked with GENCOR, IamGOLD and GoldFields in his long career—has been working full time with junior explorer Turmalina Metals (TBX-TSXv / TBXXF-OTC).

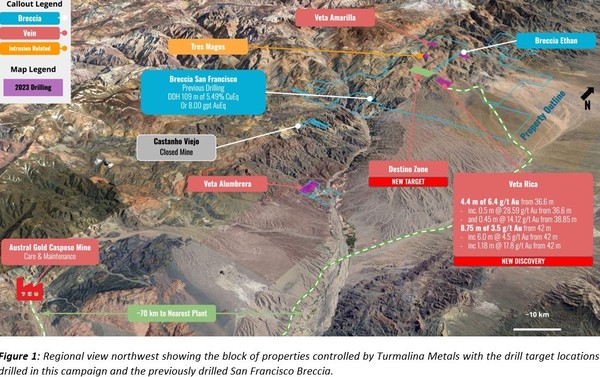

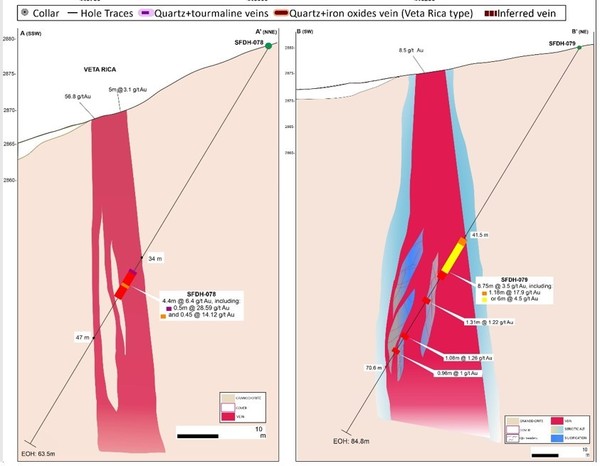

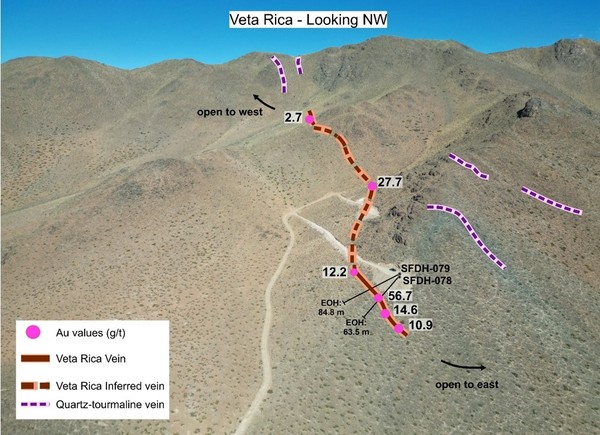

Turmalina reported this morning that they have discovered multiple mineralized epithermal gold veins around their main Veta Rica vein. Veta Rica has also been mapped out to 700 metres in strike length, and 1-6 meters in width. Surface gold is usually between 0.9 and 2.7 g/t, but they have samples up 27.7 g/t Au and 56 g/t Au.

But this is very early days. In no way am I telling you this is going to be a huge deposit or a multi-dollar stock.

This is barely past grassroots exploration. Turmalina is the highest risk kind of stock there is in the world.

One or two bad drill holes in a row can forever impair the prospects of advancing this new discovery and impair the share price despite the abundance of additional targets yet to be drilled. This is high potential risk and high potential reward.

But the team has a solid track record in South America. And at their project in Argentina they have a big property here with lots of targets. The team has developed the area around the Veta Rica vein that they now want to give it a very targeted drill campaign to see if they can find more gold in Veta Rica and the surrounding mineralized veins.

I would bring your attention to one other thing in that property map: there are TWO epithermal former producers in the area, in that very picture. Austral Gold has a 50,000 oz/yr mine on care & maintenance (see bottom left corner of map) and there is an old epithermal mining district called Castaño Viejo (the “old chestnut”). So there is proven economic mineralization in the immediate area.

Austral’s Casposo, 70 km south by road from Veta Rica, produced 283,000 oz of gold and 9.6M oz of silver with average grades of 4.8 g/t Au and 183 g/t Ag from 2011 – 2015 and another 32,000 oz of gold and 3 M oz of silver between 2017 and 2019 before the mill was placed back into care and maintenance.

(https://australgold.com/)

CEO James Rogers says “this area is known for processing epithermal veins, and what we’ve basically found is a whole new epithermal vein camp.”

All these epithermal gold veins are on their very large San Francisco property, which has over 100 breccias, two porphyry targets and dozens of veins.

“There are several mineralised epithermal veins in these zones” says James. “So now we’re poised to go on a focused drill program on these targets.

“We’re focused on advancing these vein discoveries as we see an immediate or near-term path to be able to work in an area where there has been epithermal mineralization mined. The infrastructure is there: this is part of a well-known epithermal belt in San Juan, the most mining-friendly jurisdiction in Argentina and the country’s largest producer of gold.”

Rogers says the epithermal gold mineralization is right at surface. (https://www.turmalinametals.com/news-data/turmalina-discovers-high-grade-gold-vein-system-including-179-gt-au-over-118-m)

Everything that Rogers and Azevedo are seeing from the drilling so far tells them the mineralization is vertical, right from surface. AND—it’s on a hill:

“Not only are the veins vertical,” says Rogers, “but the way that they’re oriented, the vein is going into the hill. So it’s easy to enter, easy to drift in, easy to strip. It’s not in a weird awkward spot where you’ll never be able to mine it easily.”

I want to stress to my readers—this is early-stage exploration. But this is a big property, in a very mining-friendly jurisdiction: San Juan province, Argentina. Filo Mining’s big copper porphyry discovery is here.

CEO Rogers is excited: “We’re at the lowest share price we’ve been in. We’ve just made another discovery.

We’ve got the opportunity to now build up a discovery story in this area with such a good land package that is adjacent to mills that need feed.”

DISCLOSURE—I AM LONG 190,000 SHARES.

Turmalina Metals has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.

Keith Schaefer is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.