Copper has had a tough go of it. The stocks of copper producers have been even worse.

The biggest – Freeport McMoRan (FCX – NASDAQ), is down 40% since April. Small copper producers like Capstone Mining (CS – TSX), Copper Mountain Mining (CMMC – TSX) and Taseko Mines (TKO – TSX) are all down 50-60% from their high.

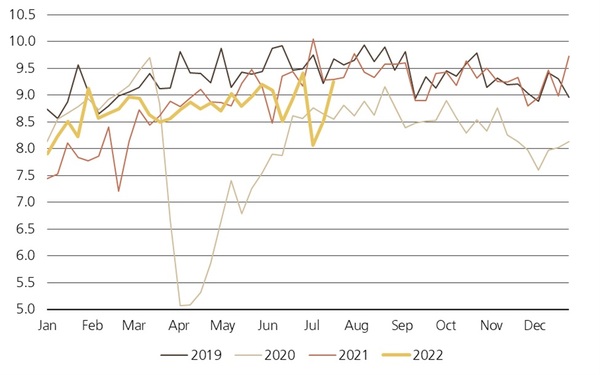

The price of copper reflects all the worries about the global economy. After hanging around $4.50 for the first 5 months of the year, copper has gone into freefall, bottoming (for now?) at just above $3 per pound.

Source: Kitcometals.com

It is hard to buy copper stocks when they are down big. The charts give you plenty of examples of when they went down even more.

Yet this could turn out to be an incredible buying opportunity. Copper is a commodity with an extremely favorable long-term demand trend.

If you can look past the next 6-12 months, hold your nose if these stocks go lower, the growing use of renewables should become a massive tailwind for copper.

The demand from transmission lines, EVs, solar and wind will be one that sends copper prices to new heights – and copper producers along with it.

THE RENEWABLE TRAIN GAINS STEAM

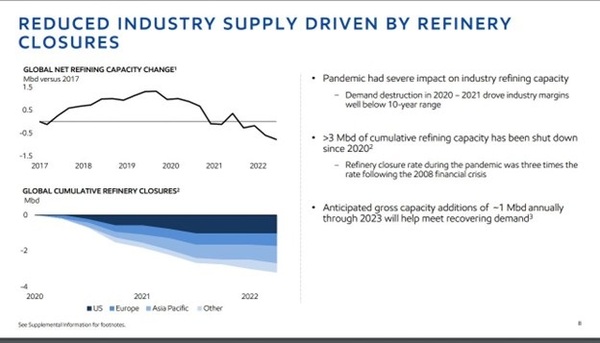

This has been a spectacular 12 months for oil and gas stocks. A great run.

But I’m not blind. Renewables are the future.

Longer-term renewables will take share and capital.

The question is – how fast?

Maybe faster than we think.

Consider the June Investor Day presentation from Next Era Energy (NEE – NYSE).

NextEra is one of the more “progressive” utilities. They have embraced renewables.

At their investor day NextEra outlined a very bullish case for renewables expansion.

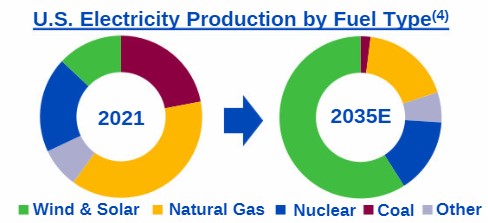

Source: Next Era Energy Investor Presentation

NextEra iforecasts a dramatic increase in renewables over the next 14 years. From a relatively modest 13% of generation capacity right now (solar is about 4%, wind about 9%) to well, well over 50% by 2035.

That forecast is based off of the IHS “fast-track” scenario. In 2021 IHS estimated a “fast-track” of renewable power generation that would allow us to hit IPCC decarbonization targets. IHS saw 2,800 GW of installed solar and wind capacity in the United States by 2050.

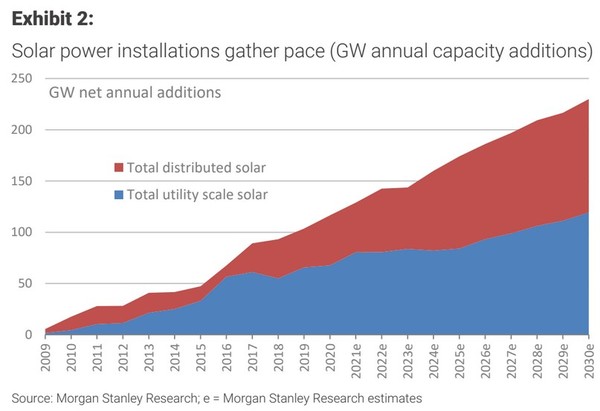

The rest of the world is expected to follow. Morgan Stanley now expects 2,800 GW of installed solar capacity worldwide by 2030:

Source: Morgan Stanley

These are huge increases to installed capacity compared to today. According to the EIA, renewable capacity in the United States in 2021 (again we are talking wind and solar here) was about 285 GW. That is expected to increase by only 15 GW in 2022.

In other words, we have a steep hill to climb. One that is going to require copper.

A WHOLE LOT OF COPPER

Copper is in the doghouse. The metal has been hammered; the one-year chart has broken down hard.

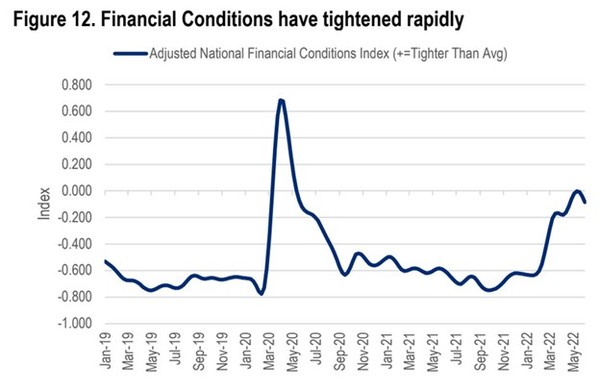

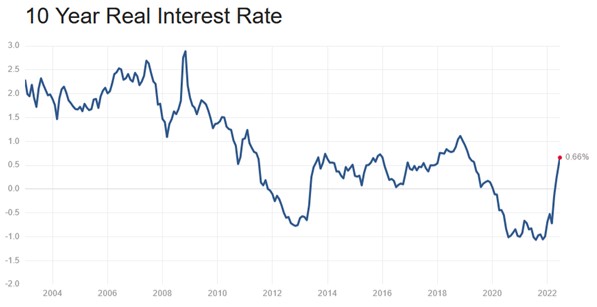

Chances are we are going into a recession, maybe a deep one. China has been in lockdown. Housing starts have waned as interest rates have spiked.

None of this is good for copper.

But, BUT – if you can look past all this, there is reason to be optimistic. Reason to watch copper closely for signs of a bottom.

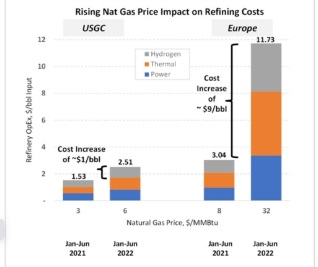

Renewable demand is going to need A LOT of copper. And that demand is going to hit very soon.

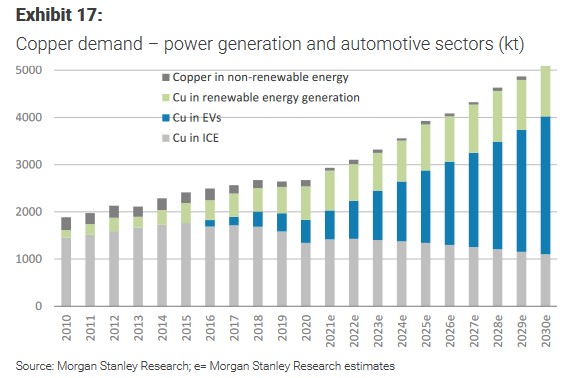

Morgan Stanley recently put out a piece on the impact of the renewable transition on copper demand.

Source: Morgan Stanley

Morgan Stanley expects copper demand from power generation and automotives to nearly double from 2020 and 2030!

By 2030 demand for copper in electric vehicles alone will exceed what the entire power generation and automotive verticals use today.

It is hard to imagine the price of copper staying down with this sort of tailwind.

DR. COPPER?

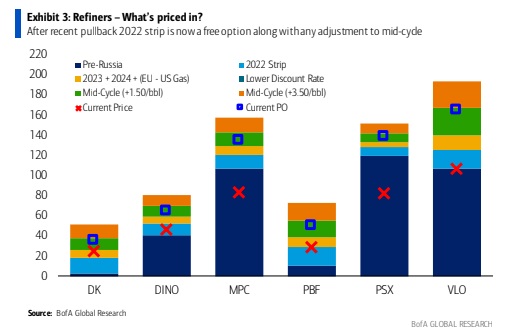

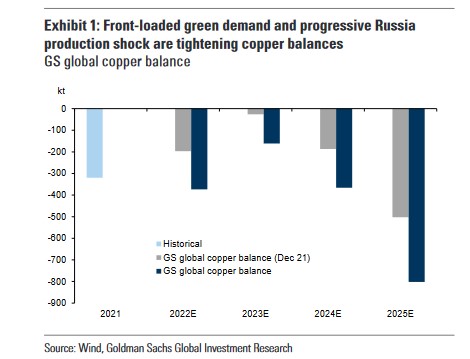

It wasn’t that long ago that the copper bulls reigned. It was only three months ago that Goldman Sachs told us that copper was “sleepwalking towards a stockout”.

This was the title of a piece written by the team of analyst Jeff Currie (a guy that is no slouch).

In the research note Goldman argued that “‘Dr. Copper’ no longer existed – that ESG, geopolitics and chronic underinvestment” would drive copper fundamentals far more than overall global growth.

The note was badly timed. Couldn’t have been worse. Copper has fallen off the cliff. But the point they were making bares repeating.

In April Goldman saw larger and larger deficits coming from increased demand for renewables and the loss of production from Russia.

Source: Goldman Sachs

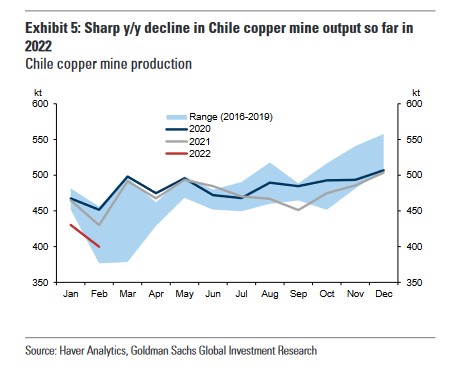

They also noted drought conditions in Chile, the worlds biggest copper producing country, leading to lower year-over-year production there.

Source: Goldman Sachs

Left-leaning governments aren’t helping the supply picture. Chile is proposing a mining royalty that would significantly increase costs of mining and deter future projects.

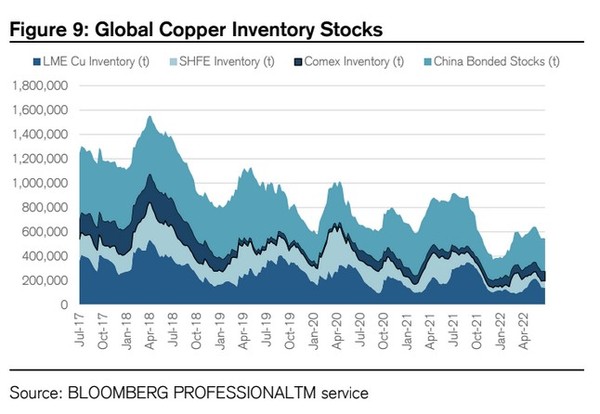

While the recession looms, global copper inventories remain extremely low. Most of the inventory left is in China.

Source: Credit Suisse

None of this means the price of copper won’t keep going down in a recession. It will. That is just what commodities do.

But what it does mean is once we are past the recession, the bounce back could be fierce.

LOOKING PAST THE RECESSION

Yes, the next few months may look bleak. A recession could very well be on the horizon. Heck, we may already be in one!

But out of recessions and bear markets come new economic growth cycles and bull markets.

New leaders come with it.

What are the secular trends that will lead us through the next cycle?

The renewable buildout is almost certain to be front and center.

The copper chart looks like death warmed over. But that screams to me that we are coming up on a HUGE opportunity here.

Nine months ago, if you had told me I’d get another chance to buy copper producers at half price and without a real hiccup to the renewables story, I would have jumped at the chance.

Down here in the weeds that opportunity seems less certain. It always does.

Demand is almost certainly going to come back strong once we get through this rough patch. We may find that once we hit bottom, we are off on a super-cycle.

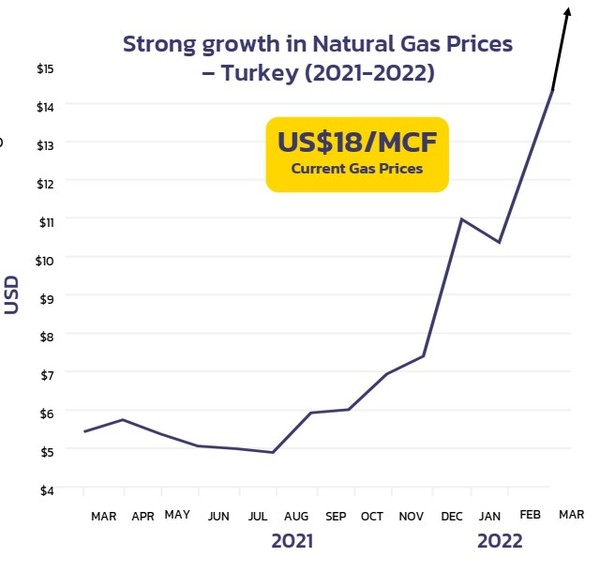

While in the short-run we may see a lull in renewable projects as capital tightens, the Russian invasion of Ukraine has only made governments more steadfast in their plans for a renewable buildout over the long-run.

The only way we hit those climate goals is with a whole lot of commodities, a lot of copper.

Timing is everything. You can buy copper equities here – 50% off – but be forewarned, these producers could easily go down another 30% from here.

But – they could also just as easily be back at their 52-week highs, or higher, a year from now.

Big risk, big reward. That’s commodities for you. But it is not too often that commodities are pricing in the risk while at the same time giving you such a clear picture of long-term demand.

I may not be ready to buy the copper producers just yet, but I am not going to let them get away from me once the turn comes.