Everyone is an oil bull right now.

In the last 6 days I’ve listened to Vitol Asia head Michael Muller, UAE Energy Minister Suhail Al-Mazrouei, and Trafigura CEO Jeremy Weir all warn of higher prices.

Muller said that limits to Saudi production are “very bullish for oil”.

Al-Mazrouei believes “prices may well climb further”.

Weir went furthest of all, saying prices could reach “a parabolic state”.

Now these are smart guys and smart guys saying oil is going higher is not necessarily bearish.

Except… it is not just the smart guys. It is pretty much everyone.

We’ve got Jamie Dimon saying $150 to $175 oil is in the cards.

We’ve got Jim Cramer, the guy who two years ago said he was done with fossil fuels, giving us headlines like this:

Source: CNBC.com

Forgive me if this all makes me a little bit skittish.

Name me an oil bear right now – and I don’t mean a permabear – I mean someone that has been bullish before but has now pulled the plug.

It is not easy to find.

WHAT IS DRIVING OIL RIGHT NOW?

Okay, so we’ve got an oil bull market and a whole lot of oil bulls. Maybe it is just that the bull case is that strong?

Maybe.

Demand is surprising to the upside – travel, travel, travel – no question. Still, oil is more about supply than demand right now.

But is oil actually “tight”?

Pinning down tightness in the oil market is a tricky business.

You’ve got spare capacity tightness. You’ve got actual tightness of the physical market – the supply and demand.

Then, maybe most important right now: you can have varying tightness across the crude slate.

Not all oils are made equal.

There is light oil, there is heavy oil, there is sweet and sour. Demand can vary quite a bit from one crude to another.

Usually, give or take a few bucks, different crude types move in lockstep. But what I’m seeing now is that this is not the case. It is making me wonder if the historical ties are broken, and why that might be?

IS OIL TIGHT?

If you look at oil at a high-level you would be hard pressed to say its tight.

On one level, talking spare capacity, you can make the argument. Spare capacity is basically how much more can OPEC+ pump. This is tighter than it has been in a long time.

The very excellent Energy Tidbits, put out by SAF Group each week, linked to a podcast interview with Vitol Asia head Michael Muller this week.

On the podcast Muller said, “smart money is of the view that the Saudi current sustainable production limit is somewhere 11 point something, a huge gap vs “surge” KSA #Oil of high 12’s mmbbl/d… Very bullish for oil as demand keeps going up.”

It may very well be that only Saudi Arabia and the UAE have spare capacity right now. The Saudis may have less than we think.

Is it 12+ million barrels a day? Or is it, like Muller says, something closer to 11? If it is 11 – that’s tight.

While spare capacity is tight, it is a bit less clear if the physical market for crude is really that tight.

For one, Russian crude exports have not actually been hit like many thought they would. Again, to quote from the Muller interview (my highlight):

“When you look at information available today… crude output from Russia is still level-pegging with what it was, and its products that have been hit”

Even with all the talk about the loss of Russian oil, that isn’t happening. Yet we are adding more crude into the supply from the SPR.

I think that Christof Ruhl, from The Center on Global Energy Policy, hit it on the head later in the same interview when he said:

“There is no shortage of crude oil… crude oil doesn’t seem to be the big problem at the moment… its with products, in particular with diesel.”

THE CHIRPING CANARY

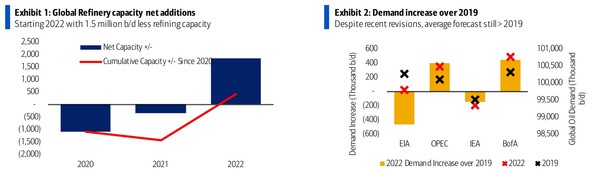

Here is where things get interesting. While the crude market is at best marginally tight, mostly with respect to spare capacity, it is the products market that is just plain tight across the board.

I wrote about this in a blog post two weeks ago (Are We in a Refining Golden Age?).

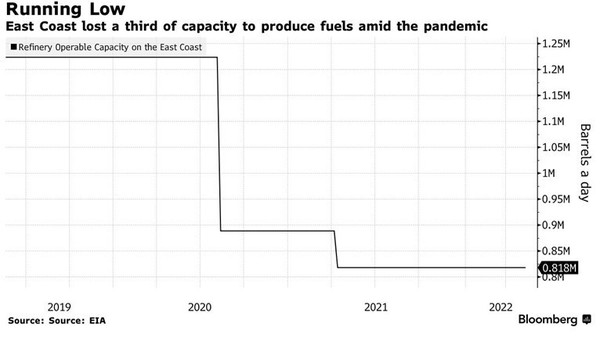

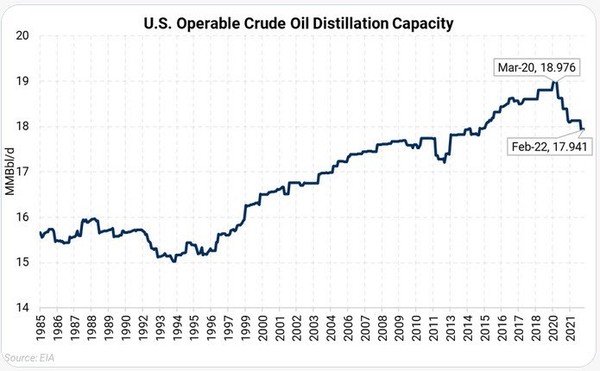

We lost refining capacity with COVID. We lost even more refining capacity when Russia went rogue.

Now the world is getting back to where it was pre-pandemic – but there are less refineries available to get there.

You can drill a well a lot faster than you can build a refinery. That is if you even want to consider a long-lived project amidst a fossil fuel sunset.

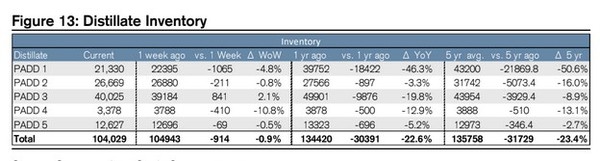

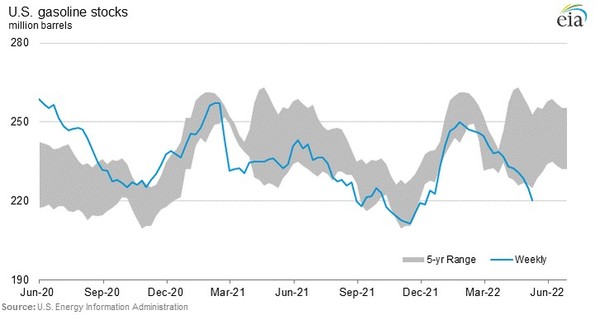

We’ve got diesel and gasoline inventories at multi-decade lows. We’ve got Europe importing all they can from the United States and anywhere else that has inventory (re-read that comment from Muller: its Russian product exports that have been hit).

Unlike oil, government emergency stockpiles of gasoline or diesel are not the same scale as oil.

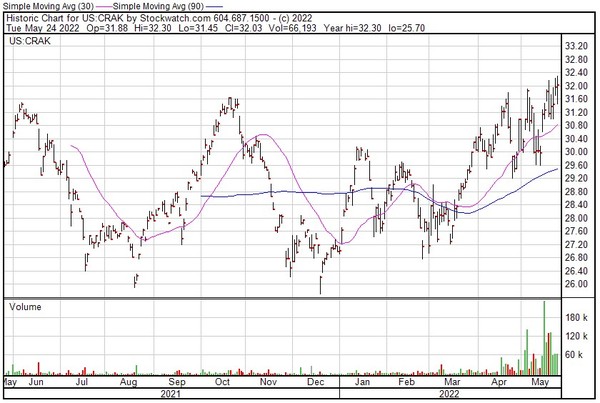

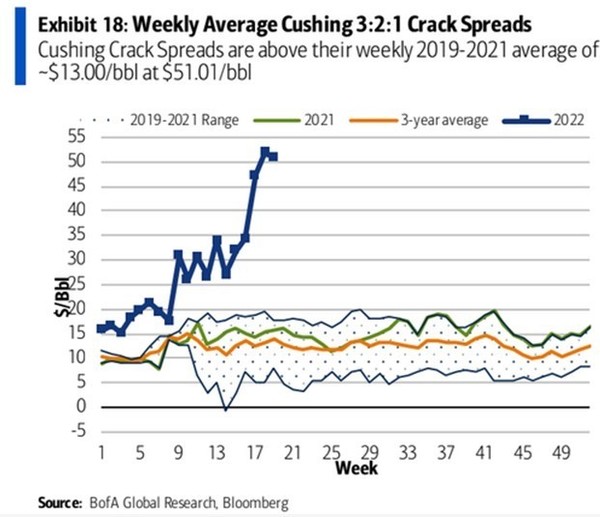

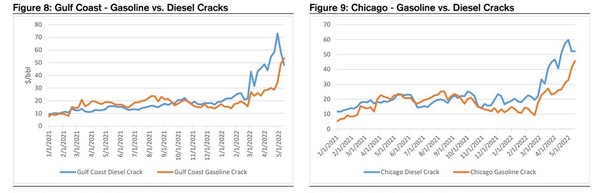

No surprise that crack spreads are making oil prices look pale.

Source: Bank of America Global Research

This is not just a US thing. Refining margins everywhere are parabolic.

Margins in Singapore have gone from under $10 per barrel to nearly $50 per barrel in the last 6 months.

With that in mind, I stumbled on the following chart this week:

Source: Bloomberg

My first reaction to this chart is – WTF? How can we have tight oil and ballooning differentials?

Of course, the answer when it comes to Canada is usually egress capacity. In other words, there isn’t enough pipeline to get the oil out of Canada.

But that doesn’t seem to be the case this time. The Line 3 replacement project, owned by Enbridge, expands an existing pipeline running through Minnesota to 760,000 bbl/d. It is up and running and has added ~350,000 bbl/d of new capacity. There was another 200,000 bbl/d added with the Southern Access expansion.

From what I read there is around 300,000 barrels of extra pipeline capacity right now.

Yet the heavy oil differentials are going south.

Some of this has to do with the SPR releases. They are putting more heavy crude on the market. But I don’t think that’s the whole story.

I think widening diffs are the canary in the coal mine. They are hinting at what is really happening in the oil market right now.

With refining margins off the charts every refinery is trying to produce as much product as possible.

They don’t care about how much it costs to buy the crude – just produce as much gasoline, diesel, and jet fuel as you can.

We know that heavy oil produces less of those products, and more of the lower end products (stuff like asphalt), per barrel compared to a light or medium crude.

Because product margins have gone into stupid land, for maybe the first time ever the refiners really don’t care if they have to pay up for the better-quality oil. They will more than make up for that on the sale of their products.

Now I know there are other considerations. The oil complex is nothing if not complex. But at the margins I think this is driving some of the price action we are seeing.

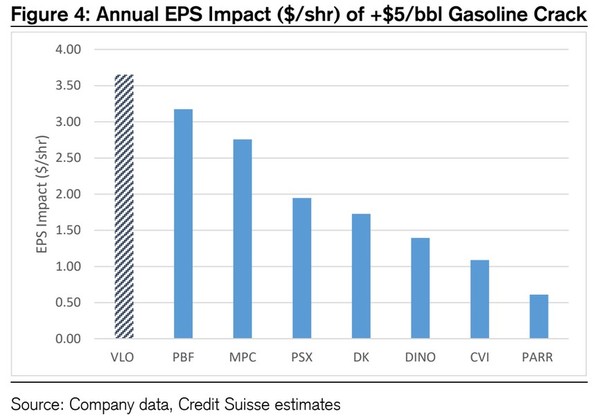

This is a whole different ballgame than we are used to. Refining is not a high margin game – UNTIL NOW.

Usually refiners are like nature’s equilibrium, making sure that all ends of the crude slate are in balance as they try to maximize their margins.

Now, with margins through the moon, refiners have abandon that post. They have the unusual incentive to bid up crude that will give you the most product and not to worry about the cost.

WHERE FROM HERE?

Keep in mind that this is all just my theory. I can see that something different is going on and this fits the evidence.

If I’m right, then we are in a whole new world. If refining margins can stay in the stratosphere, the old rules do not apply.

Rising oil prices are not about a shortage of oil. If there was a shortage of oil, we would see refiners scrambling for every barrel. That is not what’s happening.

Refiners are looking at heavy barrels from Canada and saying no thanks. The same is happening for heavy Mayan crude from Mexico, or medium-sour crudes like Mars.

What we have is a shortage of product, leading to massive refining margins that are causing distortions in the market.

As a result, it looks like we don’t have enough oil. But its really a refining complex that simply doesn’t care what they pay for the best oil – for WTI.

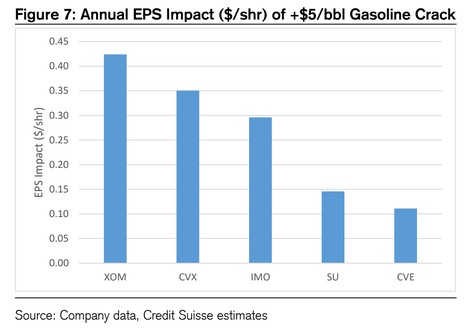

REFINERS IN THE CATBIRD SEAT

If I’m right, then the price of WTI and Brent are going to be driven less by the overall supply and demand for oil and more by how wide refining margins go.

As for stock-picking, it looks like refiners are the place to be if you are bullish the energy sector.

I am long a little bit of oil, and we have a big position in one microcap natural gas play. I have a bigger position in one refiner, and I wish I had bought some others. But I’m skittish to buy now.

What makes me hesitate? Why not buy more refiners?

Well, what I’m describing here is why I think the oil price has been going up.

Which is different then saying that I think refining margins can stay at this level.

Maybe they can. But if you have watched the oil markets for as long as I have, it is hard not to look at those crack spreads, shake your head, and think something has got to give.

The questions are what, and how high?