Turkey’s Oil Potential: Onshore and Offshore

On the surface, Turkey has everything going for it in oil and gas. Onshore, it’s under-explored with one of the top international shale plays—the Dadas Shale—about to get tested for the first time with new technology.

Offshore there is talk of a Black Sea bonanza. The country has good governance, full-package infrastructure, easy access to markets and attractive fiscal terms.

But under the surface—in the ground, where it counts—there has yet to be a big discovery to ignite the country’s energy sector, and the share prices of the Canadian and American juniors active there.

BACKGROUND—Big Oil is All Around Turkey

Turkey’s oil production doesn’t tell much of a story. Production is less than 70,000 boe/d, and Turkey imports 90% of its oil and natural gas needs.

Nor is Turkey about proven reserves: It only has about 270 million barrels of proven oil reserves and 218 billion cubic feet of natural gas reserves, so it isn’t exactly Iraq—which borders Turkey to the southeast.

Turkey is about close-ology and a recently renewed interest by the majors in the tight oil, or shale oil—the “unconventional” stuff.

In terms of close-ology, there is:

1. To the North—Black Sea potential.

2. To the South—27 billion barrel onshore finds like Iraq’s Kirkuk field.

3. To the East—Azerbaijani oil fields.

4. To the West—well, this just gets silly. Look at this list:

a. 22+ billion barrels of oil in Greek waters in the Ionian Sea.

b. 4 billion barrels in the Greek waters of the northern Aegean Sea.

c. An estimated 7 billion cubic feet of natural gas in one well offshore the Greek-held part of Cyprus discovered late last year.

d. 33+ trillion cubic feet of gas discovered in nearby Israeli waters.

And Turkey knows how to lure investors. It offers foreign oil companies a flat 12.5% royalty tax and a 20% corporate tax rate.

“Approval processes are clear and rapid,” Patrick McGrath, Chief Financial Officer for Anatolia Energy Corp., told OGIB. Anatolia is exploring for the Dadas shale in southern Turkey.

Turkey has a web of pipelines, refineries and export terminals. Here, there is no question of refinery difficulty or getting product to market.

For pipelines, there is:

- The Blue Stream system transporting Russian natural gas to Turkey under the Black Sea.

- The Baku-Tbilisi-Ceyhan pipeline (the longest), which transits oil from Azerbaijan.

- Kirkuk-Ceyhan pipeline (the largest), which transits oil from northern Iraq.

- The planned Samsun-Ceyhan crude oil pipeline which will run from Turkey’s Black Sea province of Samsun to the Turkish Mediterranean hub at Ceyhan.

State-owned Turkish Petroleum Company (TPAO) estimates there are up to 10 billion barrels recoverable in the Black Sea.

Turkey’s offshore hopes have been hit as BP’s Black Sea exploration failed to find any oil reserves in the marine regions off the northern Turkish coastline, though exploration continues. In late 2010, Chevron temporarily withdrew and a year later Exxon packed up in two areas after exploration yielded no finds.

But offshore exploration potential to the west remains attractive because of its geography: It adjoins Israeli, Cypriot and Greek waters where massive finds ALSO include:

- 232+ million barrels of oil and another 1.8 trillion cubic feet of gas discovered off Tel Aviv in March

- Turkey has also started exploratory drilling for onshore oil and gas in the Turkish north of Cyprus

This has also created some geopolitical tectonics.

Turkey has threatened war if Greece drills any further into the Aegean. And a deal struck between Israel and Greek Cyprus has Turkey worried that it will never benefit from its “share” of Cypriot gas. The Turks invaded Cyprus in 1974 and the island has since been split between the Greek zone (two-thirds) and the Turkish zone.

In early November, the Turkish authorities warned foreign oil and gas companies that they would be banned from participating in new oil and gas projects in Turkey if they cooperated with Greek Cypriot offshore drilling plans. This is a direct response to the Greek Cypriots awarding four Mediterranean Sea gas concessions.

The problem here is that the Turkish Republic of Northern Cyprus—and Turkey proper—claim the same rights to these concessions. Everyone is eyeing this Aphrodite field greedily as it sits next to Israeli waters that hold gross mean gas resources of more than 33 trillion cubic feet.

Turkey warned military action last year, but Greek-held Cyprus is supported by the United Nations, and the Turkish-held part is not recognized internationally.

– Jen Alic, guest editor

NEXT: With one of the top shale oil prospects in the world, Turkey’s potential is as big as the Barnett Shale in Texas. Geologically it’s just like the Woodford shale in Oklahoma. In Part 2, we’ll outline who is drilling this world-class play, and when investors should be paying attention.

Before You Invest in Oil & Gas Master Limited Partnerships

The chase for yield has investors asking lots of questions about MLPs — Master Limited Partnerships. Today’s editorial is an 8-point checklist every investor should know before adding MLPs to their portfolios, and comes from guest editor Brian O’Connell.

Can you afford to miss out on an investment opportunity that has returned 66% to investors over the past five years – and has beaten every major market index in 11 of the past 12 years?

That’s the promise, and the potential of Master Limited Partnerships (MLPs), an energy investor’s answer to a long-unanswered question – how can I get income and growth appreciation out of a single investment – and earn a big tax break in the bargain?

When it comes to MLPs, the positives have outweighed the negatives, but that doesn’t mean you should jump in eyes closed and head first.

Before you pour cash into an MLP, take these tips with you first:

Master Limited Partnerships Defined

By and large, master limited partnerships are just that – limited partnerships that happen to be highly liquid, and tradable on U.S. stock exchanges, just like traditional stocks.

Instead of shares, MLP’s offer investors “units,” and payouts aren’t called dividends, they’re called “distributions.” In essence, MLPs offer the tax advantages of limited partnerships with the asset growth benefit associated with common stocks.

Tax-wise, MLPs are treated differently from stocks and bonds, and are generally treated more favorably by the Internal Revenue Service. Taxes are paid by MLP unit-holders, on a pass-through basis.

That means MLPs, unlike common stocks, don’t face double taxation on distribution payouts to investors. However, non Americans (like Canadians, eh) do face double taxation—there is a withholding tax by Uncle Sam and they are not part of the Canada US tax treaty. All MLP investors should check with their tax accountants.

The vast majority of MLPs invest in midstream oil and gas companies, primarily in the pipeline, storage and distribution sectors.

Why MLP’s?

Master Limited Partnerships are often referred to as an “investor’s dream.” Why? Because some MLPs really do make that true – at least from a historical sense.

Statistically, MLPs offer…

• Historical yields of up to 10%

• From 2002 to 2012, MLP’s outperformed the Standard & Poor’s 500 Index by a whopping 291%.

• In the past five-years, the Alerian MLP Index has returned of 66.6% to investors, approximately 32% of that return coming from price appreciation. Conversely, the S&P 500 fell 1.55% over the same time period.

• MLPs have averaged a14.5% annual rate of return over the past 10 years.

• In 2012, 78% of MLPs actually raised their distributions.

• Due to depreciation, up to 90% of MLP distributions are tax-free until you unload the investment. It’s not unheard of for MLP investors to go 10 years before they pay a dime in taxes.

Demand for Oil Drives MLP Growth

There’s no sure thing on Wall Street, but MLPs may be as close as a “sure thing” as possible. Since MLPs generally invest in relatively stable midstream energy companies – think pipelines, storage tanks, and oil and gas terminals – investors benefit from high demand for the services those midstream oil and gas companies provide. In other words, it doesn’t matter where the price of oil stands – $150 or $75 – as long as global consumers use oil and gas, MLPs benefit from that steady demand.

Bear Market Benefits

Master limited partnerships have proven resilient against down stock market cycles. In the immediate aftermath of the economic collapse of 2008, 39 of 50 MLPs actually raised their distributions to investors to, on average, 10%. In addition, as MLP’s invest in “high demand” midstream oil and gas companies, MLP’s provide investors with stable, reliable.

Ups and Downs

While MLP’s do offer stable, dependable yield growth, significant tax advantages, the tax situation is complicated, and you may need to bring in a tax advisor to handle the MLP portion of your investment/tax portfolio. In addition, exposure to small-cap oil and gas stocks – a common investment for MLPs – can lead to higher-than-normal volatility.

Not All MLPs Are Created Equal

Some master limited partnerships are riskier than others. For example, larger pipeline MLPs are relatively stable – they generate a steady cash flow, as they’re not significantly impacted by oil and gas prices. Larger pipelines are also difficult to replace, making them more valuable for MLP investors.

That’s not the case for smaller pipelines that move natural gas from processing plants to suppliers. Since natural gas is more vulnerable to commodity price fluctuations, MLP investors should proceed with caution when it comes to evaluating various MLP investments.

Midstream Demand

According to the Interstate Natural Gas Association of America both the U.Ss and Canada will shell out an estimated $84 billion to build new midstream oil and gas platforms, pipelines, storage tanks, and other necessary infrastructure that meets the needs of skyrocketing domestic energy production.

That demand will generate big revenues to MLPs, who are expected to provide that entire infrastructure. In turn, those revenues should fatten up distributions, and boost MLP performance for years – and maybe even decades to come.

SEC Regulated

MLPs are exactly the product of the Wild, Wild West. In fact, the U.S. Security and Exchange Commission regulates MLPs, just like it regulates stocks. As a result, MLPs must file annual and quarterly reports, and keep investors apprised of any changes to its business model, and any developments that may impact the MLP. In addition, MLPs must also comply with the accounting requirements mandated by Sarbanes-Oxley.

Why Investors Are Flocking To Energy MLPs

What are the top reasons why regular, everyday investors are so attracted to MLP’s? Here are four big reasons why:

1. The high level of current income – MLPs offer steady, reliable yields, and steady, reliable distribution payouts. That makes it perfect for income-minded investors, especially retirees.

2. The growth element – As MLPs are essentially operating companies, which means they can buy companies and grow dynamically, MLPs are high-growth vehicles. The “perfect storm” of current income, distribution yields, and growth dynamics fuel the type of double-digit investment returns that MLP investors have enjoyed for years.

3. Low correlations – MLPs traditionally have low correlations with the U.S. equities market, and are largely immune from price volatility of crude oil.

4. Tax advantaged – MLPs offer investors extremely favorable tax treatment, allowing investors to keep more of their partnership profits, and keeping more cash out of the clutches of Uncle Sam.

Why Do So Many Investors Overlook MLPs?

Historically, master limited partnerships have been a relatively small asset class. Even as recently as 2000, there were only about 16 energy-related MLPs available for investor access.

Today, there are over 100 energy MLPs, and the largely positive investment returns have earned the notice of the financial media, of financial advisors, and finally, of investors. Now, MLPs are morphing from an asset option for the rich and powerful, to a broadened investment category open to investors of all financial categories.

Make no mistake, MLPs aren’t a secret anymore. For energy investors, that increased visibility is good news, and it may just be an opportunity of a lifetime for savvy investors.

– Brian O’Connell, guest editor

Junior Oil & Gas Dividend Stocks: Will Their New Strategy Work?

The last few months have seen a flurry of E&Ps announcing changes to their business strategy, moving from a growth-through-drilling focus toward an income-and-dividend model.

These companies realize things are changing in the oil patch. Commodity price forecasts are down and investor euphoria over billion-barrel resource plays is fading.

The stocks of junior producers went from 9.3x debt adjusted cash flow in 2011 to 1.8x in the coverage universe of Canadian brokerage firm Canaccord Genuity (dated Jan. 2/13).

It leaves these companies with some tough choices about how to improve their trading multiples, to get back a bit of their glory days of 2009-2011.

With the winds behind the resource-play boom waning, companies are looking for ways to protect these valuations. It appears that increased payouts to shareholders are the weapon of choice.

But the market remains cautious about this new strategy, with none of these new junior dividend stocks seeing much share price appreciation, until Whitecap Resources (WCP-TSX; SPGYF-PINK) jumped last week—six weeks after they announced their strategy.

Here’s a few data points:

On November 20, Calgary-based intermediate oil player Whitecap Resources (WCP-TSX) announced a change in corporate strategy, moving to focus on “paying sustainable dividends.”

On November 21, Pinecrest Energy (PRY-TSX) and Spartan Oil (STO-TSX) announced they were merging and transforming into a dividend-paying corporation. But investors didn’t like that deal, sending both stocks down after the news. After the deal was scuttled, both stocks rose.

On December 20, Pace Oil and Gas Ltd (PCE-TSX), AvenEx Energy Corp. (AVF-TSX) and Charger Energy Corp (CHX-TSXv) said they were merging to form a dividend-focused company.

Whitecap plans to pay $0.05 per month to investors, beginning in January 2013, yielding about 6.4% at today’s share price. Before January 2—six weeks after it said it was about income now, the stock was stagnant.

Of course, sending more money home to investors means putting less cash to work in the field. Whitecap’s stated forecast is to pay out about 32% of its cash flow on dividends, leaving an anticipated 63% cash for capital projects: drilling, completions and facilities.

Such a move to cut drilling would likely have sent investors running for the hills, even a few short months ago. As recently as April 2012, newspapers like Canada’s Financial Post were praising Whitecap for its growth potential. Investors wanted to see Exploreco money put to work—dividends were for little old ladies.

That’s because the last several years the climate in the industry and broader economy favored a strategy of growing through aggressive drilling.

That was primarily due because of commodity prices. The last decade has been salad days for the petroleum sector. Oil prices rose to previously unthinkable levels. Equity markets soared. Investors cheered.

The energy sector offered those investors something they’d been desperately seeking: upside. Inflation was threatening to digest real returns on traditional equities, and to boot, many investors—especially the retail buyers becoming more prominent in the energy space—were carrying big debts and staring down poorly planned and under-funded financial futures.

The possibility of supercharged double- or even triple-digit returns in the E&P game was just the answer. After all, even “sluggish” giants like ExxonMobil (XOM-NYSE) were up over 200% during the bull run.

This provided the kindling for The Growth Story. In-ground oil reserves were soaring in value, and the trend was your friend as energy-hungry upstarts like China and India were threatening to buy every last barrel of crude they could sail a tanker to, sending prices higher.

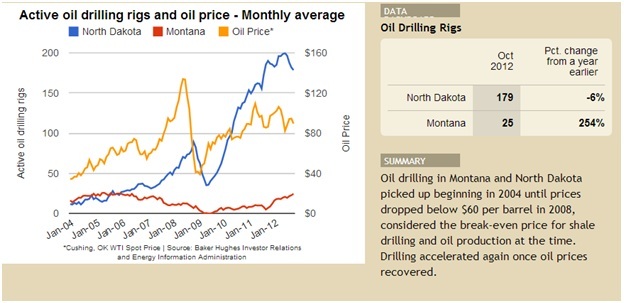

In such an environment, the more barrels a company booked, the better positioned it was to benefit from exploding oil prices. E&Ps drilled aggressively—the Baker Hughes oil rig count more than doubling between 2005 and 2008, the first substantial increase since the 1980s. If you weren’t drilling, you were dying.

But during the last year, the outlook for oil has become more tempered. Largely because the drilling rush was so successful—creating a surge of new North American oil production.

In the year since September 2011, U.S. crude output jumped 16%, or 900,000 barrels per day. This is the biggest rise in nearly 30 years, leading analysts to speculate that this new supply will dampen prices. US prices are now $15/barrel below world prices and Canadian light oil prices are a further $10/barrel cheaper.

The other headwind for E&Ps is recent data showing that a number of much-hyped resource plays are not living up to (admittedly high) expectations. Many wells that came on at mouth-wateringly high rates are now dropping off hard and fast.

TD Newcrest analyst Roger Serin pointed to exactly this issue in a recent cautionary note on resource player PetroBakken Energy (PBN-TSX), stating that “issues relating to high decline rates, a rising cost structure and a balance sheet that in our analysis provides limited future flexibility past 2011, causes us to take a more cautious approach.”

Analysts are realizing that lower-than-expected production from resource plays means a bite out of profits. That’s a big part of the reason the consensus forecast of long-term earnings growth for the S&P 500 Energy index has been falling steadily throughout 2012, now sitting at its lowest level since 1995 (save for the brief inflection seen during the 2008 financial crisis).

With all of these clouds looming over the E&P sector, will companies like Whitecap be able to shore up their valuations by giving money back to shareholders through dividends?

At current share prices, the strategy looks dubious. Whitecap Resources’ planned yield of 7% is only slightly higher than the current 4.6% average yield on larger, perceived-safer multinational oil companies.

All of the new yield stocks say they’ll spend 100% of cash flow on drilling and dividends. That’s where investors are getting cautious on valuation. How do you mix high-risk junior production with a blue chip business model?

If capital cost overruns or unbudgeted expenses rear their heads, these companies will either have to cut dividends or reduce upkeep of their fields. Both of which mean a fall in yield—either today, or down the road as production falters.

Such disappointments will almost certainly mean a cut to share prices. After which, dividends and valuations may well re-calibrate at attractive yields.

The current, more-cautious investment environment might see investors more receptive to dividend cheques rather than capital gains through share price growth. But can E&Ps with waning cash flows pay enough to make themselves relevant as income investments?

Until the new dividend model is put through the wringer of field reality, investors should be cautious of gilded promises.

– By contributing editor David Forest

Editor’s Note: As David mentioned above, America hasn’t seen a bigger increase in domestic crude oil production in 30 years. While that puts a big question mark in the price of U.S. oil going forward, there’s one play that capitalizes significantly on the continent’s production boom… like clockwork. And it’s not just one of the best income plays I know of… it’s a compelling contrarian story that is quickly gaining traction on the Street. Click here to learn all about it.

Bakken Oil Production: Can the Giant Oil Formation Reach 1 Million Barrels a Day?

Can the Bakken produce one million barrels a day of oil?

If so, it would join an elite group of oil fields able to produce at that rate. Only six other fields, including Saudi Arabia’s famed Ghawar field, have ever topped 1 million barrels per day–they are Burgan (Kuwait), Cantarell (Mexico), Daqing (China) and Samotlor (Russia) and Kirkuk (Iraq).

The Bakken is a growth story like no other in the North American oilpatch. Less than ten years ago the Bakken was a useless resource, a pool of oil locked away in rocks too tightly packed for our technologies to penetrate. Then fracking technology unlocked America’s shale oil. Today, the Bakken is churning out more than 700,000 barrels of oil per day (bpd).

But a growing chorus of naysayers thinks the Bakken’s days of growth are numbered in North Dakota. These analysts and operators argue that wells spacing is growing too tight, making each new well less successful.

Who is right? Will the Bakken best 1 million bpd? Or is the Bakken’s biggest growth already over?

There’s no clear answer. What is clear is that the North Dakota Bakken is maturing. It’s now perforated with holes, with a well on almost every 1,280-acre unit, (in Canada, we call that two sections) and the name of the game has changed from wildcat exploration drilling to infill holes.

For the naysayers, it adds up to a Bakken story that has lost its edge. But if the optimists are right, Bakken output will climb by another 50% in the next year or two, the formation will earn historic status, and another round of investors will bank many a Bakken buck.

What Goes Up Must Come Down

The geologists with the North Dakota Department of Mineral Resources are tasked with understanding the Bakken – what has happened to the shale formation and what will happen. And their predictions tell a very interesting tale.

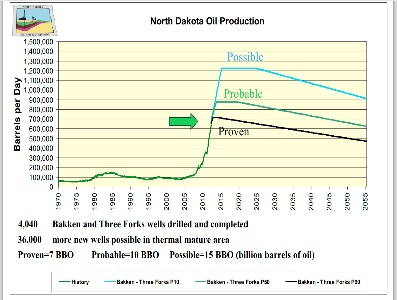

This chart is from a recent department presentation. It shows three possible scenarios for the North Dakota Bakken, all of which show production doing the same thing—but peaking at very different levels.

This chart is from a recent department presentation. It shows three possible scenarios for the North Dakota Bakken, all of which show production doing the same thing—but peaking at very different levels.

That’s because the three forecasts describe three levels of certainty. Proven resources are barrels of oil in the ground that have a 90% chance of being economically recoverable. In other words, the black line showing the ‘proven’ future is a near certainty, one that would be derailed only if oil prices fell a lot.

The other two lines show what would happen to North Dakota’s oil output if less certain resources also end up being put into production. Probable resources have a 50% chance of being economic to recover; possible oil carries a 10% chance of being pumped to the surface.

Areas with probable or possible resources have not seen enough drilling for geologists to be sure of the geology, which leads to two types of uncertainty. First, there may be more or less oil than estimated. Second, the oil may or may not be economic to recover – especially since no one knows what the price of oil will be when the resource is eventually drilled.

If oil prices remain strong and the Bakken’s geology remains consistent through these less certain areas, operators will keep drilling new wells and North Dakota’s Bakken output should hit 1.2 million barrels per day by late 2014. This optimistic outlook means several more years of booming Bakken in North Dakota.

If oil prices tank or the Bakken reveals a geologic surprise that renders billions of barrels of probable and possible resources economically moot, output will plateau at a lower level, and sooner. In fact, if this prediction is the correct one then production has already peaked, at just above 700,000 barrels per day.

The most likely scenario, based on current information, is the one in the middle: that production will kiss 900,000 barrels per day in 2014, remain at that level for almost a decade, and then start to decline.

Whichever one happens, the message is that the North Dakota Bakken is coming close to its production peak.

“There is that point where the older wells aren’t producing as much and newer wells coming online aren’t as successful, so it does even out and production stops going up,” says Alison Ritter, public information officer with the North Dakota Department of Mineral Resources.

That being said, the North Dakota Bakken likely hasn’t reached its plateau just yet – and even when it does, the region will still be pumping a huge amount of oil for many years.

“If you think about it, two to three years is still pretty far out – we’ve still got a long ways to go as far as the drilling phase of things,” Ritter said. “It’s just that we are entering the efficiency phase, where operators are using more efficient rigs to pad drill, so there are not as many drills turning.”

Putting it into Perspective – The Backstory of the Bakken

The story of the Bakken to this point is of a technological triumph that unlocked billions of barrels of oil.

Until the advent of horizontal drilling and fracking, oil contained in shale formations like the Bakken was uneconomic. There was simply no way to access the oil trapped in those thin layers of tightly-packed rocks.

Horizontal drilling and fracking released the bounty of the Bakken. At first, oil production only inched upwards, in large part because there weren’t enough of the powerful drill rigs needed to frack a hole. But as the number of rigs increased so did the average number of fracks completed per hole, and soon production started to skyrocket.

In 2007, Bakken output averaged 75,000 barrels a day. Three years later, production had increased six-fold to 458,000 barrels of oil a day. As of September, production had hit 728,494 barrels of oil per day.

The chart above shows North Dakota Bakken production, which to date is a pretty good proxy for overall Bakken output even though the formation reaches beyond that state’s borders.

Three Challenges

There are three main challenges for the Bakken to reach oil production of 1,000,000 bopd:

1. How much oil can be recovered

2. Can the Bakken overcome steep decline curves

3. The Bakken becomes a victim of its own success—in both geology and economics

There truly is still an immense amount of oil in the Bakken. Original oil in place (OOIP) for the formation stands somewhere between 200 and 400 billion barrels, and production since 1953 adds up to just 503 million barrels.

OOIP is interesting, but what really matters is the amount of oil that can be recovered. If you want to get to 1,000,000 bopd production, you must recover a lot of that oil. The older style, pre-shale, conventional reservoirs have recoveries of near 30% (that’s called the Recovery Factor, or RF) of OOIP.

But in tight reservoirs like the Bakken, the Recovery Factor drops below 10%.

In 2008 the US Geological Survey estimated the Bakken contained 3 to 4.5 billion barrels of “technically recoverable” oil. Soon after the North Dakota Geological Survey came out with a much higher number: 11 billion barrels. For its part, Bakken pioneer Continental Resources (CLR-NYSE) pegged the formation’s recoverable resources at 24 billion barrels.

Whatever the number, it is important to remember that technically recoverable is not the same as economically recoverable. An area with very low recovery rates might host technically recoverable oil, but oil seekers aren’t going to spend millions of dollars on a well that will only produce a trickle of oil.

And a Bakken well that starts with a trickle is bad news, because in shale deposits well outputs decline rapidly – along the lines of 40% year-over-year for the first few years.

Wells in conventional oil fields usually decline in a much more gradual manner:

The third challenge is starting to become more apparent right now. In trying to reach 1 million bopd, the Bakken could be a victim of its own success. The Bakken boom took off so quickly that infrastructure could not keep pace, and now there isn’t enough pipeline capacity to move oil from the Bakken to America’s refineries–on the Gulf, east or west coasts.

The result: Bakken oil is piling up in the storage hub in Cushing, Oklahoma. Basic economics say a glut of supply means lower prices – a heavy burden in a place where wells are unusually expensive.

A vertical well into a conventional oil field costs something like $1 million. The Bakken’s horizontal, multi-stage frack wells cost an average of $9 million, according to the North Dakota Department of Mineral Resources.

That’s a huge upfront cost. Each well produces approximately 615,000 barrels of oil, meaning the breakeven price for each Bakken well ends up in the $70-$90/barrel range, once taxes, royalties, and expenses are included. If oil prices slump below that level, a lot of people say Bakken wells aren’t worth the cost.

As the wells in the Bakken grow closer together, initial production rates are sliding. According to some sets of data, average first year well output climbed steadily from 2005 to a peak in mid-2010, then declined almost 25% over the following 12 months.

With more wells tapping into the same resources, there is simply less oil pressure available to each well. And when initial well output starts to fall, an accelerating number of new wells must be brought online to sustain overall production volumes.

Such is the heart of the pessimist argument: that sliding initial flow rates will tag-team with the Bakken’s high decline rates to mean that, no matter how many new wells are drilled, production will stagnate.

Then there are the crowds of optimists who still see many bright days ahead for the North Dakota Bakken. One of those optimists is oil and gas writer Michael Filloon. Filloon says the naysayers are wrong because they generally fail to consider a slew of factors that impact the economic success of a Bakken well, including increasingly effective frac techniques, longer lateral wells, revenues from the sale of byproduct natural gas and natural gas liquids, and cost savings from the shift to pad drilling. (I really enjoy Michael’s articles—if you’re a serious Bakken investor you should read his articles at www.seekingalpha.com)

CONCLUSION – Production Plateau Is Coming Soon

Exactly when and at what level Bakken output plateaus, one thing is clear: the Bakken is a national treasure. North Dakota is now second only to Texas in terms of state oil production. By 2035, the US Energy Information Administration thinks shale oil could account for as much as a third of US oil production and believes North Dakota alone will contribute 10% of America’s oil needs.

That’s impressive by any measure.

While it’s too early to say if the Bakken can produce 1,000,000 barrels of oil per day, the reality is we should know in the next 2-3 years. Bakken production does best 1 million bpd it will join an elite group of oil fields able to produce at that rate. Only six other fields, including Ghawar, have ever topped 1 million barrels per day.

Even at its current level near 730,000 bpd, the Bakken is a formidable discovery. It has significantly enhanced America’s energy security and generated incredible wealth for investors, landowners, North Dakotans, and state and federal governments. And North Dakota’s Bakken will continue to pump impressive volumes of light, sweet oil for many years.

But whether in a year or three, and whether after reaching that million-barrel mark or not, North Dakota’s Bakken boom will soon plateau. That, my friends, is simply the nature of resource extraction – the Bakken bounty just can’t last forever.

The Montana Bakken Oil Play: “Great News for a Great Play”

Activity in the huge Bakken field is going home.

Home is Montana, where the Bakken was originally discovered.

Drilling equipment and crews are moving back across the border from North Dakota—where the Bakken Boom has been the Biggest—boosting Montana’s rig count to 22 from just eight at this time last year. Montana’s Department of Natural Resources and Conservation issued a record 356 oil drilling permits in the first ten months of the year, easily beating the previous record of 313 set in 2005.

Thanks to the Federal Reserve Bank of Minneapolis for the figure.

In October a Texas company paid $13.5 million for 75,000 acres of oil and gas leases, one of the largest federal lease acquisitions by a single company in Montana in recent years. Several other companies, including Bakken leader Continental, are working to expand the boundaries of the state’s most productive Bakken field, known as Elm Coulee.

Investors often forget that the first successful horizontal well drilled into the Bakken was drilled into the Elm Coulee field in Montana, drilled by Lyco Energy Corp in 2000. There were earlier wells, even horizontal ones, but this 2000 Lyco well is widely cited as the first successful one. (For more, check out this a cool timeline of the Bakken here: http://www.undeerc.org/bakken/pdfs/BakkenTimeline2.pdf)

But geology doesn’t pay attention to state lines… and even though the Bakken boom started with a few good wells in Montana, attention shifted next door after operators decided the geology in North Dakota offered more potential.

There is still an immense amount of oil in the Bakken, which means investors can still find ways to profit from this fantastic formation. But instead of coming late to the North Dakota Bakken party, where six years of profits have left slim pickings, a more savvy choice might be to check out the new scene next door.

BACKGROUND – WHY THE BAKKEN MOVED TO NORTH DAKOTA

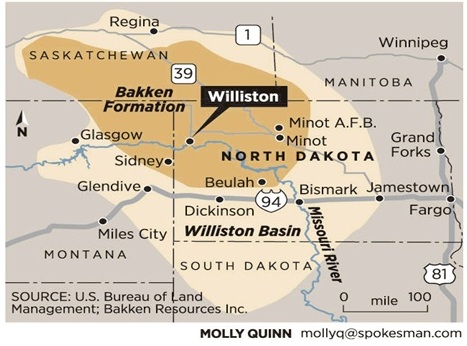

The Bakken is a 200,000-square mile rock unit within the even larger Williston Basin, an ancient inland sea that reaches from southern Saskatchewan to North Dakota and eastern Montana. The Bakken therefore touches four states and provinces, and in the early days of the Bakken boom – way back in 2006 – drilling was fairly evenly split between North Dakota and Montana.

So why did North Dakotans get all the fun? Because of geology.

The Bakken is generally divided into three stacked layers—Upper, Middle and Lower. The upper and lower layers are organic-rich black shales that gave birth to the formation’s oil. The industry calls those layers “source rocks”. The middle layer is made up of more porous rocks—which also means more holes and less pressure in those rocks—so the oil seeped away from those higher pressure, denser layers, looking to a more porous resting place. The industry calls that the reservoir. And the oil is stuck there in the middle Bakken reservoir.

That’s why the Middle Bakken generates the best production volumes…and the Middle Bakken is thickest in North Dakota. In the early days of the Bakken boom, a couple high-volume wells tapped into the Middle Bakken drew almost all of the attention to North Dakota.

Click here to get caught up on the whole story.

Those few gushing wells in North Dakota sparked a land grab there. Then, because North Dakota requires mineral lease holders to explore their acreages within three years, companies with ground in North Dakota had to spend their money there.

And so North Dakota became the Bakken boom ground, with a rig count that climbed from 25 in 2005 to 213 in mid-2012. Meanwhile Montana was largely forgotten, even though the heart of the formation extends across state lines.

BAKKEN MOVING HOME TO MONTANA NOW

Now that is starting to change. In recent months, the Montana Bakken has started to steal some of the spotlight.

Helping the move is new data showing that geology may be less of an obstacle in Montana than originally thought.

Remember, North Dakota produced those gushing Bakken wells because the primary reservoir layer, the Middle Bakken, is thickest within its portion of the Bakken.

In Montana the middle layer is thinner, pinched by the Upper and Lower Bakken layers, and geologists thought a thin Middle Bakken would translate into poor recoveries and flow rates.

But recently, several explorers have had success with wells that targeted the Upper Bakken. The wells don’t have the big initial flow rates as in North Dakota, but they declined more slowly and had a better oil-to-gas ratios (98% oil) than normal, Middle Bakken wells. The result is making geologists rethink the potential of the Upper Bakken – and therefore the potential of the entire Montana Bakken.

A productive Upper Bakken is particularly significant in Elm Coulee, the best-producing part of the Montana Bakken to date. In this area the Middle Bakken becomes very thin, pinched out by a broad Upper Bakken. The result is a world-class source rock – remember that the organic-rich Upper Bakken is the source rock for the formation’s oil – with no nearby reservoir. That means all the oil has remained in place.

Colorado School of Mines professor Steve Sonnenberg pushed the potential of the Upper Bakken in a recent article, saying these results from the Upper Bakken represent “great news for a great play.”

Jim Halverson, a geologist with the Montana Board of Oil and Gas, is cautiously optimistic about the potential for a Montana Bakken boom.

“We’ve got lots of rigs, there’s lots of stuff going on right now,” he said in an interview. “And we’ve got a fair amount of development that’s targeting the upper shale.”

However, Halverson is not letting himself get carried away with dreams of a major Montana Bakken boom.

“Here in Montana we’re going to have the western edge of the Bakken,” he said. “That edge is going to be economic. We will have good wells, then less good wells, then wells that are uneconomic – the price of oil is going to be critical.”

That being said, Halverson also spoke to the possibility that drills might hit into something unexpected – and exciting. Sometimes drills “…find things you weren’t looking for, so just getting more wells drilled here is a good thing. Maybe a year from now we’ll all be doing something we never thought we were going to be doing.”

Next Story: Can the mighty Bakken reach 1 million barrels a day production… OR is the boom soon to plateau?

OilandGas-Analysis.com: A New Screening Tool I’m Using in My Stock Research

I’m all about empowering retail investors. I write my blog and my subscriber paid copy to help them gain back an edge against the institutional money that gets better information faster in the markets. I mean, how many retail investors have a paid analyst at their call?

That’s why I’m excited to put some analytical power in your hands. My colleague Michel Massaad has created The Oil and Gas Analysis (OGA) website — www.oilandgas-analysis.com — which hosts data on more than 400 oil and gas stocks trading on the TSX and the TSXV.

The Oil and Gas Analysis site offers easy to use yet powerful tools for screening oil and gas stocks. Its feature set will let you edit the balance sheet of a stock, compare it to peers, apply commodity price scenarios, production scenarios… producing your own target price estimates.

This initial version of OGA covers Canadian stocks, for now, and mostly junior/intermediate producers. We’ll be expanding it, but in the meantime we want YOU to play with it for free, and tell us what you like, don’t like, and also more of what you want to see.

The stocks are distributed in 5 categories:

1. Junior producers

2. Intermediate producers

3. Senior producers

4. Oilfield Services

5. Pipelines

Other tools allow you to compare peer valuations on multiple metrics:

1. production

2. cash flow

3. cash flow multiple

4. debt to cash flow

5. Price to NAV

6. commodity prices

7. dividend sustainability (payout ratios)

8. netbacks

9. price per flowing barrel

For me, one valuable tool here is calling up all the junior producers with netbacks over $50. Then I compare their cash flow multiple as a quick, initial screening process to see who might be undervalued. It’s a good starting point for Do-It-Yourself researchers.

I think www.oilandgas-analysis.com has the potential to be a great tool for armchair analysts.

Curious about finding out what your stock is worth following an M&A scenario? Michel’s software allows you to plunk in recent metrics—he keeps track of the latest M&A—into your favourite stock to determine a potential takeout price.

OGA also offers a filtering system that allows you to build your own market view. You can:

· Display the top 5 daily movers per category or for the whole market.

· Display the top 10 year-to-date performers per category or for the whole market.

· Display only the dividend payers per category or for the whole market.

· Apply ascending or descending order to any column of your choice.

· Filtering your stock list by price, above or below any price you chose.

Looking at the sector from the angle of your choice helps you spot momentum, trends or simply get a feel on market sentiment in general.

Michel doesn’t cover every energy stock in Canada—just the ones worth investing in ;-). He has put his software background to work with a passion and come up with a product that I think has a lot of potential, and he is continually adding new stocks into his system.

BONUS:

Other than its intrinsic value, I’m offering one-year subscriptions for free to my OGIB trading service for the two people who email us the highest quality feedback on how to improve this service.

If you’re a novice investor, this is your chance to dive into oil and gas investing and learn all about it. Michel has included a tutorial that explains how each variable affects the stock.

If you’re an experienced investor, I think this will complement your strategy by increasing your efficiency in spotting opportunities and evaluating companies based on multiple data points.

OGA is open for OGIB readers to use (for a limited time).

Click here to get started: www.oilandgas-analysis.com — and scroll down to the register/sign-in area.

Please give this new tool a try, and be sure to bookmark the site.

And more importantly, tell us what you liked, and didn’t like—and what you would like to see that’s not there. Remember, the two people who give us the most helpful feedback get my OGIB service FREE for a full year.

Good luck!

START YOUR FREE TRIAL:

OILANDGAS-ANALYSIS.COM

Leak Detection: A New Challenge for the Oil & Gas Pipeline Industry

Do you know how most leaks are found on oil and gas pipelines?

They get a shrill complaint over the phone from one of the landowners where the pipeline crosses.

It’s true, says Dr. David Shaw, one of the authors of a draft “Leak Detection Study” prepared for the U.S. Department of Transportation, for a report that will go to the US Congress early in 2013. Dr. Shaw is a project engineer with independent consulting firm Kiefner & Associates, Inc., a high-end, Ohio-based consulting firm that specializes in pipeline engineering.

The Study – commissioned and funded by the U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) – analyzed several leak detection systems. What the Federal Aviation Administration (FAA) is to airlines, for example, PHMSA is to the pipeline industry.

“Very often pipeline operators haven’t known they have a leak until they get a phone call from somebody saying there’s oil in my field,” Dr. Shaw said in a recent interview with the Oil and Gas Investments Bulletin.

The PHMSA was first founded in 2001 as a result of several large pipeline spills, and their report only goes to Congress every few years. And now is a time when more pipelines are needed than ever before to transport the huge new supply of shale oil, and Canadian heavy oil, through the continent.

Of course, that has brought more public scrutiny to the industry than ever before—making it a high-stakes report for the industry. Surprisingly, the mainstream media has almost completely ignored the 269-page draft report, which was released in late September.

(And of course, the trade magazines don’t cover this issue because that would bite the hand the feeds them—you can’t annoy your advertisers!)

You can access the draft report here: https://primis.phmsa.dot.gov/meetings/FilGet.mtg?fil=397. The public and industry had eight weeks to comment on it. Those comments will now be worked into the final PHMSA report that goes to Congress.

Shaw says there is relatively little market penetration of automated leak detection systems. It’s still being done semi-manually, through periodic monitoring of pressure and flow by operators.

“It’s not sensitive or modern, but that’s where the majority of pipeline leak detection is,” he says. “We rely on controllers to identify something big happening on their instruments. It’s not particularly high-tech. They’re (the pipeline industry) trying to avoid these technologies. The question is why?”

“We called them up and asked them. One primary reason is there’s no systematic guideline for leak detection system deployment. So one of our macro-recommendations (in the study) was to develop standards and certifications for leak detection systems.”

He added: “They (the industry) are particularly worried of regulations that will force them to have specific leak detection procedures.”

He says that pipeline leaks, ruptures, and spills are “systematically causing more and more property damage…in a bad year you can have up to $5 billion in property damages due to pipeline related accidents.”

Given the volume of public property damage, the report comments that pipeline companies would be “probably justified” in spending $490,000 a year for every 400 miles of pipeline.

He adds that the reality is that “right now companies might spend a tenth of that figure (per year for every 400 miles of pipelines). It just needs pushing along here. Somebody has got to move this technology into practise.”

Anthony Swift, an attorney with the Natural Resources Defense Council, said that the report’s findings show that industry talk on leak detection systems doesn’t match the realities of the situation.

“These systems aren’t as effective as many pipeline operators suggest,” said Swift.

He is hopeful that the report will lead to better improvements in leak detection engineering and public transparency.

Industry groups such as the American Petroleum Institute (API) and the Association of Oil Pipe Lines (AOPL) said that the report is flawed.

“The report includes an extensive recitation and largely academic description of LDS [leak detection systems], their technologies and potential applications,” said API and AOPL in a joint statement.

“However, this study presents relatively little in-depth data or analysis of the actual experiences of operators using these technologies, their operational experiences, or benefits and costs in practice. The study hints at many of these issues, but never explores them substantively or with any numerical analysis.

“A critical reader is left unable to make any accurate assessment on the technical, operational or economic feasibility of LDS (Leak Detection Systems-ed).”

Enbridge (ENB-NYSE;TSX) is a member of both API and AOPL. They are researching and testing leak detection technologies that are suitable for its pipelines, including Northern Gateway, said Enbridge Spokesperson Graham White.

“[This initiative] includes an evaluation of fibre optic and odour sensing cables to ensure the technology actually performs as vendors claim,” said White.

(Responses to these comments by the pipeline industry from Kiefner and Associates are also available at the public website:

https://primis.phmsa.dot.gov/meetings/Mtg80.mtg

Shaw says the leak detection technology industry has been caught in a Catch-22 situation for years—they find it difficult to develop new products because there aren’t any major sales to pipeline operators.

Natural gas pipelines will also get discussed in the report to Congress, though most of it will be on liquids pipelines.

Since the last report, a natural gas pipeline exploded in San Bruno California, just south of San Francisco, killing 8 people. Operator PG&E (PCG-NYSE) was found negligent but regulators also came under scrutiny as being too trusting of the companies operating the pipeline.

In conclusion, leak detection technology around pipelines is not modern, scientific or technical. In today’s age, that will just not fly politically.

The challenge for the industry is to either take the lead, increase their leak detection budgets and adopt new technology, or allow government or regulate them into action. What great PR that would be for them!

Both the US and Canada need thousands of miles of new pipelines to get their fast growing supply of oil to market. This could be a big first step in winning over public opinion with billions of tax dollars and profits on the line.