What was the best investment niche in the U.S. energy sector the first half of this year?

Master Limited Partnerships, or MLPs.

Consider one key benchmark, the Alerian MLP Index (AMZ). Since December 31, 2007, the index has returned 66.6% for investors, with about 32% of that from capital gains. Compare that to the S&P 500, where returns slid by 1.55% over the same time frame.

This year has been no exception: over the first six months of 2012, MLPs kept up the pace, outperforming all major investment indexes (as follows):

Index Return Through 6/30/2012

Alerian MLP 6.4%

Utilities Index 4.1%

REITs 3.9%

DJIA 2.7%

S&P 500 2.2%

There’s lots to love about MLPs:

- They combine the income-producing benefits of bonds with the capital appreciation advantages of stocks – and combine them into one energy investment that has outpaced every other leading investment benchmark in 11 of the last 12 years.

- On top of that performance, factor in a tax element that wipes clean 80%-to-90% of your tax burden on that investment.

- Combine that performance with an oil and gas industry investment that, historically, makes money no matter what commodity prices are doing

That’s where MLPs may just may change the way you look at investing, altogether… especially in the more conservative part of your portfolio.

They are particularly engaging in a tepid economy, where finding oil and gas investments with reduced downside risk and returns that beat average dividend stocks is no easy task.

Can MLPs be a game-changer for you? Sure – if you know the lay of the land, and if you know how to play them right.

Here are seven key points on MLPs:

1. What are MLPs, exactly?

In short, MLPs are publicly traded investment partnerships. MLPs have unit holders, and not shareholders, and are targeted toward the energy sector (primarily oil and gas), and trade on major exchanges such as the New York Stock Exchange, or Nasdaq.

For Canadians, MLPs are akin to their former Energy Income Trusts, as both can send most of their income—with almost no taxes—to unit holders.

Energy-related MLPs have one critical legal threshold to clear: In order for a partnership to qualify as one, the partnership must get 90% of its cash flows from commodities (usually oil and gas).

MLPs merge the tax benefits of a traditional limited partnership with the liquidity of a publicly traded company. The MLP doesn’t pay taxes from the profit. Instead, the money is only taxed when the partnership’s unit-holders receive their cash distributions.

And yes, MLPs are growing. According to industry figures, over the past 10 years, MLP market cap growth has grown from $25 billion to $350 billion. MLPs own oil and gas pipelines, transportation and processing, refining, and storage sectors.

| MLP Fact SheetThere are over 100 MLPs actively traded on major global financial markets.MLPs focus on the transport (pipeline) side of the energy market – meaning they earn money no matter the price of oil and gas.

The Alerian MLP Index tracks the performance of 50 MLPs weighted by market capitalization. |

BNN interview on Income Trusts — Canada’s counterpart to U.S. MLPs.Click here to watch.

|

2. How long have MLPs been around?

While the first MLP, Apache Oil Company, was formed in 1981, the investment vehicle really gained momentum in 1986, via the Tax Reform Act, and in 1987, via the Revenue Act. Both pieces of legislation stated that as long as 90% of MLP revenues originated from natural resources related to the exploration, development land ownership, and investment gains and losses, they would be considered “established” MLP structures.

Later in the decade, MLPs morphed into midstream ownership entities that owned assets that transported, refined and stored oil and gas products. That “asset ownership” feature helped MLPs reduce their exposure to volatile oil and gas prices, and provided a steady and reliable cash flow for MLP investors.

Historically, investors have been drawn to MLPs for two significant reasons:

- Income generation — In volatile markets, where high investment risk is par for the course, income-generation is a priority.

- Tax benefits – Since master limited partnerships are considered legal, qualified partnerships by the I.R.S., unit holders earn more income – but pay less tax on that income.

MLPs have taken a pivotal, even leadership role in getting energy to U.S. consumers. They generally trade at a higher valuation than regular corporations (the industry calls those “C-corps”) and can therefore raise money for big projects more cheaply than them.

As owners of the storage facilities and pipelines needed to transport oil, gas and other commodities from the refineries to consumers, MLPs are ideally positioned to benefit from rising energy demand.

3. How are MLPs structured?

MLPs are generally structured with a General Partner (GP) acting as management, and the Limited Partners (LP) providing the capital.

- MLPs can have one or more General Partners, who can have a 2% ownership stake in the partnership.

- MLPs can have thousands of Limited Partners (known as unit holders) who own publicly traded units. Limited Partners play no role in the management of the partnership, and are eligible for quarterly cash distributions.

Most MLPs have a tiered-hierarchy, with a General Partner at the top of the organization, and are tasked to manage the MLP on behalf of unit-holders. Typically, General Partners have a 2% interest in the MLP, while the participation rate varies for individual Limited Partners, and they are tasked with providing financial capital, and benefit from investment gains from the partnership.

Unlike stocks, MLP partners own “units” of the partnership, and the number of units owned represents a Limited Partner’s stake in the partnership. Typically, Limited Partners look for two investment results from MLPs – strong yield and solid growth. In both areas historically, investors have often been rewarded handsomely.

Operationally, MLPs offer investors the following benefits:

- As a partnership, MLPs aren’t taxed like corporations. That “pass through” structure means unit holders aren’t “double-taxed” on dividends they receive. For the partnership, that tax structure means a lower cost of capital, thus giving MLPs a big advantage in generating more assets.

- MLP’s unique tax structure allows for more money to funnel to investors. And since MLPs are publicly traded, that enables MLPs to gain access to a wider ranger of investors.

MLP Business Structure

4. How Can Individual Investors Get Going With MLPs?

Historically, MLPs were only available to the public as individual investments, but in recent years they’ve become available as closed-end funds and exchange-traded funds, and are now widely available on financial exchanges.

Some of the most widely traded individual MPs include:

- Kinder Morgan Energy Partners (KMP)

- Enterprise Products Partners (EPD)

- Magellan Midstream Partners (MMP)

- Linn Energy Corp (LINE)

The most prominent exchange-traded fund is the Alerian MLP (AMLP), which holds over $4.4 billion in net assets. The Alerian ETF invests at least 90% of total assets in its underlying index, the Alerian MLP Infrastructure Index.

Note that individual MLP investors based in the U.S. generally must file a unique IRS tax form annually, called a K-1 form. It’s advisable to consult a professional tax specialist before filing the K-1 form. Canadians can buy MLPs but may be subject to a withholding tax by the U.S. government—again, check with a financial advisor.

5. How do MLPs offer energy investors special tax advantages?

Master Limited Partnerships earned a unique benefit from the Tax Reform Act of 1986, as it largely exempted MLP investors from corporate taxes. Investors may look to real estate investment trusts (REITs) as a blueprint. Like REITs, MLPs are considered pass-through entities by Congress and by the Internal Revenue Service. In that regard, any profits or losses are “passed along” to MLP unit-holders, who pay any associated taxes at their individual, ordinary income tax rate.

Due to what accountants refer to as “depreciation allowances,” MLP investors may receive up to 80% to 90% of investment distributions without paying immediate taxes on the income, thus providing an ample tax deferral advantage for investors.

*Non-U.S. residents get hit with a 35% withholding tax by Uncle Sam. There is paperwork to ensure there’s not double taxation on what you do receive.

6. What are the major risks associated with MLPs?

MLPs do present some risk. For example . . .

- Commodity risk: MLP returns can be impacted if there is a slide in oil and gas exploration and production due to gyrating energy prices.

- Correlation risk: This just means that MLPs go up and down with the market and with commodity prices more now than ever before.

- Liquidity risk: MLPs don’t always offer the same easy liquidity prominent with stocks, mutual funds, and exchange traded funds.

Of course, you have to throw in the regular volatility of the oil and gas industry, macro events, changes in legislation etc—which aren’t always good for the oil and gas industry.

7. Outlook for MLPs going forward

Energy-related master limited partnerships are positioned positive for substantial investment growth over the next few years.

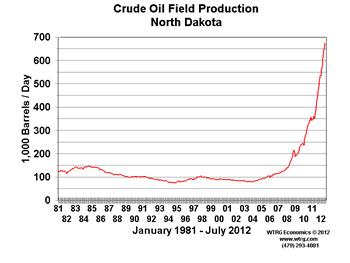

You see, a lot of MLPs transport energy, and as more oil and gas are produced by the U.S., it has go somewhere—and the oil and gas transport services MLPs provide is influenced energy volume, not price. And there’s a strong argument that the lower oil and gas prices go, the more demand there will be for it.

Put another way, pipeline-oriented MLPs are paid to move oil and gas, no matter if it’s priced at $100 or $25 per barrel.

That’s a big advantage for MLP unit holders, who already enjoy some of the best investment returns on the global financial markets over the past 25 years.

More and more investors are becoming aware of that fact.

– Brian O’Connell, guest editor

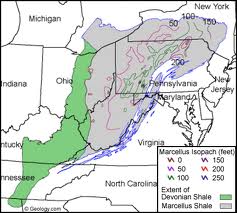

For decades, western North America has produced gas and shipped it to the populated east coast.

For decades, western North America has produced gas and shipped it to the populated east coast.