There is a huge catalyst in the lucrative lithium market right now. It’s something that the entire global industry—and the investors behind it—are watching and waiting to happen.

Somebody, somewhere, sometime, is going to perfect DLE—Direct Lithium Extraction from underground brines.

Below, I have one of the world experts on DLE and lithium brine processing, Dr. Andy Robinson President and COO of Standard Lithium (SLI-NYSE/TSX), explain what some of the challenges have been for them to get as far as they are along this road.

Investors thought that Standard would quickly discover a DLE solution (pardon the pun), and the stock ran from 80 cents to $15 in the last two years—but after running their pilot plant for two years they are not yet commercial.

From all their research into this, they have seen the lows—two high profile short reports earlier in 2022 (because of this DLE delay)—and the highs; a US$100 million investment from the Koch brothers. They have raised over $200 million total.

DLE is a process that will dramatically shorten the time (and hopefully the cost) to bring up trillions of litres of brine to surface, run it through a plant to parse/strip out the lithium and send the brine back down to where it came from.

Because lithium prices are so high and so profitable—up 700% to US$80,000 per tonne sometimes in the spot market now—there are dozens of lithium exploration plays listed in Canada and Australia now.

Many of these penny stocks have properties in what’s called The Golden Triangle, high up in the Andes Mountain Range on the Chile/Argentina border.

Producers up there build huge evaporation ponds, which use a lot of water, and let the sun do its magic for free for 20 months, evaporating away the water and leaving a high-grade lithium concentrate to then be processed.

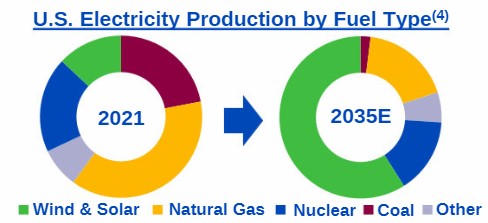

But society no longer wants to wait 20 months for lithium. It wants A LOT MORE lithium right NOW. EV sales are booming around the world. AND… the industry is under huge government pressure in Chile and from environmentalists to do things differently.

A working DLE will almost certainly have huge and immediate impact on the lithium market. I think there’s a good chance the Market will start to price in a large increase in supply.

Will a working DLE become best practice across the industry (this is what happens with drilling and fracking technology in oil and gas, for example) or will it be secretly guarded by anyone who develops it?

Short answer: nobody knows. For now, the Street is discounting DLE in junior valuations—they are not believers yet. To analysts, DLE is being treated like cold fusion—a dream.

For the long answer on the real and imagined challenges for DLE becoming a reality, I interviewed Dr. Robinson. His team has spent the most time and money amongst the juniors so far on DLE, and he was willing to share what they’ve learned to date:

Keith: Andy, you’ve had a pilot DLE plant for two years and raised $200 million. You have a huge body of trial and error to learn from; more than anyone else in lithium. Can you walk us through where you’re at now in commercializing your DLE process, and what you would say are…The Big Learnings?

Keith: Andy, you’ve had a pilot DLE plant for two years and raised $200 million. You have a huge body of trial and error to learn from; more than anyone else in lithium. Can you walk us through where you’re at now in commercializing your DLE process, and what you would say are…The Big Learnings?

Robinson: OK that’s a big question.

So, we’ve been running the DLE plant for a couple of years now at the site, getting data, figuring out how to design, but almost more importantly how to operate one of these plants at an operating facility.

We’ve got a team of 30 people in Arkansas right now, running that plant, day and night, 24/7, 365 days a year, and we’ve been doing that since May, 2020. We’re getting the data, figuring out how to build, design, run, and operate one of these DLE plants at an operating chemical facility.

Keith: That pilot plant to extract lithium is on one of the big Lanxess plants, down in Arkansas. Lanxess has three big chemical plants.

Robinson: Right. Now, one thing I’m pretty sure most people don’t appreciate is that–the DLE part is actually that everyone thinks is the magic beans to get lithium out of the brine, that that is the big secret, and that’s the thing to unlock everything.

That’s actually one of the easiest parts to solve.

So those loads of technologies that you can use to get greater than 90% of the lithium out of the brine, that’s actually quite straightforward, okay? There are lithium extraction technologies everywhere.

The key is knitting that into a complete flow sheet. And this is where it gets, you start to just lose the average investor because as soon as you start to talk about process chemistry, people’s eyes glaze over and they don’t want to know how complicated it is, no one wants to know that.

The practical reality is complicated.

You need to bring this giant brine stream into a plant to then have a relatively small stream of very high purity solid product coming out of the other end, which is what we are doing, right?

We’re taking this giant brine flow and we’ve got this very high, almost pharmaceutical purity product coming out of the other end, right? To do that you’ve got 6, 7, 8 separate process steps, basically. And they all have to knit together, they all have to talk to each other. The recycle loops, a flow here, a waste stream here that has to go back here, this has to be able to handle that waste stream, it all has to knit together and each process talk to one another and work on a continuous basis.

It has to happen every single second of every day. The same thing has to happen all of the time. And that’s complicated to figure that stuff out. And we’ve been able to do it because we have access to an actual operating brine processing facility, where we could figure that stuff out in real time. And that’s why we we’re so far ahead of our competitors.

Keith: Ah, so the DLE itself is simple, but getting the right set up for the brine to get DLE’d, that’s the hard part. Is that right?

Robinson: Kind of, sure, nothing is simple about this, but even then, you have to make sure all that happens 365 days of the year, 24 hours a day, to take a natural brine stream and do the necessary work to get it ready for the sorbent to do the lithium removal.

You have to figure out, pick and test the pieces of equipment and have the other right conditions to run a continuous plant.

Keith: What if anything did you have to invent, like, from scratch?

Robinson: Where we can use a commercially available technology, we have taken that action i.e. We have tried to invent as little as possible in our flow sheets. And we’ve tried some of that.

But the best success is where we’ve been able to take a commercially available solution and adapt and adopt that for use in our flow sheet. That helps a lot for where we are right now, which is looking to scale and build the first commercial plant because we can just point to it and say, “Look, we’re going to use that thing and we’re just going to use more of them basically. We don’t have to reinvent anything there.”

Keith: Does that mean barrier to entry is low to create your own DLE technology?

Robinson. No, because it’s only in operating a plant continuously where you learn so much.

Operators come in, they turn something on, they do some chemistry and then you go, “Oh yeah, it’s working great.” Take down some data and you go, “Yeah, everything’s perfect here. It’s all working well.”

Compare that to running a plant day in day out, every hour of the day, having operators adjusting parameters at three o’clock in the morning when the plant’s still running and making a plant work under those conditions, that has been the biggest learning.

Look, there is industry standard equipment that you can use to do this thing. And whilst that’s true, the practical reality—and what we’ve learned is—that getting the right industry standard equipment and learning how to operate it, is really, really important because when you don’t, things foul up, they clog, you have to shut the plant down, you have to use a whole lot of reagents to clean stuff up.

You talk about low barrier to entry, but in the lithium developer world, I think the market has been a little credulous about how easy it is to go from running a pilot plan in a SEA-CAN somewhere separate from the project for a few weeks or a month.

Going from that to actually running and operating a real continuous process is quite complicated, has a lot of practical learnings that you just have to learn. So that’s really been the biggest understanding for us.

Keith: OK, tell us where you’re at in your DLE process. When will you guys be producing home-grown lithium in the USA?

Robinson: The first commercial project is going to be built on one of the Lanxess facilities in Arkansas, near the town of El Dorado. So, it’s the same facility where we’ve got the demo plant running right now. We don’t have to drill a well or build a pipeline; everything is already there on their site.

We’ve done some pre-feasibility work with an engineering construction company. We then went to a competitive tender process to find the best partner to basically do the engineering design, the bankable feasibility study, and with the conversion mechanism defined in the contracts to become the EPC contractor. And, we went through that competitive process in the late spring, early summer.

By the middle of next year we see ourselves moving towards construction; basically second half of 2023.

We think we’re probably the only project in North America that can point to that really quite short period between where we are right now, finishing up all the design studies, the engineering, et cetera, all of that to moving towards construction by the end of 2023.

And the only way we can say that Keith, is we have no permit issues on our critical path, right? We don’t have any federal permits. So we are not on public land, like in the desert in western US. We’re not in California.

Keith: You have all your permits to go into production?

Robinson: We have some minor permits that we’ll need to get from the state, but no federal permits. There’s a minor air emission permit we’ll need to get; it’s about a three month permit process. We’ve got a surface water discharge permit. Again, that’s just a short permitting window. So, we don’t foresee anything that we have to get to allow construction to commence, which is on the critical path.

Keith: How much lithium are you going to produce?

Robinson: Remember, this is the first one, so it’s not a huge project. It’s going to be a little under 6,000 tons per annum of battery quality lithium carbonate for the first commercial project. So it’s not a globally significant project in terms of its scale.

However, it allows us to be fiscally responsible moving into the first project, given that there’s risk. It’s the first one of its kind, and like you say The Street is still not convinced about DLE, but it will be the first one commercially constructed that we can point to, and we’ll get revenue out of it.

Keith: You say this is the first one. How many DLE plants are you going to do? How many can you do?

Robinson: Well, let me put it this way: We’re in the what’s called The Smackover Formation. It is a very large subsurface brine resource, touching central Texas all the way to Florida. This is the best brine resource in North America.

There is nothing like it anywhere else on the planet based on every piece of research that we’ve looked at. The Smackover Formation is globally significant as a lithium resource for the whole EV transition story.

Because the resource is so consistent (and we’re starting at the Lanxess plant at 220 to 240 PPM lithium in the brine, which is good), the brine is the same, the depths of the brine is the same, how we get it out the ground is the same, how we put it back in the ground is the same, and the plant that we need to build to process it is the same.

So, the first commercial Lanxess facility will be proof that our DLE works, and then we can replicate and scale across our asset resource base in the Smackover fairway.

You know we have our South West project, which is a greenfield area of leases in Southwest Arkansas where that’s going to be a 30,000 ton per annum lithium hydroxide project.

I think we’ve got a very compelling story with all that. I think we’ve got great partners to help us do that.

Keith: But you don’t have the entire Smackover staked.

Robinson: No, for sure, but it’s difficult to build up a big land position. You have got to spend a lot of money and it takes a lot of time to do it. And at the same time there’s no point having a big land position unless you’ve got the technology that you know is going to create the value from that land position.

And we’ve been lucky again that we are the only group that’s been able to deal with a real brine coming continuously to the ground, to the surface day in day out and to be able to figure out a process that works with that actual brine, and we can then translate that across the region.

That’s not to say that there won’t be others, I’m sure there will Keith, but I think we feel we’re ahead of the pack. We’ve got a good competitive advantage, we have great partners, we have large partners who want to see this succeed.

Keith: Big partners like Lanxess and Koch Industries.

Robinson: Yes. Koch has put money into a whole bunch of other EV and battery metals related businesses as well. So, they’ve bet very heavily on this particular energy transition story. So yeah, they’re being very, very helpful, very helpful.

So, you need big partners who help push you along because otherwise it’s just hubris, right? You’ve got small developers saying oh yeah, we’re going to do this, that and the other. And it’s not real. They’re just telling fantasy stories about what you’d love to do, but you need big partners who will help you move along, give you the support, give you options, have ancillary businesses that you can lean on, et cetera. That’s actually how you get stuff built.

Keith: Last question Andy—are you—like Standard Lithium—ever going to announce that your DLE technology is commercial or are you going to keep it quiet?

Robinson: Yeah, and I think we’re contemplating doing an investor day, Keith.

Keith: To say what?

Robinson: You’ll find out the same as everyone else Keith.

Keith: Ok. Anything else you want to share?

Robinson: I know that we’ve been very quiet lately Keith. We’ve been very focused on execution to address the short naysayers who I think they’ve knocked the wind out our sails in terms of engaging with the street and the market.

That was a very unpleasant experience. Completely unfounded, just crazy. But those things happen. I think we’ve, as a result we’ve been very conservative about communicating, telling the story, we tended to keep our powder dry a little bit.

I think we are now at the point moving into execution, real execution that we know we can expect to engage a bit more with market and with shareholders on a public communication level.

Keith: OK. Andy, thank you for your time. Very informative and look forward to more communication.

Robinson: Thanks for your interest Keith.

DLE—Direct Lithium Extraction—will be one of the biggest developments in helping the global EV industry catch up to surging demand. It will shorten the time frame and likely lower the cost of lithium production. It’s a big deal—for the sector and its investors.

Keith: Andy, you’ve had a pilot DLE plant for two years and raised $200 million. You have a huge body of trial and error to learn from; more than anyone else in lithium. Can you walk us through where you’re at now in commercializing your DLE process, and what you would say are…The Big Learnings?

Keith: Andy, you’ve had a pilot DLE plant for two years and raised $200 million. You have a huge body of trial and error to learn from; more than anyone else in lithium. Can you walk us through where you’re at now in commercializing your DLE process, and what you would say are…The Big Learnings?