This guy has my vote for Fund Manager of the Year.

2022 is one of the worst years in history for stocks—yet Rob Mullin continued his winning ways for investors in his Marathon Advisors hedge fund.

Mullin’s fund–it’s called the RAEIF, which stands for Real Asset Equity Income Fund—had a phenomenal year (3rd year in a row) and is one of the top performing strategies in the world over the last 1, 3 and 5 year periods. (due to quirky US securities laws, I cannot provide Mullin’s specific–and impressive—performance data for his hedge fund unless everyone of you readers were accredited investors!)

But trust me, his market savvy and performance make him worth listening to–and below, he shares some of his best ideas for 2023.

His mandate at RAEIF is to find yield through dividend paying stocks in the resource sector.

Mullin uses a broad combination of long and short trades, with option trading of both puts and calls, plus all those dividends to create a portfolio that has given remarkably consistent returns through 2022, increasing the fund’s value roughly 20-25% each quarter.

Considering that commodities and resources is one of the most volatile sectors of the market, that’s impressive.

Mullin says that resource producers have been “demonized” by mainstream investors, and that means they are trading at some of their lowest valuations in history. That makes for very high yields—high single digit often double digits—despite low payout ratios.

In 2021, fund managers just needed to buy oil stocks to have a good year. They went from pricing in bankruptcy to being the single largest cash cows in the S&P 500. But oil producers’ stocks have been flat since March.

In fact, much of the resource sector stalled out at the end of Q1, and Mullin said he had to get nimble, and quickly—weighting his RAEIF LP to the short side in a hurry.

I’ve known Rob for 15 years, visiting him in his San Francisco head office whenever I was in town, and hearing his thought process on the Market at the time.

But he really came back on my radar in early 2020, when he pulled off an incredible trade—buying “put insurance” for the Market just in advance of the COVID meltdown. Every other fund manager (except Bill Ackman; same trade) lost huge, but Mullin’s well-placed insurance markers made his year.

His fund has been open only to American accredited investors, but in November 2022 he set up a fund that TROW—The Rest Of the World—can now invest in, to take advantage of his expertise. You still have to be an accredited investor though.

I’ve convinced him to speak to our paying subscribers once a quarter through 2023. But he agreed to share his strategy and some stock picks for 2023 with us today:

Keith: Rob, you had a great year, congratulations. But let’s look forward now. How are you positioning yourself for 2023:

Mullin: Well, a lot of the stuff that I’m buying is actually a heck of a lot closer to its 52-week lows, than it’s 52-week highs.

Where I’m looking, there’s still a lot of opportunities that aren’t pressing high valuations, not up 50, 150% year to date. So that’s really where I’m focusing.

Keith: Do energy stocks fit into that at all?

Mullin: Yes. So in the energy patch, I think the global integrated oil energy companies are really interesting. You look at things like a Petrobras, (Brazil’s NOC—national oil company) which trades a US ADR (symbol PBR-NYSE).

Or an Ecopetrol, (Colombia’s NOC, national oil company) which trades a US ADR (symbol EC-NYSE). These are global $20 to $60 billion market cap companies, trading at two and a half times earnings, with 20 plus percent dividend yields. And yes, I understand that there are some political things that happened in both Colombia and Brazil, respectively.

Ecopetrol was an $18 stock in March. It’s a $9 stock today, and it’s $18 billion in market cap, earning $2 billion a quarter. You look at Petrobras, a $65 billion market cap, it’s paid off almost $80 billion worth in debt. It may be the greatest pay down of debt in the history of any company in the world. I mean, we’ve never seen anything like it

And again, this is a $65 billion market gap company, that made $9 billion in earnings last quarter. So it produces more oil than Exxon does. Exxon’s got a $450 billion market cap, this is a $65 billion market cap.

So to me, those are really interesting opportunities that offer a lot of asymmetry.

Keith: There’s so many different—and big—macro currents right now in the Market. Will the US Fed pivot or not pivot, COVID in China, the Ukraine-Russia war, COVID supply chain issues etc. When you look at 2023, what would be one of the top two factors that’s guiding your macro thinking.

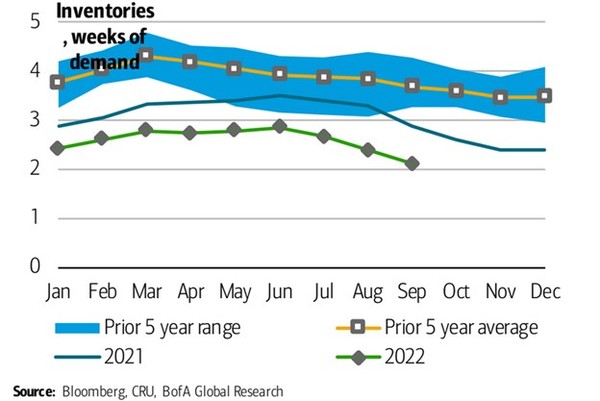

Mullin: What I’m trying to do is kind of strip out the noise, and really listen to, what are resource inventories telling us? What are inventories telling us about the global economy, on the margin?

And to me, what that is telling me is that demand remains fairly firm. You look at what has happened to oil inventories in the last three or four months. They’ve been fairly steady, they’re not really building, they’re not really coming down. Oil prices have come down a lot, but oil inventories have been pretty flat.

That said, you strip out the impact of the SPR releases, which have added about 350 million barrels to global inventories, global inventories continue to fall really rapidly.

So that backdrop to me, on energy, just seems really robust.

To me, a big part of the reason why oil prices have come down, is because of the massive financial liquidation of oil. You look at the speculative traders positions, the CSTTC reports, and areas where you look at where managed money…you’ve had a selling of financial barrels, but the underlying inventories, which is what I think we should be really listening to, tell you that the underlying demand story is pretty good.

And a related sector is oil tankers, though I call it tanker and infrastructure sectors. I think there may be a case here to pivot back to the bulk shippers, the ones who do iron ore and grains, and things like that. Those stocks have been beaten up pretty good. They’re sort of back again, back a lot closer to their lows than highs. Some companies in there have some pretty substantial dividend yields.

Keith: Any favorite stocks there?

Mullin: So, my favorite in the bulk guys is Star Bulk, SBLK-NYSE. That’s, in all likelihood, call it a $20-ish stock that’s going to pay something close to $4 in dividends, in 2023. So that’s right up my alley. It’s reasonably large, it’s liquid.

Keith: As I read your quarterly letters, you talk about all ELEVEN sub-sectors of resources that you follow. What are two of those 11 you like in 2023.

Mullin: Sure. The Ag space—agriculture—is one. I would say that even before Ukraine, the higher fertilizer prices were causing farmers to cut back on fertilizer applications.

That’s going to start showing up in yields over the next three to six months. I think inventories are going to tighten up considerably, and I think the big risk that we run is going into a 2023 where we’re seeing a lot more in the way of resource nationalism, which I’ve written about a little bit.

That’s where those countries that typically have surpluses, and the ability to export those surpluses, may be less inclined to make those surpluses available to importing countries.

If we continue to tighten up on inventories, like we have been over the last year or two, I think there’s going to be even less of an inclination to share, which when you tighten up the marginal bushel, or marginal barrel, whatever it is. That’s when prices tend to sort of surprise, to the upside.

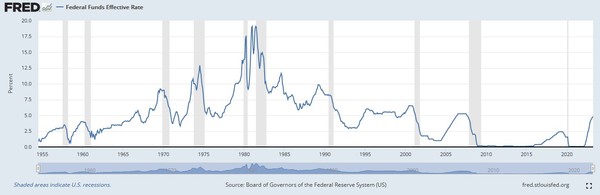

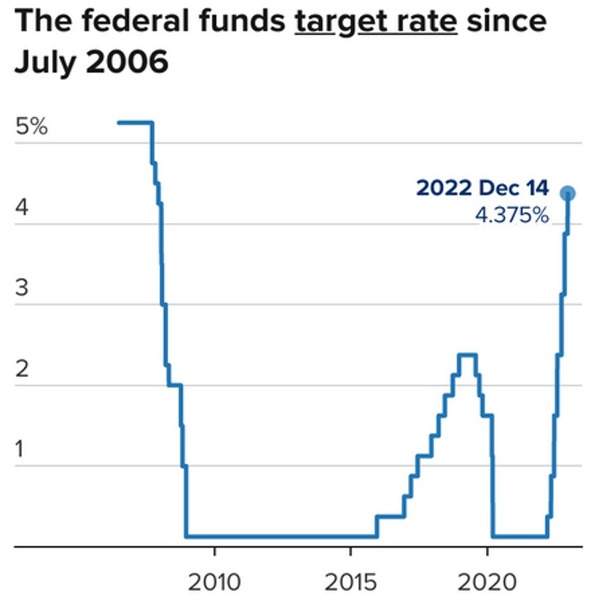

And then, one other sector for 2023–I actually like the gold space. I think we are seeing, as the Fed marginally moves towards a more flattish outlook, they’re still going to raise, maybe they don’t cut aggressively. But the pace of tightening is going to go down.

It seems like this relentless dollar rally has sort of lost its steam. I’m not saying that highs have been made for USD, but I think we’re kind of in the ballpark. For that reason, I think gold’s performance this year has actually been pretty darn good.

Particularly if you look at it outside of the US dollar, in most other currencies around the world, it’s actually up this year. In some currencies, like the Japanese yen, it’s up a decent chunk.

The fact that gold has held in, despite again heavy financial liquidations, is impressive. Gold ETFs suffered 22 straight weeks of outflows, up until last week. Late November saw the first inflow in 23 weeks.

So you’re starting to see some of this financial demand sort of reverse. I think the physical markets are going to remain relatively tight. Gold stocks have started to rally a little bit, the bigger caps have come up a little bit more.

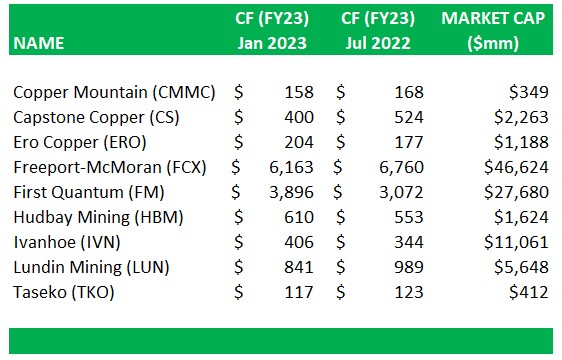

The smaller caps are still lagging, but they’re sort of coming off their lows. They’re inexpensive stocks, lots of them with kind of reasonable dividend yields, high free cash flow generation.

If you look at them as I do, compared to the valuations over the last 25 or 30 years since I’ve been doing this, I’m not sure I’ve ever seen the gold stocks, in aggregate, at a cheaper price to cash flow, price to free cash flow, price to NAV on strip, than I see them right now.

And so I think it’s sort when everyone has given up on them for being dead, is exactly the time where I want to be sort of kicking around, and looking to position myself in them. So that’s another area.

Keith: that’s great color, thank you. So what’s a stock in that sector you like?

Mullin: Well, I like Sprott—SII-NYSE and SII-TSX. So here you get the benefits of the gold play, but you also have uranium funds, you also have others.

Sprott has traded around this $30 level, when it had $6 billion in AUM (Assets Under Mgmt), when it had $16 billion in AUM. Now it has north of $20 billion in AUM. It’s still right around $30 per share. And so, again, I love places where you’re building convexity and not paying for it

And there’s actually good precedent for that. The same thing happened back in the 2002 to 2007 gold bull market, one of the best performing stocks from 2004 to 2006 US Global Investors (GROW-NYSE), which was the Sprott of its day, in an environment where the GDX went up 50 or 60%, US Global went up tenfold over those two years. So there’s precedent for this, and I think we could see something like that again.

Keith: Rob, any final words of wisdom you have for resource investors in 2023?

So over the top of all of this, investors need to be cognizant, that this is not going to be a straight run. I think that if 2022 taught us anything, none of this is going to come easy.

We as resource investors do not get to have the great technology, healthcare, sort of up and to the right, where you can just lever along and ride it for four or five or seven or 10 years. It just doesn’t happen in our sector.

The nature of resource bull markets, which I’ve said a number of times, is that the fact that commodity prices are rising and inflation expectations are rising, that causes a lot of instability in the broader markets.

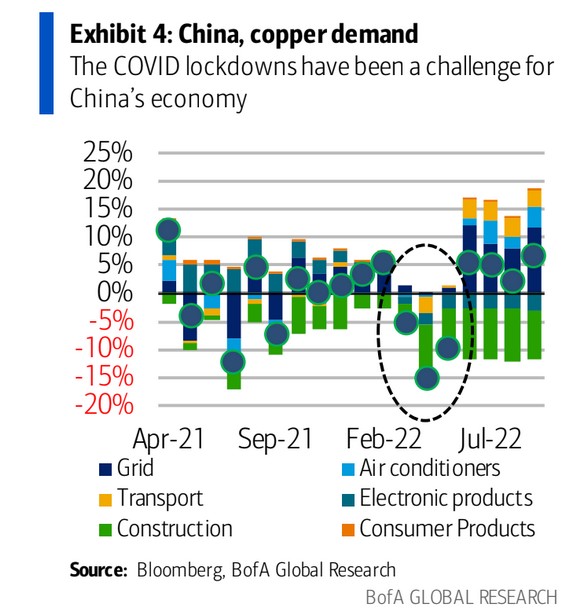

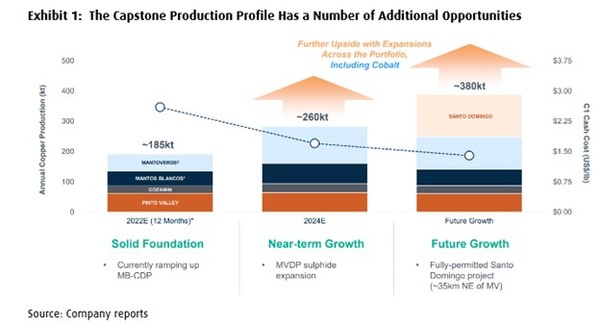

The resource cycle doesn’t end until the capital is spent to bring on enough supply, to make it end. If all the politicians and bankers and management teams were able to raise the capital required to produce more oil, more copper, more nickel and more lithium–we would still be five to seven years away from really seeing a meaningful uptick in that supply.

That money to create that extra capacity was not spent in 2016 to 2022 and it’s not being spent now.

So I think it’s really early. The real resource cycle doesn’t end until late this decade, if not even later. We can have volatility and phases within the cycle, but we have years to go here I think. So that’s where I think we are.

Keith: Wow, that’s powerful! Rob thanks for sharing your thoughts and congrats again on an amazing 2022, and look forward to catching up in early 2023.

Mullin: I appreciate your interest Keith. Merry Christmas.

EDITORS NOTE–you can connect with Mullin on LinkedIn at https://www.linkedin.com/in/robert-mullin-58422b84/

Keith