Have you had trouble wrapping your head around this market? I know I have.

The economic data is ugly. 10%+ unemployment is not a good place to be, no matter how you frame it.

A second wave of the virus means a slowdown and a W-shaped recovery even if there is no broad shutdown.

It can’t be good for stocks right? Yet the market is resilient. The action I watch every day is screaming to me that this is not a market that wants to go down.

So, what is going on?

A few things, I think. First, the market is not the economy. It does go up and down roughly with economic activity, but this isn’t a one-to-one relationship.

The market is full of largest companies in the economy. The shutdown, the second wave, the half-full malls and stay-at-home workers – these are all disproportionately impacting small business.

But Ma and Pa’s restaurant or uncle Joe’s barber shop aren’t trading on the big board. These businesses are being decimated, but they are not part of what we trade.

Second, many of the companies that we do trade are actually benefiting.

We have been picking these sorts of names up for InvestingWhisperer subscribers. These are businesses that are outperforming because they are part of the stay-at-home, work-from-home, medical supplier, and biotech sectors – ie. parts of the economy that are booming.

Third and most important – liquidity. There is an old saying that stock markets perform best when you have a lot of liquidity and no where else in the real economy for it to go.

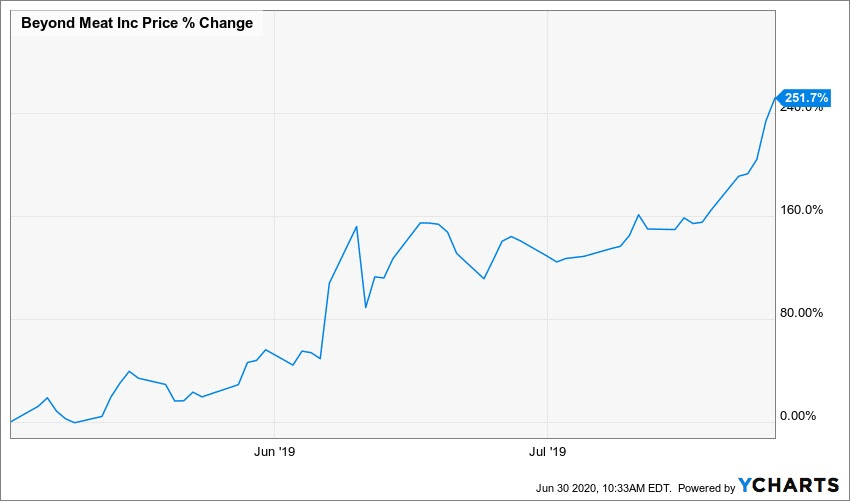

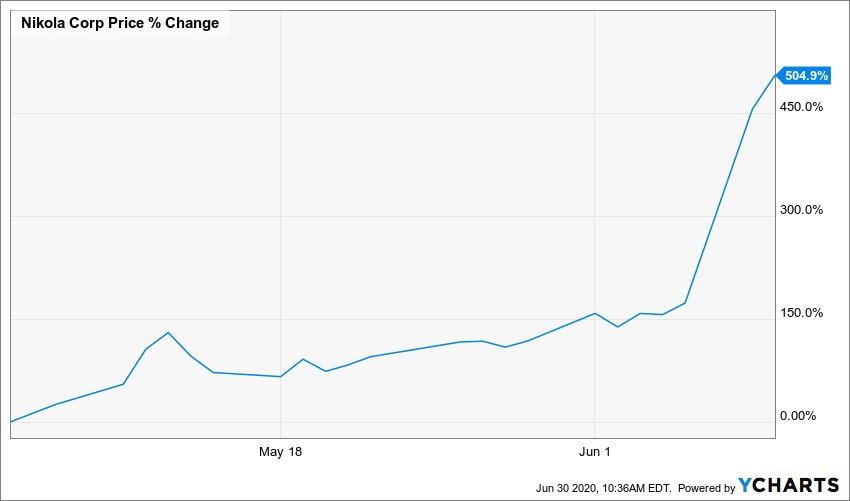

No surprise that the outcome is topsy-turvy – this is a market where it has been better to be speculative.

You do not want to be tied to the underlying bricks and mortar economy. That economy is not doing well. Eventually you will have to report numbers that are going to be ugly.

Far better to have a business that is far removed from real measurement of performance – or where performance in terms of revenue and earnings is secondary to the story.

It is all about the story.

You want a stock that has a good story as story stocks are the rage. Take for example electric vehicles – great story. I love it. Some day this business is going to be amazing.

Just not yet. Electric vehicles remain an (albeit growing) niche. We are in the nascent stage of their deployment and it still is not clear how fast their ramp will be.

But ironically that makes for the perfect story in this kind of market. If quarterly sales numbers disappoint – no problem. It is not about current demand anyway – write-off the disappointment as a one-time (pandemic induced) hiccup and the story remains intact.

This week the iShares Biotechnology index broke out to new highs after 4 years of consolidation.

This is not surprising. Let me ask you what group of stocks are

- story stocks,

- untied to the economy and

- speculative.

You guessed it: development stage biotechs.

Yes, I realize that clinical trials are being delayed and that is a negative. But this is a minor complaint. The business of these names is so far out – usually 3+ years – that what they do next quarter is largely irrelevant. Whether approval occurs the first half or the second half of 2023 does not matter – all that matters is that their drug gets approved.

You want another example you only need look so far as the gold juniors. I’m not talking producers – I’m talking companies with a project or a property.

These stocks are screaming. We have made a killing of these names. Yes, that is because gold is hot right now. But it is also because these are great, speculative vehicles whose outcomes have no relationship to the economy, to the pandemic or anything else.

This may all end badly. In fact, I would bet it does at some point. But that could be a long way off. The Fed and other central banks only started pumping the money a few months ago. If history is any guide, we have years of printing ahead of us. Given the scale of economic destruction, this cycle will likely be bigger than ever.

I may not like it, but it is not my place to moralize. My place is to detect and understand. And it seems to me that there is so much liquidity out there that people will want to buy stocks for some time coming.

Weirdly enough, you may not just want to buy stocks, you may want to buy those stocks that are furthest away from what you would normally buy – those that don’t have real earnings, aren’t tied to the economy and cannot be hurt by the economy.

It sounds like a wacky formula, but it is one that is working in this topsy-turvy world.

EDITORS NOTE–Here’s one story stock that’s turning into reality–and fast. Armed with a disruptive technology that is fast gaining market share vs. competitors, and a CEO with an amazing track record in larger companies, this business is taking off THIS QUARTER. Trading at just 10 cents, it’s the best ground floor opportunity I see in this market–get ready to profit by clicking HERE.