In the 18 months since I profiled Trillion Energy (TCF-TSXv / TRLEF-OTC) has drilled 6 successful wells—with zero misses, and raised CAD$60 million in debt and equity! They made 3 new discoveries and tripled their reserve base to 63 bcf—billion cubic feet of gas.

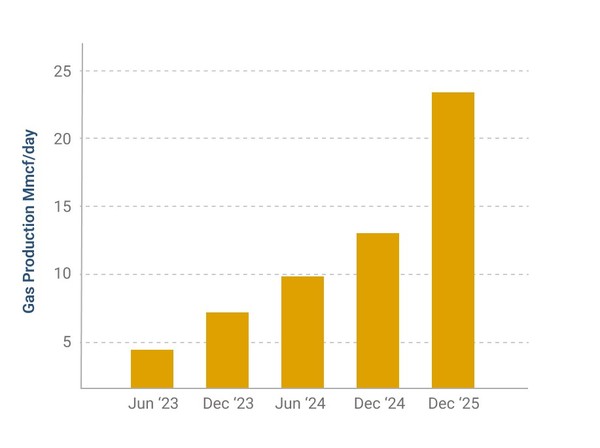

They’re now producing –net to them—over 7 million cubic feet a day of natural gas in the lucrative European market—where prices are bouncing between US$10-$15/mcf lately.

Yet the stock is trading at 3 year lows, despite gushing cash flow.

To give you a sense of the numbers—their October gas price was US$12.33 or CAD$17 per mcf, which generates just under CAD$120,000 a day in revenue.

But get this–that was with only 3 of the 6 wells online! Three wells that have already been drilled—that money is spent—are coming online by the end of January 2024.

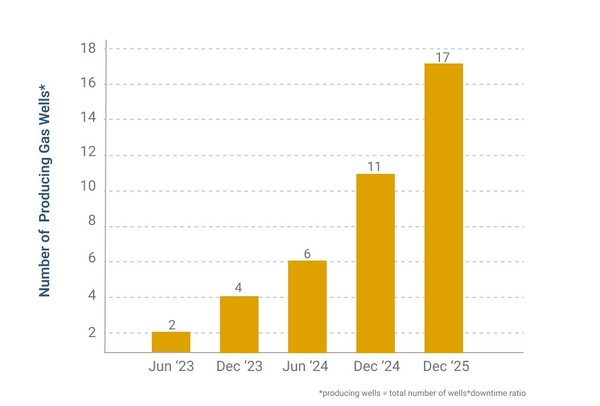

In total, in the next 13 months, Trillion expects to bring 5 more wells into production, for a total of 11, which should increase production 70%+. By the end of 2025—17 wells online!

That’s all good news—really, it’s great news. But as they now start their biggest growth curve in history, the stock is cheaper now—at 40 cents a share–than it was when I first profiled them, and they had nothing!

As recently as October 30, 2023, Canadian brokerage firm Eight Capital has a $4 price target after the latest update on more drilling success.

The main reason for this low share price is crazy—in October, a small cap fund manager went bankrupt, and had to blow out their shares—just as the company’s growth curve is about to start:

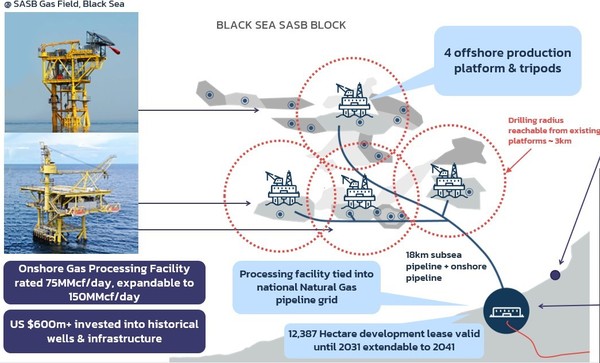

Well, I shouldn’t say Trillion had nothing back then. They owned 49% of 4 offshore drilling platforms—for which they paid US$2.5 million, buying it in a bankruptcy sale from a trustee. Those platforms originally cost US$270 million—that’s a 99% discount!

Combine that super cheap asset with new technology—long, flexible underwater drilling technology—and suddenly Trillion was able to start growing quickly, and cheaply.

And now that growth curve will accelerate—with the first three new wells coming on very quickly, and very cheaply—as they have already been drilled!

There’s a bonus play here I’ll tell you about at the end of this story—an oil play, onshore, with well costs of just $2.5 million and surrounding wells have 10,000 bopd production—ten thousand barrels a day. It will get drilled in 2024, and it’s a game-changer for shareholders if it produces what neighboring wells recently have.

But there is so much momentum in their core gas play in the next 6 months, Trillion is set to reward investors NOW—especially from these levels.

THIS IS ONE OF THE MOST

PROFITABLE NATGAS MARKETS

IN THE WORLD

Turkey is a GREAT market for natural gas—with 86 million people, it’s the 7th largest natgas market in the world. And they import 98% of their gas, and 90% of their oil (mostly from Iran and Russia)—one of the reasons their prices are 2-4X what they are in Canada and the US, all the time.

It’s a G20 and NATO country, but the Turkish lira has been weak this year—which reduces costs. You get to sell gas in USD, but produce it in lira.

More good news for producers is—even though European natgas storage is essentially full, prices are still very high. You see, every year the news service Bloomberg writes a story reminding investors—European storage only lasts anywhere from a third to a half of a cold winter. Last year’s super warm winter may not repeat.

Trillion’s 2024 guidance (Sept 29 release) conservatively calls for their net production to be at 15 million cubic feet per day by year end. The company’s projections have them producing—net to them—over 20 mmcf/d by YE 2025.

CME futures pricing for the main European benchmark (shortform is “TTF”), which you can track HERE– https://bit.ly/TTF-price-2024 shows US$15+ per mcf each month in 2024, even in spring and summer.

Turkey’s gas price is within a couple dollars per mcf of TTF; sometimes less, sometimes more.

But even at the current US$12.33/CAD$17 per mcf, their YE 2024 target rate equals CAD$255,000 revenue per day, or CAD$93 million annualized—IF they meet their guidance. Now, so far, CEO Art Halleran is 6-for-6 on his wells, and the next 3 get to come online at a very cheap price—roughly $150,000 in new parts, as the wells are already drilled.

The current market cap of the company is CAD$32 million.

Please remember, their overall 2023 revenue will be smaller than that number, as these wells come online throughout the year. But the hoped-for prize at the end of the year in 2024 is pretty good!

THE MOST WATCHED OIL WELL IN 2024

On May 1 this year, there was an incredible new oil discovery in southeast Turkey—way at the other end of the country, far from where Trillion was drilling in the Black Sea. The Yalcin-1 oil well—just north of the Iraq border, but inside a G20 country that belongs to NATO—hit BIG paydirt…and is now producing 10,000 barrels of oil per day.

This well only cost US$3 million. At current oil prices, it would pay out in less than a month.

Trillion gets to drill a nearby well in this same prolific field in 2024!

Because of Trillion’s success in drilling—6 for 6 remember—they were invited to earn 50% of oil exploration block M47. It’s three large properties, totalling more than xx km2, and the first well will be drilled only 11 km from Yalcin-1.

Yalcin-1 is credited with over 1 BBBBillion Original Oil In Place (OOIP). It had a payzone of 162 metres of beautiful light crude at 41 API (that’s very light!).

This is an incredible opportunity for Trillion and its shareholders. This one well is a company-maker on its own.

- They will be drilling into a known field, with well control data from a nearby producer.

- It’s not a deep, expensive well—only US$3 million to drill down roughly 2600 metres, or 8500 feet

- Trillion gets a simple joint venture agreement, not a Production-Sharing-Contract (PCS) which is usually heavily tilted in the gov’t’s favour

Just to give you an idea of what a repeat of Yalcin-1 would mean for Trillion—at US$80/b ($84 today) their 50% would equal 5000 x 80 x 365 = US$146 million gross revenue, or CAD$197 million.

That all sounds exciting doesn’t it? But remember—this is still exploration!!!

CEO Art Halleran has a great track record now, but they COULD still miss on this big well. That’s the risk.

But they do have fast growing cash flow from their gas production to help pay for everything.

IF they DO hit, however, they will be gushing record cash flows, and easily able to meet their CAD$16 million commitment to earn their full 50% interest in all three large blocks in this prolific oil field.

CONCLUSION

Trillion is starting a huge growth curve now, with THREE already drilled wells coming online in the coming months—just as one fund manager was forced to liquidate a large position in Trillion stock.

When you see the stock chart, you can see the impact this has had—and that’s why I’m updating you on this story NOW. The stock has traded 39.4 million shares in the last two weeks—there’s only 78 million shares out now! Fifty percent of the stock has now turned over, and volume has soared as savvy investors try to get a position at a historically low valuation here.

The steady natgas drilling will continue to lift production and cash flow for Trillion. Europe WANTS more domestic gas, especially Turkey. Trillion has hit on every single well so far, and increased the number of producing gas fields from 4 – 7. They understand those reservoirs very, very well.

But when I talk to CEO Art Halleran, it’s the excitement around this oil well that he gets to drill in 2024 that stands out. Their success has earned them this opportunity.

Success here would create a mid-tier producer instantly, with diversified production of both oil and gas in a low cost country—a G20 nation that’s part of NATO.

It’s a rare opportunity—in both 2024 and…due to this fund liquidation—right now.

Trillion Energy has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.