There is a very limited time for investors and gold majors to snap up big assets—on the cheap.

As the western world gets used to a MUCH higher gold price now—maybe higher, maybe lower than the current US$2300/oz—asset SELLERS will want a much higher price for their ounces in the ground.

That’s why you saw Frank Giustra’s Black Wolf Copper and Gold (BWCG-TSXv/BWCGF-OTC) announce a merger with James Gowan’s Treasury Metals (TML-TSX) today.

Gowans is ex-CEO of Barrick Gold, and has built two mines in Ontario (Victor and Rainy River). Giustra is Canada’s most successful early-stage mining financier. This win-win merger marries two of the top mining networks and financiers, and they’re giving investors a head start with:

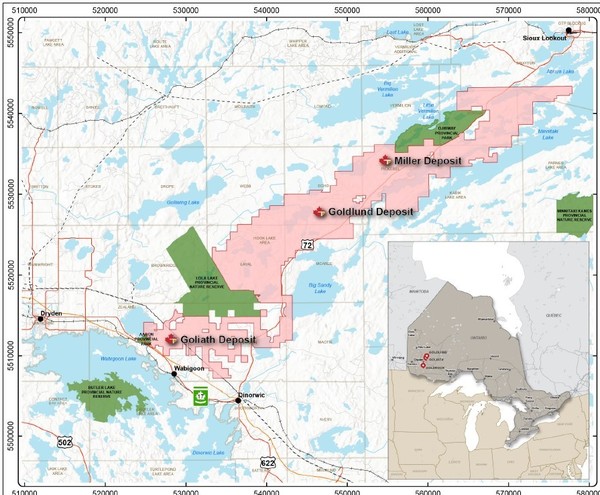

- THREE MILLION OUNCES of gold in the ground still (these assets produced in the 1980s once)—and all of it is what they officially call “43-101 compliant”—in northwest Ontario

- Multiple exploration targets to increase that number

- The all-important federal environmental permit already in place

- $10 million in the treasury + $4 M in post-deal financing=$14 M cash

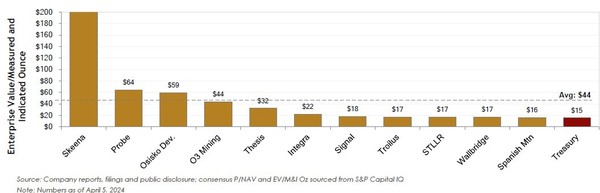

- A valuation at the bottom of their peer group

At a market cap of just $37 million (Enterprise Value=$28 M), TML screens as one of the cheapest gold stocks on the board right now—and its asset in Canada, on the TransCanada Highway with hydro power right there.

Their ounces can be mined simply, cheaply, and safely (in Canada)—and they are ready to go; a pre-feasibility was recently done. The Street LOVES simple/cheap/safe.

With a surge in the gold price leading investor interest, there is a brief time window when teams with these big assets can get structured properly so EVERYBODY wins as the gold bull market gains momentum.

Giustra and his team saw the opportunity to create the starting block for a new mid-tier gold play with a great asset suite and a team of proven mine-builders—led by Gowans and CEO Jeremy Wyeth–two proven mine-builders–on the board at Treasury.

Both companies are so cheap compared to these assets and the price of gold, they have a lot of flexibility in forming the new merged entity, which will get a new name—today we call it NewCo.

I’ve seen Giustra operate up close for 30 years, and one thing I learned was that how a deal gets structured in the beginning is key to its success.

And Giustra is a genius at that, with junior companies that turned into Goldcorp (gold), Northern Orion (copper) and Urasia (uranium) in the 2000s and most recently West Red Lake Gold—all being multi-baggers for investors who bought on days like this—Day One.

With Giustra as a fund-raising partner and major shareholder, Treasury CEO Jeremy Wyeth and his accomplished board get to stay independent—and deliver on their vision to shareholders.

The Street will now have a lot more confidence these assets can get into production in a timely and efficient manner. That could have an immediate impact on valuation.

A lot of that just has to do with the stock being liquid. And as you watch Giustra’s West Red Lake Gold (WRLG) trade, you know regular liquidity will be there.

The Market timing is very good—as the price of gold skyrockets—but the asset timing is near perfect as well.

The opportunity here is for NewCo to get the first 1.2 million ounces into production—and generate hundreds of millions of dollars of Free Cash Flow—quickly.

With a pre-feasibility study that’s only a few months old for TML’s Golden Goliath project—which in Year 2 should produce over 100,000 ounces a year production and in that year alone gush $100 million Free Cash Flow (FCF) at strip pricing—this asset is near-ready to get built and start generating great returns for investors at current metal prices.

Payback on this $335 million capex is less than 3 short years—and that’s just at US$1750/oz gold. Today, at US$2300/oz that payback period would obviously be shorter.

Simple. Cheap. Safe. Add FAST to that list.

A Hidden Key here is—permitting. NewCo has its all-important federal Environmental Assessment permit, which can take YEARS—and gives NewCo a HUGE advantage competing for investors against other gold developers.

So not only is NewCo in a premium jurisdiction—and the Market wants North America gold assets more than ever, after several coups in gold-rich West Africa, and leftist governments re-taking power in much of South America—they have the key permit that will allow construction and production here quickly.

The pre-feasibility shows an IRR of 41% at US$2150/oz an NPV(5) of $652 million. All-in-Sustaining-Costs (AISC) are estimated at US$1037/oz.

Those are great economics in this gold market! And like I said earlier, these assets are CHEAP compared to their peers, giving lots of room for investors:

Source: Treasury Metals presentation

This is Giustra’s second move in Canada in exactly a year—last April he used his West Red Lake Gold to buy the $350 million Madsen mill in Ontario—sitting in a bankrupt company—for only US$6.5 million, some shares and the rest to be paid out of future cash flow.

It was a steal then, and with gold rocketing up to a recent peak of US$2400/oz, it’s an even bigger win for shareholders. The stock more than doubled from 40 cents to over $1/share recently. A 3% lower Canadian dollar, YoY, is helping Giustra’s strategy, making Canadian operations even lower cost.

The Blackwolf-Treasury Metals deal is more a win-win merger for shareholders of both companies.

While TML is officially the senior partner here, with 3x the market cap of Blackwolf ($37 M vs $16 M), BWCG is coming in with the funding track record; being able to raise a lot of capital quickly, in good markets and bad.

In the months before this big US$400/oz move up in the gold price, Giustra’s team raised CAD$90 million for WRLG to move Madsen back into production in the next 18 months. The stock traded $750,000 worth of volume a day for the last 3 months, now it’s more like $1 million a day.

Nobody else was raising that kind of money for juniors in 2023.

Three million ounces is a great head start for NewCo—but the potential is for a lot more. Only 5 km out of 65 km has been explored for gold so far, with many well-defined targets right in the known mineralized trend.

The asset—called the Goliath Gold Complex—sits just 200 km south of the prolific Red Lake Gold Camp, where 30 million ounces of gold have been produced. It’s one of the largest gold districts in the world.

Giustra and Gowans think the Goliath complex could be the start of something BIG. And they’re giving investors a big head start with three million ounces of gold and a low valuation.

I expect this to start happening with NewCo. Today is Day One.

Blackwolf Copper and Gold has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.