Canadian pipeline companies transporting western Canadian gas are slowly get squeezed out of the North American market, says a new report by Bentek, an energy analysis company based in Denver, Colorado.

“The utility of certain pipelines in Canada – of pipelines that are traditionally considered as export pipelines – that utility will drop,” says Jack Weixel, Director of Energy Analysis for Bentek.

Bentek’s report – titled The Big Squeeze – states that “planned pipeline expansions in the U.S. will unleash more supply from shale and other unconventional formations in the coming years.

“There is nearly 10 Bcf/d of capacity planned for pipeline expansions or new builds designed to support the growth of the Marcellus and other supply from unconventional plays in the Southeast/Gulf and the Rockies.”

Weixel says there are two squeezes going on for western Canadian gas. One, outlined in my story here – http://oilandgas-investments.com/2010/natural-gas/2012-outlook-for-canadian-natural-gas/ – is that gas from western Canada is being displaced by fast growing US shale gas production in the Marcellus shale of New York State in the east and Rocky Mountain gas in the west.

The second Big Squeeze, says Weixel, could have major impact on pipelines companies, particularly TransCanada Pipelines (TRP-NYSE, TRP-TSX).

Bentek estimates Canadian gas exports into the US will drop 2 bcf/d over the next five years, out of 6.9 bcf/d exports now. Less volume means higher tolls for natural gas producers and other shippers on TransCanada’s Mainline, as TRP has a guaranteed rate of return with its current toll, or fee, structure.

But producers cannot afford to pay higher tolls and stay competitive in the new low gas price market – so they are negotiating now with TRP to lower their tolls. But obviously, Transcanada does not want the value of its Mainline to be reduced.

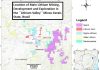

Weixel says gas transported by TransCanada from Alberta is subject to being “squeezed out” of the western U.S. market by the new Ruby and Bison pipelines that will transport cheap Rockies gas to markets in in Northern California and the Midwest.

In eastern North America, Weixel says there is 1.7 bcf/d of new pipeline capacity from Marcellus over six or seven different projects, so US gas from the Marcellus could end up REVERSING its flow, moving Marcellus gas west in southern Ontario, displacing more western Canadian gas and further reducing the utility of TRP’s main line.

I have only seen one analyst mention that attributes TRP’s recent decline in stock price to the market’s realization that toll rates on its main gas lines must get reduced to keep WCSB gas competitive. As a result, TRP is focusing efforts to secure shorthaul gas transportation contracts in Ontario to make up for a shortfall in longhaul gas transportation from Western Canada.

At a recent investor day presentation, TRP did say it is negotiating with the producers on its toll charges. TRP and the producers have had a strong relationship over the years, and the producers I spoke with (nobody wanted to be quoted) were confident a good deal would be reached. Others commented the discussions were frank and lively though.

TransCanada did not grant an interview for this story.

In its presentation (http://www.transcanada.com/docs/Investor_Centre/MASTER_INVESTOR_DAY_2010_PDF_for_Website_Final.pdf) the company used all the right buzzwords –

• Industry negotiated solution

• Lower and stabilized toll

• Various Concepts for Toll Reduction

• Lower depreciation

• Deferral of revenue shortfall

• Rate design changes

And said it would be filing its application for toll charges with Canada’s National Energy Board (NEB) by year end.

There needs to be some very creative thinking between the Canadian producers, the pipeline companies and the government (royalties) – everybody in the food chain – to keep western Canadian gas competitive.

That is happening – TransCanada is weighing the idea of providing producers more value for the liquids portion of their gas stream (the NGLs, or natural gas liquids like propane, butane, and condensate etc.) instead of leaving that value with shippers who actually move the gas out of Alberta for export.

Bentek’s report says that by next summer, the situation will worsen for TransCanada and Canadian producers.

Rockies producers will then have an incremental 1.2 Bcf/d of westbound capacity on El Paso’s new Ruby Pipeline, bound for Oregon, which is in direct competition with Canadian supply for PG&E’s (Pacific Gas and Electric) Citygate, the premium market in the West.

Bentek’s Big Squeeze report states “The competition between Alberta and Rockies prices has already ratcheted up this year with the increased Canadian imports to the West. Ruby will intensify the battle and, given its low variable cost, ultimately displace significant volumes of Canadian gas.”

Follow this link to read Part 1 of my 2011 Canadian Natural Gas Outlook