One of the Largest North American Oil Discoveries in Decades

What has the oil and gas industry so excited about the Alberta Bakken – the stealth play of the year?

Some big companies on both sides of the 49th parallel have spent millions buying thousands of acres of land – with almost no well data. This flurry of activity says the industry is convinced the Alberta Bakken could be North America’s next big play.

“I think what has the industry excited is the potential and similarities between the Alberta Bakken and the Williston Basin (in North Dakota),” says Mike Marrandino, President of Primary Petroleum, which has 235 net sections in the Alberta Bakken in Montana.

“The (Alberta Bakken) reservoir size is over such a large land area, the potential is huge – if it does prove up.”

The original Bakken covers parts of North Dakota, eastern Montana and southern Saskatchewan, and estimates of how much oil it could hold (OOIP-Original Oil in Place) range from 5 billion to 167 billion barrels of oil, making it one of the largest discoveries in North America in decades. And the industry is always figuring out ways to increase recoveries; i.e get a greater percentage of that oil out of the ground.

It is the largest onshore discovery in North America in decades, and is really the only shale oil play on earth with a production history. In many of the new shale plays emerging around the globe, the management teams are saying – “This is a Bakken look alike!”

But are they? How does the Alberta Bakken stand up?

Analysts agree the source rocks from the two plays were built up at the same geological time, but that eastern Bakken, in North Dakota/Saskatchewan, was the inside of a giant crater. The western one was a big west facing beach.

Canadian brokerage firm BMO Nesbitt Burns wrote a report on the two Bakkens in October, and it said the Alberta Bakken meets the criteria for a big Bakken like discovery (my translation in brackets after each point):

i) pervasive petroleum saturation; (lots of oil all over the place)

ii) abnormal pressure (high); (high pressure=big wells)

iii) a lack of downdip water; (no water below the oil)

iv) updip water saturation; (lots of water above the oil)

v) low-permeability and low-matrix porosity reservoirs ; (it’s typical tight rock)

vi) deliverability is enhanced by fracturing; and (natural cracks in the rock make it easier for oil to get to the well)

vii) plays that are self-sourcing within a mature source rock fairway. (there is lots of oil in an area surrounded by a bigger area where we have already found a lot of oil)

BMO concluded that the Alberta Bakken met its criteria on all counts.

Macquarie Capital, a large, world-wide resource investment bank and brokerage firm, compared them this way:

“Geological properties….To the west in southern Alberta and BC, the lower Bakken members actually correlate with the Exshaw formation, while the upper Bakken member is similar to the basal black shale unit of the Banff formation….”

TRANSLATION – the lower Bakken formation in North Dakota and Saskatchewan is called the Exshaw in western Montana and southern Alberta, but it’s basically the same thing. And the upper Bakken is called the Banff formation in Montana/Alberta.

“….The Exshaw/Bakken is an organic-rich, marine, source rock that occurs in the lower part of the Mississippian-Devonian system.”

TRANSLATION – there is oil in the rock at the bottom

“….The formation as a whole represents a petroleum system that can be tracked from source to trap.”

TRANSLATION – you can see where the oil was formed, and you can also see how the oil has moved up until it hits the top of a cone in an impermeable rock and stops—trapped there.

“….The Exshaw, Bakken (lower and upper members), and Lodgepole formations consist of organic-rich, black, basinal laminites with average TOC’s up to 12% in the lower Bakken, 40% in the upper Bakken, 5% in the Lodgepole, and over 20% in the Exshaw. Each formation consists of Type II organic matter (characteristic of most marine oil source rocks)…

TRANSLATION – the Total Organic Content (TOC) of the rock (this means enough little bugs died in one place millions of years ago) is big enough that it’s likely a lot of oil is present.

“…Unfortunately, the Lodgepole formation is typically less mature than the Exshaw/Bakken shales and as such over time has demonstrated the most oil expulsion of the three layers; in fact, it serves as the source rock for most Mississippian oil pools.”

TRANSLATION – most of the oil is gone and moved up into oil pools closer to surface

“…Conversely, the Exshaw/Bakken is considered the most conducive (and prospective) for horizontal multi-stage fracturing given that it has experienced limited migration, and most of the oil remains contained within the member.”

TRANSLATION – most of the oil is still there, and it looks like the best one.

“We have identified over 18 wells that have drilled through the Bakken near or on our property,” says Primary’s Marrandino. His team has been evaluating old data to better understand the similarities between their Bakken package to that of the Bakken Williston Basin. They have had to travel to Denver Colorado and Billings Montana to locate the physical data – old core, or “thin sections” and analyze them under a microscope to better understand the characteristics of the Alberta Bakken formation and potential oil in place

“It further de-risks the play,” he says.

So it looks like the two plays have very similar geological characteristics. What about economics.?

BMO, Macquarie and Haywood Securities have all acknowledged that the Alberta Bakken is a deep, overpressured formation. This leads them to believe that the deliverability (economics) may be superior to the main Canadian Bakken play in Viewfield, south-central Saskatchewan, but lower than the North Dakota Bakken in the US.

Like most horizontal, multi fracked wells in the Bakken it is assumed that the initial flow rates of the Alberta Bakken will be high, with high decline rates, and a relatively large total amount of oil recovered.

For the Alberta Bakken play BMO Capital Markets estimates that oil companies will recover a total of roughly 250,000 barrels of oil per well (this is called the “Estimated Ultimate Recovery” or EUR) and a three-month average IP of 348 bopd. They say this yields a Before Tax Net Present Value @ 10% of ~$4.5 million for a Horizontal Oil Case, an Internal Rate of Return (IRR) of 75.9–108.8% and a Breakeven Supply Cost (BESC) of $41.25–42.20/ bbl.

These economics are just below that of the Saskatchewan Bakken, BMO adds. It’s as big an “NPV 10” (the present value of how much money the producer might get after the well pays back its cost) as the Saskatchewan Bakken – which has the highest valuation per barrel of any basin/play in the country.

Keep in mind that there is only one well on which to base these figures, and that was a vertical well which hit a natural fracture—not exactly a typical well that investors expect to see over the life of the play.

Concludes BMO Nesbitt Burns: “Ultimately, when comparing the Alberta Bakken type well to the Saskatchewan Bakken type wells, the Alberta Bakken—due to the overall thickness of the reservoir, and the overpressured, Deep Basin setting—has the potential for a highly economic well.”

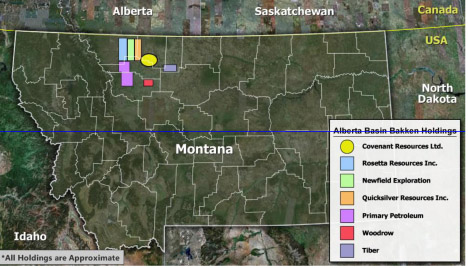

There are a basket of juniors in Canada that now have some very intriguing capital gains potential, if they get lucky with their geology.

I’ll tell you who they are and a rough outline of their plans in my third and final story on the biggest oil play most investors have never heard of, the Alberta Bakken.

Keith Schaefer

www.oilandgas-investments.com

Publisher’s Note: Many of my readers have emailed me to ask what my # 1 energy trade is. That’s an easy one to answer at the moment. It’s a little-known Canadian company with an extraordinary new technology… one that will shape the oil & gas hydraulic fracturing (fracking) market for decades to come. This company’s proprietary process is proven to increase production in wells by 40% or more — while it literally “pays for itself.” I’ve put together a video that details this trade in full. Watch it by following this link.

Want to learn more about investing in junior oil and natural gas stocks? If you have a Facebook account, just “like” this article and a hidden link to Keith’s 10 page how-to on oil and gas investing will appear:

[facebook-like id=”1″ ]