Water stocks have been in a drought for 20 years. I have been hearing about the great potential for water stocks for at least that long. ‘Water will be worth a lot some day—maybe one day soon’ is the line I hear every few years. But investors have not made...

Editor's Note: Today's OGIB is my interview with fund manager Chris Theal...

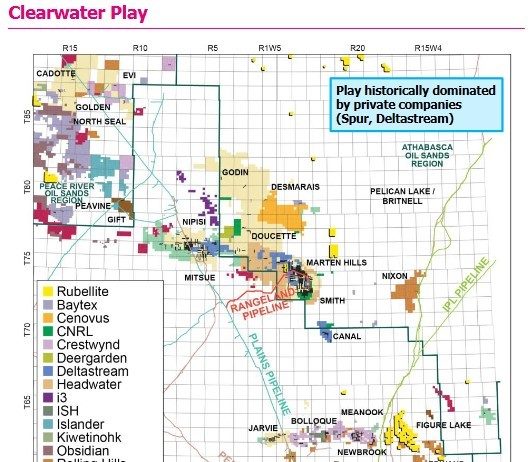

The Big Investing Themes for Kootenay Capital fund manager Chris Theal right now is oil field service companies (OFS), and heavy oil producers.

Driving these two themes are:

1. Liquid Natural Gas (LNG) in North America

2. The huge growth in...

Keeping up with oil and gas companies 10 years ago was not easy. The dynamic duo technologies of fracking and horizontal drilling were opening up MANY new shale plays all over the continent. There was a huge land race, with companies buying each other up to get as many...

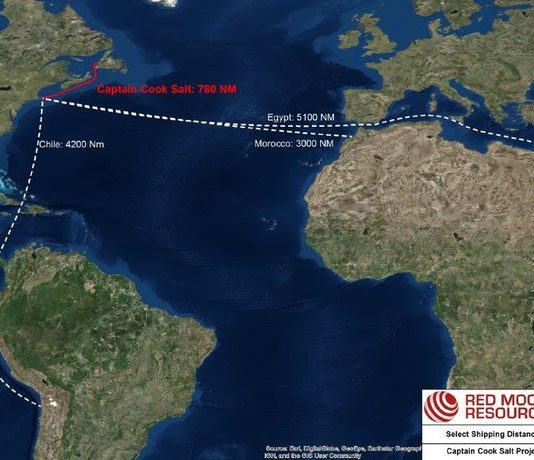

THE SALT OF THE EARTHIS MORE VALUABLE THAN YOU THINK

It is time to get BULLISH on commodities.Pick a commodity and it is moving higher. Grain prices are soaring. Nickel, copper, oil and silver—all higher.Investors are seeing upticks in so many commodities— now back to above just prior to pre-pandemic highs. The charts...

Friday’s IPO of psychedelic focused Compass Pathways (CMPS: NASDAQ) was the inflection point for ALL psychedelic stocks. It was a huge success, up 70% that first day—from $17-$29.I am now expecting this sector to begin a big bull run. But as usual, we have to do our due diligence...

When we bought Aldeyra (ALDX – NASDAQ) in May of last year the stock was $3.50. The analyst price targets were a long way off.

Oppenheimer was the lowest, with a target of $12. Stifel was double that – at $25. Cantor Fitzgerald topped them all with a $33 target.

When I saw those targets,...

THIS IS NOT YOUR REGULAR SILVER RALLY

Some investment trends smack you right in the face.This is one of them…….and you are quickly going to understand why.The Netherlands, one of the leading nations in the transition to renewable energy, recently commissioned a study through the Dutch Ministry of Infrastructure and Water Management.The...

One ETF that I have followed closely over the past 9 months has been the Credit Suisse X-Links Monthly Pay 2xLeveraged Mortgage REIT (REML – NASDAQ). REML is a levered way to play the REITs. It tracks the iShares Mortgage Real Estate ETF (REM -NASDAQ), which tracks the FTSE Nareit All Mortgage Capped Index,...