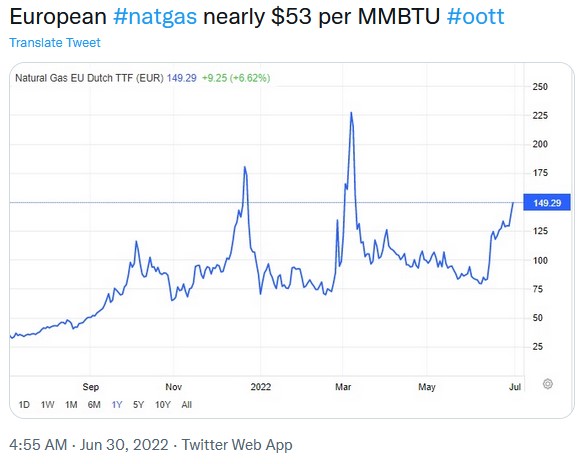

European natgas prices are starting to rip higher once again. They had settled a bit after going ballistic on news of the Russian invasion of Ukraine in February.

In February it was The War News that caused the price spike. This time Euro gas prices are surging because supply is being intentionally choked off.

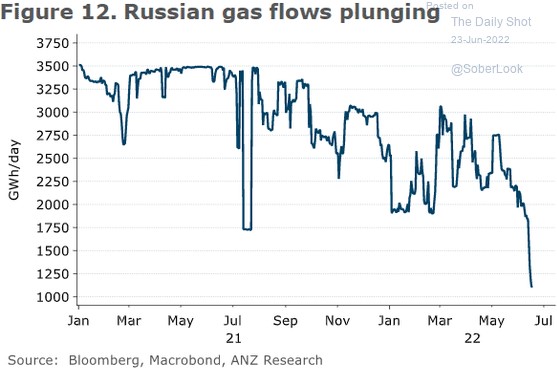

What was feared is now actually happening. Putin is using natural gas as a weapon against Europe. Natural gas flows from Russia have suddenly been cut by two-thirds.

For some countries Russia has cut off supply by 100%. For others the cut has been 10-15%. (2)

The general view from European leaders is that Putin won’t cut the gas supply off completely during the summer. But that this is a strategic weapon that he is much more likely to use in the winter when the weather turns cold.

You don’t fire your big gun until you know it can cause maximum damage.

When talking about Russia completely shutting off supply Luxembourg Prime Minister Xavier Bettel just told CNBC: “I’m fully aware that they can. They can. It’s their choice, natural choice. They can close or open.”

This is the nightmare scenario for Europe. Now the continent is scrambling. They have the same problems the rest of the world has with energy—they have vilified fossil fuels, and to a certain degree nuclear, and renewable energy has not been able to fill the gap near quick enough.

In Germany, 56% of electricity still comes from conventional energy sources (natural gas, coal, nuclear) and only 44% from renewables (wind, solar etc). (1)

The German government has now triggered the “alarm stage” of their emergency natural gas plan. This is defined as being when the government sees a high risk of there being a long-term natural gas supply shortage.

No kidding……..

Utilities in the country can pass on high prices to customers to help lower demand. The next step up from this level is when the government steps in and actually starts rationing supply.

This is where Germany is headed——an energy emergency where “non-essential” elements of demand are cut in favour of ‘essential’ ones.

The Race Is On To Find Supply Before Winter

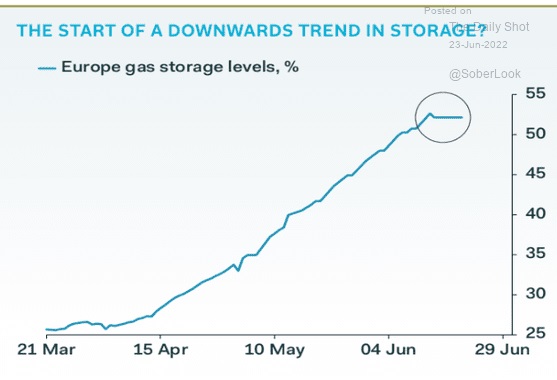

Germany has been rushing to fill up gas-storage facilities——but has made only modest headway.

Reserves are currently around 58% full. Target storage levels are for 80% by October 1 and 90% by November 1. But storage has recently stopped increasing.

Source: Pantheon Macroeconomics, The Daily Shot

There is some urgency as every bit that storage is not full amkes them more vulnerable to Putin and Russia. Nobody in Europe–or anywhere in the West–wants that.

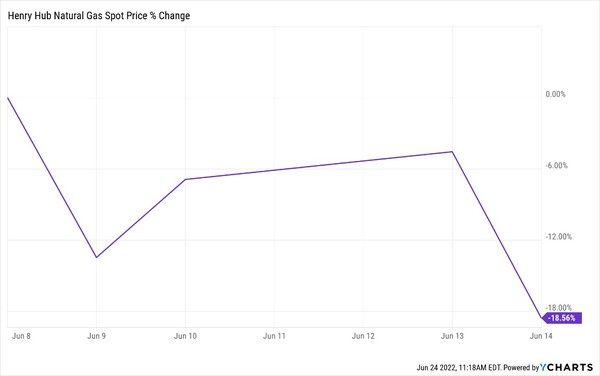

Another unfortunate supply blow for Europe came from the June 8th Freeport LNG terminal fire which has taken 2 bcf/day offline that was supposed to be heading to Europe.

US natural gas prices fell 17% on the news of the Freeport incident and they still haven’t recovered.

What is bearish for US natural gas prices–in this case is bullish for Euro natural gas prices. It is supply that the Eurozone desperately needed.

German companies that drive the economy are now already planning for painful cuts to reduce output.

They are also resorting to polluting forms of energy to try and reduce consumption of natural gas.

Chemical giant BASF (the world’s largest) is planning which factories will cut output first.

Management said that deciding which plants will be shut off first would follow talks with both politicians and customers——some of its products are essential for pharmaceutical and food production. War time decisions being made by a for-profit business.

Their rival Lanxess is delaying shutting coal-fired power plants. Kelheim Fibre which is a major supplier to Proctor and Gamble is considering retrofitting its gas power plant to run on oil——burning oil for power was phased out of Europe a decade ago.

Desperate times call for desperate measures.

I keep saying Germany (which is Europe’s biggest economy)——but the crisis is impacting with 12 European Union member states affected and 10 issuing an early warning under gas security regulation.

Qatar has potential to be a great help in providing supply for the long-term, but the country is holding Europe’s feet to the fire. Qatar is demanding that Europe sign undesirable long term LNG deals if they want more gas sooner.

The terms of these deals aren’t what Europe is looking for. Qatar wants Europe locked for two decades of LNG purchases——something that doesn’t align with goals to reduce emissions and achieve climate goals.

Amazing that just half a year ago climate was by far the biggest concern when it came to European energy.

Now the largest concern is whether European citizens are going to freeze this winter while also seeing a partial economic collapse.

Negotiations with Qatar have been in deadlock since March.

This sets up a very bullish market for domestic European natgas producers–potentially for years. If there is peace in Ukraine tomorrow, Europe wants to wean itself off Russian gas and US LNG cannot compete with domestic supply economically.

Europe is going to need every single molecule of domestic natural gas supply that it can scrounge up.

There are very few juniors in this market. As you may remember, I profiled Trillion Energy (TCF:CSE, TRLEF:OTCQB) to you earlier this year.

Trillion is developing a big, low-cost development project in offshore Turkey in the Black Sea.

This is not exploration—management is drilling seven BIG development wells over the next few months. The Market wants this so bad, they were able to raise $37 million in just a few months.

The first well will spud within weeks, starting off a news flow that will keep investors steadily updated on results and cash flows. And all this production will go straight up into the BEST natural gas prices that the industry has seen EVER.

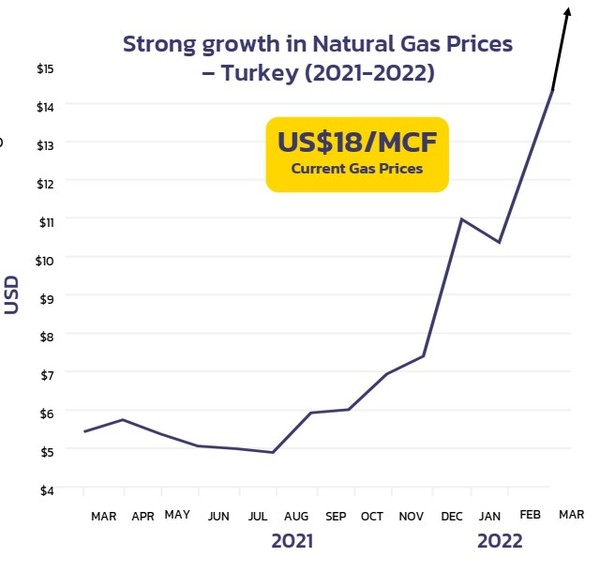

Trillion’s delivery point will be Turkey where natural gas currently fetches $18/mcf.

Wowza.

Again….these aren’t exploration wells. The first 7 wells are already discoveries. This is simple stuff.

The engineers know what to expect from the wells already drilled and the costs involved. Management has said that operating costs will be less than 50 cents per mcf–and prices are over $18/mcf!! For sure costs have gone up in last few months–but the natgas price also doubled to $18/mcf!

This play is ready to go. There are four offshore platforms, 16 km of pipe that have already carried natgas from 8 producing wells. News flow is about to start–for one of the only juniors in the best bull market in energy.

Source:

- https://www.ans.org/news/article-3274/germany-coal-tops-wind-energy-in-2021-but-theres-more-to-the-story/

- https://www.cnbc.com/2022/06/24/putin-is-squeezing-gas-supplies-and-europe-is-getting-seriously-worried-about-a-total-shutdown.html

Keith Schaefer