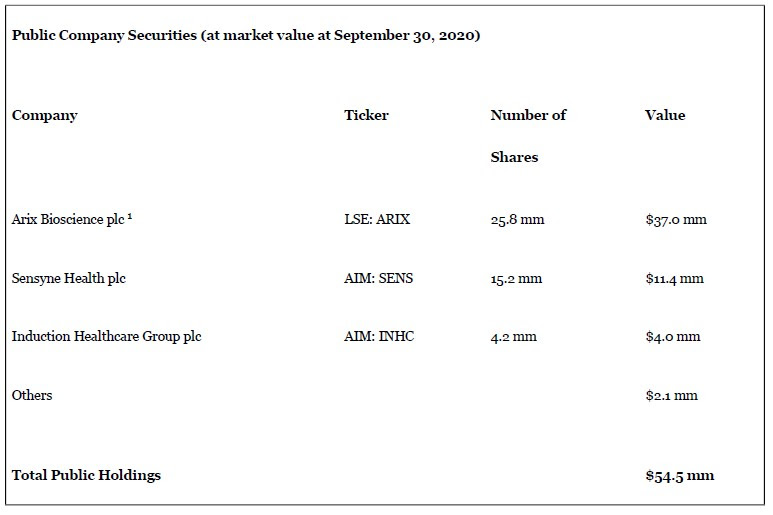

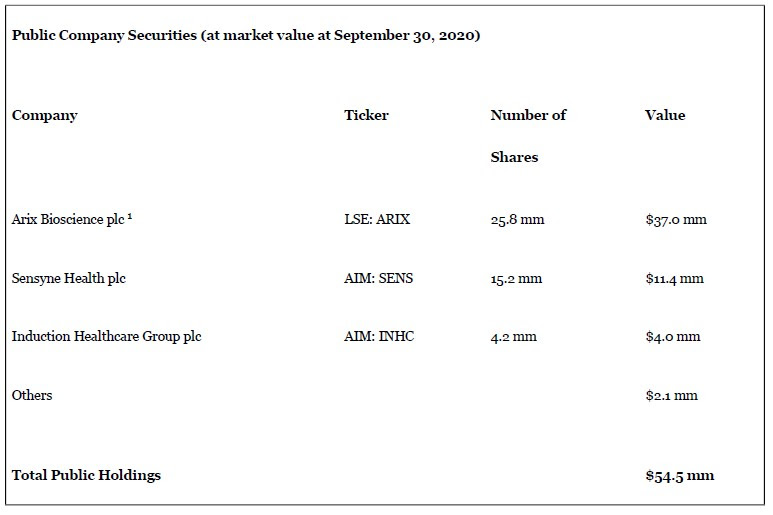

The three public company names on the list are all up:

· Sensyne Health plc (SENS – AIM) has gone from GBp58 to GBp168.

· Arix Bioscience (ARIX – LSE) is currently GBp200 versus GBp111 at the end of Q3.

· Induction Healthcare Group (INHC – AIM) is roughly flat.

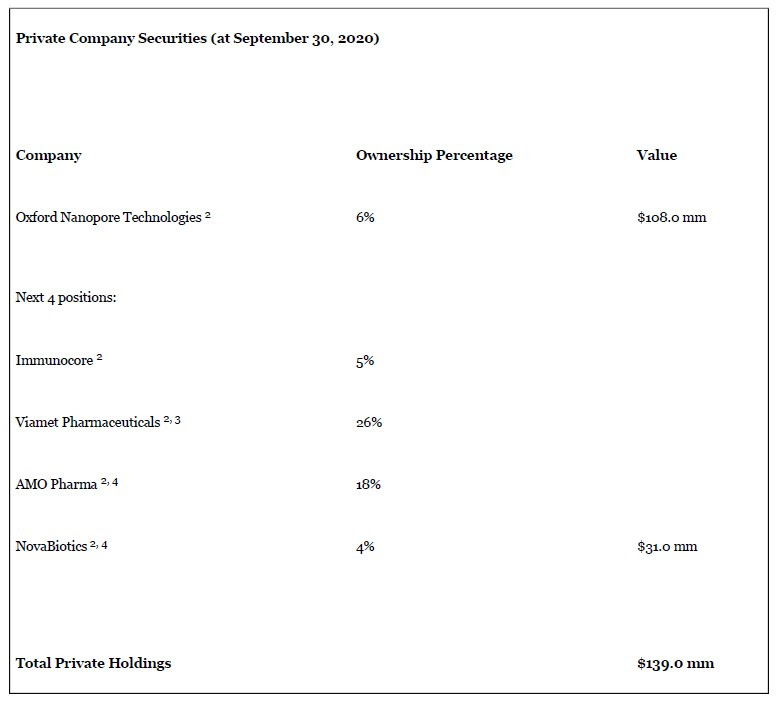

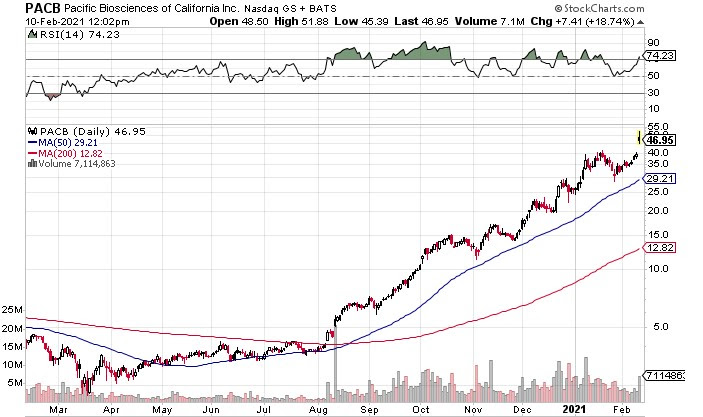

As for the private companies, the best place to start is with Immunocore (IMCR -NASDAQ). That is because Immunocore recently went public.

The IPO was at $26 but the stock has nearly doubled from there. ACTG had a 5% pre-IPO ownership, or about 1.65 million shares. Those are worth $74 million today.

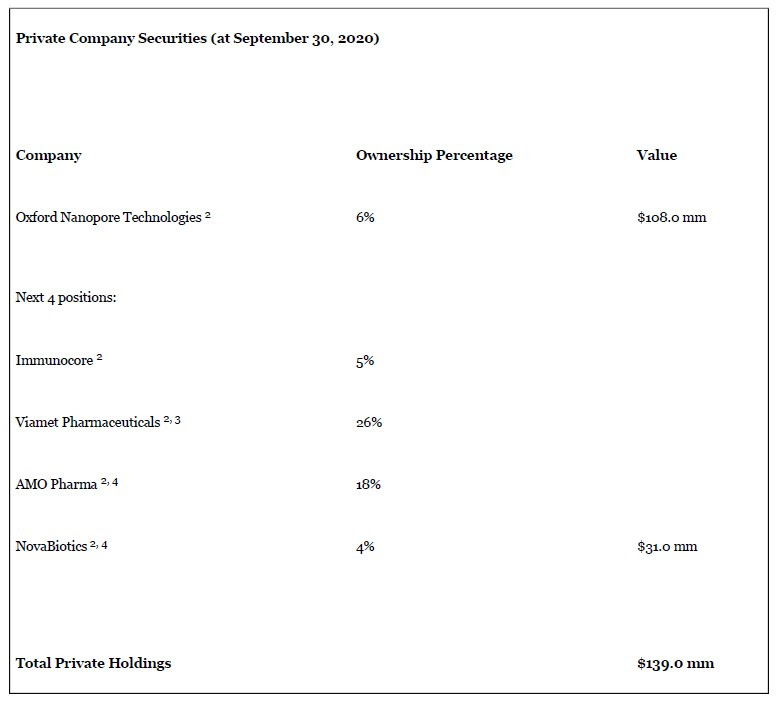

Viamet Pharmaceuticals and AMO Pharma are more difficult to peg down.

Viamet is a royalty company. One of their royalties is for the drug oteseconazole, which they licensed out to Mycovia Pharmaceuticals. Oteseconazole had positive phase 3 data in December and Mycovia seeks FDA approval of their drug in 1H21. It is hard to know what other royalties they hold.

AMO Pharma announced the start of a pivotal trial for their drug AMO-02, which is targeting a rare disease in children. AMO-02 was granted rare pediatric disease designation from the FDA.

Both companies are worth something, but it is difficult to know how much.

But even ignoring them entirely, the portfolio (ex-Oxford Nanopore) is currently worth at least $175 million.

The Starboard Connection

ACTG was not always in the business of buying portfolios of biotech companies.

In September 2019 ACTG went through an overhaul. The company announced a new CEO (Clifford Press) and a new Chief Investment Officer (Alfred Tobia Jr.).

A couple of months later they announced a strategic investment from Starboard Value, a private equity fund.

Starboard ponied up cash for ACTG to invest. They took on $365 million in senior notes and another $35 million in preferred shares. In return they were granted warrants for 100 million shares.

That cash is being used to buy portfolios. Those 9 companies listed Q3 above were purchased from the Woodford Equity Income Fund. Woodford was a poor performing fund that was eventually wound up.

ACTG paid $282 million for the fund’s ownership interest. The Starboard funds were used to pay for it.

The Balance Sheet – A Bit Complicated

One consequence of the Starboard partnership is a complicated share structure.

There are shares and warrants and convertible preferred.

With ACTG at $8 everything is in the money, so it is best to assume that everything gets exercised.

That means the share count will go way up. But the net cash level will too.

By my calculations, the fully diluted share count is 127 million. That would put the market cap at ~$1 billion at $8.

But… if you count the warrants, you have to count the cash.

In this fully diluted scenario, all the debt is paid off and cash balance would be $540 million.

That puts the enterprise value at $460 million. Not expensive for what I have described so far.

The Patent Litigation Business

And… we still have not talked about the patent business.

ACTG buys patents and then looks for ways to monetize them. They either license the IP or litigate companies that are illegally using it.

Before Starboard came along this was ACTG’s core business. ACTG has made over 1,580 license agreements on over more than 200 patent portfolio programs.

The business remains alive and well. In 2019 ACTG acquired 5 new patent portfolios. In 2020 they acquired another 4 portfolios.

These patents are relevant to today’s technology and ATCG should be able to realize value from them.

The 4 patent portfolios ACTG acquired in the first quarter of 2020 represent over 3,000 patents. They cover everything from Yahoo! patents for internet search, cloud computing, e-commerce, location-based services, mobile apps, media management and social networking, to commercial applications of Wi-Fi and Internet-of-Things technologies, to storage and memory patents on flash memory systems such as solid-state drives and controllers.

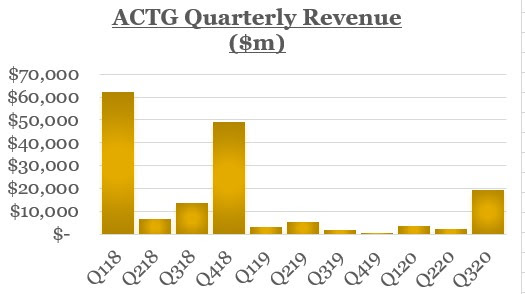

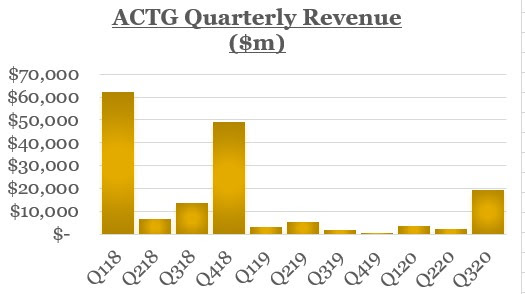

The revenue from these patent portfolios is lumpy. ACTG recognizes revenue when they win litigation or sign a licensing agreement.

Take the third quarter. Q3 was a banner quarter – $19 million of revenue. But 98% of that came from one license agreement. The past few quarters have been lackluster.