By guest writer Michel Massad, publisher of Beating The Index.com

Energy stocks across the board have been hit hard in the last quarter—both producers and service companies. Stock charts have been laid to waste. Neither sexy resource plays nor respected leadership were enough to stem the bleeding.

But shareholders of three energy services companies—Gibsons Energy (GEI-TSX), Black Diamond Group (BDI-TSX) and Horizon North Logisitics (HNL-TSX)—are laughing all the way to the bank, as their stock charts are at or near all-time highs. (See OGIB story on Black Diamond here.)

And strangely enough, they are all oilsands related. I say strangely because analysts have not been kind to the producers, warning investors that lower Canadian heavy oil prices could stay for a couple years, impacting profitability. And there is no close resolution on increased pipeline capacity to handle any increased oilsands production.

On the services side, Canadian securities firms like National Bank and Raymond James have been telling their clients to sell oilfield services stocks for weeks.

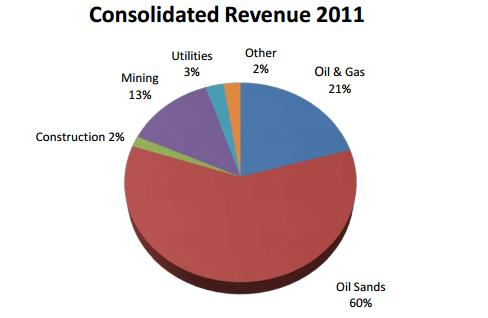

The first 2 oilfield services companies are Black Diamond Group (TSX-BDI) and Horizon North Logistics (TSX-HNL), which derive a substantial percentage of their revenue from business related to Alberta’s oilsands.

They provide a turnkey-style Camps and Catering service offering, including manufacturing, transportation and installation, servicing, as well as catering. These companies basically make money from renting beds to oilsands workers, including charging them for management and catering. The work camps are equivalent to small villages with a population exceeding 3,000 souls in some instances.

Black Diamond Group

But oilsands stocks have been even worse performers than the energy sector, so why do these two oil sands-related stocks have the best charts in the North American Energy sector?

Because the market pays for certainty.

The catering/camp management business enjoys a side the market loves, and that’s the predictability of the recurring revenue base. When a contract is signed, it’s typically for a 2- or a 3-year period. This means that the market sees the current weakness in commodity pricing as temporary since these companies will be able to weather any violent storms in the near term as they continue to grow.

There’s also another way for seeing things. According to the Canadian Association of Petroleum Producers’ annual forecast, Canada could emerge in the top 3 producers in 2030. Bitumen will dominate production growth and is expected to more than triple to 5 million bopd by 2030 from 1.6 million bpod in 2011.

The market is clearly looking towards billions of dollar in capital expenditures required to add more than 4 million of barrels of oil in production. More barrels require more manpower which equals more work camps. Just imagine how many beds will be required in order to accommodate this growing workforce!

Welcome to the bed business. And it’s a huge market, judging by the number of beds in the Ft. McMurray/Conklin region… which currently stands at 58,499 beds with 12% of these beds greater than 15 years in age (replacement coming up). To put it bluntly, these companies are building cash flow by increasing the number of beds they rent.

HNL estimates new oil sands project capital spending in this market could exceed $100B through 2016 with future additions totaling more than 21,000 new beds.

This business is not limited to the oil sands industry; accommodations are in demand for infrastructure projects, unconventional oil and gas operations and mining camps… which diversifies the customer base.

BDI estimates more than 50,000 beds will be needed over the next 5 years between oil sands, Northern BC, NW Territories and Eastern Canada. What’s not to like about a visible pipeline of beds? It’s more like a visible pipeline of profits.

Besides the camp business, both companies are active in the oilfield services by selling anything from matting to a full array of nuts and bolts required on a drill site.

HNL pays an annualized $0.20/share (payout ratio of 19%) and has recently posted an all-time record quarterly EPS. Its 2012 capex program has been increased by $20mm to $120mm with $85mm dedicated to expanding its bed rental fleet by 1,800 units. Analyst targets vary between $8.25 and $9.50.

BDI pays an annualized $ 0.72/share (9% increase in 2012 with a payout ratio of 25%). Its 2012 capex program has been increased by $25mm to $95mm. Analyst targets vary between $24.00 and $27.50.

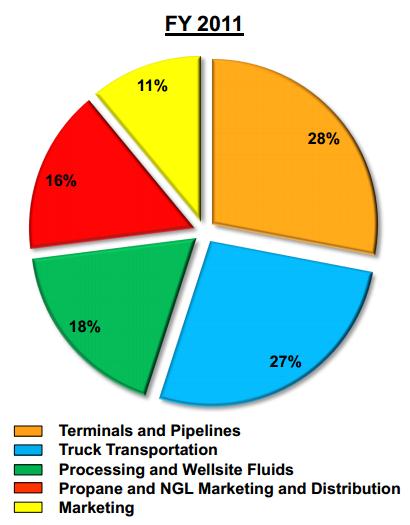

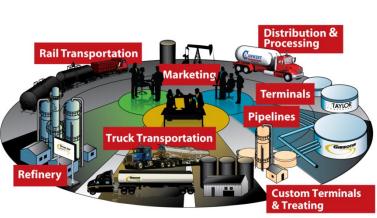

Our third stock is Gibson Energy (TSX-GEI), which IPOed on June 15, 2011. GEI is an integrated energy infrastructure company with 5 business divisions: truck transportation, terminals & pipelines, processing and wellsite fluids, propane distribution, blending and marketing of crude oil, NGLs and refined products.

Gibson’s business segments allow the company to earn revenue, several times, from a barrel of crude oil during its life cycle. I would say it’s THE most vertically integrated companies in North America that is neither a producer nor a refiner.

Its terminals at the heavy oil hubs of Hardisty and Edmonton, which have lots of room to grow, give it a big touch to the oilsands.

Its marketing segment purchases the crude from the producer at wellhead, transports the barrel via truck transportation and stores it in a Gibson Terminal. Gibson has one of the largest trucking fleets in Canada, and one of the largest for-hire independent trucking fleets in the US. And the truck market has become tight, with pipelines out of Canada and the Bakken basically full. Analysts are expecting rate increases here.

Revenue is received from selling condensate to blend the barrel (a heavy oil barrel has to be blended with condensate in order to meet pipeline specification as it makes the oil easier to move – less gooey). The product is then moved downstream to a refinery — such as Gibson’s Moose Jaw refinery — to be processed.

And when the company is not “touching” a barrel of oil during its lifecycle, it is making money from the volatility and widening differentials in Canadian oil prices as a marketer. Contrary to E&P companies that suffer due to lower realized price per barrel sold, widening differentials present GEI with an opportunity to capture higher marketing margins.

Its pipelines segment also profits from capacity constraints due to fast production growth. In order to capitalize on rising production volumes across North America, Gibson is working on several projects including terminals and refinery expansions. The market loves organic growth which when coupled with opportunistic acquisitions results in a growing cash flow and a higher dividend.

Gibson shares have risen 30% on the back of meeting or exceeding expectations on a quarterly basis since the company’s IPO. The company reported record quarterly revenue for Q1-12 and increased its dividend 4.2% to $1.00/share paid annually. Its diversified asset base across North American oil basins forms a balanced cash flow stream and offers leverage to liquids infrastructure rather than natural gas.

While oil and gas producers and field service companies adjust to a shrinking cash flow, a few continue to deliver a strong performance from their base business. It’s a business that doesn’t have much sex appeal (renting everything from toilets to high speed internet to oilsands workers?)… but that has sure contributed to forming great-looking charts.

– Michel Massaad

BeatingTheIndex.com

HNL Consolidated Revenue

GEI Profit Breakdown