In my last story – Investing in Energy Services Stocks — I explained why the entire energy services industry should see rising revenue and profits over the next few years.

These are the companies in major demand as the shale revolution continues.

Now let’s look at the services sub-group that’s really benefitted from this revolution: the fracking industry.

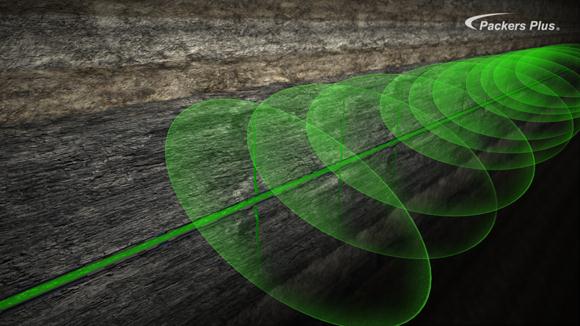

After you drill an economic well you have to “complete” it, which means get the oil out of the ground. In shale plays, or any tight sand oil or gas play, fracking and completing have basically become the same thing.

Whereas drilling used to be the highest cost component of a well, it is now completions and testing. Today that comes to roughly 54% of the total well cost… vs. just 17% in 2000. (In Canada, the largest fracking companies generate as much cash flow as the biggest drilling companies.)

The fracking industry is judged not by the number of fracking rigs or setups, but the amount of horsepower (HP) any one company can provide. Macquarie Capital estimates that in the U.S., HP demand will jump 62% in 3 years, from 9.1 million HP now to 14.8 million HP in 2014 – and they expect the market to still be under-supplied then.

In Canada, oil and gas companies can wait up to four months for a fracking crew.

There is one other very positive trend to throw into this mix – the fact that the energy industry in North America is now becoming oily. This continent has been known as a gas basin for the last 50 years, and a boring mature one at that.

The last five years has turned that idea upside down, and that has very positive implications for the valuation of energy services companies.

As recently as 2008, more than 80% of all drilling in North America was for dry gas (methane that heats your home). It’s now 50% oil.

The gas industry was notoriously cyclical, as it depended on the weather. Cold summers and warm winters meant a glut of gas, low gas prices, and low cash flow for producers… so drilling was low.

Of course the market likes predictable cash flow – it will pay more for a less-profitable well that will last for 25-30 years than it will for a highly profitable well that is depleted in 5 years.

And now that half of all drilling is for oil, Macquarie Capital is calling for higher valuations in the energy services sector. Oil is not driven by unpredictable weather (but by unpredictable geopolitical issues ;0)).

—————————————————————————————————

This Technological Revolution Allowed Me to Earn Gains of 529%, 338.4%, and 675% in Oil & Gas

New technologies – at this very moment – are revolutionizing the oil and gas exploration industries.

But only a handful of people truly understand how the technology works.

This remarkable scenario creates an enormous, short-term profit opportunity each time a company employs these new technologies successfully.

I’d like to show you exactly how this scenario is unfolding… and how you can pounce on the next triple-digit oil & gas blockbuster.

Click here to read my full report that explains how to get started.

—————————————————————————————————

But overall global demand for oil is strong, and even if oil drops back to US$90 per barrel, almost all oil plays in North America are profitable… and will sustain steady drilling and fracking levels – keeping the cash flows of service companies high.

In conclusion, the services sector is the place to be in the energy sector for 2011 – and the next three years – for the following reasons:

1. The number of horizontal wells being drilled is increasing because they’re so profitable.

2. The depth and length of horizontal wells is increasing.

3. The industry is at capacity right now, and will be for three years.

4. One brokerage firm is expecting cash flow per share to increase 40% for the full services sector.

5. A more predictable, steadier work schedule — due to oil exploration vs. gas exploration — will mean higher valuations for energy services companies… even without increased cash flows.

As I said, fracking and drilling companies are all but maxed out. (The industry is building new rigs and more fracking equipment as fast as possible.)

And that makes natural gas the “X” factor. If natural gas prices ever pick up, it’s safe to say demand for gas rigs will go up.

In such a scenario, we could see energy services stocks really take off.

– Keith