My deep dive into solar has been a good news story. I am finding companies growing revenue and generating cash.

Solar has tremendous growth ahead of it. The Inflation Reduction Act (IRA) will great a boom for years to come.

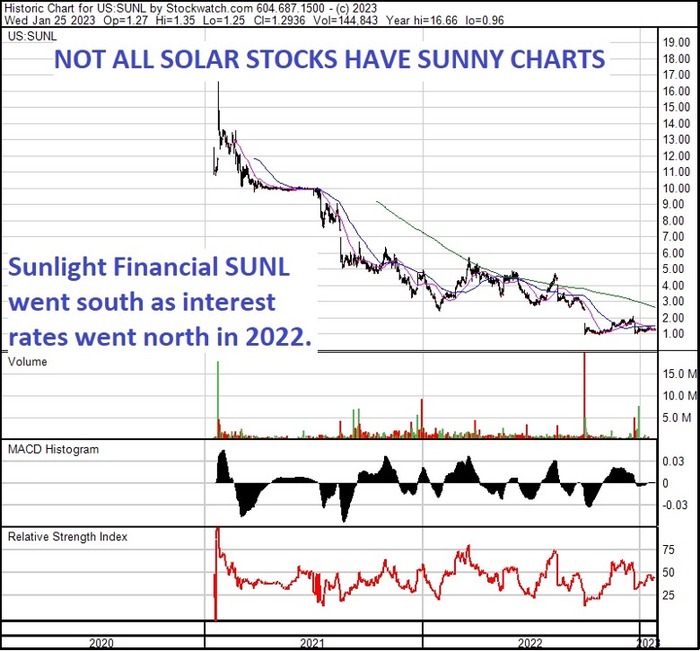

But not every stock has been a tempting buy.

If the story has an Achilles heel, I can tell you where: Financing.

Solar installations need credit. Preferably cheap credit.

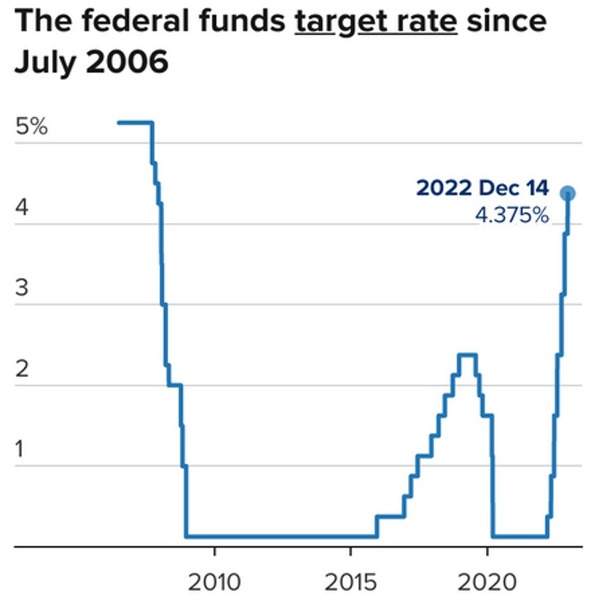

Today credit conditions are going in the wrong direction. Liquidity has tightened a lot. Rates are higher. It is creating pockets of stress in solar financing.

There is no better example of this than the mess that Sunlight Financial (SUNL – NASDAQ) has found for itself.

THE BUSINESS OF SOLAR LENDING

Sunlight Financial came to the public market as a SPAC in January 2021.

Sunlight was born out of the Spartan Acquisition Corp II. At the time of the business combination, they were valued at $1.3 billion.

Today Sunlight has a market capitalization of just under $100 million – or a 90%+ decline.

What happened?

Rates happened. Sunlight got caught on the wrong side of the rise in interest rates. Here’s how:

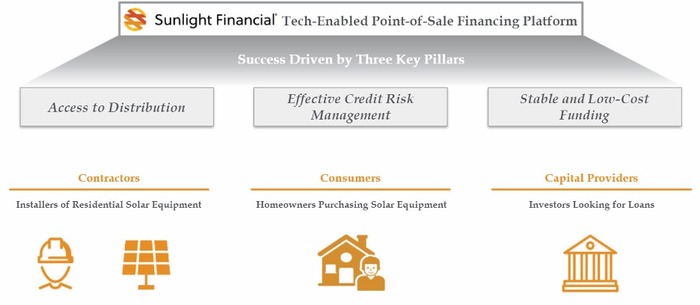

Sunlight is in the business of lending for residential solar installations and home improvement.

Most of Sunlight’s lending is on the solar side. In Q3 22, 84% of their loans were solar installations. These are loans to homeowners that let them put solar panels on their rooftops.

Sunlight is a big player in residential solar financing: it has an 8% market share in the US.

They get customers via a network of solar installers. When a Sunlight approved installer sells a system to a homeowner, they offer a financing option to purchase the array with no money down, with the loan originated via Sunlight.

A loan gets made, the system installed, and some of the revenue from the electricity produced goes toward paying interest and principal on the loan.

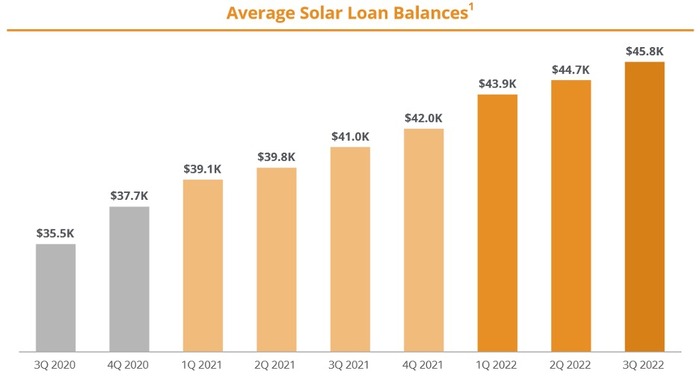

These are decent sized loans, averaging just under $46k in Q3:

Source: Sunlight Financial Q3 Results Presentation

While only 20% of residential solar system sales were financed with solar loans in 2015, by 2020 63% of residential solar loan sales were financed. It is a large market and a growing one.

THE HOME IMPROVEMENT MARKET

In 2019 Sunlight added a new business when it began to originate home improvement loans.

Sunlight makes its home improvement loans in the same way as its solar loans. A contractor agrees to a job with a homeowner, but in this case to pay for a new roof or new windows. Sunlight has a network of ~1,000 contractors that act as their loan originators.

Source: Sunlight Financial Q3 Results Presentation

I’m not thrilled with this business. Home improvement loans are a bit more dicey than solar. They aren’t backed by a revenue stream. These are loans that seem more likely to go south.

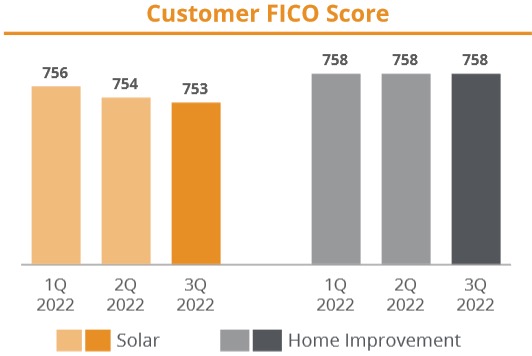

On the other hand, this is a small business compared to Sunlight’s solar lending (it is about 1/5th the size and was only 6% of revenue in 2021), the loans are a lot smaller ($17.8k average in Q3) and interest rates on the loans are far higher. Sunlight also seems to be making loans to credit-worthy customers

Source: Sunlight Financial Q3 Results Presentation

At any rate, it isn’t the home improvement lending that causes Sunlight’s book to go south.

A 100 YEAR STORM

Solar lending should have a lot going for it. There are subsidies, electricity rate advantages, and a relatively constant stream of cash.

Considering that ~85% of Sunlight’s loans are solar, you might think that this is a safe bet – cash flows that cover debt and happy lenders.

What could go wrong?

We always hear about 100-year storms. We hear about them so often that it seems impossible that there could be one every 100-years.

The same goes for financial storms. There is a 100-year financial storm about every 10-years. Inevitably when one happens, boats get caught and capsize.

Sunlight found itself caught in the storm. It remains to be seen if they capsize, but it’s going to be rough sailing.

THE LAG THAT CAN KILL

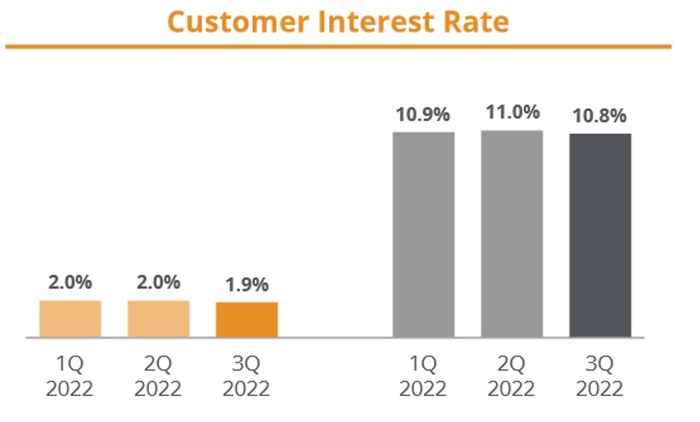

The storm that caught Sunlight was the speed of the rate hikes.

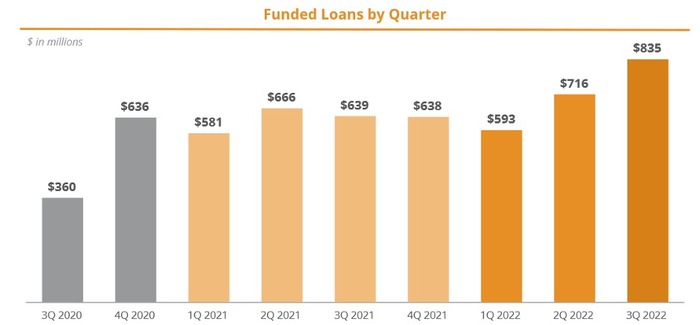

Throughout 2022 Sunlight made more loans than at any time in their history.

But because rates rose so fast those loans quickly went underwater – before Sunlight could sell them to investors.

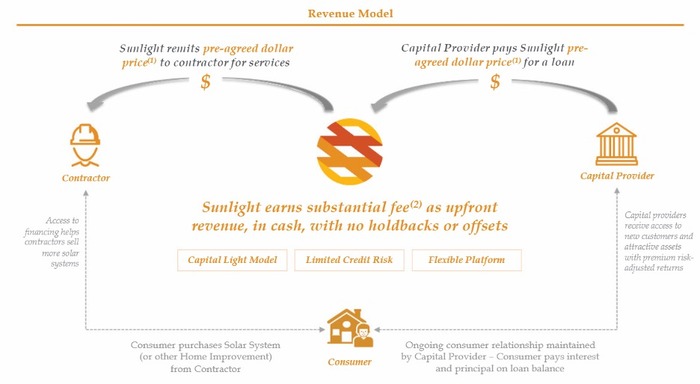

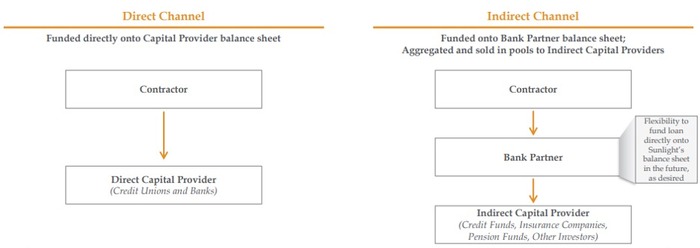

Sunlight is a point-of-sale lender. Contractors and installers approach households with their solar product and offer Sunlight financing. Sunlight approaches investors to funds loan. Loans are matched up with lenders.

There are two ways a loan can get funded. Either before it is made or after it is made.

Sunlight’s preferred model is to pre-fund the loans. Investors agree to a rate before the loan is even made. This was the process described in Sunlight’s initial investor presentation:

The key in the above slide is the term “pre-agreed dollar price”. Sunlight clarifies this in the footnote:

For a pre-funded loan, there is no lag between originating the loan and funding it. If rates rise sharply and suddenly, that is on the investor, not Sunlight.

But then how did Sunlight get in trouble?

STRETCHING FOR GROWTH

Here’s how.

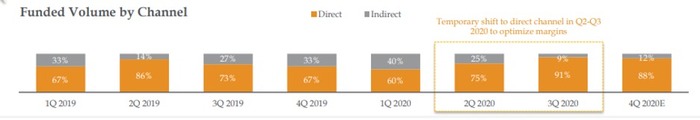

Historically, most of Sunlight’s loans are pre-funded (they called it direct lending). At the time of the SPAC acquisition around 90% of lending was direct:

Direct lending soared after the pandemic. Money was cheap. Banks were bursting with deposits. Investors jumped at the chance to fund solar installs.

But in more normal times Sunlight has more loan volume than it can pre-fund. In that case they take a different tact.

Sunlight uses an intermediary – a bank – to hold onto the loan while Sunlight looks for an end buyer.

They call these “indirect loans”. They are basically loans that are warehoused with the bank until they can be sold to investors.

The process takes 3-4 months.

This happens all the time with mortgage loans. There is nothing wrong with the warehousing model.

But for Sunlight, the model went south when rates went north.

The Fed hiked rates by over 4% in less than a year. Last cycle it took 3 years for the Fed to raise rates 2.5%.

This broke Sunlight’s funding model. Sunlight was forced to move more loans to indirect funding.

In the first quarter of 2021 Sunlight funded $581 million of loans. $84 million of that was from the indirect channel (15%).

In the first quarter of 2022 Sunlight funded $593 million of loans and $164 million were indirect (28%).

In the third quarter Sunlight funded $834 million of loans and $264 million was from indirect (34%).

At the same time, rising rates and widening spreads made loans only a month or two old underwater – with Sunlight holding the exposure.

On the Q3 call they said:

A BADLY TIMED BANKRUPTCY (NOT THEIR OWN)

Adding to their woes, in late September Sunlight announced an “installer liquidity event”.

That “event” was the bankruptcy of one of their largest solar installers, Pink Energy.

The bankruptcy hit Sunlight in a few ways.

First, Pink was a large partner and the loss of their business cut into new loan originations.

Second, Sunlight advanced money to Pink to build the customer projects. Sunlight estimated they had about $32.4 million of advances that they would not recover.

Third (maybe most important), this was a hit to Sunlight’s credibility at exactly the wrong time

FIRE SALE

Sunlight is in a tough spot. They are going to have to sell underwater loans and that means sell them at a loss.

They disclosed as much in a December 13th 8-K filing.

The filing announced several changes to the agreement with the bank partner.

The good news is that Sunlight’s bank partner increased their lending capacity. More of Sunlight’s loans can be held on their balance sheet.

The bad news is that amendments changed the fee structure (likely not in Sunlight’s favor) and tightened Sunlight’s collateral requirements on non-current loans.

Sunlight also said in the filing that they will have to “sell a significant portion of their backbook loans in December”.

They will take a loss on these sales. The impact is expected to reduce total platform fees in Q4 to only $0-$5 million – down from $31 million in Q3.

That still leaves $275-$300 million of backbook loans at the bank partner, which Sunlight plans to sell in the first half of 2023.

The long and short of it is that these sales will “significantly reduce the Company’s cash balance and may result in materially less available liquidity through the first half of 2023”.

Not surprisingly, Sunlight is looking at strategic alternatives: selling the company or raising capital.

They said they have “received interest from parties both in investing in the company and in acquiring the company”.

GAME TIME

I have no idea how this plays out. It will come down to whether Sunlight can find a partner with deep pockets, either to buy the company or provide capital to get them out of this jam.

That could happen. Most of the loans are solar loans so these are long-term loans. Long-term rates have come down a lot from the peak.

But Sunlight is distressed. It is difficult to imagine them having much leverage in a negotiation with a potential partner.

That makes me want to sit this one out and just watch.

There may or may not be something worth owning once the dust settles. If there is, subscribers will be the first to know.