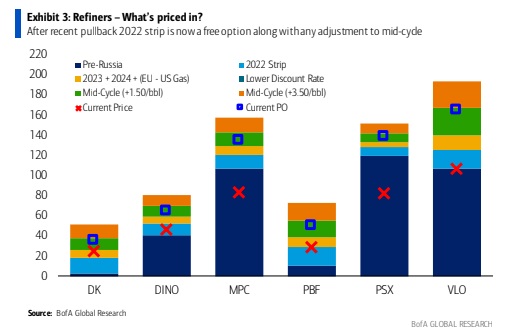

Even though energy stocks have had a great year (up until June! ) they still trade at very low multiples–2-3.5x cash flow.

That means the Market is still seeing this sector as VERY volatile. But huge Q2 profit numbers out of EVERY sub-sector in energy (oil, gas, refiners, frackers, drillers, sand producers) sure lit a fire under the stocks this last week.

The Street KNEW all these numbers would be GREAT–but there still wasn’t much love around for these stocks.

But the across-the-board strength in energy stocks this week may be the turn. EXAMPLE–I have seen a lot of crazy things in oil, and what I saw on Thursday is close to the top.

The first two of the US refiners reported on Thursday morning. Valero (VLO – NYSE) and PBF Energy (PBF – NYSE). Both reported incredibly strong results, well above analyst estimates.

PBF Energy reported earnings-per-share, excluding one-time items, of $10.58 per share.

PBF Energy is a $30 stock. They trade at 3x earnings then, right? Well, except, that $10.58 is for one quarter!

We knew the second quarter was going to be great for refiners. But even analysts underestimated just how great. The average analyst estimate going into the quarter was $7.50 EPS. The high estimate was $8.50.

Only one thing a stock can do after killing estimates like that? Right? Right – PBF Energy was DOWN for most of the day. Down a buck at one point. It did close up marginally, up 23c. (It did have a good day Friday–finally!)

NO ONE BELIEVES THIS CAN LAST

To say that no one believes these energy prices are sustainable is an understatement.

The only way a stock can have a move like that after a number like that is if investors are betting on an imminent collapse. In this case, in refining margins and, necessarily, oil prices.

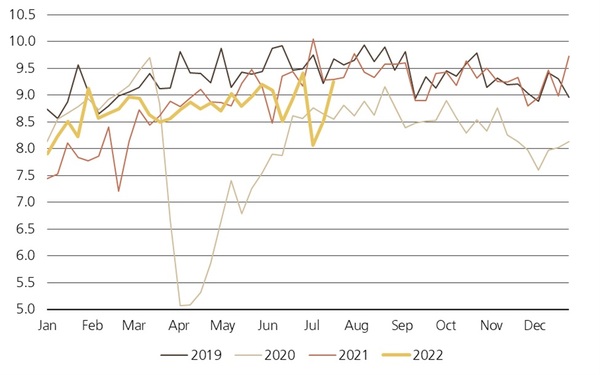

To be sure, refining margins have fallen. The crack spread has come in from ~$60/bbl to ~$40/bbl. You see that at the pump, as gas prices have fallen from stratospheric to just plain, old high.

Yet crack spreads are still way, way above typical mid-cycle levels.

Source: Bloomberg

Of course, the big worry is that this is just the start of the downtrend.

HOW MUCH IS DEMAND DROPPING?

The narrative today is that there is massive demand destruction and we’ve only just seen the start of the collapse in crack spreads and oil.

The narrative is driven by the EIA, which reported two weeks of very weak implied gasoline demand in mid-July, peak driving season. This was taken by investors as a signal that the collapse in demand, brought on by $5 gasoline, was on us.

Well, the latest EIA numbers, from this Wednesday, make that conclusion a little less certain. Below is the chart of weekly implied gasoline demand.

Source: Giovanni Staunovo

Gasoline made a dramatic comeback last week. Right back on trend.

PBF Energy CEO Tom Nimbley chalked up the two weak gasoline datapoints to the way the EIA smooths their weekly and monthly data.

So there was some aberrance in the — coming out of the July 4th week, and that’s always questionable you do there. And then there was some true-up, I think, between the monthly EIA from June that get flowed into July. And perhaps that has run its course now and yesterday’s numbers were a little bit stronger.

While the EIA numbers have everyone worried about demand, neither Valero nor PBF Energy seem to see it.

Nimbley said this:

in our own business… our demand at the wholesale level is holding up, we’re at the same level we’ve been at for the last 90 days.

On the Valero call COO Gary Simmons echoed those comments.

I can tell you through our wholesale channel, there’s really no indication of any demand destruction. In June, we actually set sales records

On their own call, Exxon (XOM – NYSE) said much the same thing Friday.

CAN SUPPLY RESPOND?

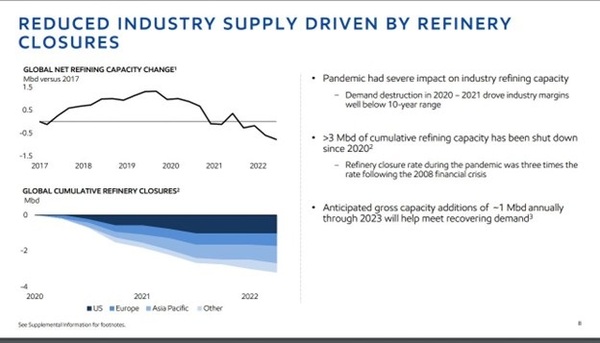

Exxon also took time to address the supply side. Exxon pointed out that the refinery “closure rate during the pandemic was 3x the rate of the 2008 financial crisis.”

Source: Exxon Mobile Q2 Investor Presentation

We’ve lost over 3 mmbbl/d of refining capacity since the beginning of COVID. In a ~100 mbbl/d market that, despite what we hear, is still growing, that is not chump change.

Exxon does not see the situation resolving itself for some time.

I’ve reproduced the entire answer that Exxon CEO Darren Woods gave to a question from Stephen Richardson at Evercore ISI, asking about his view on the refining outlook. My underlines:

Outside of that, I don’t see a whole lot of additional expansions here in the U.S. …and then as we mentioned in the presentation, over the next 2 years, probably 1 million barrels a day of capacity, including the 250 [kbbl/d] at our site coming on in the marketplace, which is still fairly short of the capacity that came off. And so our view is we’re going to see what I say, the tighter supply and demand balance.

One of the real question marks out there is what happens with demand. I would tell you, even at 2019 levels, the market is relatively tight. And so I expect a tighter market and maybe elevated margins versus what the historical norm is. But I would expect much lower than what we’ve experienced here in the second quarter.

But — and then with time, we’ll see that capacity come back on out in Asia and the Middle East. And the world market is very efficient, and those barrels will flow to the demand centers and balance things off. And so I think this will be a few year price environment, and we’ll get back to what I think is a more typical refining industry structure.

Those “elevated margins” are going to be needed to

A. attract investment to close the gap and

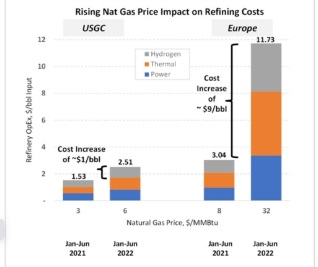

B. to keep the high-cost refiners in Europe running.

The US refiners are playing with a big advantage right now. Natgas prices in Europe are about 10x higher than the US. European refiners are paying out big OPEX costs because of natural gas.

Source: BofA Capital Markets

Yet Europe is very much in need of distillate fuels. Whereas the tightness in gasoline can resolve itself through higher prices/less driving, the distillate tightness is hard to fix.

Valero’s Simmons described the European dilemma like this:

It’s going to be a real challenge for us, Roger, to be able to supply a lot more diesel into Europe. If you look with the U.S. inventories where they are, the industry basically running all out, we’re getting back to where jet demand is recovering in the U.S., which is actually driving ULSD yields down a little bit. It’s very difficult for me seeing that there’s going to be a lot of flow from the U.S. into Europe.

NOTHING CAN GO WRONG

Look, no one on these conference calls is saying we are going back to the Q2 crack margin highs. Every executive I’ve listened to says what we saw in Q2 was too high and not sustainable.

But the whisper is clear – crack spreads will be higher for longer compared to what we’ve seen in the past.

When the market sells down PBF Energy and Valero after producing stellar earnings, they are not factoring in this scenario: that this is “a few year price environment”.

In fact, the market is not pricing in much at all.

Higher spreads than the historical mid-cycle norm are with us for a while. That is my takeaway.

But maybe more importantly is this: what if something goes wrong.

In oil we endlessly talk about one thing – spare capacity.

We never talk about that in refining. Because it’s never been a problem—until now.

Right now, there is NO spare capacity in the refining market. Nada. The refining market is running full-out on the edge right now and it is barely keeping up.

That doesn’t mean much until something happens. Then it matters a lot. In other words, if nothing goes wrong, then margins stay healthy, but not crazy high. But, if something does go wrong…

Any little hiccup – remember what happened to natural gas when the Freeport LNG terminal went offline? – and refining margins are going to go much, much higher.

The market is pricing refinery stocks like this is not a risk. I think that is a mistake.

A poorly placed hurricane, an accidental fire or a well-timed terrorist attack and we are in a whole heap of trouble.

I REALLY hope that doesn’t happen. But to price that risk at zero, seems a bit too optimistic to me.

Keith Schaefer