Gold and I, we have a love/hate relationship. From mid 2019 – to mid 2020 — I loved it. Since then, it has been a lot more hate than love.

Over 30 years, I’ve stuck with gold through good times and bad (apart from stop losses that is).

I have tried to believe in the yellow metal while others scoffed.

Gold is quite frustrating right now–because the set up for gold is REALLY good. Its next big move could just be on the other side of this market downturn. If it doesn’t move then…I don’t know. To me, that would be THE time for gold to put up or shut up.

If gold can’t make its move on the other side of this market downturn, I’ve got to re-assess how much attention I give gold. I mean, we have 8% inflation. We have nearly 6% core inflation. We have slowing growth. US GDP fell in Q1 by 1.5%. Best estimates for Q2 are that it was flat.

This is 70s style stagflation folks. Yeah, we can blame energy, we can blame COVID, we can blame supply chains. But its always going to be something. It is stagflation, no need to mince words.

It’s not just about energy. As Capital Economics noted last week, there were “ominous signs” that cyclical inflation was mounting, with “rent and OER prices both up by a stronger 0.6% month over month, while food away from home prices rose by 0.7%.”

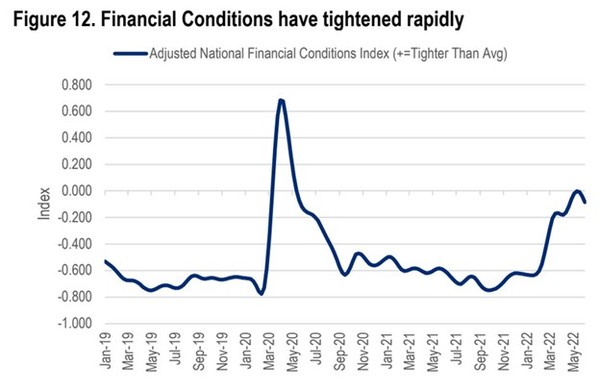

At the same time, financial conditions are getting tighter. According to Citigroup they are tightening rapidly after a benign backdrop the last two years.

Source: Citigroup

In a world of tightening conditions, gold remains one of the only assets that is no one’s liability. No one’s liability – in good times this phrase hardly matters. But when the tide goes out, your counterparty means everything (look at almost everything Bitcoin right now…).

Next, we have Russia. Two weeks ago, the Russian central bank said that they expected Asian and Middle Eastern central banks would rethink their reserve strategies in light of what happened to Russia.

The bank said “”One could expect an increase in demand for gold and a decline in the U.S. dollar’s and the euro’s role as reserve assets” given that those dollar and euro assets aren’t necessarily money-good if you step offside the West.

There have been plenty of rumors and rumblings about Russia (and China) and the role of gold in their currency. Gold never made more sense to a central bank than it does now.

Finally, FINALLY – we have Bitcoin. Digital gold, the new store of value, the better form of bullion, all the cliches.

Well Bitcoin is now down by more than 2/3 from its peak. It’s monikor as store of value has been tarnished, at least for now. While I would never count Bitcoin out, it will take time for it to recover its luster.

Putting this all together – could there be a better backdrop for gold?

ARE REAL INTEREST RATES REALLY REAL?

If the outlook is bright, why has gold not moved?

One answer; two words–real rates.

I remember a time about 15 years ago when no one really talked about gold and real rates. Back then gold was about trade deficits and quantitative easing.

But today any discussion of gold is tied at the hip to real rates. Gold and real rates are now like tom-A-to and tom-a-to.

I understand the link. Gold is an asset that does not have yield. Real rates describe the rate of interest you get on a bond (usually measured by the 5y or 10y bond) after inflation.

When real rates are negative, gold yields more (zero is more than a negative number). That is good for gold demand.

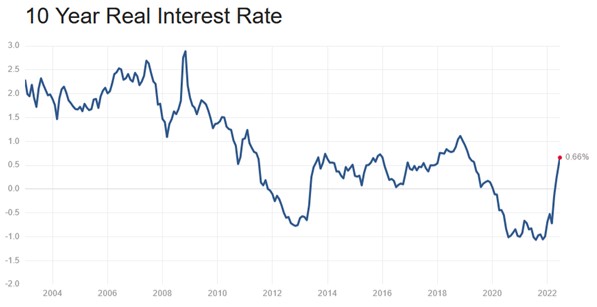

But in 2022, real rates have gone way up–obviously a negative for gold. For the first time since 2019, bonds are yielding a real return after inflation.

Source: Multpl.com

But wait. Didn’t we just say inflation is 8%? Core inflation is 6%? How can you have a positive real return with the 10 year at 3%?

Ahhh, well now we are getting to the crux of the matter.

WHAT IS A REAL RATE ANYWAY?

What is often overlooked is that real rates are really just an educated guess.

We don’t know what the inflation rate is going to be over the next 5 or 10 years. To come up with a 5-year or 10-year real rate, we have to guess at it.

In the absence of knowing, we go with what the market says. What is the market paying for an inflation adjusted bond?

The United States Government issues just such a bond – a Treasury Inflation Protected Securities (TIPS).

TIPS include a mechanism whereby the principle they pay out is adjusted with inflation. Essentially the government pays you more if inflation goes up.

TIPS yields were deeply negative after COVID–good for gold. Today TIPS are positive, having popped up quite a bit since Jan 10–not so good for gold.

But TIPS aren’t telling us what inflation will be. They are just telling us what the markets best guess is right now.

The markets estimate of what inflation will be over the next 10 years has gone up but it is still not that high – about 2.85%. With the 10-year at around 3.5% – presto – you have a positive real rate.

But it’s all a bit of hocus-pocus.

Markets are not good predictors at inflections. They under-estimate and then over-estimate.

The reason 10-year rates have taken off is not because we are worried about 2.85% inflation. It is because we are worried about 8% inflation.

Chances are either the 10-year rate is too high or the market’s guess at inflation is too low.

If we go back to a 2-handle on inflation, I GUARANTEE YOU 10-year rates are coming down too.

WHAT DOES THIS MEAN FOR GOLD?

I believe that one thing preventing gold from moving higher is this mismatch in the inputs to real rates.

Investors are shying away from buying gold because they are worried about the rise in real rates.

But that rise in real rates is not quite what it appears to be – it is more about comparing an apple to an orange.

At some point this is going to change.

Maybe it already is? Flipping the argument, I’d point out that even though real rates have risen quite a bit – gold has not gone down.

There are forces that have certainly tried to take gold down. There have been many days with big drops. But each time, gold recovers.

I suspect this is because investors are recognizing what I just described. They have concluded that real rates are not telling us the whole story and that this is not the time to sell gold.

The other thing is that…going into panic market meltdown, everyone just reaches for the US dollar, which remains the most liquid and most transparent investment vehicle in the world–by a very wide margin.

But when the Market thinks rates have peaked–the USD comes down, real rates come down and shouldn’t that WHOOSH up gold?

WHAT TO DO?

One option is to just buy some gold stocks.

But gold stocks have their own problems right now–like energy; oil, diesel, gasoline and natural gas prices. The price to run the machinery and keep the lights on has gone up a lot. Those Q2 cash costs are going to be sky-high. That is bound to be a headwind for the miners unless the price of gold gets moving very soon.

If you are going to go with a gold stock, the bigger one’s are handling the cost pressure better.

Junior producers have seen their costs go through the roof. Cash costs of over $1,000 per ounce were the norm in the first quarter.

Meanwhile the biggest miners like Newmont (NEM – NYSE) and Barrick (GOLD – NYSE) have managed to hold the line. These miners still have cash costs in the $800 per ounce range.

The reason, I suspect, is that majors have more leverage over their suppliers. They also have more efficient fleets of equipment, having spent the cash to electrify their fleet away from being diesel guzzlers.

They also have teams that can mine sequence and high-grade when they need to get through the inflationary times without it impacting the bottom line as much.

Still with the nagging cost pressure, this might be the time to just buy gold itself.

To do that, there are lots of plain-vanilla gold ETFs, with the SPDR Gold Shares (GLD – NYSE) being the biggest and most liquid.

But if gold is really going to shine, there are some ways to take more risk. The levered gold ETFs magnify the upside and the downside.

The one I am most familiar with is the Proshares Ultra Gold ETF (UBL – NYSE), a 2x bullish ETF linked to the price of gold.

The caveat here is that like all 2x ETFs, the fund looks to seek a return that is 2x the move in the gold price for a single day.

The ETF hold swaps and gold futures that are about double the size of the fund. Because it has to roll these positions over, that can mean that over longer periods the performance of the ETF is not necessarily 2x.

Consider that from the beginning of the year until the end of May the price of gold was essentially flat, but the UBL returned -2.05%.

With that in mind, the way to play any 2x product is to wait for the move to start.

You don’t want to just buy UBL and sit on it, because chances are if gold does nothing you will lose money.

With gold that must be the base case. Regardless how bullish the outlook, or how many stars align.

Because doing nothing is what gold is doing best!