My big question with the energy transition has always been: where’s the baseload going to come from?

We want to get rid of oil. Okay. Around 80% of a barrel of oil is used in transportation. If we electrify everything – EVERYTHING – you get rid of a lot of oil demand.

But now you need a whole bunch more electricity. It can’t come from gas, oil, and certainly not coal.

How do we get all this electricity, all day, and all night, from wind, solar and water?

Batteries? Storage? That always the response, but I’m skeptical that can do it on its own.

Battery tech is hitting more walls than it is scaling.

I’m not the only one to have a healthy skepticism.

Just last week Tennessee Valley Authority (TVA) CEO Jeff Lyash said that “without technological advances” the Biden administration goal of 100% renewables by 2035 is not going to happen.

Lyash cannot be brushed off easily. The TVA is the largest public utility in the United States.

Lyash pointed out that electricity use could as much as double by 2050 as we shift all our transportation to electric. We don’t have a clear path to meet that demand.

HOW DO WE GET THERE?

Lyash called out technologies that need to move ahead fast if we want to hit our zero-emission goal.

Energy storage, carbon capture – you’ve heard those before. But he also named a third, one that is often maligned – small modular reactors (SMRs); small nuclear really.

As a potential solution to our zero-emission goal, SMRs get a pretty bad wrap.

When four Canadian provinces – Ontario, Alberta, Saskatchewan and New Brunswick – recently announced plans to jointly develop SMRs, it set off a flurry of commentary.

Canada’s Globe and Mail business newspaper and The Toronto Sun both published more than one article throwing shade on SMRs.

The arguments against SMRs are not without merit. But many of these arguments could be said of any new technology: it’s expensive, its uncertain, its not yet in operation.

Those ARE challenges. But they can be overcome.

When I see broad bashing of a new technology that clearly holds some promise, I wonder if it has more to do with where the interests lie than the merits of the technology itself.

NUSCALE POWER – THE SMR PLAY

To help form my own opinion, I decided to dive into a newly public company (A SPAC no less) right in the middle of the SMR debate – NuScale Power Corp (SMR – NYSE).

NuScale is a provider of SMR technology. They have been developing an SMR module for over 20 years.

They recently signed their first deal, with Utah Associated Municipal Power Systems (UAMPS) to provide a 460 MW plant by 2028.

NuScale reached an agreement with Spring Valley Acquisition Group in December to go public via a SPAC.

The SPAC gave NuScale $413 million of cash, including $180 million from a PIPE financing.

NuScale says this will be enough cash to get them through to cash flow positive – expected to happen 2024.

The SPAC values NuScale at $1.9 billion. This is NOT a cheap name.

I am skeptical of any SPAC in this market. NuScale has many of the same markings of past, failed SPACs – long dated forecasts, revenue growth to the 2030s, 2026 EBITDA projections.

We know where that sort of thinking got us.

But there is reason to keep an eye on NuScale.

SUPPORTED BY INDUSTRY AND GOVERNMENT

First, this is not some fly-by-night operation. NuScale comes out of Fluor (FLR -NYSE). Fluor has been building BIG mines around the world for decades.

Fluor owned 100% of the company pre-SPAC and still owns ~60% of them now.

Second, NuScale seems to have the US government on its side.

Even as the Canadian media turfs the idea of SMRs, the US Government is taking a different tact.

The DOE has been shoveling money to NuScale for over a decade.

In 2013 Nuscale won $226 million in funding from the DOE, outcompeting bids from Westinghouse and General Electric.

In 2020, after receiving design approval from NRC, the DOE awarded Utah Association of Municipal Power $1.4 billion to assist them in de-risking that first NuScale project.

In total, Nuscale has received $500 million from the DOE over the course of the last 10 years. They have another $200 million of award still coming.

According to NuScale management, the Biden administration has been “extremely supportive”. The Build Back Better plan added another $10 billion towards nuclear.

The support has been bi-partisan. Management says that the Trump administration was supportive as well.

It also extends outside of the US. Japan and Korea have moved ahead with investments in NuScale.

Samsung C&T Corp took down 5.2 million shares as part of the PIPE investment.

The Japan Bank for International Cooperation, which is a financial arm of the Government of Japan, invested $110 million into NuScale.

FIRST MOVER – OR ONE OF THEM

It has been a long road. NuScale has been developing their tech since the early 2000s.

They applied for their regulatory license in 2016. It wasn’t until 2020 that the NRC approved the application.

Their process is patented: 425 patents issued and another 209 pending.

Yet even though the tech has been in development for 20 years, it is still considered a new technology.

In fact, this is one of the points the naysayers love to point out. It took 20 years! We still don’t have one in operation! It must be a dud.

Well, maybe. The first solar panel was made in the 1950s. The first wind turbine for power generation in the 1880s. Sometimes technology takes time. Especially when you are dealing with a nuclear rod.

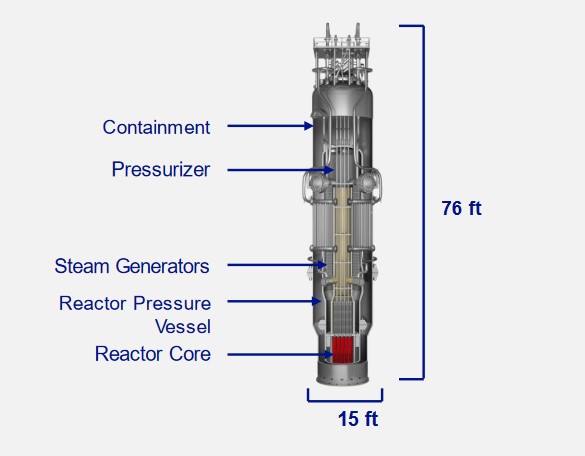

The NuScale module is a very simple machine. A modular design, this is a light water reactor, a 70-year-old technology. No fancy materials, most of it is off-the-shelf. It is like the big nukes that are used today, only smaller.

One power module can produce 70 MW of electricity.

Source: NuScale April Investor Presentation

Modules scale up to 12 per plant which gives you a size of 924 MW or the size of a large coal plant.

NuScale has 3 standard configurations for their design:

Source: NuScale April Investor Presentation

The target sites are existing coal plants. NuScale counts 132 coal plants that need retiring by 2050 – all sites ripe for SMRs.

The footprint fits because the scale is MUCH smaller than a big nuke site. A 12-module plant takes up about 30 acres, whereas a traditional nuclear plant has a 10-mile radius.

NOT THE ONLY GAME IN TOWN

NuScale said on their conference call in December that they were ahead “5-7 years of any other US technologies”.

That may be the case. I’m no nuclear physicist, so far be it for me to compare tech. I will say that NuScale is not the only game in town.

Bill Gates funded TerraPower is another US SMR developer. Like NuScale, TerraPower is getting big-time funding from the Federal Government.

TerraPower was almost first out of the gate. Before the Trump administration put the kibosh on China, where TerraPower was in line to build the first SMR there, a 600 MW reactor.

With China on hold, TerraPower is still on target to build their first reactor–now in Kemmerer Wyoming, with it being operational by 2028.

The TVA and Ontario Power General (OPG) both announced SMRs in the last few months. The utilities are partnering on their development, using a common platform – but notably it’s not from NuScale. Instead, TVA and OPG are going with a Ge-Hitachi BWRX-300 reactor.

THE MARKET IS BIG… I THINK

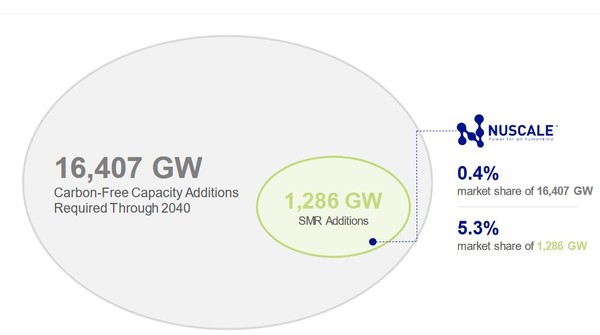

Even with the competition, there is plenty of opportunity if SMRs catch on. This is a potentially huge market.

Source: NuScale April Investor Presentation

The big questions are how many get built and when.

A recent decision by the Oregon Public Utilities Commission (PUC) highlights the challenge.

In March, PUC “declined to acknowledge” – a polite way of saying they aren’t endorsing but also not vetoing – a plan by PacifiCorp (PPW – NYSE) for a 345 MW SMR to be built by TerraPower.

Now to be clear, the project isn’t dead. PacifiCorp said they would “move forward in pursuing advanced nuclear technology”. TerraPower is intent to move forward as well.

But it does show that this could be a bumpy road.

Another datapoint: recently Duke Energy (DUK – NYSE) reduced their own expectation for their installed SMR capacity in the next 10 or so years from 1,350 MW to only 300-600 MW.

So how many get built remains a big question. But you can’t deny the growing interest.

SMR’S GAIN STEAM

NuScale has said they had 140 opportunities in their pipeline. These ranged from “very developed” to early stage.

They have publicly announced 20 memorandums of understandings (MOU).

Source: NuScale April Investor Presentation

Their first deployment is going to be with UAMPS, where they have an agreement signed and are ramping up the early-stage development. The UAMPS SMR is expected to deploy 2029. This is a VOYGR-6 plant, meaning 6 modules producing ~460 MWe of power).

The plant is part of UAMPS initiative to replace 700 MW of coal power by the end of 2030.

Next steps for the project are ordering materials for the power module by the end of this year and submitting an operating license to the NRC in 2023.

NuScale noted that there has been a surge in interest among other utilities with the Russian-Ukrainian war lighting the spark.

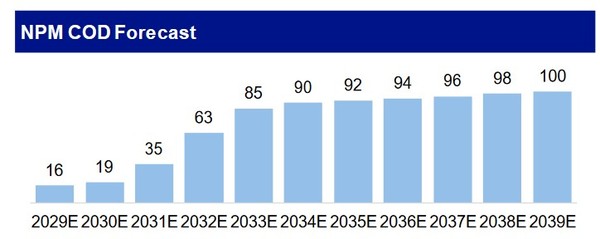

NuScale has an aggressive forecast for deployments. They expect to deliver 16 modules in 2029 (6 of those being the UAMPS project). That will scale to 85 modules by 2033.

Source: NuScale April Investor Presentation

NUSCALE ECONOMICS

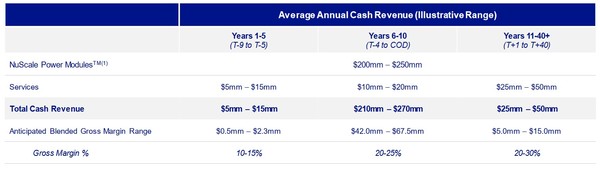

NuScale will earn revenue through the life of each SMR project. Revenue starts about 9 years before the SMR is deployed.

Source: NuScale April Investor Presentation

Revenue scales up in the four years right before deployment. Service and maintenance revenue continue over the life of the SMR.

NuScale collects payments from the customer in advance, which they can use to acquire materials and parts.

They are always running a cash surplus. This should allow them to hit cash flow positive sooner.

If there is a “gotcha”, it’s in the accounting, which is caused by GAAP.

GAAP accounting will not let NuScale recognize revenue until the modules are delivered. That means that while NuScale will be collecting revenue for years up to deployment, that revenue won’t be recognized on the income statement until 1-2 years before deployment. It will be a bit messy.

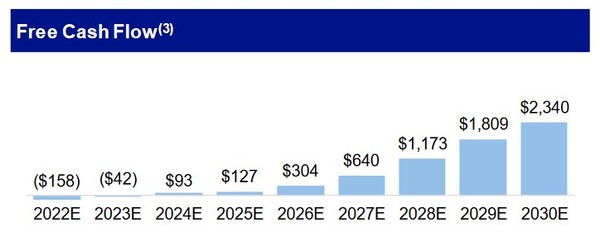

If they can meet their forecast, the cash will flow. Cash EBITDA is expected to reach $1.6 billion in 2028 – about the current enterprise value. Free cash flow will be nearly $1.2 billion in 2028.

Source: Nuscale Power April Investor Presentation

THE NUCLEAR ELEPHANT IN THE ROOM – COSTS

The big issue with nuclear (other than safety) is costs. Can we trust the cost projections and will the project produce cheap power?

A report released by the Institute for Energy Economics and Financial Analysis (IEEFA) in February scrutinized the cost of NuScale’s project with UAMP.

According to the report, in 2015 the company said the entire capital cost “would be $3 billion, which has more than doubled to $6.1 billion, even before construction begins”.

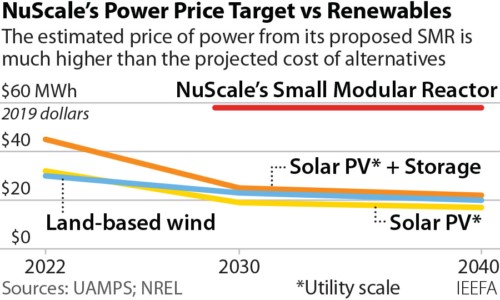

The IEEFA report also says that costs of electricity will be significantly higher than solar or wind.

Source: IEEFA Article

I suspect this report was in part the source for some of the negative Globe and Mail and Toronto Sun coverage on SMRs. On the surface, it looks like a kill shot for NuScale.

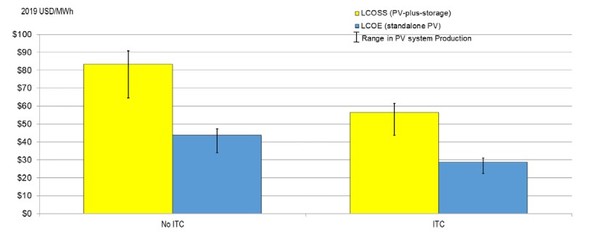

But maybe not. I dug up the most recent NREL report–National Renewable Energy Laboratory–on Solar PV + Storage costs (here) and the devil seems to be in the details.

The costs of solar PV plus storage is indeed around $55/MWh. But that is with something called the ITC – investment tax credit.

Source: NREL: U.S. Solar Photovoltaic System and Energy Storage Cost Benchmark: Q1 2020 – Jan 2021

Without the ITC, costs are $80+/MWh, or above NuScale’s estimates.

The analysis is also based on something called LCOSS accounting. LCOSS stands for “Levelized cost of solar plus storage”. While the details make my head spin a bit, NREL themselves says that “it is important to remember that LCOSS does not necessarily tell us which option is the most economically viable”

Now I for one don’t know whether NuScale’s costs are accurate or even NRELs for that matter. I also don’t know which technology is going have lower costs 10-years from now (though assuming that solar and wind will see improvements while SMRs does not seems a little biased to me).

But tax credits aside, it looks to me like NuScale’s SMRs are in the ballpark.

MAYBE, THE NEXT BIG THING?

Energy is always after the next big thing.

Shale oil, LNG going global, these were all HUGE, decade long stories that made (and lost) millions and changed the energy landscape.

Each of these next-big things has one thing in common.

It is trying to fill the energy gap.

Today there is a BIG energy gap on the horizon. Small nuclear could help fill it.

Small nuclear could be a big story. BUT: I can’t say that for certain.

I see a media that is not on board. I see government’s that are onboard. I see hesitation, baby-steps. It is going to be uphill, but not impassable.

Meanwhile, as for NuScale, if SMRs takeoff then the stock will be the real deal. But it is far from cheap right now given where we are at.

The best thing to do I think is watch and wait. See what the regulators approve. See what the utilities say on their calls. See where solar and wind costs actually go – not where they are supposed to go.

We already see what solar and wind did to Europe when the wind stopped blowing and it got cloudy for a while. When Mother Nature does not cooperate, having a nuclear baseload that provides stability to the grid seems like a pretty good idea to me.