I can’t believe it has been ten years – an entire decade since I launched the Oil and Gas Investments Bulletin in the spring of 2009.

I started with a mission to explain The Shale Revolution in simple English to retail investors…and make some money doing it, by trading my own account.

While the energy sector has struggled over this ten year period, my personal portfolio – made up entirely of OGIB subscriber picks – has done very well by any measure.

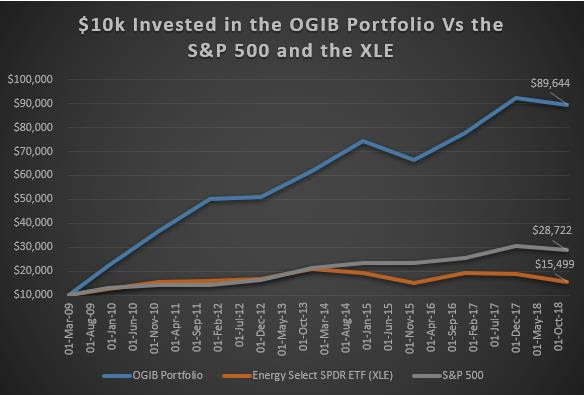

The chart below compares the OGIB results with both the XLE (energy sector) and the S&P 500. While my OGIB portfolio is up nine-fold the energy sector is up only 50 percent – it is always about exploiting the cyclicality of the energy industry not suffering from it folks!

Despite this, I do feel that I’ve left a ton of money on the table… because the energy sector is only 5% of the world’s 40,000 publicly traded stocks.

I’m at a disadvantage with just one small sector.

There is no question that over the last 10 years I have become a much better investor, honing in on what to look for in financials, how to talk to management, market expectations and more.

I’ve also developed many more valuable connections throughout the North American investment industry.

As I have started to use all this experience and discipline to branch out to other sectors to stay alive, relevant, and wealthy – I found success again in my premium subscriber group The Conversations. With The Conversations we have been finding dirt cheap, rapidly growing small-cap companies across many different sectors – not just the energy sector.

There is a world of opportunities out there folks and I want a piece of them. The chart above shows the investing performance we have accomplished with just the energy sector to pick from – I know that I can do even better with more freedom!

That is why I’m so excited to announce that I am launching a new subscriber service at www.investingwhisperer.com. This is where I’m going to be investing in companies outside of the energy sector – the other 95 percent of the market.

There will be no change to my OGIB service. I’ve still got my seven figure OGIB portfolio to invest and for the first time in awhile, oil stocks are making me good money!

But if I can grow my portfolio nine-fold over ten years while investing in a sector that only went up 50 percent…. I can’t wait to see what I can do with Investing Whisperer where I get dig out the best small-cap opportunities in every sector!

I’m NOT doing micro-caps or companies with no revenue. I’m looking for companies that trade between $1-$15 and are either self-funding, or about to be self-funding in the next quarter or two. My colleague Paul Andreola does the micro-cap investing, and he is very talented at it.

I have a new writer/researcher. I have several new research services to which I subscribe. With OGIB I spend $80,000 per year on research alone – and that doesn’t speak to what I spend on dinners with CEOs or industry experts, plus the cost of attending conferences, travelling to meet management and paying my analyst/writers.

At Investing Whisperer I’ll be doing the same because I’m going after the best small growth stocks in every sector.

Investing Whisperer subscribers won’t be just getting me – they will be getting access to the knowledge and ideas that come from the tens of thousands of dollars of research that I purchase every year.

I’m still buying all of the stocks I choose from my research – eating my own cooking, so to speak. The real money in the business is deploying my own capital. I really do make my money by risking my family’s money in the stock picks I provide you.

It was stock picks like Canadian Energy Services (CEU-TSX; $2-$11), Pacific Ethanol (PEIX-NASD; $3-$23), and Resolute Energy (REN-NYSE; $5-$48) that made the big difference for me. But even when energy stocks were tough, I found stocks like Northern Tier (NTI-NYSE; $19-$31) and Viper Energy (VNOM-NASD; $16-$42).

What would you pay to increase your wealth 900% in the next decade? $20,000? $50,000? $100,000? You can get my full research reports and market timing for just US$99/month – BUT THIS PRICE WON’T LAST LONG.

After the first 3 months, getting full access to my research and stock picks will be US$1,497 annually, or $125/month.

Ten years have passed and my OGIB investment performance has turned $10,000 into almost $90,000 in a sector that has seen many of the very best hedge funds forced into liquidation.

I produce results because I have no other choice. This is how I make my living.

Over the next ten years I’m taking things up another notch – I’m going to keep growing my OGIB portfolio and I’m ready to take what I have learned there and use it to fish in a pool that is ten times as large with much bigger and better opportunities.

MY FIRST PICK IS READY TO GO. It’s a technology stock with a clean share structure, where management owns a lot of stock, has fast growing revenues and a very cheap valuation. I just put $75,000 of my own money into it.

Get this stock working for you quickly – they are about to announce their next set of quarterly results!

Yes, I want to start subscribing to InvestingWhisperer!

Sounds interesting. Tell me more!