Intermediate natural gas weighted stocks in Canada are valued higher—sometimes a LOT higher—than oil stocks, despite oil being worth 35 times more than gas.

And that could mean significant price weakness for already battered natural gas stocks, says Haywood Securities analyst Alan Knowles.

“People think (the stocks of) gas companies have corrected, but they’ve only partially corrected,” he told me in a phone interview. “The correction hasn’t kept pace with how far it should have gone,” given how low natural gas prices have moved.

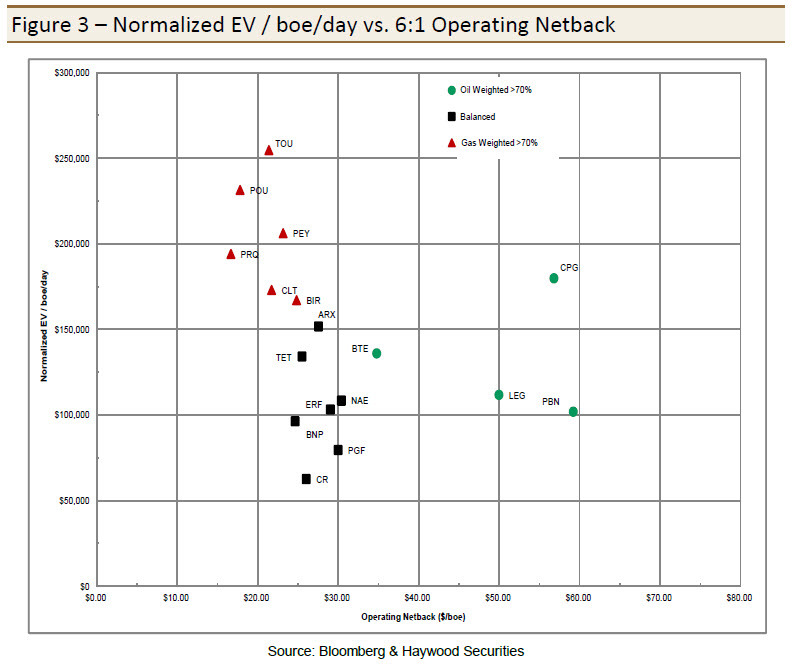

At first glance, Knowles’ says the gas companies are NOT valued more highly than the oils—but that’s comparing the two groups at the industry standard of 6:1; where 6 barrels of natural gas are considered equal to one barrel of oil. See his chart below that shows this. The green dots are the leading intermediate oil producers—Crescent Point, Legacy Oil and Gas, Baytex and Petrobakken, and the red triangles are the gas weighted companies.

The gas stocks are clearly cheaper on this chart, which measures them in terms of the value of their production — $50,000 per flowing barrel up to $250,000; again all based on the industry standard 6:1 ratio.

So this is how you would read the above chart…

Look at the red triangle symbol TOU, Tourmaline Energy, a heavily weighted gas producer. This chart shows they make just over $20/barrel profit, and for that they are valued at roughly $70,000 per flowing barrel of production.

Crescent Point (CPG), which is Canada’s leading intermediate oil and arguably the most successful and most respected management team in their sector, generates a profit per barrel of over $55… and the market values them at roughly $160,000 per flowing barrel.

But the big problem is that the value of gas is, on average, 35x less than oil—so Tourmaline and all these other gas producers should have their daily production levels divided by 35 to get an accurate comparison to oil producers, not 6. And that creates a HUGE valuation gap for these stocks to contend with.

Knowles went through each producer under coverage to get a customized oil:gas ratio based on cash flow generated for each commodity—and the ratios for the gas stocks ranged from 29.9 – 41.5. When you compare the valuations of all the companies on their true cash generating ratio of gas to oil, this is what the chart looks like:

Look where Tourmaline is now—at the top!

“Why should a gas company get so much more value than oil-weighted value?” asks Knowles. “Almost all the gas guys are valued higher than CPG, and does that make sense?”

This chart shows that the 6:1 ratio of oil to gas is outdated. In fact, most people in the industry have been saying that for years.

“We have to rethink the 6:1 ratio,” says Knowles. “Two 50,000 barrel-a-day companies are not the same. If one is half natural gas, all of a sudden they’re a 25,000 bopd company, from a revenue point of view.”

Knowles says his chart should be a warning to investors bottom fishing for natural gas stocks now.

“This is kind of a warning. Gas prices were down 33% in Q1 and they’re down even more now.” He says investors will finally understand how bad things are getting when natural gas companies start reporting their quarterly financials.

“It takes hard reality of financial results before it really hits home for a lot of people. When we see it in black and white it will get crystallized—there will be some companies whose cash flow is devastated—especially on the juniors, they’ll be hard hit.”

He expects a lot of Canadian natural gas producers just won’t re-start production after this year’s spring break-up—the 4-6 week stretch where big trucks are banned from the thawing roads in western Canada.

Knowles is quick to point out valuations aren’t just in the numbers. There are a lot of intangibles, like the Street’s opinion of management—that counts for a lot.

Take my example of Tourmaline. Chairman and CEO Mike Rose is a legend, successfully selling Duvernay Oil and Gas to Shell for $5.6 billion in 2008. Few CEOs have as good a track record. And that’s a big part of that stock’s valuation.

Later this year, Knowles sees the oil:gas ratio increasing to over 40 as Canadian oil prices increase. He says that the reversal of the Seaway pipeline in the US—which will now take oil from Cushing OK instead of delivering it, will help Canadian gas prices. Refinery turnarounds will also be a plus.

He sums up: “We think people have not adjusted to the reality of gas stocks. They’re still looking at it as 6:1.”