YOU JUST HAVE TO DIG FOR THE REAL NUMBERS

Ahh, the good ole’ days when stocks traded on simpler ideas like cash flow, not on options, or which gamma quadrant we’re in.

When the monthly Consumer Price Inflation (CPI) would come out 10 or 20 years ago, I would get at least 5 different analyses in my inbox telling me what to think of it.

One thing that certainly isn’t as good as the old days is our reporting on economics. We’ve lost a lot with the digital age.

These weren’t just cursory views – these were detailed, in-depth dives.

Today, I’m lucky to get two. And while yes, you can still find a good analysis on X if you look hard enough, and if you pay up there are some very good analysts out there, it isn’t like it was 20 years ago.

Today the standard analysis could be written by AI (in fact, it probably is!).

Instead of detailed, nuanced dives, we get a cursory review of the two topline number (headline CPI and Core CPI – which excludes food and energy), and a half-baked opinion about what they mean.

Well, we all know what you can say about opinions, and how much help they are to making money.

What is helpful for making money is looking at something closer than most other people are. Which is where we can turn this sad state of affairs to our advantage.

While everyone focuses on just two numbers from the Bureau of Labour Statistics monthly update, there is much to be learned by digging deeper, which is what I want to do here.

This month the headline inflation number was a 2.9% year-over-year change in core consumer prices. Month-over-month inflation (the chart below) was 0.4%, up from 0.3% the month before.

Source: BLS.com

If the only thing you saw was this chart you wouldn’t feel very good about inflation. Especially when you consider that it does not look like economic growth is slowing down.

The Atlanta Fed model for GDP growth, which has been bang-on of late, is estimating 2.7% growth in Q4. More growth! Which means the inflation we see today will be difficult to squash.

The bond market has been pricing in this scenario since September. Remember, when bond prices go south, it’s because rates have gone north.

The iShares 20+ Year Treasury Bond ETF (TLT – NYSE) has been dropping like a rock since mid-September (which means no, this isn’t just a Trump thing).

Source: Stockcharts.com

Now I know someone is going to say wait a minute, isn’t this all about the deficit? Aren’t rates going up because we just have too much debt?

My answer to that is yeees, too much debt does play a role. But its not as big as some observers make it out to be.

Japan has had huge deficits for years and virtually no one cared. The United States has a lot of things going for it – its military, its status as reserve currency – which makes claims that investors are going to stay away from US Treasury bonds because of debt a little hard to swallow.

Besides, its debt and deficit expectations that matter. If anything, the belief is that Trump will be tougher on spending.

Tariffs, for all they are (rightly) maligned, will bring in Government revenue.

And DOGE (that’s shorthand for Elon Musk’s Department of Government Efficiency) may not meet its lofty goals, but it will reign in spending at the margins.

So no, I don’t think this is about deficits. It’s about inflation.

Which, if you ask me, is a whole bunch of shoddy analysis.

THE PROBLEM WITH STATISTICS – LIES, DAMN LIES

There are some big problems with the CPI numbers. I’m going to focus on two of them. Together they are doing a bang-up job of hiding what is really happening with inflation.

The first problem has to do with what the Fed calls the “shelter” component of inflation. The shelter component is exactly what you would think it is. It accounts for the cost of either owning or renting a home.

This cost is obviously the big one, and that is reflected in the weight of shelter in the overall index, which is a little over 36% of the total.

To put it another way, if shelter costs are rising materially, it is VERY difficult for inflation to not go up.

Such was the case in December. Shelter costs were up 4.6% year-over-year in December. The cost of keeping a roof over our head is still (apparently) going higher.

Whether this is actually the case is EXTREMELY important to overall inflation. If we exclude shelter, we get a much different picture of what inflation is:

Source: FRED Data

Without shelter, inflation is not even 2%.

Is the cost of shelter actually rising at a rapid rate?

In a word? No. Shelter costs were rising at a rapid pace. Today, they are not. But that isn’t yet reflected in the inflation number.

Why? There is a simple explanation.

The way that the BLS comes up with shelter inflation is, in a word, bananas.

There are two components that the BLS uses to estimate shelter costs. The first component is called “Rent of Primary Residence”. This component is completely reasonable.

The BLS surveys renters and asks them what they are paying in rent, including discounts, subsidies and such. Simple, straightforward, makes sense.

The other component is called “Owner Equivalent Rents”. It is not-so-reasonable.

Owner equivalent rents are also collected from a survey. This time the BLS calls homeowners. They ask the homeowner what amounts to this question – what do you think you could rent your home out for?

The question is, of course, absurd. Homeowners don’t know how much they can rent their house out for. They are homeowners, not renters. Sure, they can ballpark it, but its not going to be accurate. Yet the BLS puts a heavy weighting on owner equivalent rents. It makes up a full 27% of the CPI calculation!

It isn’t just me that thinks this is bananas. Even the Federal Reserve questions it. On January 8th, Fed Governor Chris Waller gave a speech titled “Challenges Facing Central Bankers“. He basically admitted that the numbers aren’t accurate:

“Inflation in 2024 has largely been driven by increases in imputed prices, such as housing services and nonmarket services, which are estimated rather than directly observed and I consider a less reliable guide to the balance of supply and demand across all goods and services in the economy. These two categories represent about one-third of the core PCE basket.”

Waller also points out what really is the whole crux of this blog – that if you weren’t dealing with made up numbers, the real numbers would be much lower:

“If you look at the prices associated with the other two-thirds of core PCE, they on average increased less than 2 percent over the past 12 months through November”

So yes, the shelter piece is flawed and yes, without it, inflation would be much lower.

But wait, there’s more. Even with the flawed methodology, we are starting to see the shelter component of inflation come down.

Source: BLS.com

Even owner equivalent rents can’t go up forever. That’s because the flaw in the metric has to do with perception. It’s not that homeowner are blatant liars. It is that they are influenced too much by the past.

The reality is that most of us didn’t notice inflation until the run up had already happened. It’s the same thing with owner equivalent rents. We didn’t notice that rents were going up until they already had.

What we’ve seen is an artificial lag in homeowners realizing inflation happened, and now even that lag is ending. Which means that even artificially high inflation numbers are now on borrowed time.

That’s all I have to say about the first issue. The second issue has to do with the seasonal adjustments that are made every month.

HOW THE PANDEMIC MADE THE NUMBER WORSE

When the BLS reports CPI they adjust to correct for seasonal factors. This is straightforward and necessary. We need to smooth out the impact of Christmas, summer holidays, harvests, the real estate cycle, school ending and all the other annual things.

But this can also go off-the-rails if the seasonal adjustments are not accounting for seasonal things. Which is what is happening now.

Again, it comes down to methodology – in this case that the adjustment is estimated off what has happened in prior years.

In the last 5 years the impact of seasonality has gone on tilt because of COVID. As new COVID variants came out, as vaccines came out, as people were told to stay home or told to go back to work, economic activity ebbed and flowed in unusual ways. This overwhelmed typical seasonality.

The methodology the BLS used has struggled to deal with this. As a result, the seasonal adjustments they make are not really doing their job. Which is just adding to the muddy picture from the data.

If we look at the raw data from this week’s CPI release, we can see that unadjusted (so no seasonal adjustment) CPI is up a TOTAL of 0.4% since June (that would be an annualized rate of less than 1%!). Adjusted CPI (see that first chart I showed) is up 1.4% since June.

Source: BLS Data

That difference of 1% is all seasonal adjustments. Which may be real but probably isn’t.

In February the BLS will be updating these factors, like they do every year.

Source: BLS Data

It will be interesting to see if this year’s adjustment makes some wholesale changes. We have now had 2 full years without COVID, which should be enough data for the BLS to discern what was wonky during the prior 3 years.

We can only hope that it makes the seasonal adjustment more seasonal and less random. In the meantime, we must take these seasonally adjusted numbers with a grain of salt.

WHAT DOES THIS ALL MEAN?

What it all means is this: inflation is not sticky – in fact, it’s dropping.

Even the official statistics say this. As the below chart of the month-over-month change of Core CPI (which includes the shelter data and the seasonal adjustment) shows, while the path is in fits and starts, the trend down is very clear.

Source: BLS Data

What I am saying is that this trend is potentially MUCH FASTER than the official numbers indicate.

If this is right, then it begs the question: how long can long bond prices stay so low?

As market participants reconcile themselves with the fact that the path of inflation is down, down, down, the price of longer maturity bonds must go up, up, up.

Which makes me want to buy the TLT-NYSE, and the covered call ETFs around TLT (in Canada that would be BOND, HBND and LPAY), and the utility ETFs (ZWU and UTES for some leverage). I look for a positive sector trend–anywhere–and buy the covered call ETFs as monthly income is important for me than lumpier capital gains. So far, all those trades are holding.

What could go wrong?

There are Two Big Risks I can see. The first is the one that is always lurking in the shadows – energy cost. A spike in energy prices will always reverberate through consumer good prices. It will hit input prices and shipping and of course gasoline and jet fuel as well. That will send inflation higher and if it is perceived as more than just a spike, it will make investors question where bond prices should be.

I’m not even going to guess at what could cause that shock. The last shock (Russia and Ukraine) came virtually out of the blue. No expert I followed predicted it beforehand.

The second big risk is if the trade war goes tilt.

This would have to be something more than just a one-time tariff hike like what the Trump administration is mulling. That’s just a singular shock, not something to cause prolonged inflation, and there are plenty of countervailing factors that mitigate it – currencies will fall, profit margins will shrink, and substitution will occur.

What I’m talking about is a continued intensification; to the point where there was a significant and prolonged supply shock, well that would be a whole different ballgame.

It’s not out of the question. For example, while Alberta is quite rightly resisting the idea of turning off the energy taps to the United States, the rest of Canada does not seem to realize what this may trigger.

If Canada retaliated by stopping energy exports to the United States, that would be bad. It would also likely trigger an even more extreme response from the Trump administration.

It’s easy to see how this sort of brinkmanship could quickly get out of control and stop the flow of goods entirely.

While these scenarios are both rather extreme, their probability is low.

The more likely scenario is that things just keep on keeping-on. Which means that inflation continues its march down.

Which would make rates inevitably fall too. That makes me think that buying the TLT here, along with the covered call ETFs built around TLT, is not a bad idea.

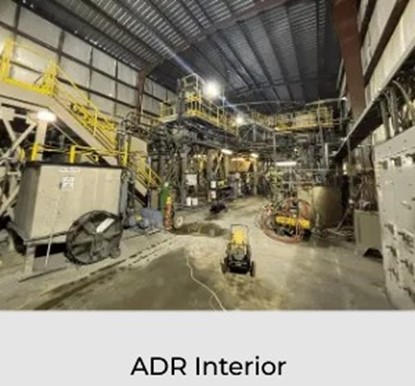

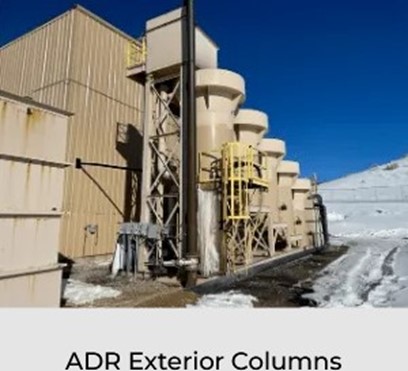

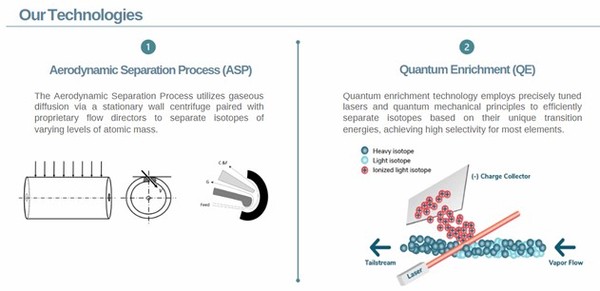

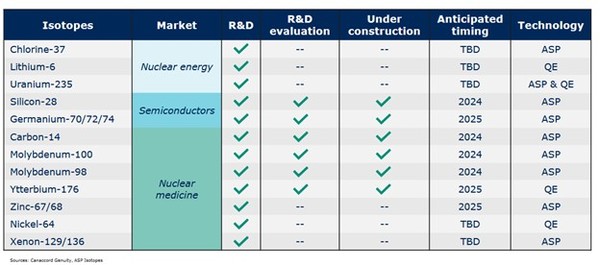

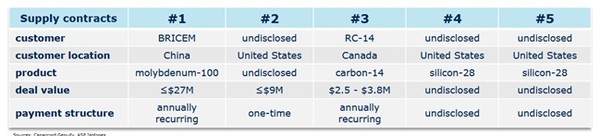

Source: Zeo Energy Corp Investor Presentation

Source: Zeo Energy Corp Investor Presentation