If it’s a raging bull market, where EVERYTHING is going up—sometimes it doesn’t pay to think too hard about an investment idea.

Case and point is ASP Isotopes (ASPI – NASDAQ). There are reasons to be wary of this stock (I’ll list off a few shortly). But while I can quibble on the details, I still bought a small position in the stock based on five big points.

- ASPI has a technology that may make small modular nuclear reactors (SMRs) more attainable here in the West (now a big dependence on Russia)

- That technology recently took a step in the right direction (this press release)

- Nuclear is HOT

a)Uranium is HOT

- The stock has a large short interest

- This is market where story stocks can win

This would be one of those stocks. There aren’t a lot of numbers here. And with this stock chart—from $3-$5 in a couple weeks on the biggest volume the stock has ever seen—it can create FOMO.

QUICK FACTS

Trading Symbols: ASPI

Share Price Today: $4.50

Shares Outstanding: 68.4 million

Market Capitalization: $325 million

Net Debt: $3 million

Enterprise Value: $328 million

QUICK BACKGROUND:

WHAT’S THEIR TECH?

ASPI has a technology for enriching isotopes. Sounds complicated? It is. But if we dumb it down it really comes down to a few simple ideas.

First, what’s an isotope is? An isotope is a particular state of an atom. Atoms have several different isotopes depending on the number of neutrons surrounding the atoms protons.

The carbon atom for example, can have 6, 7 or 8 neutrons. Isotopes are named after the number of protons and neutrons, for example 6-neutron carbon is carbon-12.

Even though isotopes of the same atom are chemically the same, other properties can differ. The biggest difference being that some isotopes decay (they emit radiation, which is good for nuclear medicine and energy) and some are stable.

ASPI uses a couple processes to change an isotope of atoms into another, more desirable (read: profitable) one. This can be VERY lucrative. While the ASPI tech has worked on light molecules (early in the Periodic Table), it has recently worked on a heavy one—Ytterbium-176.

That has management and investors excited that maybe they can produce Uranium-235 at a very small fraction of traditional process costs. That’s why the stock is running up. When I say small fraction, I mean $10 million capex vs. $3.5 billion, as I’ll explain below.

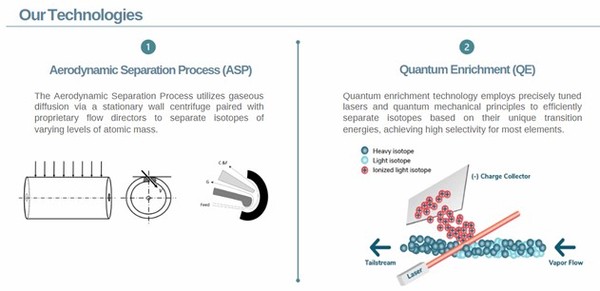

ASPI operates with two technologies: aerodynamic separation process (ASP) and quantum enrichment (QE).

Source: ASPI Investor Presentation

I’m not going to spend a lot of time describing how these processes work. If you are interested after reading this, you can look it up.

I’m going to repeat this; it’s important–what you need to know for investing in ASPI is that:

- The process works, especially with lighter atoms

- The QE process works on Ytterbium-176 – a much heavier atom then any others tried so far (the 176 is the “weight” of the atom)

- That bodes well for the enrichment of uranium – U-235 – which is an even heavier atom

ASPI CAN DO MUCH…BUT…

IT’S REALLY ALL ABOUT URANIUM

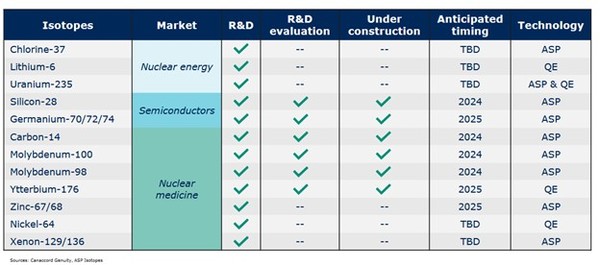

Outside of uranium, ASPI does some work that is mostly related to nuclear medicine.

Source: ASPI Investor Presentation

ASPI expects to start commercial production of Silicon-28, Carbon-14, Molybdenum-98 and Molybdenum-100 this year. They have commissioned two isotope enrichment plants in Pretoria, South Africa.

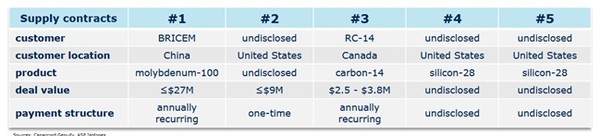

ASPI actually has 5 supply contracts announced for the first four of these isotopes.

Source: Canaccord Genuity

And…the Street doesn’t really care about this. The size/scale of these opportunities is unclear.

The stock got moving with their Ytterbium-176 enrichment—it means they could be producing it next year in what would be their third enrichment facility.

Between these deals and the Ytterbium-176 enrichment, Canadian brokerage firm Canaccord estimates that 2025 revenue will be around $32M.

Before you get excited, remember that ASPI is a $300M+ market cap stock today. 10x Price-to-Sales sounds steep!

Which is why ASPI isn’t a story about these plants as much as about what they might build in the future – for uranium for nuclear power to fuel all the electricity needed for AI—Artificial Intelligence. Three memes, one FOMO stock.

HOW ASP HOPES TO MAKE SUPER CHEAP URANIUM

The Sprott Uranium Mining ETF (URM – NASDAQ) has been on fire since bottoming in early September.

Source: Stockcharts.com

This happened as Microsoft (MSFT – NASDAQ) signed the largest ever power purchase agreement with Constellation Energy (CEG – NYSE) to restore one of the Three Mile Island nuclear units.

Source: Constellation Energy

This news tied the fate of nuclear energy to datacenters and more specifically, to the needs of AI.

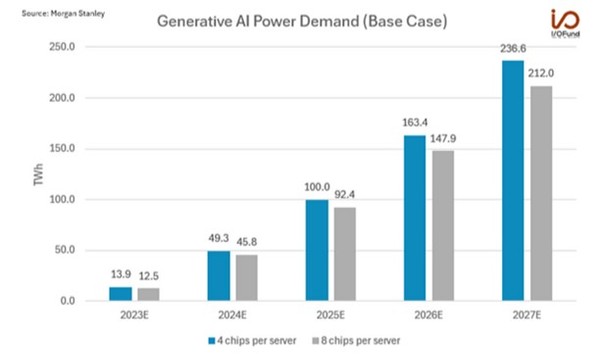

AI consumes a massive amount of power and that is expected to increase A LOT in the next few years. Morgan Stanley expects that to reach over 200 TWh in 2027.

Source: Forbes.com

By comparison, US power consumption is about 4,000 TWh. That means AI demand alone will be over 5% of the demand from the entire United States in just a few years. And it will only grow from there.

As we look further out, AI will demand more power and, unlike homes and businesses, need it 24/7. That means that intermittent power sources like wind and solar are no Bueno.

The obvious solution is nuclear. For years nuclear has been on the outside looking in. AI could be the “trojan horse” that kickstarts new nuclear development.

A number of companies, including one we wrote about called NuScale Power (SMR – NASDAQ) (our writeup is here) are proposing a new smaller scale reactor design (called a small modular reactor or SMR) that can be built more quickly and with less regulation.

But SMR’s require a particular enriched uranium – called high-assay low-enriched uranium (HALEU) – to operate. Conventional nuclear reactors operate on low-enriched uranium (LEU).

In an effort to be more efficient, have longer refueling cycles and maintain a compact core design, SMR’s are designed to use the more densely enriched HALEU fuel.

Sourcing HALEU is a problem yet to be solved. In an attempt to create supply, the DOE recently announced contract awards to produce HALEU , which could be worth up to $2.7B if they are successful, to 4 companies.

Each will be looking to produce HALEU through the traditional method that employs a centrifuge and requires a large amount of capital. We are talking about extremely expensive equipment – Canaccord estimates that building a large centrifuge-based enrichment plant is as much as $3.5B.

As such, the anticipated cost of producing HALEU vs. LEU is estimated at 5x higher.

Where ASPI comes in is if they can produce HALEU with their technology, their costs will be MUCH lower. ASPI estimates that one of their QE plants will cost just ~$10M – that’s million, versus the billions that a centrifuge requires.

The big question here is the “if”. You will note that most of the atoms that ASPI is targeting are relatively light. Carbon-14, Silicon-28, even Molybdenum-100. In their 10-K, ASPI says:

ASP operates very efficiently at molecular masses below 100 atomic mass units, unlike other separation processes which are more efficient higher masses, which ASP can achieve equally well or to a superior degree.

Uranium-235, the naturally occurring uranium isotope, is much heavier than 100.

So the ASP process is not ideal for uranium. Which is where ASPI’s second process, QE or quantum enrichment, comes in.

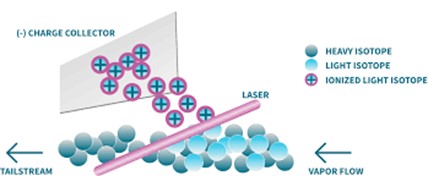

QE is a process that uses lasers to separate (or enrich) the heavier isotopes from the lighter isotopes.

Source: ASPI

The recent news that ASPI was successful in using QE to enrich another heavy molecule, Ytterbium-176, bodes well for uranium.

WHAT ABOUT SILEX AS COMPETITOR?

ASPI is not the only company that is trying to enrich uranium with lasers. Silex Systems (SLX – ASX) is a pioneer in laser enrichment. This is another company we have written about in the past (here).

Silex is working closely with Global Laser Enrichment (GLE), a joint venture between Silex and Cameco, a major Canadian uranium producer. GLE aims to commercialize the SILEX technology for uranium enrichment in the United States.

Silex has proven that their enrichment works at demonstration scale, but it’s unproven at the commercial level.

ASPI’s twist on the process is that they use quantum mechanics to tune the laser and identify the isotopes to hit with it. But how exactly it differs from what Silex is doing is not something I have been able to understand.

What I can say is that the fundamental difference appears to be how APSI deals with a solid material that is vaporized within the process, as opposed to starting with a gaseous form of the atoms, which is required by both Silex and by the centrifuges.

This removal of steps (gasifying the uranium) should work in ASPI’s favor.

I will also point out that Silex says that the SILEX technology is “the only third-generation laser-based uranium enrichment technology known to be in the advanced stages of commercial development today”. Which seems to be at odds with ASPI.

KNOW WHAT YOU OWN!

I STILL HAVE LOTS OF QUESTIONS

Which brings us to reasons to be wary. There are several of them:

- How ASPI bought the technology so cheaply (according to their filings, in 2022 ASPI paid about $400K to Klydon for the license to the technology, and Klydon had spent 20+ years on it before that!)?

- How much weight we should put on the fact that CEO Paul Mann was the former CFO of PolarityTE – a stock that had its share of controversy, including accusations of fraud from Citron and an eventual bankruptcy. Mann did come in after the fraud accusations, so why doesn’t Mann include this experience on his Linkedin profile?

- Why an officer and chief scientific advisor appear to have exchanged 3M shares of their common stock in return for direct ownership in the subsidiary that will be making the medical isotopes?

On top of that, it is VERY hard to understand the product. How their quantum enrichment process works, especially how it differs from Silex (which has been working on quantum enrichment for several decades and now appears to be behind ASPI in their efforts?) is something I tried to figure out, but quite honestly can’t.

Part of that answer could be that if ASPI has discovered a secret sauce, they certainly aren’t going to give us the recipe. But regardless, as an investor you must be okay investing in a somewhat fuzzy picture.

There is also the fact that SMR’s are just a twinkle in our eye. Apart from maybe one that has been built in Russia (I think?), they are YEARS away from operating at scale.

None of this means that ASPI can’t eventually be a successful business. These are all just questions to consider.

What is important is to recognize that for the moment, the stock is moving on the hype.

Which is what this market is about right now.

You gotta know what you own. In a uranium bull market like this, I think the stock is going higher. But I own it because of the market we are in, not because of a fundamental reason about the business.

I’m not going to gloss over it – there are unanswered questions here. I’m just not sure any of them matter for a trade like this.

Keith Schaefer