- Size – the bigger the better

- Simplicity – one big deposit

- A stock under 50 cents

Find me a big open pit with millions of ounces, just under the surface, and I will show you a project that has real potential to be a winner. Ideally in North America.

The gold market now has enough life in it–$2600/oz and counting!!–that development stocks with these BIG ounces in the ground are moving.

So pay attention to the 1.54M ounce Au Indicated and 5.20M ounce Au Inferred Moss deposit in Ontario, a 30 minute drive off the Trans Canada Highway—owned 100% by GoldShore Resources – GSHR-TSXv / GSHRF-OTC.

This big, blue-blood gold asset was almost completely forgotten by the market—leaving lots of leverage.

This large, forgotten deposit recently attracted resource entrepreneur Brian Paes-Braga, giving this company and this stock a revitalized energy that is just starting to play out.

Goldshore has spent over $65 million on the deposit with 235,000 total meters of drilling completed by all owners to make this a BIG gold asset. I LOVE the fact that the heavy lifting has been done here. As I’ll outline below, a little bit of extra drilling can mean a lot of value.

Brian and his new technical team only have to drill enough meters to bring that 5.2 million ounce inferred resource—in Ontario into the much more highly valued M&I category—Measured and Indicated.

In my experience, Inferred ounces are worth $10-$20 per ounce in the ground. Measured and Indicated are worth $50 per ounce or more. And this deposit is in Ontario–think Red Lake in northern Ontario. And then Equinox just paid almost $1 billion for just 40% of the 5 million ounce Greenstone mine in Ontario.

At Goldshore, a lot of the heavy lifting has been done—235,000 meters of drilling and initial metallurgical work!!! Now this blue-blood asset has the SPONSORSHIP to make it a success.

I think it’s one of the best set-ups I see in the global gold market—and it’s happening NOW, under our noses, as Brian’s technical team comes out with more news TODAY–a new drill program that would test five targets in and around Moss’s conceptual BIG PIT–that could quickly add a lot of near-surface ounces.

With gold at this price, that’s a lot of value. And the Market has not even prescribed GoldShore much value for the 5.2M ounces of inferred and 1.54M ounces of indicated already delineated–it trades at one of the lowest values of its peer group…..

FOUR BIG CATALYSTS COMING

There are FOUR big catalysts I really like here that will add a lot of value quickly (I mean, aside from the rising price of gold…).

- Sponsorship—Brian Paes Braga (BPB)

- Potential resource expansion near surface within the top 200 meters

- Moss is only 3.6 kilometers of the 35+ kilometer mineralized trend–NEW DISCOVERY POTENTIAL

- G Mining who did Greenstone/Equinox Feasibility study is on the PEA

From a new resource study done only a few months ago, Goldshore’s Moss deposit has a whopping 5.20 M oz of gold in the “inferred” category. Inferred ounces don’t get valued as highly as the other 1.54 M “Indicated” ounces. This is all backed up by 235,000 metres of drilling.

To me, the essence of the investor story for Goldshore is–the value gap between Inferred and M&I ounces is BIG–and easy for Goldshore after that amount of drilling. 5 M oz of inferred gives this stock HUGE leverage IMHO (In My Humble Opinion).

GSHR’s Moss deposit is 100 km west of a big resource hub—Thunder Bay, Ontario. It’s close to very cheap power ($0.08/KwH) and a 30 min drive off Hwy 11; the Trans-Canada Highway.

With 94% of the resource known to be in mineralized bands, the exploration risk to take this Inferred 5.2 M oz into the much more highly valued Indicated category is low. That makes closing the valuation gap with peers easier—just more infill drilling through well known geology. Low-risk/high-reward.

- SPONSORSHIP

The MOST-under appreciated factor in junior resource stocks by retail investors is SPONSORSHIP. Who has enough stock to work hard and smart enough to get the Market to care about this investment.

I didn’t buy GSHR when it was first pitched to me three years ago, despite a fabulous board of directors.

Everybody at the board level owned stock—good stuff—but in equal amounts. Nobody was the OBVIOUS driver.

SAF Group, led by Brian Paes Braga, is now driving this bus. In my opinion Paes-Braga is one of the top new resource entrepreneurs in the world right now. After striking it big in the last cycle, he has been patient and prudent, buying large positions in several big assets trading at cycle-low valuations—and Goldshore stands out.

In November 2023, Paes-Braga and other principals at SAF Group led a CA$3.75 million financing in Goldshore.

Then they bought a big chunk of a 19 million share block in a private transaction.

Then they recently exercised a large number of their warrants super early, — 37.5 million in total were exercised, which added CA$4.9 million to the company’s kitty.

Leadership/Sponsorship matters—a lot. The Street KNOWS Brian will never quit, and has the personal wealth and network to make it happen. He refreshed the technical team, attracting CEO Michael Henrichson, who was part of several gold discoveries while he was in senior management at Newmont for many years.

All together, the board, management and strategic investors have a 41% stake.

- MORE GOLD–Near-term potential for resource expansion in and around their conceptual open pit.

Just at the edges of the Moss Deposit are FOUR well defined targets that could add A LOT of near surface resource expansion to the deposit.

There are multiple High Priority targets adjacent to the open pit that have the potential to extend the Moss deposit.

So there is a lot of low-hanging fruit at Moss—and it now has the technical team and finance team to move it forward FAST.

Source: Goldshore Investor Presentation

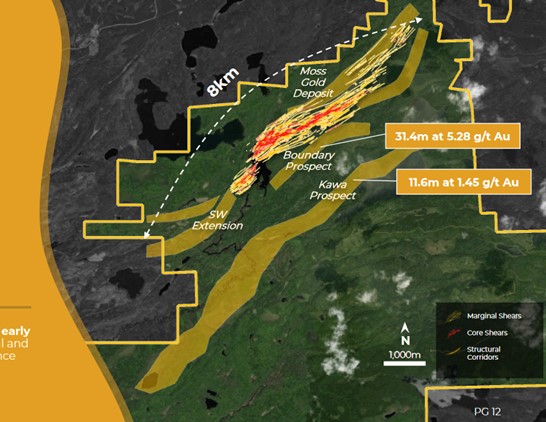

But this deposit has the potential to get expanded EVERYWHERE—it is open at depth, and along strike….see this map:

3. BLUE SKY POTENTIAL FOR A BRAND NEW DISCOVERY

The current resource that Moss has is only 3.6 km of a much larger 35 km mineralized trend across the entire property. GSHR has only drilled 4km of the immediate 8km Moss corridor—so LOTS of exploration potential left.

4. BIG GOLD BUYOUTS ARE HAPPENING NOW

Equinox (EQX-NYSE/TSX) recently paid C$995 million to buy out Orion’s 40% interest in the Greenstone Gold Mine, giving the project an in situ value of just under C$3.5 billion.

The Greenstone Gold Mine started being built in Q4 2021. By Q2 2024, the company poured its first gold.

Greenstone will be one of Canada’s largest open-pit mines, producing almost 400,000 ounces of gold every year for the first five years of its nearly 15-year mine life.

Another gold buyout—worth BBBBBILLIONS in cold hard CASH– Gold Fields made headlines with its August 2024 announcement of a C$2.16 billion acquisition of Osisko Mining, which sold for a 55% premium.

Osisko’s Windfall Project, a large, high-grade deposit, was a prime target for Gold Fields, shows there is BIG appetite for large, high-quality gold projects in Tier 1 jurisdictions like Canada.

Goldshore has hired G Mining Services, the consultant that completed the 2021 feasibility study for Greenstone, to complete the PEA–Preliminary Economic Assessment–on the Moss Gold Project.

This will be a VERY detailed PEA, with an optimized and staged mine plan and processing strategy, and infrastructure layout.

(The staged mine plan is SUPER important, because that’s what will keep the initial cost of building the mine LOW compared to other multi-million ounce deposits.)

Look, what Goldshore has found so far is an incredible Large Scale deposit. Moss holds together with mineralized widths of up to 60 – 200 meters, mineralized continuity down to 500 meters vertical depth—and is still open at depth!

CONCLUSION–FILLING THE VALUE GAP STARTS TODAY

Over many years, first Wesdome and now Goldshore has already found over 5.2M ounces inferred and 1.54M ounces indicated of gold–in Canada–by drilling 235,000 metres. The hard work is done. The Big Value Gap between Inferred and M&I will be bridged by just–simply–more drilling. They know the deposit and the geology. Today’s news of more drilling will go a long way to crossing this bridge.

That value gap is why Brian Paes Braga is here as a large shareholder, driving the bus. He knows the leverage here in a good gold market–which is getting better every week right now!!!

Brian knows what he’s doing. He bought into a big asset with a low valuation at just the right time.

Current comp tables show that if they can convert their 5 MILLION OUNCES OF INFERRED GOLD to M&I—the value of those ounces could increase A LOT.

Finding more ounces will, of course, drive even more value – potentially much more.

There are a lot of targets adjacent to The One Big Pit. There are a lot of targets along the rest of the cumulative 23 km trend. There are a lot of targets at depth.

Generally speaking, the more ounces you have, the higher the value per ounce. So every new ounce of gold has the potential for greater impact to valuation.

This is where I like to get involved in a story. Heavy lifting done. Big deposit found. Incremental drilling/spending has the potential to drive big value increase. Highly visible sponsorship.

With today’s news, Goldshore will start bridging a BIG value gap. I’m crossing with them. I’m long–so consider me biased. But I think I laid it all out here quite easy for you to understand. With gold at $2600 and rising, this timing is perfect.

Goldshore has reviewed and sponsored this article. Peter Flindell, PGeo, MAusIMM, MAIG, Vice-President, Exploration, of the Company, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project; the timing and release of assay results; timing and release of a PEA; the expectation that the development of Goldshore will be successful; and other statements that are not historical facts.

Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this press release, including that the exploration and development of the Moss Gold Project will be as expected by the Company’s management; the timing and release of assay results will be as expected by management; timing and release of a PEA will be as expected by management; the development of the Company will be successful.

These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important risks that may cause actual results to vary, include, without limitation, the risk that the exploration and development of the Moss Gold Project not be expected by the Company’s management or will be completed at all; the timing and release of assay results not be as expected by the Company’s management or will not be completed at all; timing and release of a PEA will not be as expected by the Company’s management or will not be completed at all; the development of the Company will not be successful.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws.

PAID ADVERTISEMENT. This communication is a paid advertisement for Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) (the “Company”) to enhance public awareness of the Company, its products, its industry and as a potential investment opportunity. Investing Whisperer, and their owners, managers, employees, and assigns were paid by the Company to create, produce and distribute this advertisement. This compensation should be viewed as a major conflict with Investing Whisperer’s ability to be unbiased.

This communication is not intended as, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Company purport to provide a complete analysis of the Company or its financial position. The Company is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Company’s SEDAR+ and/or other government filings. Investing in securities is speculative and carries a high degree of risk.

No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.