There is a growing niche in small cap stocks—ones with GOOD FINANCIAL NUMBERS are finally being rewarded with higher stock prices.

Q2 reporting just ended, and the winners in my portfolio had big improvements. I outline the numbers below. And the stocks responded!

For the last half of 2021, all of 2022 and 10/12ths of 2023 (end of October)—small cap land was a desert for investors.

But then last November—which coincided with the peak in interest rates—micro-cap / small cap stocks have been perking up. They haven’t all been winners, but here is the Q2 update on my best 6 stocks, all of which saw financials improve A LOT.

- California Nano (CNO-TSXv) $0.15 – high of $1.15 (666%) since September

- MYOMO (MYO-NASD) $0.80 – high of $5.60 (600%) since November

- Delcath (DCTH-NASD) $2.25 – $11.75 (422%) since November

- Bewhere (BEW-TSXv) $0.18 – high of $0.77 (327%) since November

- Simply Solventless (HASH-TSXv) from its 15 cent IPO in Jan – high of $0.60 (300%)

- Itafos (IFOS-TSXv/MCNB-NASD) $1.30 – $1.60 (23%) since November

Every stock except Itafos had a big revenue jump—Itafos just cleaned up its balance sheet to basically have no debt—it has paid off almost $200 M in debt since I bought it 3 years ago.

I see ALL these stocks continuing to head higher in the next 12 months. I’m putting the original full report on the free section of my website—www.investingwhisperer.com (Example – you can find Simply Solventless report HERE.)

Let’s dive in:

MYOMO – LET THE RAMP BEGIN!

I’ve written before in the blog about Myomo (MYO – NASDAQ) –they make a unique myoelectric arm brace that basically reads your mind to help you get better fine motor function in arms wrist and hands.

MYO preannounced Q2 in early July. At that time, they estimated revenue of between $7.2M to $7.4M for the quarter, which was a 90% jump over Q1. A month later they reported earnings and the number was even higher – $7.5M! All these number were WAY, WAY above estimates of $6.5M.

The stock popped on the pre-release in July but came back down to earth and consolidated at $4.

Source: Stockcharts.com

But that chart is turning up again, which may be the Street anticipating another bump up in revenue in Q3.

Estimates for next quarter are $9.3M, another big step up.

Now I don’t know how much credit the Street will give Myomo before it has a few quarters of trend under its belt. The stock is moving up like there are believers, but we will see. We may need a few more datapoints before the stock really takes off.

In Q2, even though Myomo saw a big increase in revenue, their EBITDA improvement was only $100K. Operating cash flow was actually worse YoY as they build out their expansion (150 new workers).

Patient pipelines adds were also only up a bit over Q1. And investors were a bit surprised that some Medicare Advantage insurers were still balking at insuring the MyoPro device.

None of this is cause for concern. Myomo is ramping product, deploying more salespeople, doing all the thing that they need to grow. The sales process of bringing on Medicare patients is going to take time.

So this move we saw the last couple days is GREAT – but don’t be surprised if the market needs more time. It doesn’t mean the stock is stuck. It just means that we need some patience.

The real juice here is in the O&P market—Orthotics and Prosthetics. There are over 10,000 clinics in the US, and their patient base has just recently had an injury or health issue that has reduced their arm mobility—those people want to get back to full mobility FAST. As they announce the successful rollout of O&P clinics adopting the MyoPro brace, the stock should gain more life.

BEWHERE BEW-TSXv / BEWFF-PINK

– HOW MUCH CAN WE PRICE IN?

BeWhere (BEW – TSXv) tracks low cost items via low-power and 5G—making them unique. This is a new pick and I like it A LOT…lots of potential that management is now realizing. Orders are getting bigger. Their distribution channels are working.

They put together exactly the quarter I was looking for. Revenue growth. Bottomline growth. Another big jump in recurring fees.

The stock popped and kept going, reaching as high as 77c.

Source: Stockcharts.com

Over the past few sessions BeWhere has backed off to 67c. This is still above where it was pre-earnings and I look at this as a normal consolidation.

At this point, what is going to determine the stock price is what the market is willing to price in. At 70c, BeWhere has a market cap of $61M. Trailing twelve-month revenue is $14M. That puts the stock at 4x P/S – which is not cheap.

A large part of BeWhere’s revenue is still low-margin product sales. That high margin recurring fee revenue was up to $1.66M in Q3 and was $5.8M over the last 4 Q’s, or about 38% of sales.

Overall, the business is a mid-30%’s gross margin business. Those margins will grow as recurring fees grow, but it still caps how much the Street will pay in the short run.

Free-cash flow over the past 12 months has been $2M. 30x FCF – again not cheap, not expensive – probably fair given where the business is going.

In other words, BeWhere isn’t crazy expensive, but it also isn’t dirt cheap. The stock is going to grow into its valuation and the price will grow as each quarter results prove out the business. That will take time.

ITAFOS – DID SOMEONE ACTUALLY CARE ABOUT THIS INCREDIBLE CASH COW?

Itafos (IFOS – TSX/MBCF-NASD) is the opposite story of Bewhere. This is not about growth and pricing in the future. Its about value and pricing in what is right in front of us.

Itafos delivers free cash flow quarter after quarter. The Q2 results were no different. Instead, the surprise was that the market actually bid the stock up a bit on the results!

Source: Stockcharts.com

Itafos had been mired below $1.50 for so long I was beginning to wonder if there was an iceberg order on the ask that would never allow it to break out!

Turns out that the stock can move after all. All it took was adjusted EBITDA of US$32M, EPS of C$0.12 per share and free cash flow of over US$42M (helped by a big influx of working capital)!

Of course, if you only looked at the numbers, not the name, you’d be hard pressed to say this move has stretched valuation. Itafos trades at a market cap of just over C$300M. With trailing twelve-month EBITDA of US$120M+, it pegs at 2x EV/EBITDA and about 2x P/E.

The debt overhang is GONE. Itafos has used their cash to diligently pay down debt each quarter. With $59M of cash and $66M of debt at the end of Q2, they will almost certainly be “net debt free” by this time next quarter.

The big issue with the stock is “what now?”. Itafos remains tightly held by private equity firm Castlelake, who completed a strategic alternatives program and came to the conclusion that they were best leaving things as is. Now we wait and see what the direction is.

SIMPLY SOLVENTLESS HASH-TSXv–

EXECUTION WILL BE THE KEY

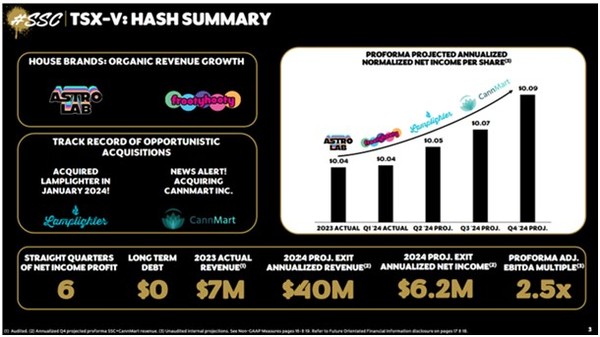

Simply Solventless (HASH – TSXv) has THE BEST operating margins that I have seen in the Cannabis business. In Q2, HASH did $4.2M of revenue and $950k of EBITDA. That works out to 23% EBITDA margin.

These margins are before we see contribution from the recently acquired CannMart and their two brands: Roilty and Zest Cannabis.

With HASH forecasting $40M of revenue and $6.2M of net income for 2024, the stock is priced at under 9x earnings.

Source: Simply Solventless Investor Presentation

That is a reasonable valuation is likely why the stock quickly digested its earnings day gap up and now looks ready to take on new highs.

Source: Stockcharts.com

What we want to see next is execution. Integrate Lamplighter, Roilty, and Zest. Ramp up inventory, reinvigorate the brands and (hopefully) lower cost at the same time.

My only worry with the story is how Canadian pricing plays out. The biggest players in the Canadian market (Organigram (OGI – TSX), Cronos (CRO – TSX) and Tilray (TLRY – TSX) have the lowest margins.

This is topsy-turvy to just about every other business. It signifies one thing to me – price wars.

If you look at the balance sheets of the big players, they are STACKED WITH CASH. If I was running Cronos for example (which has $800M of cash in the bank), I would look at all the struggling competitors and think about squeezing them out of business but cutting prices and taking short-term losses for long-term gains.

HASH is not struggling (there are plenty of other small cannabis names trading at penny stock levels), but if a nasty price war does ensue, they wouldn’t be immune.

But we’ll see. HASH could also be the beneficiary, buying up cheap brands out of bankruptcy. How management integrates these acquisitions and takes advantage of opportunity is going to determine a lot.

DELCATH – ON ITS WAY TO $15+

The second quarter results coming out of Delcath were EXACTLY what I wanted to see. And while it took a few weeks for the market to figure it out, it was clearly what the market wanted as well.

Source: Stockcharts.com

The company did $7M+ of revenue in Q2. They will be operating in 12 centers by Q3 and 20 centers by Q4. If they get to 20 that should be an east $25M per quarter run rate sometime in 2025.

If you run through the math Delcath should pull out an earnings run rate north of 80c per share on a fully diluted share base by 2025 (I’m assuming all the warrants and stock options are converted into shares – those $6 warrants are way in the money here). Which should translate into a stock price of $15+.

Of course, things are just getting started. Delcath’s pipeline of opportunities is significant, and we will see that begin to play out in 2025 as well.

We have ALREADY seen quite the move in Delcath the last few sessions and the stock is probably due for a breather. We may see a period of consolidation to get those cheap warrants cleaned out.

But after that happens, I think there is more to go to the upside with this one.

Editors Note: My top pick is releasing its next quarterly within days–and I’m sure it’s going to be great. To get THAT update–and all the ones from these 6 stocks–CLICK HERE (66% dicount)

Keith Schaefer