Oil Field Services (OFS) stocks can’t get a break. This is now one of the most profitable sectors in the economy—with the lowest valuations!

For a brief time, it looked like Donald Trump would cakewalk into the White House, and the OBVIOUS Trump Trade—is OFS stocks (not producers—because it would be back to Drill Baby Drill!)

Then Biden quit, Kamala took over and has surged in the polls—so now we won’t know who the next US president is until well into election night.

And folks this time it really is different—OFS sector has been gutted with a decade of low oil prices, and had to cut a lot of fat. Add in the new mantra of return of capital over growth and hey, why are these stocks all SO cheap.

Again, like I wrote last week, the place to be in this sector is in Canada, not the USA. The Canadian OFS sector is gushing dividends now

IS IT DIFFERENT THIS TIME?

The biggest beef against the OFS sector is that these companies always find a way to fritter away their cash.

Years of oil cycles have left investors (like me) more than a little skeptical. Usually, an OFS cycle looks something like this:

- Oil prices rise.

- Oil drilling booms.

- OFS companies put up big numbers.

- OFS companies spend BIG on capex, refreshing their equipment and trying to gain share.

- Oil prices fall and OFS investors are left wondering where the money all went.

Could it be different this time? It just might be.

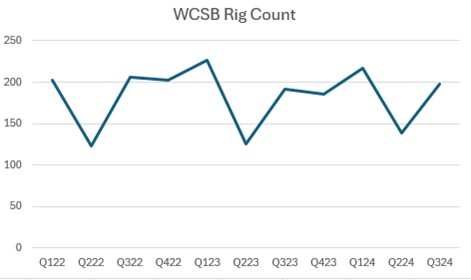

Today’s rig count is less tied to the price of oil than in the past. We simply aren’t seeing the big swings in drilling that we used to. Since 2020 there has been a noticeable decline in volatility.

Source: Pason Investor Presentation

At the same time, the OFS sector is no longer its free-wheeling spendthrift self. Stifel estimates that the OFS sector is now spending 30-60% of cash flow on capex.

This is WAY down from the old days. These same companies used to overspend like drunken sailors – at times there was as much as 170% of cash flow going to CAPEX – meaning the sector was taking on HUGE debt.

Priorities have changed. The OFS mantra is no longer about taking share or demonstrating growth. Capex is spent to maintain the fleet and keep the customers happy. Excess cash is for shareholders.

Take Precision Drilling (PDS – TSX). Their #1 and #2 focus (at the very front of their presentation) is free cash flow generation and returning cash to shareholders.

Source: Precision Drilling Investor Presentation

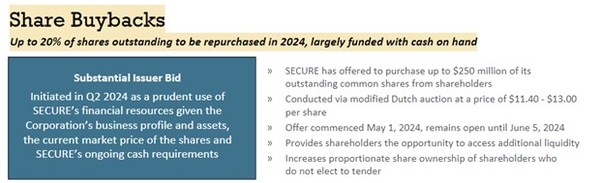

One of the best and most recent examples of returning cash to shareholders is Secure Energy Services (SES – TSX).

In April, Secure repurchased 4.8% of their outstanding shares from their large shareholder, TPG Angelo Gordon. They followed this up with a substantial issuer bid that repurchased another 40M shares.

In total, Secure has bought back nearly 18% of their outstanding shares since the beginning of the year!! Their plan has been to buy back up to 20% of shares by year-end. They also pay a 3%+ dividend!

Source: Secure Energy Services Investor Presentation

While Secure has been the most aggressive, the same could be said for many OFS names. Trican Well Services (TCN – TSX) has bought back 4.9% of shares since the beginning of the year while paying close to 4% dividend. Both STEP Energy Services (STEP – TSX) and Precision Drilling (PDS – TSX) have bought back 2.6%.

THE OFS SECTOR AT THE LOWS

With the sector no longer spending on (over)capacity, EBITDA through the cycle has become much less volatile. OFS are still a commodity, just not such a volatile one.

Yet while EBITDA for the sector has become more stable, you’d never know it from the multiples the market assigns.

The sector trades at multi-decade low valuations.

Stifel pegs the current average multiple at just 3.4x EV/EBITDA. Using Peters estimates, the average FCF yield on their OFS universe is 16% based on 2025 estimates!

That includes some bigger players in the sector. Precision Drilling trades 21% FCF yield, while STEP Energy Services trades at an extremely cheap 26% FCF yield based on their expected 2024 estimates.

To put that in perspective, a 26% FCF yield is the same as saying that STEP would recoup its market capitalization with the free cash it generates in just 4 YEARS!

IS IT BETTER UP NORTH?

Trump may about to be the President of the United States, but as far as his influence on the oil market, his reach is global.

Trump is equal opportunist – wherever the oil is coming from is fine with him, as long as more of it comes out of the ground.

That puts the Canadian OFS at a distinct advantage.

Canada has the advantage of trading in a far depreciated currency compared to their southern counterparts. Even if Trump is successful in capping the price of oil, the oil price in Canadian dollars is going to be MUCH higher.

At the same time, OFS pricing in Canada is better today than the US.

Canada has already had its OFS Alamo, with the over supply of rigs and pressure pumping capacity that plagued Canada through the teens having long since left the region – much of it for what was hoped to be greener pastures in the US Permian. What is left is experiencing less competition and better pricing.

Meanwhile the drilling continues. The western Canada sedimentary basin (WCSB) rig count has been remarkably stable for the last two years.

Source: Rig Locator

On the other hand, in the US, the rig count has seen more of a decline and is now solidly below the 5-year average.

Nowhere has the outperformance of Canada been more obvious than with STEP Energy Services (STEP – TSX), who has a foot on both sides of the border.

STEP’s Canadian division saw operating days increase 20% YoY in Q1 while their EBITDA margins jumped from 26% to 30% – indicating better profitability. Meanwhile their US division was just flat to slightly down. STEP is extremely cheap, trading at just 2x their forecasted 2025 EBITDA.

Pure play Trican Well Services (TCW – TSX) is Canada’s largest pressure pumper, with a focus almost entirely on the WCSB. Trican has experienced only slight price declines, but they have been more than offset by cost declines and increased volume.

At $5, Trican trades at just 3.7x their consensus 2025 EBITDA estimate.

Canada’s largest driller, Precision Drilling (PDS – TSX) preannounced a strong Q2 with significant free cash flow. Precision paid down $100M of debt in the quarter. Precision Drilling trades at only 3.8x their 2025 EV/EBITDA estimate.

WHEN TO TAKE THE PLUNGE

The broader OFS index, the Oil Services Index (OSX), is treading water – ti is off the lows but still has not pierced the highs of even a few months ago.

Source: Stockcharts.com

The best performers over the last 6-9 months have been names like Secure that have focused on share buybacks and dividends and seen their stock appreciate commensurately.

Source: Stockcharts.com

The trend towards rewarding those that reward shareholders make names like Stampede Drilling (SDI – TSX) look interesting. This small driller has just restarted their share buybacks in June, having bought back 2.6M shares or 2% of outstanding shares during the month.

With a market capitalization of $48M and an enterprise value of $72M, the company looks reasonably priced based on expectations they will do $22M-$23M of EBITDA this year. Their full year FCF in 2023 was $7M.

For those investors more interested in dividends, PHX Energy Services (PHX – TSX) is worth a look.

PHX is the largest independent supplier of directional drilling services in North America. This is a technology company, providing their proprietary drills and motors that other OFS firms can’t offer. Their operations are split between the United States and Canada

PHX had $1.29 of earnings per share in 2023. Even with lower rig counts in the US this year, estimates are for them to do around $1 EPS this year. PHX pays a 20c quarterly dividend, which gives a yield of just under 8% at the current stock price.

While I have highlighted a bunch of names in this piece, the BROADER point is that if you believe the current OFS market dynamic is sustainable, pretty much all of these stocks are EXTREMELY REASONABLE.

Of course, the “sustainable” will always be the big question when it comes to this group.

Oil is not going away anytime soon, regardless of who wins the US election. But if the world does get 4 more years of Trump in office, the mantra will be Drill Baby Drill!

Keith Schaefer