Stock ideas can come from just about anywhere. Your barber. Your father-in-law. Some random guy on the street.

You can’t be too picky about the source. But do the work yourself.

I say this because some of you may pause at where I got the idea for Rezolute Bio (RZLT – NASDAQ).

Martin Shkreli.

While Martin Shkreli has had his share of bad press and issues, you can’t deny that the guy knows his Biotech companies.

Shkreli does a livestream pretty much every day on YouTube. It is an odd format where he basically sits at his computer and does research on biotech stocks in real-time.

This may sound incredibly boring to some of you. And you wouldn’t be wrong. But taking the time to scan his stream can turn up some nuggets.

In December Shkreli dug into Rezolute. I’m not going to say he recommended it; all he said is that he liked it. I don’t know if he owns it today or not. But he made me want to keep an eye on the stock. I added it to my list, waiting for a pullback.

Today, we are having that pullback. The stock has broken down from a range of $4-$5 to a current level of just above $3.

Now I don’t want to catch a falling knife. In fact, I am NOT going to buy this stock yet.

There is a good reason for that, and I will get to the why shortly.

Once we get past that reason the combination of solid looking trial results and a stock that is falling for non-fundamental reasons (which may reverse in a few weeks) will make it worth a longer look.

Rezolute is a late-stage rare disease company targeting hypoglycemia caused by hyperinsulinism.

This is a two-drug company but only one of those drugs matters.

Their lead candidate is ersodetug (formerly known as RZ358). The story here is about what ersodetug can do.

Ersodetug is a monoclonal antibody. Monoclonal antibodies attach themselves to specific receptors on a cell (VERY specific receptors, ie. why the are called monoclonal antibodies).

Monoclonal antibodies can be very useful if you find one that attaches to a receptor that changes what that cell does in a positive way.

Ersodetug attaches itself to insulin receptors. By doing so it slows down the secretion of insulin. With that comes an increase in glucose (sugar) in the body.

Source: Rezolute Investor Presentation

If all this sounds familiar, it is because I’ve written about another drug that does this too.

Last summer I wrote about a stock called Amylyx (AMLX – NASDAQ). They have a drug called Avexitide, which also regulates insulin. In fact, part of the reason I made note of Rezolute is because I knew the space from Amylyx.

However, Rezolute is a different story than Amylyx.

Amylyx was about a stock that was too cheap. At the time the stock had a market cap of $140M and cash at $370M!

That meant you could have locked the doors and given every shareholder twice what the shares were worth (its not quite that easy, but you get the idea).

Anyway, it turned out well. Amylyx peaked at $7 per share a few months later.

As for Rezolute, this is not a net cash story. Yet Rezolute is cheap (IMO), just in a different way.

While Amylyx has a ton of cash and a drug (Avexitide) with a chance, Rezolute has enough cash to see the story through and a drug that has a really good chance of success.

THE TARGET: CONGENITAL HYPERINSULINISM

Rezolute has another overlap with Amylyx. The disease they are targeting.

While the primary target for Amylyx was Post-bariatric Hypoglycemia, they also had plans to go after at congenital hyperinsulinism (cHI).

Source: Amylyx Investor Presentation

In fact, their drug Avexitide had already seen results in cHI that looked pretty good.

At the time I wondered why Amylyx was targeting PBH first, instead of cHI, which seemed like the better market.

I think I know why. Avexitide’s results in cHI aren’t as good as what Rezolute has been able to achieve with ersodetug.

More on that later. First, a brief primer on cHI.

cHI is a rare disease that impacts children. Rezolute estimates the unmet need at 1,500 individuals. About 130 patients are diagnosed in the US each year.

These kids have a problem with their insulin secretion pathway. They produce too much insulin and don’t have enough glucose.

As a result, they have chronically and dangerously low blood-sugar.

Over time this causes all sorts of issues. The brain depends on a steady flow of glucose. Not getting it causes seizures, developmental delays, learning disabilities, and even permanent brain damage.

As awful as this sounds, there are no approved therapies for cHI.

Without a true targeted therapy, physicians fall back on a less-than-ideal standard of care, called Diazoxide, which has problems.

First, Diazoxide doesn’t work for all patients. Less than half the patients with cHI respond to Diazoxide.

Second, one in ten of those that do respond have side effects that are so severe they are still forced to discontinue treatment.

Finally, if Diazoxide doesn’t work, the alternative is surgery.

There is clearly an opportunity here for a drug that works well. Which ersodetug seems to do.

A PROMISING PHASE II TRIAL

Rezolute completed their Phase 2b study, called RIZE, in August 2022.

This was a trial of 23 patients, 6.5 yrs old. Thes kids spent close to 20% of the time in hypoglycemia with 13 events per week.

Evaluating the efficacy of a drug in cHI is straightforward. You look at how glucose levels are trending and, most importantly, how many times and how long glucose levels drop dangerously low.

With ersodetug, the impact was significant.

Source: Rezolute Investor Presentation

The number of hypoglycemic events declined by 74% versus baseline. The number of severe hypoglycemic events (blood sugar dropping really, REALLY, low) dropped by 89%.

Below is the abstract from the study. I highlighted relevant passages.

Source: European Society for Pediatric Endocrinology

To cherry-pick a few patients, Rezolute points to a 2-year-old and 6-year-old who both had debilitating hypoglycemia before ersodetug and were incident free in the two weeks after.

Source: Rezolute Investor Presentation

The takeaway: the drug seems to work.

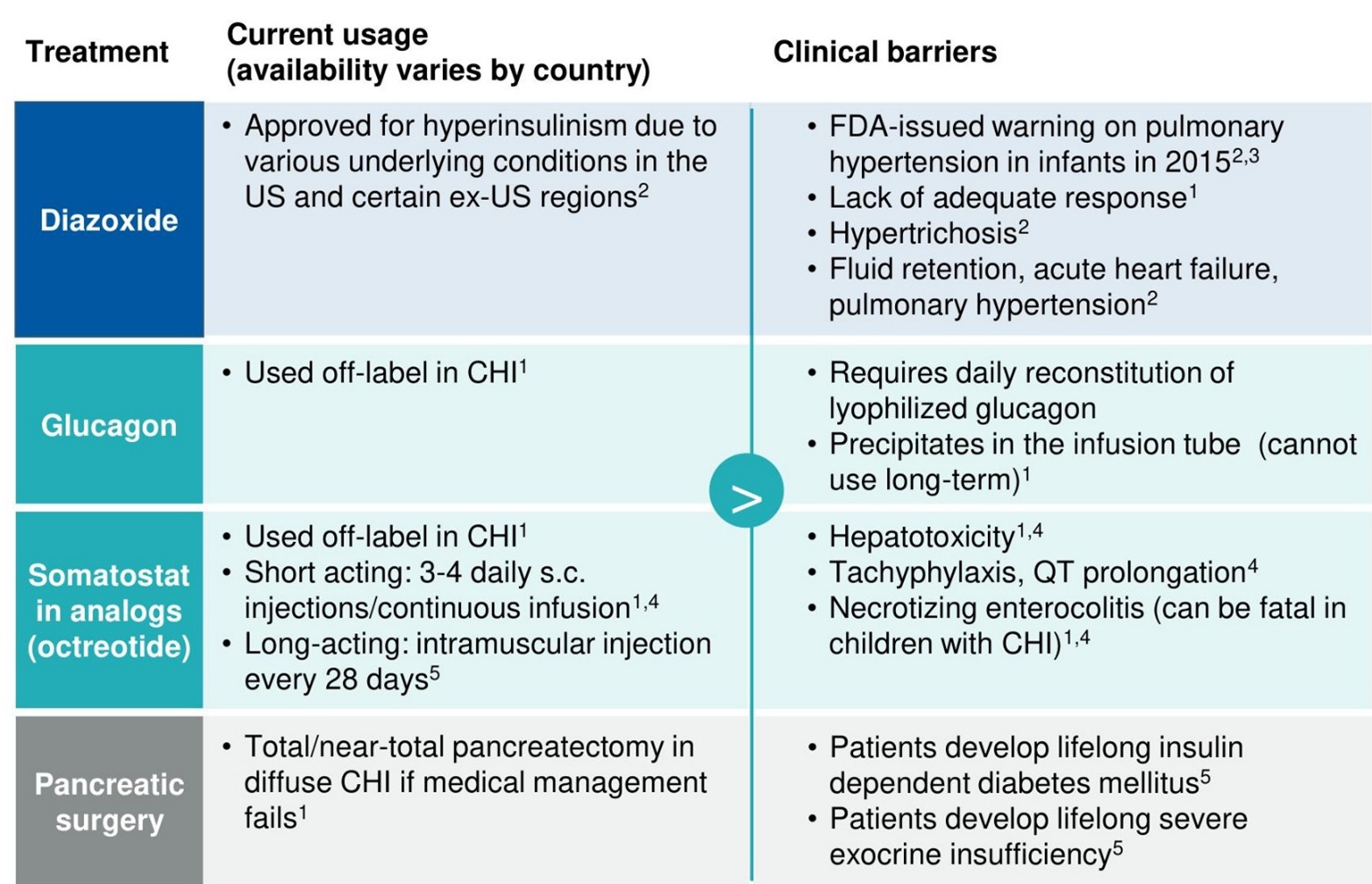

NOT A LOT OF OPTIONS

Okay, we have a drug that seems to work. But what’s the competition?

Unfortunately for the kids, cHI doesn’t have a lot of options right now.

Below is a table from a competitor that describes the options. They either don’t work, are off-label, have bad side-effects, or a combination:

Source: Zealand Pharma Investor Presentation

As for what’s in development, Zealand Pharma is developing a drug called Dasiglucagon. This is what Dasiglucagon did in their Ph3 trial:

Source: Zealand Pharmaceuticals

The drug also works. Events per week went from ~40 to maybe 20-25. They say it was a 37-40% decline in events and a littler less than 50% decline by time in a hypoglycemic state.

These results are good, but they are not as good as ersodetug.

Dasiglucagon is also only targeting Diffuse CHI, a sub-type of the disease. Diffuse cHI is 700-800 patients, with the rest of the patients being Focal cHI, which is 400-500 patients.

Next let’s compare ersodetug to the Amylyx drug, Avexitide.

This was the study summary of the small Avexitide Ph2. First, a summary of those results.

Source: Diabetes Care

At first glance, it looks like Avexitide also reduces hypoglycemic events significantly. But not so fast.

First, this trial used a protein tolerance test, whereas Rezolute was looking a real-world induced symptoms. Second, the improvement didn’t occur in severe events, which makes you wonder why?

Source: Diabetes Care

When you look at the underlying Avexitide glucose data, it doesn’t look amazing. The drug does something, but its not making a huge difference.

Source: Diabetes Care

Finally, when you look at (A) the baseline is barely getting below 4 mmol/L which is 70 mg/dL. These kids aren’t hypoglycemic in the first place whereas the patients in the RZ358 study definitely were.

Avexitide is also an infusion which isn’t ideal for kids.

Taking all this in, it just seems to me that ersodetug is the better drug compared to both Avexitide and to Dasiglucagon and better than the standard-of-care. I don’t see any other drugs in development that are passed pre-clinical.

Which makes me feel pretty good about the prospects IF ersodetug can repeat these results in a Phase 3 trial.

NEXT STEPS

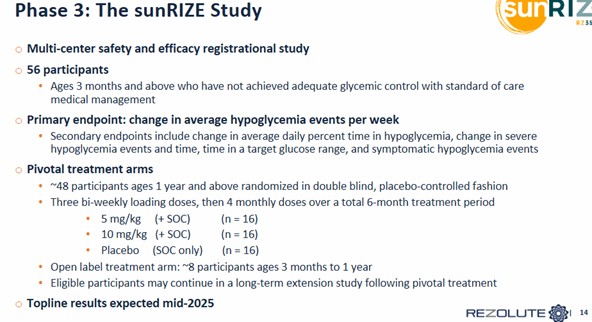

Ersodetug is now fully enrolled for its Phase 3 study, called sunRIZE.

The study is evaluating the safety and efficacy of ersodetug in participants who are unable to achieve control of low blood sugars (“hypoglycemia” [<70 mg/dL])

This is a 24-week study. Will look at two things:

1. Hypoglycemia events using self-monitored blood glucose (“SMBG”)

2. Time in hypoglycemia using continuous glucose monitoring (“CGM”)

Source: Rezolute Investor Presentation

There will be 56 participants. Rezolute is breaking the patients out into a 5mg dose and a 10mg dose (the Ph2 was 6mg and 9mg).

This study reads out in the second half. But IMPORTANTLY: there is an interim analysis that is happening in days. More on that shortly.

A SECOND TARGET: TUMOR HI

There is a second target for ersodetug, but because its readout is after cHI, and the stock is going to be a whole different thing depending on how cHI goes. I will just touch on it only briefly.

Rezolute is targeting Tumor HI. Some tumor types can lead to excessive insulin production, which in turn brings on hypoglycemia.

The current treatment for Tumor HI are:

A. tumor-directed de-bulking (chemo, surgery)

B. Diazoxide and glucocorticoids to treat the hypoglycemia.

C. Both

The problem is that Diazoxide (this is the same drug that is standard of care for cHI) doesn’t always work. There are cases where the tumor is causing HI by creating a non-insulin substance (Diazoxide works by stopping insulin production so if that’s not the problem, the drug doesn’t do much).

Rezolute estimates that there are 6,000 patients that are suffering from Tumor HI. At least 1,500 of these are immediately addressable because they aren’t responding to the existing treatment.

Source: Rezolute Investor Presentation

Source: Rezolute Investor Presentation

One interesting point about Tumor HI, and the reason I’m spending time on it at all, is that ersodetug is already used in the clinic by doctors that are out of options (called compassionate care).

It is anecdotal, but what they found was:

• Substantial hypoglycemia improvement

• No significant side effects

• They could discharge patients from in-patient to out-patient care

What this is suggesting is straightforward: the drug works.

Rezolute announced an IND for a Ph3 trial in Tumor HI in August. They plan to enroll in H125 and complete the trial in H126.

As for competition, just like cHI, there isn’t a lot. The existing option is Diazoxide or surgery and I don’t see any evidence that another company has a drug in development that is targeting Tumor HI.

FINANCING AND VALUATION

Rezolute has 60M shares outstanding. There are also 15M pre-funded warrants. These were issued from 2021 to 2024. By the end of Q4 ~5M of these warrants were exercised.

That means all-in we are talking ~70M shares. At $3.50 the market cap is $245M.

Cash at the end of Q4 was ~$105M. Their cash burn was $30M in 2024 and $24M in 2023.

They do have a licensing agreement with XOMA, which gives them the rights to develop ersodetug. They entered into the agreement in December 2017.

Under this agreement they made a milestone payment of $2M Jan 2022. They also made a $5M milestone payment when those dosed their first Phase 3 patient in Apr 2024.

Total additional milestone payments would amount to $30M for development. Once ersodetug is commercialized, they will pay royalties to XOMA and there are $185M of sales related milestone payments.

BUT WAIT – NO, REALLY, I MEAN WAIT

HC Wainwright estimates ersodetug could generate about $1.4B of revenue by 2031. They are by far the most bullish analyst.

Cantor is a bit less optimistic. They use probability adjusted revenue and estimate $390M in 2031.

Wedbush only takes their forecast out to 2030. They see $215M of revenue from cHI and another $42M from tHI.

Finally, Canaccord estimates $215M of revenue from CHI in 2032 and $130M from tHI.

You get the picture. While not a blockbuster, this could be a profitable drug.

Because cHI is a rare disease Rezolute received rare pediatric disease designation for the drug. They will receive a Rare Pediatric Disease Priority Review Voucher if the drug is approved for cHI, which can be used to fasttrack another drug.

These vouchers are often sold upfront for cash. Past sales have been worth $100M-$125M.

Sounds great, right? So, what am I waiting for?

Up until February, the catalysts were straightforward.

Source: Wedbush

But on February 4th Rezolute announced that a Data Monitoring Committee had reviewed the Ph3 data and evaluated the safety of ersodetug.

The good news was that there were no adverse safety concerns.

But at the same time, Rezolute also announced that there would be an interim analysis at the end of Q1.

An interim analysis is not uncommon. It is intended to optimize the study. There are 3 outcomes: you leave the study the same, you increase the number of participants, or you determine the study is not worth completing and end it (called futility).

I REALLY doubt that futility is going to be the result. Most likely the study continues as is.

But as an investor, there is no upside to being long into this event. When the options are status quo or something worse, you are best to sit it out.

Which is what I think is weighing on the stock.

Source: Stockcharts.com

If you go on the message boards, there are conspiracies that the data is leaked and that is why Rezolute is down.

I don’t buy that. What I do believe is that investors don’t see any upside to buying the stock right now. Thus, they wait.

A lack of buying is all you need to push down a micro-cap.

What am I going to do? Nothing. For now.

I plan to wait until the interim analysis comes out. If its not futility, and especially if its status quo (not needing to add patients), then I’m going to give a real long look to adding Rezolute to my portfolio.

Rezolute will get topline data in the second half of 2025. If the data is good, approval is next, the ~$100M voucher is in the bag.

All that that should drive the stock higher.

But that will be then. This is now. And now is the time to be patient.