Most of the stocks I writ about are sub $100 million market capitalization, because this is where the market is most inefficient. You can find deals; value that is not 100% recognized in the stock price.

But you don’t always have to bottom fish in the smallest names to find value – especially when the market is having a BIG-TIME dislocation, like right now.

There are larger stocks that have nothing to do with tariffs that have gotten hit hard. Especially biotech stocks, where up until the last few days, the S&P Biotech ETF (XBI-NYSE) had been shellacked to multi-year lows.

Source: Stockcharts.com

I have found a few stocks that I think were hit too hard. One was Akero Therapeutics (AKRO – NASDAQ), which is NOT a microcap. Here’s a company with GREAT data, and a HUGE market with an unmet need; nobody else supplies a perfect treatment–for late stage liver disease.

Akero says they can not only treat liver disease better than everyone else, they say they can actually REVERSE it. WOW! At $42, it’s trading below it’s $48/share financing price, and well below it’s high of $60 in January when some really good data came out.

For a pre-revenue company, this is a big market cap stock, with a $2.75B capitalization. But this stock is still having big moves–and fast. Such is biotech! Bargains are lost and found in more times than it takes to write about them, and I’ve been looking at Akero for a few weeks.

Source: Stockcharts.com

Given the frenetic nature of this market, I thought there could be another big dip. I thought that might happen when Trump announced his most-favored-nation legislation for biotechs the other day, but it looks like this may turn out to be positive for biotech names, raising drug prices outside of the US.

With that said, what do I like about Akero? Data, data, data. With biotech stocks its always about data. Day-to-day these stocks move like a yo-yo and the only way you hold tight is if you know the data is sound.

The data here? Akero’s drug, called efruxifermin (EFX) has very good data. Some of the best. A few gotchas but nothing that makes me pause too long. I’ll get into it shortly.

The second thing I like about Akero? The market that EFX is targeting is BLOCKBUSTER BIG.

MASH – A BLOCKBUSTER MARKET

There are a couple long names and acronyms here. Bear with me, I’m going to give the definitions because you need them to understand the charts and tables to come.

Let’s start with the very long-name of the disease EFX is treating: Metabolic dysfunction-associated steatohepatitis, or MASH.

MASH goes by the more common name: fatty liver disease. If it gets serious, it can lead to extremely serious consequences like liver fibrosis (which is scarring of the liver), cirrhosis, liver cancer, and cardiovascular disease.

The pre-cursor to MASH is fat building up in the liver (the medical term is hepatic steatosis). At this point there is no liver damage or inflammation, usually no symptoms at all.

The build up of fat in the liver is called Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD). It occurs for any number of reasons: obesity, insulin resistance, type 2 diabetes, and high cholesterol – these are all conditions that are very prevalent.

MASLD leads to MASH. If the fat builds up too much, for too long, you get inflammation and scarring of the liver. Which is MASH.

With that short crash course into the terminology of liver disease, you can better understand some of the numbers I’m going to throw out.

A lot of people have a fatty liver to one degree or another. And I mean A LOT.

The number of people suffering from some degree of MASLD is huge. The Global Burden of Disease (GBD) Study in 2021 reported that 1.27 BILLION people suffer from MASLD!

Of that about 5% have progressed to MASH – 300 million people worldwide. This comes from the American Liver Foundation.

Madrigal Pharmaceuticals (MDGL – NASDAQ) says there at 1.5 million people in the US diagnosed with MASH.

It’s a BIG patient population. And one that is not all that well served with drugs on the market.

NOT A LOT OF OPTIONS

Madrigal has the only approved drug for MASH, called Rezdiffra. Rezdiffra was just approved in March of this year.

Rezdiffra did $180M of sales in the last 9 months of 2024. It ended the year at a $400M run rate.

Source: Madrigal Pharmaceuticals Investor Presentation

Consensus has Rezdiffra reaching $800M of revenue in 2025.

It’s a big market and Rezdiffra is growing fast. Which is largely priced into Madrigal’s share price.

Madrigal has a market cap of $9B. Even though there are some legitimate concerns about the future of Rezdiffra.

Akero is under $3B. Yes, EFX is still in trials, only just enrolling in Ph3. Yet every indication so far is that EFX works better than Rezdiffra. Which means it should take significant share of the market if (when?) it is approved.

That is the story in a nutshell.

IT COMES DOWN TO THE DATA

The data here consists of two Phase 2B trials completed by Akero, one called SYMMETRY and the other called HARMONY.

That big gap up in the stock chart in early January was when Akero released topline results of SYMMETRY. The results were good.

There are 4 stages of liver disease. Stage 2 and Stage 3 are where things are getting serious, there is some scar tissue in the liver (called fibrosis) but the liver still works.

By the time you get to Stage-4, you have what is called cirrhosis, and physicians are thinking liver transplants.

Cirrhosis is when the normal liver tissue is mostly replaced by scar tissue. The liver becomes hard, nodular, and most importantly, stops functioning properly.

SYMMETRY looked at patients with stage-4 fibrosis due to MASH.

It was a 96-week trial. At the end of 96 weeks the state of the patients liver were evaluated by biopsy. There was a placebo arm, a low dose EFX arm, and a high dose EFX arm.

Of 134 patients, 39% on the high dose had a reversal of cirrhosis and no worsening of MASH compared to 15% for placebo.

Source: Akero Investor Presentation

That’s the first number to remember. 39% improved versus 15% on placebo.

The second number is that 55-59% of these patients saw resolution of their MASH. That’s a big deal. Resolution means that the inflammation and “ballooning” of the liver reversed enough that the physician declared it to be gone.

Source: Akero Investor Presentation

This is a big deal.

When you get to stage-4 liver disease, it is thought to be irreversible. At a recent UBS conference analyst Eliana Merle said the perception is that these patients “are too far gone. They’re hard to treat.”

Akero’s results are saying, we can not only treat it, but we can also reverse it.

Source: Akero Investor Presentation

Their second trial, HARMONY, was with patients in less dire condition. These patients had stage 2-3 fibrosis, called “pre-cirrhotic”.

Again there were 3 cohorts: placebo, 28mg EFX and 50mg EFX.

At 96-weeks 75% of patients taking the 50mg dose saw >=1 stage improvement in their fibrosis, 46% for the lower dose and 24% for the placebo.

Source: Akero Investor Presentation

HARMONY patients also saw a significant percent of their MASH condition resolving.

Source: Akero Investor Presentation

LOOKING AT IT HEAD-TO-HEAD

How do these results compare to Rezdiffra? Very well. Very, very well.

Rezdiffra was approved based on >= 1 stage fibrosis improvement and NASH resolution. Madrigal ran a Phase 3 trial called MAESTRO to get the results.

Before we go further, let me clarify NASH vs MASH because the name change is confusing. NASH was renamed MASH a couple years ago. Physicians decided to remove the distinction of whether the liver damage was due to drinking or not (the “N” in NASH is non-alcoholic).

I could spend a page explaining the details of the name change, but for our purposes we can simplify it to: NASH is MASH.

Like the Akero trials, results came from biopsy, which were done at 52-weeks. The participants in the trial were similar in age and medical history. If anything, the SYMMETRY trial patients had more diabetes, more hypertension, more stain use and more GLP-1 use.

Yet the results from SYMMETRY were better.

Source: Madrigal MAESTRO Study Presentation

The takeaway? Akero’s EFX works A LOT better.

WHAT ARE THE NEGATIVES

On efficacy alone, if Akero can repeat these results in Ph3, the drug is a no brainer and going to dominate.

But nothing is ever that easy.

The first complicating factor is that EFX is an injectable. It is a weekly injection, similar to GLP-1s like Ozempic and Zepbound.

Rezdiffra is a once-a-day tablet.

Second, the Phase 2 studies for EFX showed some reductions in bone density in patients, especially at the higher 50mg dose.

Source: Akero Investor Presentation

This isn’t all that different than GLP-1s, where the weight loss also coincided with similar bone density reductions as EFX.

But bone density changes are a concern, especially for elderly patients. Rezdiffra saw no change in bone density during the studies.

Third, the GLP-1’s are competition.

In November of last year Novo Nordisk (NVO – NYSE) reported results of their Ph3 ESSENCE trial where their GLP-1, semaglutide, targeted MASH.

Novo reported on the first 72-weeks of this 240-week trial. 37.0% of patients on 2.4 mg semaglutide achieved improvement in liver fibrosis. This compared to 22.5% on placebo.

These results are pretty good. They are comparable to Rezdiffra. But they are not as good as EFX.

The likely reason is that GLP-1s are only working indirectly on the liver. The liver impact is because people are eating less.

I don’t want to get too into the weeds, but EFX is an analog of a hormone called FGF21. FGF21 is primarily produced by the liver, and it protects against cell stress and regulates metabolism of lipids, carbs, and proteins in the liver (and elsewhere).

The GLP-1 is not directly helping liver function. It’s just improving eating habits, which helps the liver as a side effect.

Apart from efficacy, we know that the discontinuation rate for GLP-1s is high. The dose that Novo Nordisk used (2.4mg) has discontinuation rates from 15% to 45% in the first year. That is not great for a long-term therapy.

Still, the competitive risk from GLP-1s is there. A GLP-1 will be “good enough” in some cases. Being such a well known drug, physicians will lean toward prescribing them first.

BEST FOR THE WORST

These are all valid negatives, and they may (or may not) limit the uptake of EFX if it is approved.

But to me they all are less important than the simple fact that EFX is the only drug that has shown real improvement in late-stage liver disease.

The FDA has granted both Fast Track designation and Breakthrough Therapy designation for EFX for the treatment of MASH.

The European Medicines Agency, or EMA, has granted a Priority Medicines, or PRIME for the treatment of MASH.

These designations get the FDA and EMA involved with the approval process, guaranteeing quicker meetings and faster reviews.

There is also the potential for accelerated approval, which could allow Akero to submit a new drug application sometime next year.

This seems to be a likely path. Rezdiffra was approved in 2024 based on accelerated approval using the results of a 52-week biopsy.

Akero has broken up their Ph3 program into a longer- study that will read out in 5+ years with a shorter 52-week biopsy that would be used for accelerated approval.

Source: Akero Investor Presentation

I understand that 2027 seems like a long-time, but that’s the drug business folks, and it’s a lot better than 5 years.

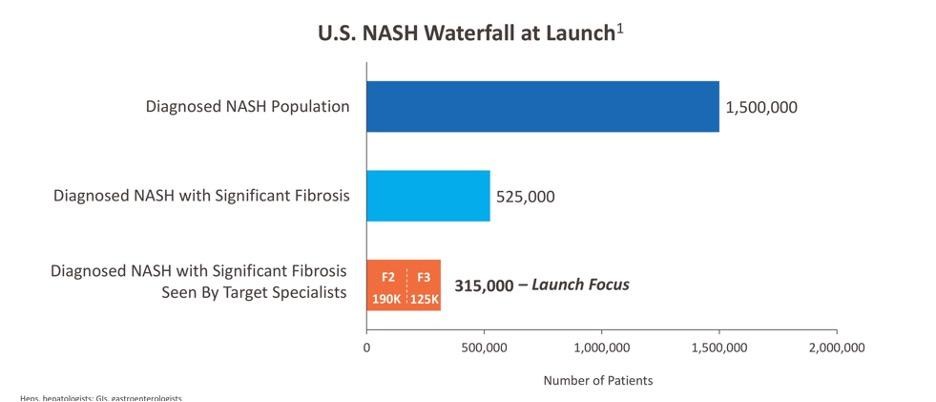

If EFX is successful, even just considering the sickest patients, the candidate pool for EFX is large. Madrigal has provided a good indication of how big it might be:

Source: Madrigal January 2024 Investor Presentation

Looking at what this could mean for revenue, the list price for Rezdiffra is $47,000 per year. If we assume that Akero prices EFX at a similar level, capturing even 10% of the sickest of the MASH market would mean a $2B drug, or a blockbuster.

I’d say that if EFX can show the same level of efficacy in their Ph3 trials, a 10% market capture is likely very conservative.

After the positive SYMMETRY results, Akero raised $378M via a private placement with Jefferies at $48 per share. That gives them a cash position of more than $1.1B, which should be more than enough to get them through their phase 3 trials (they burned $230M last year).

The stock is now $42, but was close to $60 in January after reporting the results of the SYMMETRY study–and they raised institutional money at $48.

Unfortunately, the stock was also only a hair above $30 a week and a bit ago.

While its reasonable to expect Akero to (at least) get back to its highs in the next 12 months, I also would not be surprised if the tariff-man causes it to also retouch those lows before that happens.

Plan accordingly!