Zefiro Methane (ZEFI –CBOE Canada) has an approved method to monetize methane reduction, or abatement, in North America that could generate high-margin cash flows for investors.

Headed up by a proven team of ex-JP Morgan executives—Talal Debs, Catherine Flax and Tina Reine—Zefiro just had their first batch of methane abatement credits approved by the American Carbon Registry (ACR), one of the three leading registries worldwide.

Zefiro has purchased majority interests in two operating subsidiaries which did over US$35 million in methane abatement and environmental remediation in fiscal 2023.

Doing that work is bread and butter profitable. But the market numbers around Zefiro’s model have the potential to be a lot bigger.

There are millions of sites that require environmental remediation in the USA—historically, there could be more than 5,000,000.

The US government recognizes this, which is why The Infrastructure Investment and Jobs Act allocated US$4.7 billion for environmental remediation and restoration activities, in 2022. Many states have received grants via The United States Department of the Interior.

Zefiro has already won state contracts for methane abatement in Pennsylvania. Pennsylvania’s Department of Environmental Protection has documented more than 25,000 opportunities for environmental remediation.

Zefiro operations manager explaining methane measurement equipment

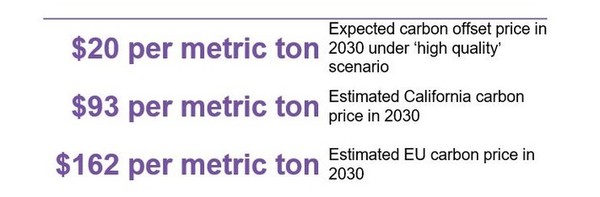

Zefiro estimates that they can sell their credits up to $20 per tonne. Taking the upside of 50,000 credits per for methane abatement at $20 per credit and using the relatively small number of 25,000 opportunities in Pennsylvania gives a potential addressable market of $25B for Pennsylvania alone.

As you work your way across the United States, the numbers become astronomical.

Again, I’m not saying that Zefiro will get the contract for methane abatement across the USA, but this market is just SO LARGE that Zefiro should have years of work ahead of them.

Each site needing remediation leaks 78 cubic meters of methane a year – that is almost 300,000 tonnes of methane into the atmosphere.

That is a health risk and an environmental risk. It is a huge climate change risk. Methane is 25 to 84x more potent as carbon dioxide at trapping heat in the atmosphere.

Environmental remediation doesn’t come cheap. Estimates to remediate methane in this one sector in the US is between $400B and $600B! (https://carbontracker.org/reports/billion-dollar-orphans/)

This market could be so lucrative, I couldn’t figure out why there wasn’t a pure play on US methane abatement. It’s because the economics for a pure-play, methane abatement stock just didn’t add up – until now.

Today methane abatement is viewed as another way of reducing the carbon equivalent tonnes in the atmosphere. Those carbon equivalent tonnes have a price–which can add up to big $$$’s for the company doing the abatement.

For Zefiro, this all adds up to opportunity.

Each site can generate between 5,000 to 50,000 tonnes of CO2 equivalent credits.

Zefiro estimates that those credits will fetch $20 per tonne. Which means that each location can generate up to $1 million of carbon credit revenue.

This is high margin revenue. On average, Zefiro estimates $75,000 of expense to remediate each location in the US. That means the unit gross margin on a high methane site can be as high as 90%.

On one level, this is a simple business—accurately monitor the methane at each site, and those ongoing measurements are the basis for a premium-value UN SDG—United Nations Sustainable Development Goal—credit.

But industry has understandably not wanted to measure leaking methane! It doesn’t look good on them! Zefiro will be the first company—and will have the proprietary IP & patents—on measuring/monitoring methane to create comfort among credit buyers.

Zefiro staff measuring methane leaks in real time

There is so much low-hanging fruit here it’s almost hard to grasp. How has nobody tried to accumulate thousands or tens of thousands of sites needing remediation? There are millions in the US.

It’s because they didn’t know how to monetize them. That’s what the Zefiro team does: the main principals are ex-JP Morgan carbon market specialists. They have spent the last two years creating the methodology—which has now been accepted—to monetize the methane abatement.

This is genius. Zefiro has the team. They have the business model. And now it’s going to start to roll out.

There are more than 5,000,000 potential sites leaking methane in the United States. Many of these were not properly dealt with at the end of their life. As a consequence, excess methane trickles out into our atmosphere each and every day.

Those margins and the massive size of the market make Zefiro worth a LONG LOOK.

PROPRIETARY IP AND CARBON EXPERTISE

The obvious question is: if the numbers are this good, won’t the competition catch on?

You can’t just go out and get credit the next day for reducing methane. Obtaining a credit for your service is a process:

- Identifying sites that are emitting methane

- Have an institutional team to measure and quantify each site

- Get one of the three major carbon registries to accept your methodology

Zefiro has this—they own proprietary technology to reduce long term remediation costs and monetize their success in carbon markets.

Zefiro will be generating voluntary carbon credits. This is, at least for now, an unregulated market that requires a lot of skill to manage.

Zefiro’s team has that. Zefiro will be following a methodology defined by ACR. It is specifically designed to address Zefiro’s business model.

The methodology defines the standards for methane abatement, how many measurements are necessary, when measurements need to happen and the calculations for determining the carbon equivalent tonnes that are abated. There’s A LOT of detail involved, and traditional industry personnel don’t have that training.

OFF TO THE RACES

Zefiro is already engaged with the state governments of the Appalachian states (PA, NY, OH, WV). They have worked through the initial stages of a couple pilots in Pennsylvania and Louisiana.

Zefiro has acquired two companies specializing in methane abatement, and their pipeline of potential projects is now over 500, and growing

Over the medium term, Zefiro is engaging with 4 regions:

- Pennsylvania Department of Environmental Protection

- New York Department of Environmental Conservation

- Ohio Department of Natural Resources

- West Virginia (as of TODAY!)

They estimate there are 45,000 immediate opportunities for methane abatement between all these jurisdictions. This is low hanging fruit, as the public, government and industry want to see environmental remediation—cleaning up after industry—now.

RUNNING THE BUSINESS

Zefiro raised $3.45M in their recent IPO. Management put in $700,000. There is 65.6M shares out.

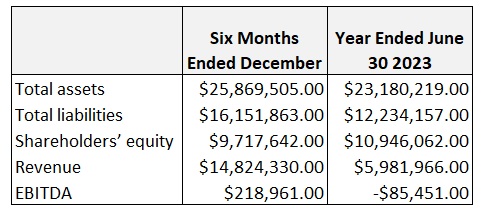

The cash from the IPO will be used to grow their already burgeoning pipeline of opportunity. In the final six months prior to the IPO, Zefiro’s operating sub had revenue of almost $15M.

Source: Zefiro Prospectus

There is a lot of potential for these numbers to be much better moving forward, as under the guidance of Zefiro is now completely different. The profit margin won’t be based on the price of the job, but the price of the credit.

BloombergNEF recently estimated that 2023 showed “record demand” for voluntary credits, above the 2021 all time highs.

Just about everyone believes that prices have to go higher in years to come. Carbon prices of at least $75 per tonne are required by 2030 according to an IMF report put out in 2022.

In their “Global Carbon Market Outlook 2024“, BloombergNEF’s estimated that by 2030 we will see a $93 per tonne price in California and a much higher price in Europe.

Source: BloombergNEF

Zefiro has already presold tens of thousands of emission reduction tons of its methane emissions offset portfolio to Mercuria Energy America LLC.

Zefiro remains an early-stage play. We have yet to see the model in action from start to finish – seeing revenue from the sale of methane abatement credits, let alone at scale.

But this business model has HUGE potential—there are literally millions of historical sites needing environmental remediation. The methane abatement can be easily and constantly measured to create an air-tight credit that is verifiable EVERY SINGLE DAY. This could/should give these credits a premium valuation.

The Zefiro team has a long and successful history in carbon markets. Their operating subs have already started, and their methane abatement methodology is accepted.

Being first to market in such a huge addressable market means Zefiro has a lot of potential. If the company can execute and become a leader in creating voluntary credits, early investors in the stock could quickly be very happy.

Disclosure: I’M LONG ZEFIRO METHANE!

Zefiro Methane has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.