Borealis Mining (BOGO-TSXv) has what every other gold exploration company wishes they had:

- Production–they just announced their SECOND gold pour since going public in September.

They expect to do one pour a month from now until next summer when a more consistent production program will take over. There’s THOUSANDS of historical ounces in a stockpile right now. REVENUE is coming fast!! - Permits—a fully permitted mine in the prolific Walker Lane Trend of NEVADA. They bought the US$70 million Borealis Mine for only US$5.1 million. The stock today has an Enterprise Value of only US$48 million (CAD$60 million)

- High grade gold in both low-cost oxides at surface and sulphides just underneath that—like 67 meters of 16 grams (half an ounce!) gold, 24 meters of 10 g/t Au.

Just this morning, they announced new drill holes that have big distances and big grades–like 2.25 g/t Au over 99 m including 4 g/t Au over 21 m–at the edge of the biggest historical pit. Borealis is already permitted to produce from that new mineralized area!

- A BIG bank account—they raised $16 million ahead of their August 2024 IPO

- A historical resource (non- 43-101 compliant, but from 2011) of 1.8 million ounces that with many more drill holes (funded by production, not new shares) will potentially grow.

They pretty much have it all. And I’m about to explain how it’s going to get even better.

But hey, don’t take my word for it.

Just look at what mining legend Rob McEwen did. McEwen is a legend, the founder of Gold Corp; he put Red Lake mining district in NW Ontario on the map. After hearing the pitch from CEO Kelly Malcolm when Borealis was still a high-risk private company—he bought in, in a BIG way.

The underlying vendor of the Borealis Mine was a top mining private equity firm; one of most savvy and well respected in the world.

Under the go-public scenario, they were to have 16% of the stock. Within two weeks of learning about Borealis, McEwen said he was in only if he could get their whole block—when Borealis was still a long way from being public!

McEwen now owns 16% of the company. And he’s not the only major mine builder & former CEO in this stock.

Director Bob Buchan built Kinross (K-NYSE) into a multi-billion dollar gold producer. Chairman Tony Makuch was at the helm of Kirkland Lake Gold as it went from $4-$64 per share on the strength of Fosterville Mine in Australia (merged with Agnico-Eagle in $11 billion deal).

Management and the blue-blood board and McEwen combined own 30% of the 83 million shares out.

THE NEXT BIG STEP IN VALUE CREATION

Let me back up one step. The Borealis Mine has twice produced gold—from 1981-1990 there was a total of 500,000 oz Au at 2.02 g/t from eight open pit oxide deposits. Then again in 2011-2013 it produced 125,000 oz of gold.

Previous drilling—and there hasn’t been any since 2012—showed the oxide rock can go as deep as 1000 feet. Oxide ore is MUCH CHEAPER to mine than sulphide—it is just crushed and put in a big mound on the ground and the gold is leached out. So having a BIG oxide deposit is GREAT.

But roughly half of the non-compliant 1.8 million ounce resource from 2011 is in the Graben sulfide deposit.

Graben is open in all directions. There are many other targets, in both near surface oxides and deeper sulphide rock that, with some time and money and luck, could develop into a much larger resource. That’s the goal of every single gold company—find more gold!

Every junior gold exploration company wants to get rich by hitting a big juicy drill hole—high grade over long width. Borealis will be going after that as well, and with holes like 115 meters of 4.5 g/t Au and the above mentioned 67 meters of 16 g/t Au (which were at Graben), investors can have high hopes for that.

A NEVADA OXIDE GOLD ROLL-UP

But Borealis is different; it’s special. With a fully permitted mine/ADR facility, it can do something that almost nobody else can–consolidate the really small (but very high margin!!) oxide gold deposits that have low valuations. CEO Kelly Malcolm says these deposits can be valued at $10-$15 per ounce in the ground.

By trucking that (still hypothetical) ore to their 50 acres of permitted leach pads, Borealis can create low-cost, highly profitable gold production that keeps the number of shares out very low.

Very few, if any, exploration companies in the USA have that benefit. I-80 Gold (IAU-TSX) does—in Nevada–and it’s a CAD$500 million market cap.

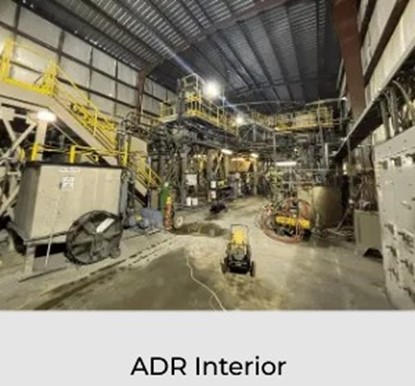

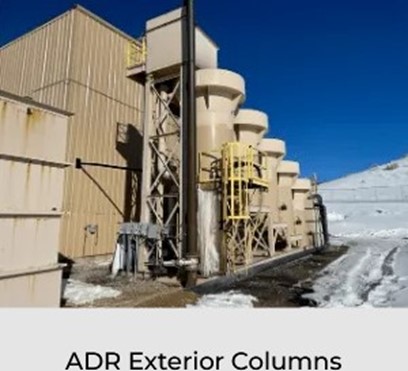

Here’s a couple pictures of the Borealis mining facility:

CEO Kelly Malcolm say they are putting in A LOT of time into their M&A strategy, building a detailed database of potential acquisitions. There’s both private and public targets.

With this much cash, and this backing by some of the biggest legends in the business, I expect Borealis to be very aggressive in adding shareholder value, by both the drill bit and through M&A.

In drilling, the bar for huge success is very low—if they even find a 50,000 oz oxide deposit, it can turn into ore and cash flow VERY quickly. They have a fully permitted mine that is producing right now. And once you are in production, you have so many more financing options available to you—gold loans, straight debt, royalties etc…you are not always at the mercy of equity markets.

THIS GAME IS JUST STARTING

Borealis has only been public for a few months. The Market is just getting introduced to it—its assets, its initial production cadence, and its backers.

With gold at US$2600/oz and the markets convinced that both Kamala and Trump are good for gold…the outlook for the gold price looks…well…pretty darned good.

Borealis is a story that doesn’t have to dilute their shareholders for years, developing assets and waiting for permits while it struggles to find a glory hole.

They bought a US$70 million asset for US$5.1 million. They bought right, and they’re making it pay already—they have done a total of FOUR gold pours since taking over the asset and a FIFTH one is being readied.

They’re in a great spot; they can negotiate from strength up and down the gold market.

They have yet to announce their first transaction, or even their first set of drill results on their current 3500 meter program. Everything…is still out in front of us.

This gold story excites me. It has everything that all the other gold exploration companies want. It has everything I want.

BOREALIS MINING COMPANY LIMITED has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.