Heliostar (HSTR-TSXv / HSTXF-OTC) just made the single most accretive M&A deal I have ever seen in 30 years in the junior gold market.

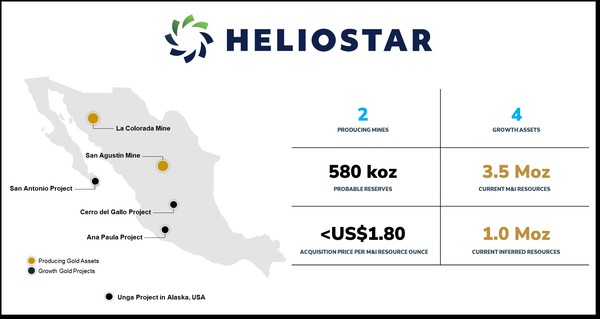

- For a US$5 million payment on close (October) and US$5 M from operating cash flow, they bought several Mexican assets, including two producing mines—La Colorada and San Augustin—from Florida Canyon Gold (a spin-out of Argonaut Gold AR-TSX). NO MONEY UP FRONT!

- These assets should produce 18,500-22,000 oz over the next 6 months, based on Argonauts previous 2024 guidance

- Which will, at forecast US$1700/oz cash cost and US$2400/oz gold–generate US$13-15 million (CAD$18-$20 million) in cash flow for Heliostar shareholders in that time. That’s nearly a 4:1 return on their money in 6 months!

- Give them over 3.5 MILLION OUNCES of gold in current M&I (Measured and Indicated) category and over 6,000,000 oz of M&I when the 2.8 M historic ounces at the Cerro del Gallo asset are included.

- Give them a path to becoming a 150,000 oz producer with minimal capex and permitting requirements—cash flow, debt and forward gold sales are expected to look after ALL staged expansions

Folks, yesterday this company was an exploration company trading at 30 cents. Today I have no idea where the stock is going, but it’s not closing at 30 cents. This kind of deal–in this kind of gold market–is going to attract a lot of INSTITUTIONAL interest.

Heliostar put a down payment of US$10 million for Ana Paula, with US$20 million in future payments. As part of this deal this morning, that $20 million is wiped clean. As of now, they bought this very high grade deposit for only US$10 million.

So now CEO Funk has delivered US$15 M in proforma cash flow and had $20 M in future payments extinguished. We’re at US$35 M in value so far.

Then, Funk was able to get the US$150 million in contingency payments for San Antonio completely wiped out; cancelled. That would have been paid if/when that deposit gets to production. Essentially, they now get San Antonio’s 1.7 M oz Au for FREE.

That’s US$185 million total value for Heliostar shareholders—FOR NO MONEY UP FRONT–and only US$5 million out of Heliostar’s pockets.

“Most major gold companies are pretty happy discovering gold at $50 an ounce, Heliostar buying it for less than $2 per ounce is an incredible deal,” CEO Charles Funk said Tuesday.

WHY DID HELIOSTAR

GET THIS SO CHEAP?

“It’s too small for the big guys and it’s too big for the little guys. And already owning Ana Paula gave us a $20 million headstart on everyone else on why this deal made sense,” Funk added.

“Lastly, the $150 million backend payments come off San Antonio, and the royalty disappears. We effectively get San Antonio for free as part of this transaction.”

The issue for most buyers was—the La Colorada and San Agustin mines are nearing the end of their life, and the industry was worried about closure costs. But Funk and his team see lots of upside at these gold/silver mines—expansion permits would add over 200,000 of gold immediately, plus there is exploration upside. La Colorada could see another 5-10 years of production.

And most importantly, with cash flow NOW, in the coming quarters, these two mines can pay for most of the capital costs for the very profitable Ana Paula deposit.

“We enjoy operating in Mexico. Our expertise and having Ana Paula—made this deal really make sense for us.

What makes Funk REALLY excited is—the staged growth plan, where small, low-cost jumps in production can be paid for by cash flow—meaning little to no equity on the road to 150,000 oz per year with Cerro del Gallo and San Antonio providing BIG down-the-road potential.

“We’ve got this tremendous growth profile that comes with the portfolio that we’re buying. We can grow to 150,000 ounce a year production within the permitted projects.

“And we’ve got a longer term pathway to more than double that within our portfolio, that doesn’t require any M&A risk going forward.

In a perfect world, Funks sees that by 2030 he can deliver annual production of 100,000 oz at Ana Paula and 50,000 oz at La Colorado. Based on Argonaut’s previous economic studies, Cerro del Gallo and San Antonio could add +200,000 oz (if/when permitted).

Funk also sees the path to this big production with little or no equity. He sees getting these mines into production is like tipping over a row of dominoes:

“I see the cashflow from San Agustin as the domino that can tip over/pay for the phase I at Ana Paula, which will tip over the large scale Anna Paula and La Colorado expansion, which can tip over into Cerro del Gallo and then San Antonio.

“So I really think about it as one of those images as a small domino of 15 to 20,000 ounce a year production will ultimately tip the dominoes over to a major gold company.”

In simple terms, the immediate cash flow from San Agustin and La Colorada will provide the “equity” component of a 50,000 oz pa phase I build at Ana Paula.

Cash flow from Ana Paula Phase I will then provide Heliostar with equity to do the life extension at La Colorada and the Phase II expansion at Ana Paula…

…which provide a clear line of sight to 150-200k oz pa of production with no more equity.

ANA PAULA DEPOSIT IS STILL

THE CROWN JEWEL

Ana Paula is a very special asset, halfway between Mexico City and Acapulco in the HIGHLY prolific Guerrero Gold Belt. With permits in place, Funks wants Ana Paula in production in three years—WAY faster than the industry could build & permit a mine in Canada or the USA.

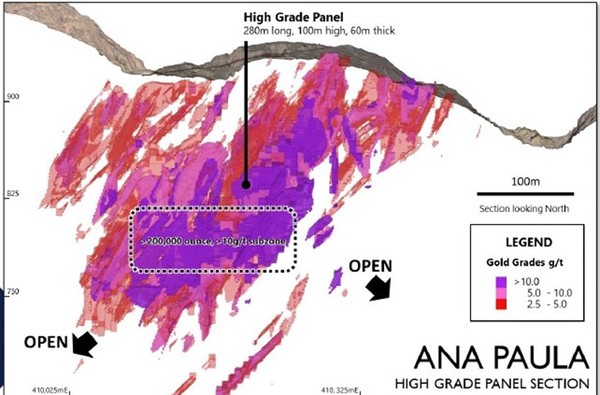

Over US$100 million has been spent to fully permit this for an open pit mine. But Funk and his team are switching to an underground operation to access a large, high grade, near surface “panel” of mineralization.

One drill hole in 2023 hit 209 meters of 9+ grams per tonne gold. So far—with more infill drilling to happen—there is 700,000+ ounces of gold at an average grade of 6.6 g/t, all M&I, and another 447,000 oz inferred ounces at 4.24 g/t.

The Market got very excited at the last round of high grade assays at Ana Paula, and the next round of drilling will start in the coming weeks to months. Investors will like that!

The combination of cash flow from operations with a debt facility will likely pay for most of the capex that will turn Ana Paula into a 50,000 oz per year producer.

Moving to underground mining has so far increased the grade by 30-58%–so these are high grade, fast-payback ounces—and global ounces have actually increased from 1.4 M oz to 1.9 million. The high grade ounces have increased from 865,000 to 1.1 M. The intent of more drilling in both the high-grade panel is to increase those ounces.

A new study in the coming months will show just how lucrative mining this high grade panel section at Ana Paula will be for Heliostar shareholders.

And they now have the cash flow to help fund it. That cash flow also gives them more levers with banks and commodity traders for other forms of non-dilutive capital to turn Heliostar into a fast growing gold producer.

Like WOW–they bought ALL of Ana Paula for just US$10 million. Then they bought the production assets to fund Ana Paula into production for ZERO UP FRONT DOLLARS — US$5 million this fall plus $5 million from operating cash flow.

Funk’s team has worked hard to get in this position:

“I think our first move, our advantage, was that we had the imagination to see the potential of Ana Paula as an underground mine and no one had gone down that pathway before. I think that we are a management team that looks outside the box.

“And then on this deal, we’re the logical owner given the relationship with Argonaut. We were in the right place at the right time.

“So I think the first move was smart. The second move was a bit of good fortune.”

A good fortune is exactly what Heliostar shareholders are thinking about after this morning’s news.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.