Spire Global (SPIR – NASDAQ) gave me, and everyone, a big surprise when they announced their Q1 update on May 15th.

Spire was one of my biggest wins in the last year—broken SPACs like this have been a great source of new investment ideas. We sold the stock for roughly a double earlier in 2024, and have been waiting for a time to get back in. Space stocks had a bid and Spire became a market darling.

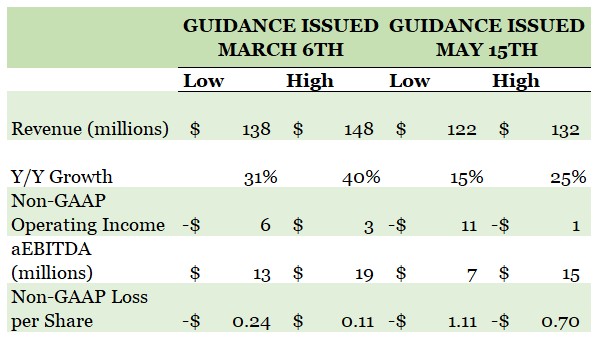

But now the Market is taking its time deciding what to do—this was a BIG miss. Spire reduced their 2024 revenue forecast by 11.2% and reduced their full year adjusted EBITDA by 31%!

Misses happen, but what really surprised everyone is that Spire did all this after issuing the guidance only 9 weeks prior.

Source: Spire Q1 2024 Press Release

The stock dropped from 12 to as low as 8 in the following days.

Source: Stockcharts.com

The BIG question is: what the heck happened? How could this business deteriorate so quickly?

The answer to this question is a little technical but very interesting. It sheds some light on the unknown unknowns of investing and the treacherous landscape that is space.

BURNED BY THE SOLAR CYCLE

Spire’s big miss was related to the solar cycle.

A lot of us hadn’t even heard of a solar cycle before the weekend of May 10th. That’s when we all looked up into the sky to glimpse the amazing Aurora Borealis.

Source: Forbes.com

For a few days, this was BIG news. A large and unusual geomagnetic storm. There were articles about possible grid disruptions and malfunctioning satellites.

You had a storm disrupting satellites. Spire operates satellites. A natural conclusion would be the storm impacted Spire’s business.

But that isn’t quite what happened here. The truth is a little more nuanced.

The May 15th geomagnetic storm occurred during a period of generally increased solar cycle activity. Overall solar activity is at a cycle high. What happened in May was an unusually big burst of it.

Spire’s constellation of satellites are all Low-Earth Orbit satellites (LEO). As the name suggests, these satellites are closer to earth than the older, higher orbit geosynchronous satellites.

Ironically, being closer to earth means that Spire’s LEO constellations are actually less exposed to bursts of radiation like the May geomagnetic storm. Much more impacted are the geosynchronous satellites (which stay above the same place on Earth all the time) that have less protection from Earth’s atmosphere.

But Spire’s LEO satellites are more susceptible to prolonged high solar activity.

Prolonged higher solar activity heats up the upper atmosphere, which increases the density of the air where the LEO satellites orbit. That increases drag, which pulls the satellites out of their orbit faster.

This is exactly what happened to Spire in Q1. While Spire CEO Peter Platzer was a bit cagey in his conference call response, it was clear that their older satellites had de-orbited faster than expected.

Platzer said that “it’s a highly dynamic process where things can move from you have an asset for another six months to you have an asset for another six weeks”.

While I don’t want to overstate the issue – this was only a few older satellites that dropped out the sky earlier than expected, it did put gaps in Spire’s data collection. Spire said it created “not necessarily a volume issue with the data provision, but mostly a latency and quality issue“. Which is directly impacting what they can bill their customers for.

DID SPIRE ROLL THE DICE?

It would be simplifying too much to say this was Spire’s only issue in Q1. A bunch of things went wrong. Spire had newly launched satellites which did not live up to expectations. They also ran into contracts delays because of the impasse in passing the Federal government budget.

But it’s likely that much of the sudden change in full year guidance was tied to the lower expected performance from their constellations.

Conservatism may have played a role as well. After all, this cycle isn’t over yet.

What has also crossed my mind, and what Spire is not going to tell us, is whether this is maybe just a little bit their own fault as well.

While it is easy to blame nature, the truth is that higher solar activity did not happen out of the clear, blue sky. This is a cycle, after all.

That makes me wonder if Spire simply rolled the dice—in part, out of necessity.

Cash has been tight for Spire for months. At the same time, shareholders have been clamouring for the company to show free cash flow.

I have to wonder if Spire decided to take the chance that their older satellites would last through one more cycle, rather than refresh the fleet and risk an already precarious financial position.

As CFO Leonardo Basola said on the call, “A lot of those assets [that deorbited] were fully depreciated, and we anticipated that eventually they would lose orbit soon.”

Maybe they were fingers crossed it wouldn’t happen this soon.

JUST A BUMP IN THE ROAD

The good news is twofold. First, satellites can and will be replaced. Spire said they can get their constellation back up to full without increasing their 2024 capex estimate.

Second, Spire is, for the first time in a long-time, flush with cash. In the intervening period between when Spire issued their original, impressive 2024 guidance and when they ratcheted it back down, they raised a boatload of money.

In late March Spire announced a $30M private placement at $14. This was after a previous $10M placement (at $12) with Signal Ocean in February.

Together Spire has added $40M to their coffers. Spire exited Q1 with $62M of cash. While the guidance reduction is unfortunate, it is much less worrisome given the cash on hand.

There can be no doubt the stock would be much lower if Spire had announced the same guidance in March with ~$30M less cash in the bank.

As it is, Spire had a hiccup. Space is a tough place to do business and we got another reminder of that in Q1.

DON’T GIVE UP ON THE FINAL FRONTIER

While Spire reminded us of the perils of space, we got a more upbeat reminder of the potential from AST SpaceMobile (ASTS – NASDAQ). ASTS gave us news that showed space can also be a very good place to do business.

Beginning in mid-May, ASTS made a moon shot as investors reacted to news of two agreements. The first with AT&T (T – NYSE) and the second with Verizon (VZ – NASDAQ).

ASTS will provide satellite-based cellular service from their constellation directly to AT&T and Verizon customers. Verizon also took a stake in ASTS and committed $65M of prepayment funding.

This is still an early-stage story – ASTS has yet to launch the first wave of their communication satellites into space. But the potential of providing cellular service via satellites opens up a HUGE market. The end-game are satellites replacing roaming charges which, if realized, would give ASTS a BIG, BIG use case.

And that brings us to THE BIG ISSUE for all the space plays, Spire included. What’s the use case and how can you make money off of it?

The lack of interest in ASTS prior to the AT&T deal says it all – investors gave ASTS no credit that their space aspirations would gain traction. This even though ASTS was clearly in negotiations with AT&T – they had already signed an MOU.

Yet the stock languished for the better part of 3 years – since coming public as a SPAC it was down 75% to $2.50 before the deals were announced.

The story of space is truly a “show me” one. Show me the contracts, show me the money.

The same can be said for Spire. The market is NOW treating the stock as a show me story. Rightfully so.

While I am not in Spire today, it is gone but not forgotten. I am actively monitoring the stock and fully expect subscribers will have another go with the name.

Spire continues to partner and sign deals for its satellite data. In the last few months they signed:

- A multi-million-dollar deal with a financial firm for high-resolution weather data

- A space services deal to build and operate South Korea’s first three-satellite remote sensing image data service

- An $8.4M contract with the European Maritime Safety Agency (“EMSA”) for provision of SAT-AIS data services

- A partnership with Signal Ocean, a leader in shipping technology, to drive digitization of the maritime economy

- A $9.4M award by the National Oceanographic and Oceanic Administration (NOAA) for 8-months of weather data

These are all incremental but also none are the BIG ONE. We haven’t seen that sort of game-changer type deal that we saw from ASTS (if we did the stock wouldn’t be single digits).

The bet on Spire is that someday that deal will materialize.

I continue to keep an eye on the stars. The long-term opportunity of space is just too good. In the short term though, Spire’s Q1 update reminded us it can be treacherous as well.