It feels like the start up of the new Trans Mountain pipeline has been coming for years. Wait a minute, it has been. But now the day is truly upon us – the Trans Mountain Expansion (TMX) is expected to start up in less than 3 months!

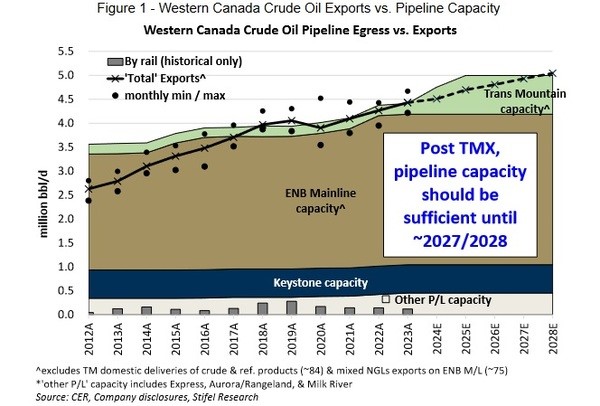

The pipeline expansion is going to add 590,000 bopd (barrels of oil per day) of capacity to Canadian oil egress (export) – with a total of 890,000 bopd that will go through the new pipeline. Overall export capacity in Canada will increase to a record 5 M bopd.

Source: EIA

On top of the Trans Mountain start-up, which goes to the west coast, there is additional US Gulf Coast capacity for even more Canadian oil exports, coming via the Enbridge (ENB – TSX) system and debottlenecking of the Express pipeline also owned by Enbridge. The Express pipeline connects Hardisty with the Midwest United States, ending in Wood River, home of the Phillips 66 (PSX – NYSE) Wood River Refinery.

Together, this is an even bigger story than just TMX for Canadian crude–and especially for heavy crude, called Western Canada Select, or WCS. For the first time in a very long time—there will be MULTIPLE bidders for WCS; it won’t just be grudgingly piped down to the US Gulf Coast (USGC) refinery complex. And there will be more than enough pipeline capacity to get it there. Supply isn’t expected to catch up until late 2025 at the earliest–possibly 2027.

You see, with only the USGC and the US Midwest as customers, our millions of barrels of WCS have been the cheapest in the world every day for 30+ years! No real competition! (WCS is today US$68.20/b, nearly a full $6/b less than the next cheapest in the Gulf Coast, Mexican Maya, at US$74.05).

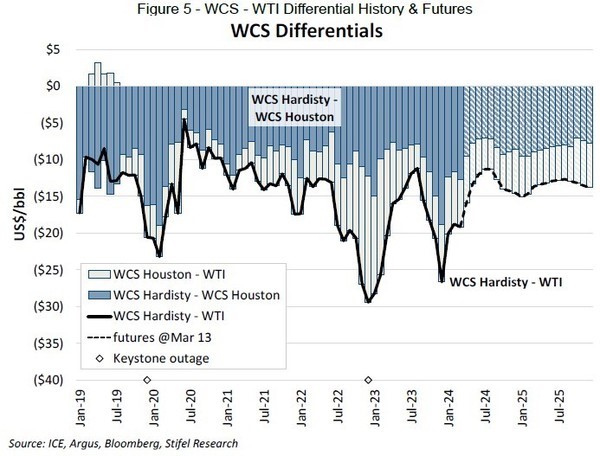

The enlarged TMX capacity changes that outlook—for a couple years anyway. Once TMX comes onstream, differentials (the difference between the price of Canadian crude and the benchmark WTI crude) should tighten to levels not seen since Covid.

(Lower differentials is an industry term for lower discounts. Just know that lower “diffs” = higher prices, higher cash flow and higher profits for Canadian producers.) Stifel, for one believes that the “window” of tight differentials is going to stay for a while – at least until the fall of 2025.

The big buyers of TMX heavy crude off the Canadian west coast are likely to be California (who have very little access to Canadian crude), China, India, Japan and South Korea, says the Canadian arm of US brokerage Stifel in a March 15 report. These are obvious Pacific Ocean customers with much more direct shipping access now. (Canadian producers did ship 170,000 bopd to Asia via the USGC in 2023! Crazy!)

So for a couple years at least, crude volumes from Canada won’t be butting up against pipeline constraints. That will even help light oil producers but–this should give Canadian heavy oil producers a long period of outsized profits–at least until the end of 2025.

Not only will TMX bring higher prices for WCS, steady competition also means lower volatility of WCS “diffs”. Better pricing and less volatility is already making a difference in Canadian heavy oil stocks—many are up 30% in the last 6-8 weeks. Stocks like CNQ-NYSE/TSX, Canadian Natural Resources, CVE-TSX/NYSE, Cenovus, MEG-TSX/MEGEF-OTC, Meg Energy are examples.

Stifel believes that the pull from the Midwest and the West Coast could mean we see single-digit differentials (again, lower “diffs”=higher prices) for the benchmark WTI-WCS spread. As you see from the above chart, this spread has been as high as US$30/bbl at times (almost $50/bbl on a few spikes) over the past few years and has averaged in the mid-to-high teens.

The good times won’t last forever. Over the next couple of years Canadian crude production will rise to fill the gap. Canada heavy oil WILL find themselves in oversupply again at some point.

Crude production in Canada has been growing at 100,000 bopd to 200,000 bopd per year and ended 2023 at 4.7 M bopd. According to Citigroup, it is expected to reach 4.9 M bopd in 2024 and increase above 5 M bopd in 2025.

With a similar increase in 2026, It is not hard to imagine a glut again by then. Oilsands production should increase a total of 500,000 bopd by 2027—a lot! (Great for provincial & federal gov’t tax coffers!)

But that is a problem for the future. For now, the heavy oil players are seeing light blue skies for at least several quarters.

Keith Schaefer