The Problem Is – Markets Don’t Always

Anticipate The Downside

Right now the Dow Jones Index doesn’t look that bad–in the last few few months there have been higher lows, and an investor could reasonably think the market could break out, not break down.

But sentiment–and a lot of economic data–is quite negative right now.

How do we reconcile this?

Unfortunately, it is not true. At least, not always.

Yes, stocks usually anticipate the news. But the caveat is this: they do so when that news is to the upside.

To the downside? That one is a bit trickier.

Here is a much lessor known market truism: stocks do not go down until they have to.

Implicitly we know this. When we talk about volatility rising, we almost always mean because the market is going down. Volatility, a measure of the sudden movement of stock prices, is subdued in a bull market.

That is because stocks methodically price in the potential that good news is coming.

But bad news? That is a completely different beast. Bad news does not get priced in until it has gotten so bad that it can’t be ignored.

A great example of this occurred during the bear market of 2007 and 2008.

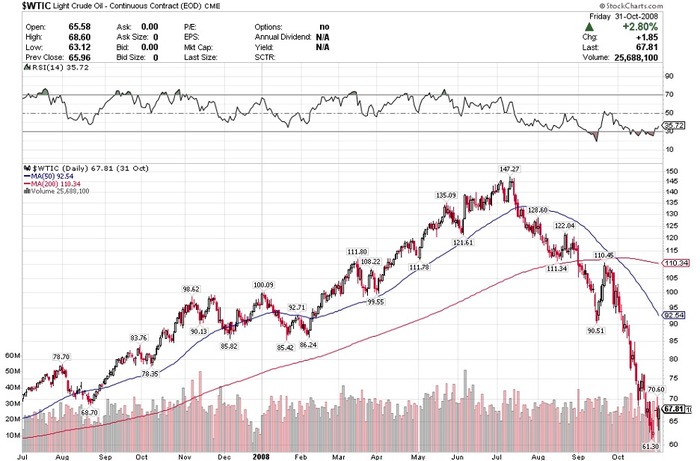

Below is the performance of the S&P 500 from July 2007 until October 2008. July 2007 is, by most accounts, when the subprime crisis took center stage. House prices began to fall, lenders began to wobble, and the first dominos in the hedge fund business closed shop.

Yet it wasn’t until late September 2008, when Lehman Brothers failed, that the stock market finally fell out of bed.

Zoom in to this chart to the period ending mid-May 2008. At that time the market was only down about 7% from the peak.

Taking the chart on its own, you would be forgiven for thinking that the market had double bottomed and was on its way back to the highs.

Yet by mid-May the burgeoning crisis was well known. It had been over 6 months since the WSJ had published its piece on the United States of Subprime way back in October 2007.

Source: WSJ.com

Bear Stearns had already failed a few months before. The stocks of money-center banks like Citigroup (C – NYSE) and Bank of America (BAC – NYSE) were looking precarious. There was PLENTY of reason to be afraid!

Yet the market as a whole was holding up well. Pockets of the market, commodities for example, were rushing off to new all-time highs.

DON’T RELY ON PRICE ALONE

Of course, what we are experiencing today is not 2008. In fact, I am always reluctant to use 2008 as a comparison to anything. The Great Financial Crisis is wheeled out every time a fear-mongering doomer wants to make a point.But the point I am making is not to compare now to then. I don’t know what is going to happen. We may be in the very early stages of the next bull market. We may not.

It is to point to market behavior. Particularly, the way the market behaves when it is in a bear market. While investors expect markets prices will always look ahead, that is not the case when the future is to the downside.

To give another very recent example, consider the banks.

The banks have had an awful month. The collapse of Silicon Valley Bank (SIVB-NASD), the deposit runs at First Republic (FRC – NYSE) and others, and now the worries about commercial real estate loans.

You know what? None of this is new. All this stuff was plain to see even 6 months ago.

The market? It didn’t care. The bank index chugged along happily. And then the bottom fell out in mid-March.

If you look at the chart of the SDPR S&P Regional Bank ETF (KRE – NYSE) from May 2022 to March 2023 you would have been hard pressed to see what was about to happen–even though all of those factors I mentioned above were already in play.

Again: the market does not care about the downside until it has to care – which in this case meant: when depositors start pulling their cash out.

PRICE DOESN’T ALWAYS TELL THE STORY

I am always wary of simply following the trend. In a bull market, it is a good strategy. Markets are pricing in the probability of future success ahead of time and so you are just riding the wave.

But in a bear market? That is a bit dicey.

When I look across sectors today, one that seems to be finally getting a little bit of love is biotech. It has been a rough couple years for the biotech stocks. They started going down before everything else and since bottoming last May every rally has been sold.

What do I make of this last bit of strength? Is this finally the move up we’ve been waiting for?

Well… biotechs are starting to get some love but this remains a blah market. And potentially still a bear market. I’m not yet ready to call it a bull market.

Until I am, I remain wary of pronouncing any sector as “off to the races” just yet.

You have to remember just how bad 2022 was for most stocks. The averages don’t truly reflect the carnage that took place.

Just like how the May 2008 rally came off of the depressed “Bear Stearns” lows of February 2008—the rally we are getting now is coming off of a period of real weakness in 2022.

Is this just a dead-cat bounce off of very depressed conditions? Are we just so happy that the bottom didn’t fall out this year that we are running back to the table without realizing it still could?

In my portfolios I am sitting on small positions. I am not out of stocks. I don’t want to ever be out because when the turn comes, I probably won’t catch it. But keeping my position size small lets me have skin in the game while managing my concern.

I am sitting on a large cash position right now. Larger than I’d like.

I don’t want to be so cautious. A lot of stocks look cheap. This is especially the case for the micro-cap names where I play.

But until I get more of an all clear signal from the market I’m just not willing to guess the trend.

Keith Schaefer