Talk about poor timing!

GFL Environmental (GFL – TSX/GFL-NYSE) saw its IPO debut on March 3rd, 2020. Smack dab in the middle of COVID and a big plunge in the stock market.

It made for a rough start for the stock. But after falling from an IPO price of C$25 to a low of $16.77 at the peak of the pandemic, it has been nothing but roses for GFL. Even as the market swooned into year-end last year, GFL bucked the trend and has since taken off toward new highs.

Source: Stockcharts.com

How has GFL avoided the ups and downs of the rest of the market?

Some of it can be explained by a flight to safety (GFL is in the waste management business, which you would expect to be reasonably recession resistant).

Some of it can be explained by their successful roll-up strategy. Since going public in 2020 they have acquired over $7 billion of new businesses. In 2022 GFL acquired 40 new business for just under $1.3 billion. The result was 32% revenue growth in 2021 and 22% in 2022

But another factor has passed under the radar of most investors.

By 2025 GFL will be deriving meaningful revenue and EBITDA from natural gas production.

That’s right – natural gas.

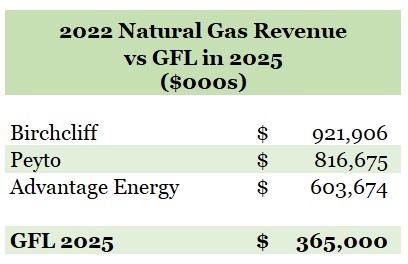

In fact, using their own expected pricing, GFL natural gas revenue will be in the same ballpark as some of the biggest gas names in Canada.

Source: Company Filings, GFL Management Estimates

Wait, what?

I kid you not.

To be sure, GFL is not turning itself into a natural gas producer. Natural gas will account for ~5% of revenue and a little less than 10% of EBITDA if all goes well. Yet it is certainly becoming a piece of the pie.

The real story here is in the “how?”

How does a waste management company generate this much incremental EBITDA from natural gas?

The answer lies in the type of gas they produce. GFL produces a special kind of gas, one they get a lot more money for it.

LANDFILLS ARE A GOLD MINE (OR AT LEAST A GAS FIELD)

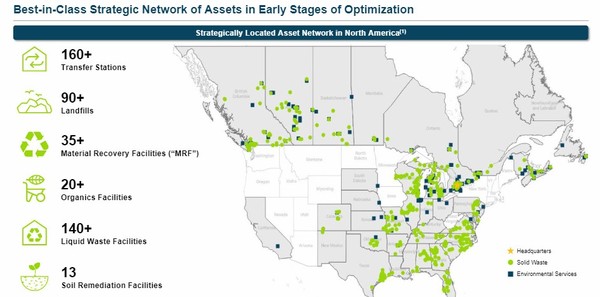

GFL is waste management company. They operate landfill, recycling and organics facilities across 26 states and 9 provinces.

Source: GFL 2022 Investor Day

Most of what GFL does is contractual waste management with municipalities. While not entirely recession proof, it is about as close as you can get.

The vast majority of the business is boring and dirty. Collecting waste, collecting recycling, managing industrial scale composts. They collect fees from municipalities for contracted waste and recycling disposal.

But those landfills contain a hidden resource.

Deep in the landfills organics are decomposing. That slow decomposition releases methane, which becomes trapped below the waste.

It is that methane that GFL is able to make money on. When extracted, it is considered renewable natural gas (RNG).

WHAT IS RNG?

RNG comes from the decomposition of organic material in landfills. Solids, yard scraps, food.

Source: EPA Landfill Methane Outreach Program

The gas is extracted with wells drilled into the waste. These wells are not that different than the conventional natural gas wells drilled into the ground.

Source: EPA Landfill Methane Outreach Program

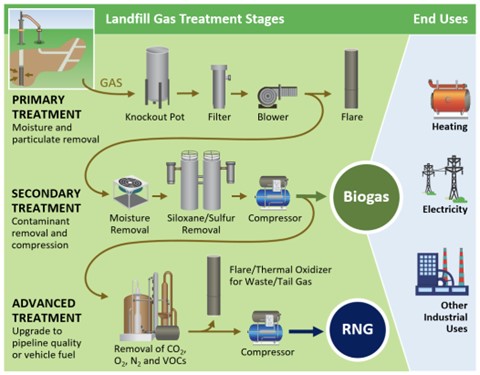

The biogas that comes out is not pure natural gas. It is a roughly 50/50 mix of methane and CO2, along with a small amount of other organic compounds.

To be useful, the biogas must be processed. Just how processed depends on the end use. For electricity production a relatively “dirty” mix of methane and Co2 is used. If it is going to be pipeline quality, much more upgrading to pure methane is required.

Source: EPA

At its most pure form, what you are left with is methane – ie. natural gas. The same stuff that comes out of the ground.

IT LOOKS LIKE NATURAL GAS,

TASTES LIKE NATURAL GAS…

BUT IT ISN’T PRICED LIKE NATURAL GAS

While the chemical composition of RNG is no different than the stuff coming out of the ground, the price is a whole new ballgame.

RNG prices can be as high as $75/MMBTU. Even with conservative assumptions you are usually looking at $20/MMBTU+.

Consider GFL’s own pricing assumption on their RNG projects:

US$26/MMBtu over the periods reflected and is equivalent to underlying price assumptions of US$2.00 RINs and US$2.50 natural gas

Clearly the current going rate – $2.50 natural gas – isn’t driving the price of RNG. The vast majority comes from the “renewable” component. In the United States (where most their projects are), that comes from renewable identification numbers (RINs).

ABCs OF RINS

I’ll be honest with you. I hate RINs. Not because there is anything wrong with them. But because every time they come up (and they come up a lot in the refining world), I have to figure out how they work all over again.

RINs are ubiquitous in the (US) refining world. US Refiners are required to attach RINs to gasoline and diesel they sell to verify that they meet renewable fuel content requirements.

If a refiner has not produced enough renewable fuel per gallon of gasoline and diesel, they have to go out and buy RINs from another refiner who has produced enough renewable fuel to have an excess.

Thus, the RIN price is determined by supply and demand.

RNG counts as a renewable fuel. The EPA has determined that RNG producers get 11.7 RINs for each MMBtu of RNG that they produce.

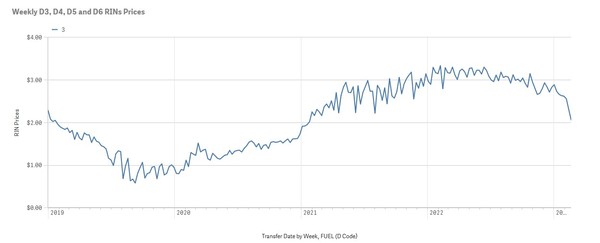

Depending on the RIN price, this can be a windfall. RINs have been as high as $3 at times!

Source: https://www.epa.gov/fuels-registration-reporting-and-compliance-help/rin-trades-and-price-information

At $2 RIN, which is roughly the average over the last 3 years, and RNG producer is getting over $23/MMBtu!

With the going rate for natural gas being under $2/MMBtu, this is obviously a windfall.

GFL – A BURGEONING NATURAL GAS PRODUCER

GFL announced their RNG strategy in 2021 at their Environmental Investor Day.

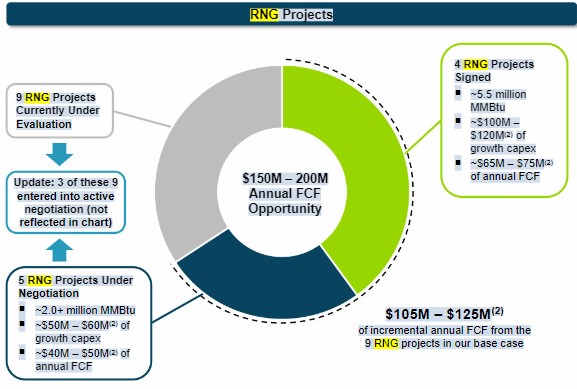

At that time, they outlined 4 signed projects, 5 more under negotiation and 9 being evaluated.

They estimated $65-$75 million of additional FCF from the 4 signed projects, and $105-$125 million from the first 9.

Source: GFL 2021 RNG Projects from Investor Day

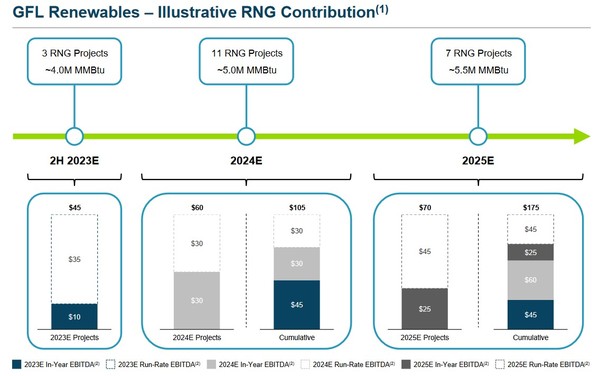

Flash forward to today and we are up to 21 projects, all of which should be producing RNG by 2025.

Together these projects will produce 14.5 million MMBtu of RNG per year.

Now let’s be clear: this is not a massive amount of natural gas. Going back to my earlier comparison, Birchliff (BIR – TSX) produced 10x that amount last year. Peyto (PEY – TSX) produced 20x more.

But on a revenue comparison, GFL stacks up much closer because their RNG gets such a high price.

RNG revenue is expected to make a sizable contribution to corporate EBITDA. GFL is estimating the cumulative run rate to be $175 million of additional annual EBITDA from their RNG.

Source: GFL Q4 2022 Investor Presentation

All the projects are MSW land fills. While the company has not disclosed locations, it appears that most or all are in the United States. They appear to be making headway on at least one project in Canada.

ONE TIME GROWTH

GFL is a very large waste management company. They have a market cap of C$16 billion and an enterprise value of over C$25 billion.

To give some better perspective on the impact of RNG, GFL did $1.7 billion of adjusted EBITDA in 2022.

They guided to US$2 billion to US$2.05 billion of EBITDA for 2023.

That means that the growth from RNG through 2025 is about a ~9% increase to this year’s EBITDA. Not huge, but enough to move the needle.

Could there be more growth ahead?

Honestly, I am not sure.

GFL owns a lot of landfills. Over 90 of them. So far we are talking about RNG from about ¼ of them.

But not every landfill is well-suited for RNG.

While all landfills release methane, to make RNG processing worthwhile, the extracted gas must be tied into a pipeline. That means pipeline proximity is key. Then there is the approval side – both for the pipeline (which is never a slam dunk nowadays) and for a utility to offtake the gas.

GFL has been coy about just how many landfills it can retrofit. When asked straight-up on the Q2 2022 conference call, they stuck to the script that they have 22 active projects.

That suggests to me that GFL is likely not going to become a renewable natural gas behemoth, building ever more production capacity each year.

I expect we will see more to come, but the easiest fruit has been picked.

Getting back to the stock – well, I have watched GFL for some time now and I always feel like I’m waiting for just a little more of a pull back.

Today the stock trades at 13x EV/EBITDA and, based on average estimates, a 5.7% free-cash-flow yield. That makes it neither cheap nor expensive.

But what it does say–is that the Market is looking for every molecule of RNG it can produce.

EDITORS NOTE: I just updated my full report on my favourite RNG play. This stock is–by far–my largest position. And it is bumping up against 52 week highs. I think the catalysts here are near term, and huge for shareholders.

Get the name, symbol and report–RISK FREE–Click Here

Keith Schaefer