Solar stocks have the potential be No-Brainer investments. In Canada, provincial governments are giving them incredible tax breaks so they start to spit out Free Cash Flow very early in their 20-25 year project life.

And that’s just to mostly—but not all the way—catch up to how many big tax breaks the US is giving them.

There is a HUGE political will for solar to succeed, so you have to make them No-Brainers. Both Canada and the US have just increased tax credits and accelerated depreciation to get more solar projects built.

My job is to go find some good management teams in junior public companies who know how to access this non-dilutive capital and make their shareholders very very happy!!

Of course, increasing solar power capacity is good for the environment/climate change etc. In fact, the only bad part—and it’s not really bad—is that the banks get to win yet again. The (much) smaller solar developers win too, but as I’ll explain, the banks really make out here. (I just like The Little Guy to win a lot, you know?)

Before I get into all this, understand—solar can be profitable without tax rebates. But tax rebates take solar from ‘that’s an okay return’ to ‘this is a no-brainer’!

Which makes sense, I guess. If you want to drive investment into renewables, if you want exponential growth, you want a no-brainer.

In the most un-technical of terms, this is what the government has done.

IT’S ALL ABOUT FAST PAYBACK

FOR THE BANKS AND SOLAR DEVELOPER

I am going to keep this simple. There are two main contributors to tax breaks for solar projects in the United States and Canada:

- Investment Tax Credit

- Accelerated Depreciation

The intent of both is straight-forward: Recover the costs of the project, and do it FAST.

If you recall from my prior post, the #1 thing to know about solar is how big the capital costs are.

Paying back capital is what limits free cash and free cash is what determines if a project gets built.

The government recognizes this and is here to help. How? By essentially paying for 30-40% of the cost themselves (by not taking taxes).

In the United State the result as much as 40% of the capital cost comes back. In Canada it is a bit less because Canada’s accelerated depreciation is a little more drawn out. But either way it is a big benefit.

#1 REBATE: THE INVESTMENT TAX CREDIT

How does the government do this? For one, with the investment tax credit (ITC).

This credit has been around in one form or another since 2006 in the United States. It was supposed to be tapered off, starting in 2020. No more: the recent Inflation Reduction Act (IRA) entrenched it for the next 10 years, which will give solar (and wind) a long run-way.

The ITC gives a tax rebate equal to 30% of the capital cost of the solar project. For a $300 million project, the ITC allows the owner to deduct $90 million of it.

I was surprised to learn that until this year, Canada did not have an ITC of their own. But now that has changed. This fall Canada met the ITC with their own Clean Technology Investment Tax Credit. Like the ITC, the credit is for 30% of capital put towards renewable energy generation and storage.

Obviously, a $90 million rebate on a $300 million project is a big deal. But it is made much more of a big deal by the way the government lets you use it.

ITC TRANSFER-ABILITY

Let’s start with the basic premise that a tax rebate is worth more the faster you can use it.

If you are a solar company, you may not have a lot of taxes to offset. It may take you 5 years to use $90 million of tax rebate (in other words have $90 million of profits to offset). Maybe more.

Enter the transferability of the ITC. With it, comes the invention of solar tax equity financing.

Solar tax equity is matching a solar project with an equity investor who has a tax liability they can offset right now.

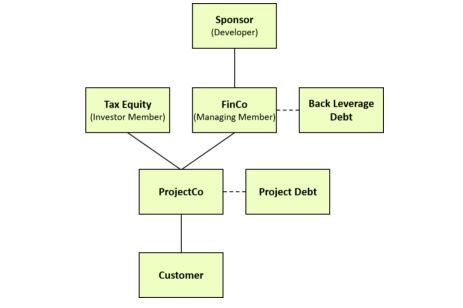

The structure usually looks something like this:

Source: Woodlawn Associates

You have a solar developer, a tax equity partner, and usually some other financing partner that lends the rest of the money (they aren’t very important for us right now).

Together these parties form a “ProjectCo”. The ProjectCo is where the solar project lies.

The whole reason for the structure is to let the tax equity partner benefit from the taxes. While you, the solar developer, still own the project.

How does it work? The ProjectCo is structured to let the tax equity partner take 99% tax ownership for the first year, the year when the tax credit is realized.

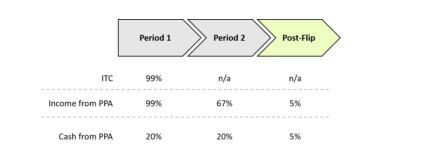

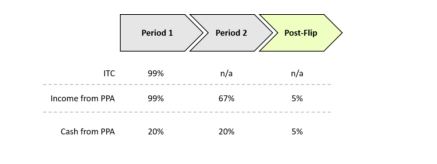

Every structure is different, but they usually look something like the table below, which shows the economic interest of the tax equity partner over time.

Source: Woodlawn Associates

For the moment, focus on the ITC row. The tax equity partner gets 99% ITC ownership for tax purposes in the first year. In other words, that entire $90 million rebate is their write-off.

What do you get as solar developer? The tax equity partner funds some of your project.

For our $300 million solar project, the tax equity partner may finance $85 million (give or take) in return for the tax credit of $90 million.

Not bad. But that is just part of it. The tax equity partner will likely finance even more. I will get to that shortly.

But first, who is this tax equity partner?

THE BIG WINNERS? THE BANKS (OF COURSE)

Well, the banks aren’t the only big winners here (the solar developer wins too, as does the environment). But it never hurts the ole page views to make the banks look like the bad guys.

The most common tax equity partners are the banks. In the United States the 3 biggest partners in tax equity are Bank of America (BAC – NYSE), JP Morgan (JPM – NYSE) and Wells Fargo (WFC – NYSE).

It makes sense. Banks virtually always make money. They have lots of taxes to pay. They are happy to share a ~10% return. They have the back-office to handle complicated structures and the capital to make large short-term loans.

The takeaway here is that this is all done to realize the tax credit as fast as possible. Because the faster it is realized, the more money it is worth upfront to the developer.

#2 REBATE: UPFRONT DEPRECIATION

The second tax rebate is accelerated depreciation. Companies in the United States can depreciate 85% of a solar project in the first year of operation (Canada has something similar, but the depreciation is over two years, not one).

In both the US and Canada, this isn’t a new credit; it was introduced in the Tax Cuts and Jobs Act of 2017 in the US and has been around since 2005 in Canada. The recent IRA in the United States extended the credit to apply to renewable storage and hydrogen projects.

Upfront depreciation can be a big benefit to developers. Like the ITC, it takes advantage of banks as partners.

Back to our $300 million capital solar project. The ITC effectively lowered the price tag by $90 million. Now, because of accelerated depreciation, 85% of the other $210 million can be depreciated in the first year of the project ($178.5 million).

In order to take full advantage of this, the solar developer partners likely deal with that same bank that gave them ITC funding.

Below is a re-post the chart I gave above, showing the structure of the partnership.

Source: Woodlawn Associates

We already talked about the ITC, of which the tax equity partner gets 99%. But you’ll notice that the tax equity partner is also getting 99% of the income from the project in the first year.

Why? So that they can benefit from the accelerated depreciation. (In Canada the structure is all the same except it’s over two years, not one.)

Here is the benefit to the tax equity partner. Let’s say they have a tax rate of 25%. With $178.5 million depreciation they can offset $44.5 million of taxes.

In return for the $44.5 million of tax-offsets, the tax equity partner will give the developer more money for the project.

How much? That will depend on factors like the timing of the financing, when they get to realize the benefits, what the discount rate is, and some other aspects of the deal (usually the tax equity partner gets some cash flow stream as well – Cash from PPA in the table above).

Let’s say you get $35 million from your partner in return for the accelerated depreciation. Add that to the $90 million ITC and you have reduced your $300 million project by $125 million – or 41%.

Not bad!

MAKING IT A NO-BRAINER

If a mildly-profitable $300 million project becomes a $175 million project, obviously that project is no longer just mildly profitable. Some might say, it is a no-brainer.

Which is what the government wants.

Together, these two tax incentives allow solar projects to realize a lot of tax benefits right away. Which effectively reduces the cost of the project by that amount.

What does that mean for us investors?

As long as these credits exist, the mantra will be: “build baby, build”. Companies that are involved in these projects, either developers, financers or manufacturers, will all benefit.

The trick, and our job as investors, will be to find the one’s that will benefit the most.

That is my goal over the next few months. Which companies stand to benefit from these big government subsidies which are now virtually written in stone for the next 10 years?

My hope is that I can find a few big winners. Given the market we’ve had over the past year, we all could use them.

EDITORS NOTE

As an addendum, I would say The Little Guy did win once–in the early 2010s the premier of Ontario (14.5 M population), Dalton McGuinty, set out to transform the Ontario electric grid. (A Canadian premier=US governor).

They pushed out a build of wind and solar power projects. To encourage those projects, they signed 20-year power purchase agreements (PPA) with guaranteed power prices.

Flash forward a few years and it was clear that the government had made a BIG mistake. They had way-overpaid for power (2x the going-rate for wind, 3-4x for solar) to get the plants built. And now Ontario was faced with skyrocketing electricity rates. Many farmers had installed huge moving solar arrays in their yards and made big bank!!

Farmers signed PPAs as high as $420/MWh! Holy cow!

Well, a few years later the Ontario government was skewered. Deals like this saddled the province with high power prices and in large part led to the defeat of then Ontario premier Kathleen Wynne’s Liberal government (she took over from McGuinty).

In 2020 the provincial (now a Conservative premier, Doug Ford) government bit the bullet and said the government would pay for the high rates, rather than pushing those rates down on rate payers (which, given that rate payers are generally tax payers, could be taken as – po-tat-o/po-tato – but well, politics…).

Since then, governments have learned their lesson. Not that they should not subsidize renewables. But that they need to more discreet about it. Government is much better today at making renewable subsidies less painful.

Higher monthly power bills do NOT win votes! Far preferable are write-offs of depreciation and capital that can be transferred to 3rd parties in return for upfront cash.

That’s where the banks started to win—and win big.