North American drivers are now competing with global drivers — and global industry — for cheap American crude.

I went on FOX National Business News to explain why that is (click the link at the end to watch the interview.)

For starters, keep in mind that driving gasoline is 50% higher today than in 2008, relative to the oil price.

Put another way, gas prices right now are near the highs of 2008 (when oil was a whopping $147 a barrel.)

Yet the oil price is $50 a barrel lower today — that’s what I mean by 50% higher gas.

Why is that, exactly?

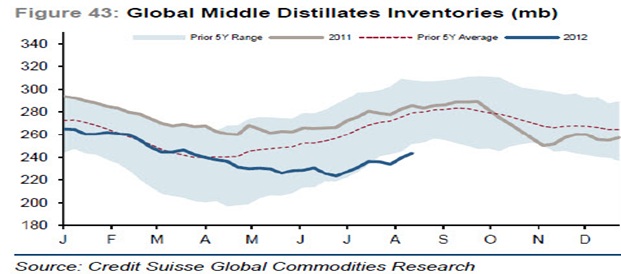

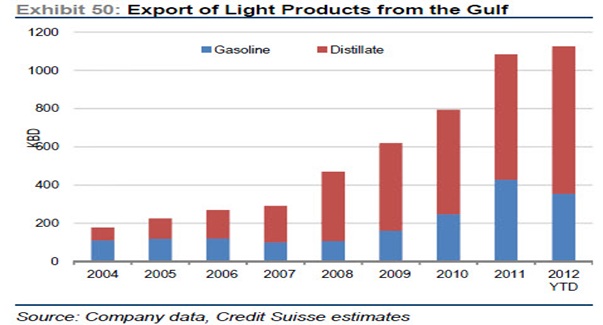

Look at these two charts — I talked about both in the Fox segment — which help explain one part of a complex story.

The first chart says there is a low amount of middle distillates globally—these are the refined oil products that are used to power and transport the world: diesel, jet fuel, home heating oil, etc.

The above chart means that either demand is low, or supply is low. But then I look at the chart below, and I see supply is high and rising—so I conclude demand must be higher (which I have to think is bullish).

US refineries are dramatically increasing their exports of light/middle distillates from the Gulf refinery complex out into the rest of the world.

And yet global distillate levels are still low. That intimates a bullish world demand case to me, and tells me we won’t see a dramatic drop in the price of oil.

Refineries export into a global market for their refined products, which are all priced on Brent Crude, while their input costs—North American crude oil—is priced on cheaper WTI, or West Texas Intermediate.

That $15/barrel price difference between the Brent and WTI is pure profit for refineries. The WTI price is so much cheaper because of the HUGE supply of new oil created by the U.S. in the fast-growing Shale Revolution.

It allows refineries to choose whatever global product has the best price for export—and that’s not always driving gasoline for North Americans. Several North American refineries are trying their best to move their processing over to other products besides driving gasoline.

But even with lots of gasoline, domestic drivers are now competing with those around the world for cheap North American crude products.

And that should keep retail gasoline prices high.

Click here for my FOX interview.

P.S. Meet me at one of these 4 conferences where I’ll be speaking in the next two weeks:

One2one Energy Investor Forums

- Calgary September 19th – Please click here to sign up.

- Vancouver September 20th— Please click here to sign up.

- Chicago Hard Assets Investment Conference September 21-22, 2012 — http://www.hardassetschi.com

- Toronto Resource Investment Conference September 27-28, 2012 — http://cambridgehouse.com/event/toronto-resource-investment-conference