What are The Pros doing in the Market? Each quarter I like to interview with a fund manager who I think has his pulse on what’s happening in the energy markets.

Today I’m sharing an interview with Martin Pelletier, one of the principals at TriVest Wealth Counsel in Calgary. I only have to manage risk for one person; me. They have to manage risk for a large number of clients which makes their take on the energy markets a bit different than mine.

Keith: Martin, you’re on the record recently as saying it’s time to take some profits on the energy sector—can you give us some colour on that? Like, do you keep a disciplined selling strategy? Do you have certain numbers and metrics you go by to do that?

Martin: For sure. One thing I look at is what commodity price is being discounted in stocks and compare that to the forward curve. This tells me whether stocks are discounting higher or lower commodity prices than the future’s price.

Keith: What’s that telling you right now?

Martin: It’s telling you that the forward curve for gas and oil is too low and is going to have to move up OR investors in stocks could be wrong and stocks could go lower to match the curve. For example, a year ago it was the opposite as stocks were discounting lower oil and gas prices which is the type of value environment we like to invest in as we can hedge out some of the forward commodity risk.

We think energy should be a core component of any portfolio over the longer term given its inflation protection abilities. But there are periods where you want to have a greater exposure and periods you want to have a reduced exposure. This is where the exercise of comparing to forward commodity prices can be quite useful. It gets you thinking what kind of risks are being factored into the stocks?

Currently, we believe energy stocks have gotten a bid ahead of themselves especially among some of the juniors. But we’re not in 2007 territory by any means. We do see more upside to the sector but there is no longer a table-pounding value proposition, that’s long gone.

Keith: Where rising tides will lift all boats.

Martin: Yeah. What concerns me is the high level of complacency in the sector among investors right now and especially among those buying junior E&Ps. People are overly confident since we’ve had a hell of a run with some juniors up 300% to 400%.

Keith: Something crazy.

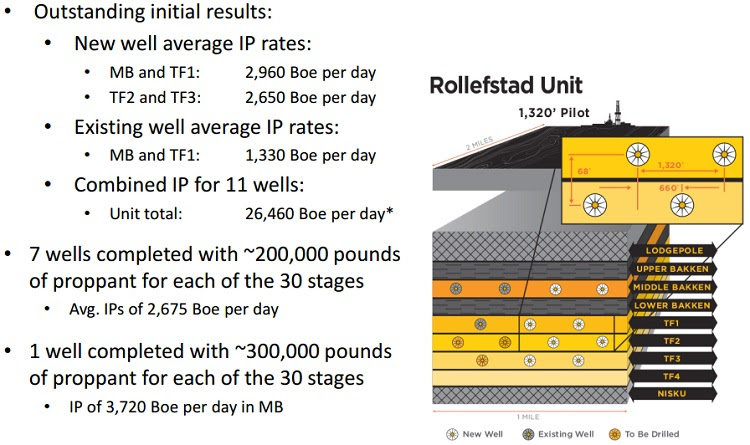

Martin: What’s crazy is that some of these companies are saying expect another double from here. They are compounding matters by returning to tactics of old with overly promotional press releases including such info as huge IP production rates on one or two days of testing.

Come on, even IP30s are pushing it in my opinion. The problem is that investors and analysts start extrapolating those production numbers and saying if they drill X amount of wells get the same results, and the wells don’t experience their usual hyperbolic decline then there will be massive growth going forward.

Proof is in the pudding and we know more often than not when you factor in risk into the equation the outcome will leave many disappointed especially since the bar has been set way to high from management.

Keith: So how do you manage risk in this environment now that most of the stocks worth owning have had such big runs?

Martin: A big focus for us is risk management. And there certainly is a lot of risk in the oil & gas sector. This means at times giving up some of the upside potential which typically retail investors and fund managers in the sector don’t like doing.

It tends to be more momentum based meaning more money comes in during market rallies and exits during corrections thereby compounding the moves to either direction. We’ll take it while the sun is currently shining but are keeping a close eye out for the first signs of a down turn.

That said, we’re starting to get a pick-up in volatility in the sector.

Keith: Yes, some days you think it’s going gangbusters and then 2 days later it’s party over.

Martin: This can be a problem in the energy fund management side as most managers are permabulls taking big swings and getting big payoffs – and it works when it comes to attracting new money.

Simply look at the inflow of those funds–up over 50% in the past year. Many forget that this style of management will often result in big draw downs during corrections often completely wiping out previous gains.

Martin: Investing in a really good management team who does good due diligence is important. They’ll investigate the risk of all the plays and allocate capital where they see the best risk returns. It’s almost like having a management team be your portfolio advisor on your energy portfolio.

The next question becomes how do you pick the better management teams? I think it comes down to consistency, humility and balance. A great management team will have consistent results that meets or surpasses expectations, humility in their forward assumptions and a balanced approach with a focus on risk-management.

Look at their assets, look at the production life and how diversified they are and their history of creating shareholder value. Then how are they managing the risk appropriately within their company? There are some really good teams in the patch that you’re going to have to pay a little bit of a premium for but they will protect that downside for you.

The same can be said when selecting an energy fund manager. Who do you want to invest with? You can invest with an energy fund manager that has the best 12 month returns right now but taking excessive risks not unlike some of the juniors. If there is a market correction how much will you lose? You’re coming in at a period of time where it’s had a nice run. If there is a broader market correction ask yourself how it that going to really relate into your energy portfolio?

Keith: That’s what separates the men from the boys at the end of the day.

Martin: All I’m saying is it’s been a great run and let’s not get ahead of ourselves. This is a time when you want to be humble and not after the fact. This is all 30,000 foot type stuff but there are ways you can protect yourself.

Number one, you want to pick the right management team; number two is you want liquidity so you can get out of your position if you had too.

Three is you want to employ some risk management and so if you’re overweight in energy at the moment maybe it’s a good time to rebalance. Take some profit off the table and not get caught up in the hype.

Finally, there are other strategies you can employ for hedging. For example, we’re pretty active in the option market as an overlay to our portfolios. We also can do other strategies in the energy fund such as going short which is useful when doing so against the underlying commodity.

What I’m generally saying is to be a little cautious here and not make a binary call just be very selective where you’re positioning.

Keith: Where do you make money in this energy market right now?

Martin: Services are the high torque play if you are bullish and believe the momentum is sustainable, however it does also have more downside risk if you are wrong with the call. Look at the moves in some of these pumpers (hydraulic fracturing companies–KS), for example, they can be quite volatile.

The midstream side would be the other end of the risk spectrum. While they’re not going to move to the same extent as the services, they have performed quite brilliantly. If you want to own oil or natural gas right now, own the commodity and not the stocks.

Keith: What factors can take the market by surprise either up or down in the next 6 months?

Martin: This feels different than the bull run we had in 2002 through 2007. It moved rather quickly and that’s not unusual but a couple of things to note.

First, energy typically rallies at the later stages of a broader bull equity market. The leaders are usually the consumers, discretionary and then it moves into industrials, transportation and then eventually works its way down to energy and finally materials.

When you have that happening in one of the longest running bull markets without a pull back since the 1960’s it causes some concern that if the broader equity market corrects, what’s going to happen to the energy sector? Probably more down side.

The other disconnect? People aren’t picking up on emerging markets. We had a really good run in the 2002 cycle through to 2008 which corresponded with the rapid growth in China.

Many, including myself, were talking about peak oil and extrapolating and all kind of demand growth scenarios and saying we’re going to run out of oil, etc. Then we have unconventional development come out of nowhere which is a real game changer on the supply side.

On the demand side you now have China another emerging countries that are not in the same position that they were in back in 2005 or 2006 and so demand is somewhat muted or not as bullish as it was back then.

Therefore, you have a scenario where the demand growth is modest while supply has changed considerably due to unconventional development – a much different picture from 10 years ago. That said, the good news is that you still have the geo-political risk and actually it may be a little more escalated then it was back then and that’s the factor keeping pricing relatively high.

So if there is any mitigation on a geo-political side then we think there can be some downside risk to commodities. That’s what is being missed I think.

Keith: That makes perfect sense.

Martin: It would be great to see China doing what it was in 2005 and 2006 and then I would be more bullish and recommend riding out this recent rally even more.…it was just the perfect situation back then. Now it’s not there anymore.

Keith: So to get back to what I’m hearing, macro situation is a little weaker and production side is a bit stronger.

Martin: A lot stronger; the production side is a lot stronger. Look at the US and I don’t need to tell you you’ve done the work. Look at global unconventional resource development that’s a real game changer.

Keith: So the current oil price is taking a higher risk premium that you figured?

Martin: Yeah.

Remember, it wasn’t that long ago every analyst was out there saying don’t touch Canada you want to go to the US.

Keith: Right.

Martin: Now it’s the opposite. Its good times, all the money is supposedly coming back into Canada because of the “better value” up here. Forget about the transportation risk because we’ll deal with that via rail. Interesting that no one talks about these things anymore. It was clearly overdone a year ago, people were being too negative but now the gap has narrowed not to the point where these things are way ahead of themselves but the value proposition has gone away in my opinion.

Keith: Right.

Martin: We’re not in that environment anymore. It doesn’t mean there isn’t further upside, it’s just wouldn’t be expecting huge gains for the next 12 months.

Keith: I guess high grade the portfolio a little bit into the higher quality management teams, little bigger names?

Martin: Yeah. If you do that don’t kick yourself if these things continue to run a bit higher. Be happy you made whatever the number is, 25% to 45% in the last year?

Keith: Anything else you think investors would be interested in hearing about? Any oddities in the market that you’re seeing?

Martin: I think I pretty much covered it. I mean I’m still bullish on the sector and still excited about the prospects but I think we’re due for a little breather here. I don’t like those companies who are over confident. I’ve been through so many cycles myself that I’ve learned that being humble during periods such as what we’re in right now can save you a lot of money.

I would like to remain very bullish like I was 12 months ago but it’s challenging when I don’t see some of the supporting factors in the market such as what we talked about with emerging markets. I think investors should keep a close eye on emerging markets because Canada is a 2nd derivative of it because of our resource exposure.

China, I don’t know if you’ve been following what’s happening there, it’s not necessarily in the best of shape with its corporate lending and financial system. If that turns and gets better then it’s really good news for Canadian energy.

Keith: Martin, thank you for your time today.

You can learn more about Pelletier and his firm at www.trivestwealth.com

+Keith Schaefer