The LNG (Liquid Natural Gas) countdown is on in Canada. Within weeks, there are three major catalysts happening that could reshape the entire economy and labour market of western Canada.

1. The British Columbia government outlines its fiscal regime for LNG

2. The environmental assessment for the Petronas’ LNG facility in Prince Rupert will be issued

3. The Malaysian national oil company Petronas is widely expected to give a positive FID–Final Investment Decision–to build North America’s first greenfield LNG export terminal at Prince Rupert.

I spent three days in Prince Rupert in mid-August to get a first hand look at the leading sites, and I also drove two hours along the Skeena River over to Kitimat, the other potential hub, to check out a couple potential sites there as well.

I met with local business people—truckers, barge operators, bankers, town councillors and real estate developers among many. I visited the community offices of Petronas and BG Group here, talking to the people there—all just to get an idea of how these LNG initiatives are viewed in the community, and develop some relationships I can call on, as the promise of these multi-billion dollar spends turn into reality.

As a quick background there are at least 14 proposals to export LNG off Canada’s west coast, and another one to export Canadian gas down to Oregon and ship it to Asia from there. (You can review them here:http://www.pipelinenewsnorth.ca/news/industry-news/b-c-s-15-lng-projects-where-they-stand-today-1.1122622 )

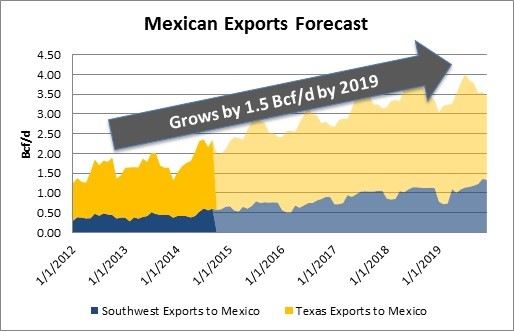

If they all get built, they would export more than the entire 13 billion cubic feet per day (bcf/d) that all of Canada produces today! Nobody expects that, but 10 years from now it is conceivable that 5 bcf/d could be leaving Canadian soil.

What could this mean for the economy? Consider that it costs roughly $7.5 billion to build 1 bcf/d of export capacity for aland based terminal. That huge cost is why there is increasing talk of using smaller, Floating LNG ships that would be built in Asia and towed over to Canada’s west coast.

I can’t think of another town in North America—certainly in Canada—that has the “optionality” of the Prince Rupert area. It’s a town of only 13,000 people, and $15 billion could get spent here in the coming 7 years. It’s actually on an island, but only by a normal sized bridge you would see on a highway overpass.

The town was founded in 1910 but really only grew after the American army built hundreds of homes in 1942, and built the road that first connected Prince Rupert to the rest of Canada—all in the name of getting US troops and armaments to Alaska to fight the widely expected Japanese naval invasion (which never came).

The two main industries of yore—fishing and forestry—have fallen on hard times. The town was re-invigorated in the early 2000s with a new deep port—one of the most modern and efficient in the world. It’s a direct ship-to-rail facility that can have a full train leaving for Chicago or Memphis—where 80% of the port of Prince Rupert’s cargo goes—in one day and be in those cities 96 hours after that.

There is a lot of room for expansion at the port. It’s deep and it has lots of protected coastline.

But the town doesn’t appear to be that excited about LNG just yet—and that is probably a good thing. A common—almost universal—comment from people was that the townsfolk are used to big companies promising prosperity, and not delivering anything.

Despite a shiny new port, the town’s infrastructure is in quite a state of disrepair. While housing prices and rents are up recently, they don’t compare to the jump that nearby Terrace BC (90 minutes east) has had, or Kitimat (another 30 minutes south).

Kitimat is where Rio Tinto, formerly Alcan, has its big aluminum smelter. Built in 1954 in a way that could never happen today—two tunnels through a mountain, moving streams, etc—the entire complex is just completing a huge multi-billion dollar refurbishment, and has kept that local economy strong.

The local council in Rupert is also heavily weighted to the political left, with the online resumes of councilors saying how they want to be the guardians for the environment against industry. Yet surprisingly, nobody sees development or LNG as a critical issue for the municipal elections coming this November. The City of Prince Rupert has become active in the LNG game, trying to re-purpose Watson Island, where an old pulp mill sits, into an LNG site.

One morning I took an hour long helicopter ride around Prince Rupert to see all the major proposed LNG sites—Grassy Point to the north, and Ridley Island and Lelu Island to the south. It gave me great perspective on topography and potential logistics.

I started up towards Grassy Point, which is the edge of the mainland about 15 miles north of Prince Rupert. The only road access is via a barge across an inlet onto First Nations land. As you fly close to Grassy Point, you can’t help but notice a very large, round and tall (50 metres?) hill that the proponents will have to drill, detonate and clear away.

I’m not 100% clear yet why the proposed pipelines are coming through what the inlet near Grassy Point, which the locals call the Portland Canal. It must be a lot cheaper to run these pipelines in the water.

One of the big logistical challenges for all these facilities will be the very large tides in the area—sometimes 20 feet or more, compared to 3-4 feet or less on the Gulf Coast in the USA.

Grassy Point is more exposed to the ocean than the proposed sites near Prince Rupert, so they will also have to account for the huge rollers that the ocean creates quite often.

There is a lot of work happening at Grassy Point—at least one survey crew was down there with a helicopter, and I saw multiple sites where testing of some kind or another was being done.

One barge operator I had lunch with said he is busy 16 hours a day, 7 days a week. Labour is already VERY tight in the Rupert-Terrace-Kitimat area; anybody who can or wants to work is working. For all intents and purposes, unemployment is zero in that area. And construction of any LNG facility hasn’t even started.

There is tens of millions of dollars in pre-commitment, pre-construction spending this year in the region. One new restaurant has opened in Prince Rupert. ;-)

The helicopter only took 10 minutes to fly back over the centre of Prince Rupert—which, when it’s not raining or fogged in, is snuggled beautifully up against the mountain on Kaien Island. It was a cloudy day, and the pilot dodged the clouds as moved a couple miles south to where Petronas and BG are planning to have their sites.

This is Prince Rupert on the north (front) side of Kaien Island. Flying just around the corner of that hill you would see Ridley Island.

Downtown Prince Rupert at top, and kitschy Cow Bay right underneath me

I think the best sites are in the south, despite the fact that right now, the pipelines look they are going to come in from the north. Two of the largest proposed LNG facilities—Lelu Island and Ridley Island—are very close to towns.

BG Group has, IMHO, the best site: Ridley Island, whose northern edge is just over a mile south of town. It’s a flat piece of land—I don’t think it’s actually even an island anymore as it has been developed so much–a big coal terminal is already there. It already has zoning. It has the waterfront that’s deep for an LNG carrier. It’s just out of sight from the town itself.

Watson Island in foreground with old pulp mill; Ridley Island in background where grain elevators are. I’m looking west and the land at the top of the photo is the south (back) side of Kaien Island; Prince Rupert is on the other side.

The only issue is BG doesn’t have a partner or any vertical integration—they have no upstream producing gas reserves or assets. Former Prince Rupert mayor Herb Pond is their community relations manager.

BG and Petronas are developing their LNG strategies completely opposite to each other. Petronas is completely vertically integrated in their approach, having spent $6 billion to buy Progress a few years ago, and having other Asian natural gas buyers in their consortium.

Petronas is widely expected to be the first group to give a positive Final Investment Decision (FID) to their LNG plan, and the Market expects this in November or December. I would suggest it’s going to be 2-3 months later than that. The BC government will announce their tax/fiscal regime for LNG in late October (industry is deep in those negotiations now; so it won’t be a surprise). Petronas will announce the results of their Environmental Application (EA) process in November. This is, to me, a big wild card, and the chance of something needing tweaking (one set of tweaks has already been made public) is high.

I have no doubt Petronas will say yes, but they have to say yes at the right time and in the right way, and I’m not sure that time will be by Year End 2014.

Lelu Island is also flat, and it’s truly just a stone’s throw from the 800-person town of Port Edward, about 3-4 miles from Prince Rupert proper. I could probably walk to Lelu Island from Port Edward at low tide in less than two minutes—it’s that close. And the footprint for the Petronas LNG facility takes up every square inch of that island. That’s a lot of high concrete close to homes.

The other issue Lelu Island has is that it is right at the mouth of the Skeena River, the single most important river in the northwest of British Columbia. What the Ganges River is to India and the Hindu faith, the Skeena is to First Nations here. And no LNG development is getting off the ground without their full involvement and support. If they think their fishing will get disrupted, there will be a lot more negotiating. I would expect ALL of Petronas EA issues to be marine related, and most of it around it being at the mouth of the Skeena.

Skeena River shot by yours truly

Port Edward has a separate town council–more pro-development–and Petronas has already given the town millions of dollars to begin improving infrastructure. Council has visited a Petronas LNG facility in Malaysia, with the noise issue being one of the top items to investigate—but it ended up being much quieter than the old pulp mill that shut down 20 years ago.

Late this fall will be a very exciting time for this area. I believe an incredible amount of prosperity is about to hit this region. It’s building already.

The next Big Stage with LNG will start this fall with the provincial government’s new tax regime.Then the EA for Petronas gets approved–or not. Then the FID from Petronas.

But there are challenges. High tides. Big Mountains. Tight waterways. A local labour force already full.

All the stakeholders will have to pull together to make this the success it should be.

+Keith Schaefer