TransCanada Corp. (TRP:NYSE) recently announced that repairs to its Bison Pipeline in northeast Wyoming have been completed, reports Platts.

Who is saying “America First” when it comes to oil?

OPEC is! And it means US oil stocks—especially in the Permian Basin in Texas--should have a great run in the coming months.

It’s so simple—let me explain.

The rising oil price is now pricing in a production cut of 1 million barrels...

Gold and I, we have a love/hate relationship. From mid 2019 - to mid 2020 -- I loved it. Since then, it has been a lot more hate than love.Over 30 years, I’ve stuck with gold through good times and bad (apart from stop losses that is).I have tried...

This is not a time for investors to sit on the sidelines and suck their thumbs.

Now is the time to act.

Now is the time to buy, buy, buy!

Why?

Because the U.S. Federal Reserve just released the biggest fiscal monetary policy BAZOOKA in history.

The Fed has completely taken all of the...

It’s quite plausible that The Biggest Winner in Donald Trump’s America First energy plan is--Canadian heavy oil producers.

In Trump’s “An America First Energy Plan” he laid out his vision for the country’s energy policies going forward. This plan had seven key points:

Make America energy independent, create millions of new...

Everyone in the oilpatch is now nervous that the United States could run out of oil storage capacity. This “storage issue” is now Big News, and is driving light oil prices in the US—WTI—to fresh six year lows of $42-ish a barrel.

I see a lot of copy on the...

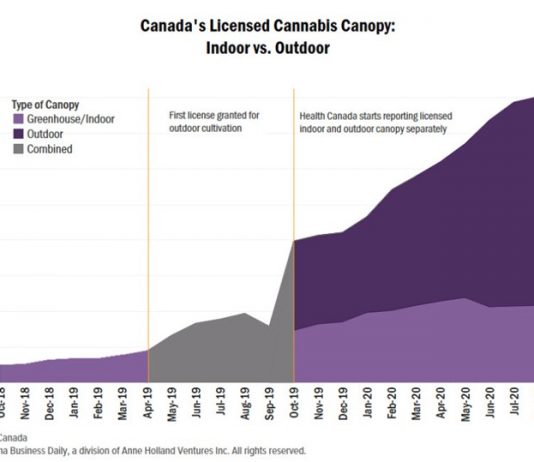

The lowest cost producer in any commodity always wins. It really is that simple.And that’s why I’m long 150,000 shares of Christina Lake Cannabis—CLC-TSXv/CLCFF-PINK.I’m about to explain to you how much I like management, the business model, the upcoming catalysts and yes, even the Canadian cannabis industry – but after...

Private capital is POURING into midstream stocks in energy (think pipelines/infrastructure).

Since the start of 2018 private equity or pension fund backed midstream and infrastructure transactions total almost $10 billion.

The list of transactions includes: Wolf Midstream’s purchase from MEG Energy (MEG-TSX), KKR buying from Meritage Midstream, SCV acquiring Paramount’s (POU-TSX)...