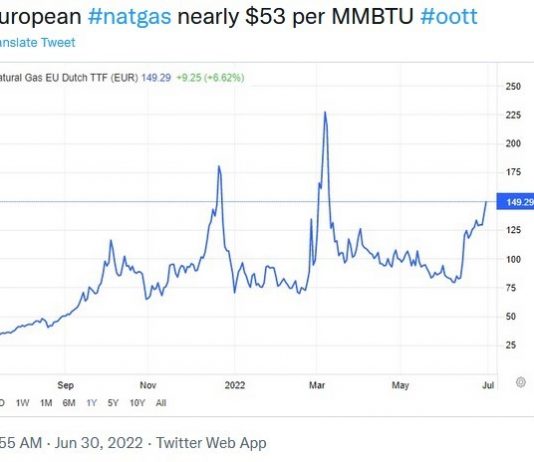

European natgas prices are starting to rip higher once again. They had settled a bit after going ballistic on news of the Russian invasion of Ukraine in February.

In February it was The War News that caused the price spike. This time Euro gas prices are surging because supply is...

I want to tell you that you HAVE to short natural gas.

I want to tell you that the $8.50/mcf natural gas that we saw this week is crazy.

That the price is going to come down hard. The market is hugely backwardated--meaning prices are much lower in the months farther out on "the strip".

The easy...

The Set-Up: In February 2014 I wrote a story on how the US arm of brokerage Raymond James saw a lot of negatives for Canadian natural gas. Longer term that could be true but in this article OGIB guest writer Shaun Polczer—who was formerly an energy writer at the Calgary...

Fertilizer stocks have been on a tear.

This is just the start of a major move. These stocks are going to have a long runway.

There multiple tailwinds behind these companies——each of which are going to be supportive for years to come.

It all starts with a problem here at home.

In the...

US natgas prices have been trading near or above $9/mcf for a week now, while Canadian natgas prices actually hit ZERO for a short time recently—and on the main AECO benchmark no less!ZERO, as in $0.00. How can that happen you say, in a North American market where natgas...

Many small exploration and production (E&P) companies could still be worthless even if oil prices rise next year according to RBC Capital Markets. RBC’s recent energy note—Surviving The Downdraft--looked at the prospects for 29 US and Canadian small cap stocks.

They are what I call The Zombie Stocks—The Walking Dead. ...

Low prices, high discounts and high condensate prices are conspiring to make this The Week From Hell for Canadian heavy oil producers. Heavy oil prices are now at the bottom of the barrel.

And not to sound like a traitor, but there is a very simple way for investors to...

The Green Trade got up off the floor in the last two weeks. After a very hyped 2020 through early 2021, this has been a dead zone for investors. But from hydrogen to RNG--Renewable Natural Gas--alternative energy stocks came to life in a big way.High oil and gas prices--especially...