What is The Best Growth Story Ever–in the history of junior energy? That’s easy…it was Pacific Rubiales, symbol PRE-TSX during its heyday from 2009-2012.

Pacific Rubiales grew from 9000 bopd to 300,000 bopd from its Colombian heavy oil operations in just a few years. It was an incredible run, and made tens of millions for shareholders during that time. It was the very first pick in the Oil and Gas Investments Bulletin at $7. (Like any junior oil, you wanted to keep a 20% trailing stop loss because debt eventually forced the company into a painful restructuring.)

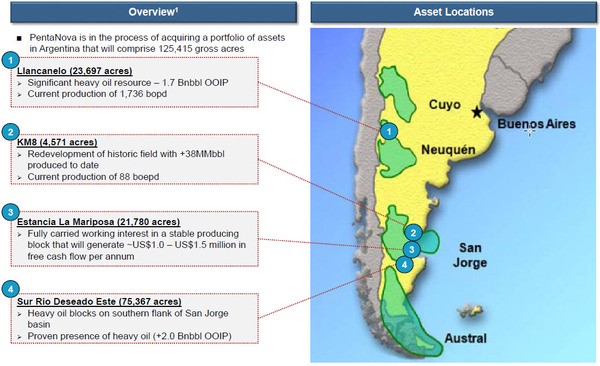

Serafino Iacono was the Chairman of that company. He is now back in the public markets with PentaNova Energy, symbol PNO-TSX, with another heavy oil play, this one in Argentina.

Much like the Colombian Rubiales field, Pentanova’ Llancanelo field is a development stage asset–no exploration. The oil is there and the engineers just have to determine the best way to get it out of the ground and get it to market.

Iacono has Pentanova presenting at our Subscriber Investment Summit (SIS) in Vancouver on October 3. With net cash, an experienced team and a big asset in front of him, he’s confident he can repeat the success of Rubiales today, with the Llancanelo field in Argentina.

When I spoke with him by phone last week, he was at home in Bogota Colombia. I asked him if he would take me through the growth curve of the Rubiales story, piece by piece–because 9000 – 300,000 bopd in four years is almost too much to comprehend.

Keith: Fino, walk me through the Rubiales growth path.

Serafino Iacono: Before it became Pacific Rubiales, it was called Rubiales Energy, and then Pacific Rubiales. That was the merger that we did with Pacific and Rubiales.

That’s when Frank (Giustra) and us formed the Rubiales Company.

But what is the parallel that we see with Llacanello. We started the company pretty much the same way. We started the life of Rubiales, Pacific Rubiales with the acquisition of a green field actually was in … That was a gas area in northern Colombia, which was the second largest field discovered in Colombia. This was in 2006.

The concession was called La Creciente. We did from the beginning, it was like a wildcat. In the first well that we did, we were doing 90 million cubit feet a day of gas in operation. The stock went from 30 cents to $7.00.

Then with Frank, we did the Rubiales Acquisition and we formed Rubiales Energy, which had the Rubiales field. It had the oil fields in hand. We paid $250 million for the acquisition to buy at the time, 30 million barrels in reserves and a production of 9,000 barrels a day.

It was in a very remote area, with very little infrastructure; there was absolutely nothing there. The oil was being carried by trucks. It was in a very remote area with very rural roads. It would take a truck to get from the fields to a regular highway…it would take them 12 hours in trucks, just to get only 150 kilometers. So imagine how bad the roads were.

We took that operation with the 9,000 barrels a day, everybody thought, including Ecopetrol, that we were nuts and we saw great potential.

What was the great potential that we saw over there? The fields, usually these deposits of heavy oil are massive. They’re not small areas. They’re very, very large sedimentary deposits. We knew that this thing was going be massive.

So, first thing we did, is we took over the operation and looking at the 2-D seismic and a little bit of 3-D seismic, we determined very quickly that it was very shallow oil, very good oil, very easy and there was one great advantage that it was a water driven reservoir.

So, lots of pressure, lots of movement for the oil to come out. You could cold flow and recover the oil easily. We told Ecopetrol in the first year of operation, Ecopetrol said, we don’t believe in the deposit, you do it at your sole risk.

We started doing drilling in the area and we brought in three machines that started drilling, consequently and what we did different than what they were doing … They were doing only vertical wells. We went in and we did something that hadn’t been done in Colombia frequently, which was horizontal drilling, which we had done in Venezuela many, many times.

The horizontal drilling did one thing. It took a well that was doing 150 barrels a day, which was good, because we were doing one kilometer, two kilometer wells, horizontally. because we were covering more area. We took the same 150 to 2,000 barrels a day, simply from changing technique.

And so, we took this thing over. We expanded the area and then we started doing drilling in different areas never drilled before; pattern drilling every kilometer or two kilometer a well, so that we started calculating how much oil there was over there. And out of the 20, 30 million barrels of oil that was in the area, all at once we found ourselves with 400 million barrels of oil in place.

That changed the story of the company.

I’m telling you this whole thing, because it’s important for you to understand, and then I’ll bring you to the parallel of where we are in Argentina with Llancanelo.

____________________________________________

Register for the 7th Annual Subscriber Investment Summit TODAY!

Tuesday October 3, Vancouver B.C.

Presenters 9 am – 4 pm

Click HERE to reserve your space!

____________________________________________

So we developed our gas fields. We created immediate cash flow, because gas was immediate cash flow. We took a production that was a small production, unprofitable at the time in rubiales and we said ‘Within five months by drilling and doing our horizontal drilling, we can take this production from 9,000 to 35,000 barrels a day’, which we did.

Then once we understud the deposit, it was just a cookie cutting operation. We started drilling more, we raised more money and with the money, what we did was expanded the production.

We took the production to 85,000 barrels a day in the 2nd year of operation . But still with zero infrastructure. At that point, we were carrying 85,000 barrels of oil a day with trucks, 2,500 kilometers to the coast. It was literally a moveable pipeline. It was becoming so inefficient and so cumbersome that we decided that we were gonna build a pipeline.

We did it at our own risk and we built a 300 kilometer pipeline that connected us with the canon-limon pipeline that went to the coast, and that opened up for us then to take the production, increase the production from 85,000 barrels to almost 250,000.

Then we went to Keifa, the extension of Rubiales. We expanded Kipa, that had all but been written off by Ecopetrol. Then we did an additional production in there and we took the full production to 320,000 barrels a day . This was done over a course of four years, we did all of that.

The company made so much money and then we started building infrastructure, ports, everything so that we could be self sufficient in carrying the crude, because there was zero infrastructure in Colombia.

What is the parallel story over here? When we did PentaNova, PentaNova was being created under the same model and the model was we wanted to get some concessions that would give us immediate cash flow and it would give us a good position that strategically in the country of colombia.

In Colombia, I didn’t want to go for oil because of all the challenges, security and things. The best area for us to go and the biggest growth that I saw in Colombia was the gas. So we went after a bunch of gas concessions that were underpriced at the time because nobody was investing money when we started acquiring these concessions.

Last year, it was the worst year in oil. Nobody was buying anything in Colombia. We took advantage of those low prices and we took Maria Conchita, which we’re gonna start drilling the next two months. We took Sinu-9, two of the greatest fields in gas, developement one right next to Canacol where Canacol is producing 180 million cubic feet of gas a day.

180 million cubic feet of gas a day is the equivalent to 30,000 barrels a day of oil. So we took strategic areas with production, near production, 90% chance of finding gas and we established a front in Colombia in the natural gas, where we see the growth.

But I wanted to have the same story and looking for a concession that had critical mass in Argentina. The concession that had the critical mass to me, outside of Colombia we found Llancanelo.

What does Llancanelo have in common with Rubiales? It’s the same thing, 3 billion barrels of oil in place 300 million barrels recoverable. It’s a concession that has been known and studied for the past 36 years. It produces 1,800 barrels a day. It flows cold. It’s got even better infrastructure than Rubiales, because it’s seven kilometers off a main highway with an airport and 30 kilometers from a pipeline to connect.

Best of all, a refinery 330 kilometers away in the north that receives all that oil and needs that oil, because every oil, it’s used for deep conversion refinery. The refinery need that kind of oil.

I looked at this massive concession, 50% owned by YPF and 50% owned by … Well, 41% owned by a whole bunch of small guys that didn’t have the money, or it was part of a portfolio that had become an orphan, because they always wanted to put money in easy things, not things like heavy oil.

I took advantage of that, consolidated that and with the idea that this was another Rubiales field. We took the most conservative approach. When we were producing in Rubiales, our recovery rate from the oil in place was 18 to 22%. In Llancanelo, we took a conservative approach and said, “Let’s not do anything special. Let’s say that we can only recover 10% of that oil in cold flow. 10% of that oil out of 3 billion barrels of oil in place, certified, it’s 300 million barrels.

Remember, that we paid for 35 million barrels, we paid $250 million at the time to the owners of the Rubiales field. This acquisition we did it with $25 million less than … $20 million in cash and the rest in shares. We are buying 150 million barrels of oil that cold flows. I still see huge potential up-side to produce more then 300 million barrels.

We bought if for less than 50 cents a barrel. So by me looking at this thing and taking over this company, now what we’ve done is we’ve consolidated ourselves in being a one decision maker with a partner that is YPF, that is the 800 pound gorilla, who loves the idea, was happy to come in and be our partner, because they know our experience in heavy oil and our understanding of heavy oil between (PNO President) Gregg Vernon and (Head of Argentine Operations) Warren Levy, between what we did in Rubiales.

Gregg Vernon did that in Argentina with heavy oil and he sold it very successfully, so we took all of this and I see the same pattern that I see in the Rubiales field.

This thing will start with us going … In the next six months, seven months, we’ll probably go to 5,000 barrels a day, 6,000, slowly until we understand what’s best drilling technique we will use . Obviously, we know that horizontal drilling works, because its been used there .

What we do now is do a test, our drilling by doing the multiple lateral drillings that will liberate more oil and have better recoveries and go two miles vertical in length, we must do that first. Once we test and we know that we can recover 1500 to 1,800 barrels a day from the multiple layers, we then will start drilling in the pattern another 20, 30 wells.

Remember that one of these wells is going to drill 12 parallel wells. So when we do 17, 20 wells of this thing, what you’re doing really, you’re doing 250, 300 wells underground. So you drain a lot of the deposit.

What’s the difference between Rubiales and Llancanelo? Rubiales was a water driven reservoir. It had some good news and some bad news. Good news is that they had a lot of pressure, so that the oil flew a lot easier, okay?

The bad news was that the more oil you took out, more water you were taking out and then all at once you have a problem with disposition of water out of these deposits. They become impossible to manage. For every barrel of oil at the end of the Rubiales fields, we were taking 50 barrels of water outper 1 barril of oil.

So Llancanelo doesn’t have the water driven reservoir, but Llancanelo’s got a great advantage. Rubiales was pay zone was 30 meters thick, the area, between 15 and 30 meters of oil. Llancanelo is 190 meters thick. It’s a gigantic field and it’s got another layer that hasn’t been tested that most likely’s going to double those reserves.

It’s not a water driven reservoir, that’s the bad news, but the good news is that it’s got a very low water cut. It’s got less than 20% water cut. We believe that the maximum that it’s gonna achieve is 25% water cut, for the life of the deposit, so very little water, which means that, at one point, once you start easy oil with cold flow, you will probably get the rest of the oil with steam or with some polymer or some other technology.

But we are going to have a massive deposit that we–very quickly, with very little money–and what I mean by very little money, all the infrastructure is in place. I have to do a 33 kilometer pipeline, but that costs no more than $20 million to do a 33 kilometer pipeline, I’m talking about eight inch to twelve inch pipeline. You bring in night crews that go in to the refinery. You mix it with the heavy oil and you take the heavy oil and you blend it and you take if from 14 degrees to 21 degrees.

Talking about the quality of oil, Llancanelo is a better oil than Rubiales. It’s got less than 2% sulfur, so it’s a very low sulfur oil. It’s 14 to 16 degree oil normal viscosity, so it’s better than Rubiales, because Rubiales had 11 degree oil. This thing over here it has 14 to 16, so it needs less dilutants to take it to 22.

So it’s a lot more economic to develop.

It’s massive. I think that within the next four years of drilling Llancanelo, we’ll be able to take the production to 100 to 120,000 barrels a day, which means that it’s 60,000 barrels net to us and we can do this for the next 20 to 30 years and still have more.

Keith: Wow, that’s an amazing story…and an amazing goal for Argentina if you can bring it all together in that kind of short time frame. How do you see the KM-8 asset developing?

Iacono: KM-8 is strategic. KM-8 is light crude. It’s in an area where YPF is also working, and it’s taking light crude facilities.

What will get interesting with that is…that I can do swap with a light crude from KM-8 with YPF that it takes into the refinery and use that as the blend, so that I don’t have to go buy blend on the market. I’ll do a swipe of my blend, which is a 34 degree with the blend that comes into the pipeline, so that we have a full cycle of light crude, heavy crude that we can blend and then all the infrastructure in place with our partner in both concessions.

In a nutshell, that’s the story.

Keith: That’s a great story, Fino, and I don’t think investors understand what you did before, only a few short years ago, and what you’re planning now. So thank you. And thank you for coming to Vancouver on October 3 to tell your story directly to our retail audience.

Serafino Iacono: I’m sure it will be a fantastic day. If you need any more information, go on the website and look at the success story that Rubiales was.

Rubiales was a success in the gas. I believe we’re going to be a success in the gas, a ‘money’ discovery. It’s not a discovery, it’s a development and Llancanelo is a world class deposit. There is no doubt whatsoever.

What is the only question? How do we take it out? We know horizontal drilling works. How big do you want to be and how much oil? How fast do you want to get out? And that will be the question–how the technical part gets done on this and that’s what we’re going to do.

Keith: Fino, thanks so much for your time today. Look forward to seeing you October 3 and getting an update then.

Serafino Iacono: Thanks, Keith. We’ll talk to you, okay?

The Subscriber Investment Summit ‘sells out’ every year (even though it’s free to attend–we have to close registrations ;-) ) REGISTER TODAY–RIGHT HERE.