The Obvious Trade That The Entire Market Has Missed

It is as plain as the nose on your face but it has been missed by virtually everyone, especially the analyst community. Yesterday (Monday) was the first time I saw an energy analyst on TV talking about this issue.

There is a surge in the level of Canadian oil production on its way in the coming weeks that is catching the market completely off guard.

This production surge isn’t something that might happen, it is a certainty.

And there is a great way to profit from this.

I’m amazed this hasn’t received more attention–the size of the production increase is staggering.

There is a lot of attention on how much additional oil production that Iran might be able to bring back online in the coming year…well, that same 500,000 barrels of oil per day (bopd) increase is coming this quarter–from Canada.

In fact, we could be talking about a production increase of almost 600,000 bopd.

So forget about the end of Iranian sanctions which has the attention of the media–here is the next big disrupting event in the oil markets. And I’ll show you how I’m profiting from it.

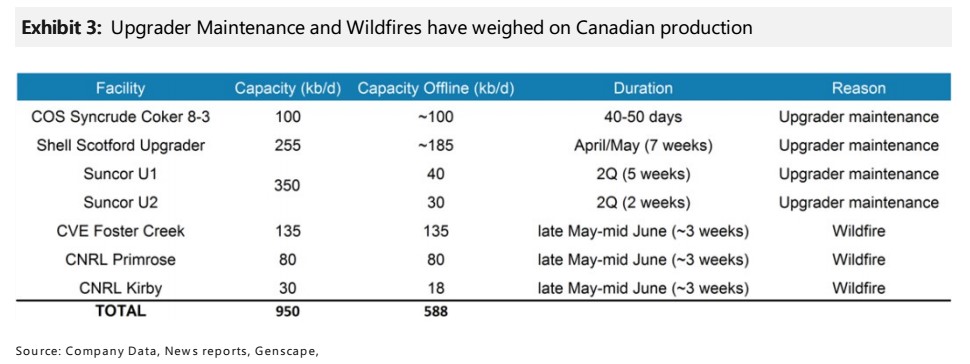

This spring, refinery maintenance and wildfires in western Canada choked out roughly 400,000 bopd of production that was heading to the US refinery system. But that’s mostly under control now. Now that Canadian production is coming back–as this chart from Morgan Stanley shows:

As I said, there is no speculation involved here. This is happening folks, and it’s happening now. That’s the #1 reason why US oil inventories are up in the middle of the summer this year–when they’re normally down.

Most of this Canadian production flows to US refineries via the Midwest–right beside the Bakken. Canadian and Bakken oil prices will now go back to competing for refinery and pipeline space.

It’s a race to the bottom for regional oil prices–just like 2012.

There has been no mention of this production surge in the mainstream media and I have seen exactly one analyst report that referred to it.

That has created a tremendous opportunity for those of us who are prepared for what is about to happen. And it just so happens I’ve got the perfect stock to profit from the surge in Canadian oil production and its negative impact on Canadian and Bakken oil prices.

This company has input costs that are entirely determined by the price of Canadian and Bakken oil. Meanwhile its revenues are based on Brent oil pricing.

The wider the Brent and Canadian oil differentials get from Brent, the more money this company makes. Those differentials are already starting to trickle wider as some of that oil is beginning to have an impact.

Over the next three to six months this company’s profits are going to explode.

But that’s just the icing on the cake. The cake is the dividend this stock pays out–double digit yield. And it has very manageable debt. It is a sound company that I owned back in 2012 as it made its First Big Run, from $14-$33.

Yes, this company is already sporting a double digit dividend yield without the benefit of Canadian and Bakken differentials widening.

But if I’m right and those Canadian and Bakken differentials really start blowing out–getting BIG–the market will rush into this stock in a hurry.

That is why NOW is the time to act on this, before everyone else gets wind of it.

I’ve prepared a full report on this double digit yielding company that is starting to benefit from the Canadian oil production surge.

For a limited time get the name, symbol and my full updated report RISK-FREE by clicking here….

Keith Schaefer