Analysis on Petrolia, Corridor Resources, and Shoal Point Energy

Dear OGIB Reader,

When I say “Atlantic Canada,” I bet that shale oil is not the first thing that comes to mind.

But as the global shale revolution continues in the energy patch, prospective shale targets – once written off as a waste of time and money – are being dusted off and re-tested everywhere – including Atlantic Canada.

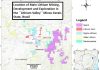

The stock of Petrolia (PEA-TSXv) jumped from 50 cents to $2 in a week in early February 2011, when they announced the results from an analysis of their and Corridor Resources (CDH-TSXv). They’re looking for a partner to develop the Macasty shale on 250 km long Anticosti Island in the Gulf of St. Lawrence. It looks huge – covering almost 75% of the island.

And Shoal Point Energy (SHP-CNSX) is testing the Green Point oil in shale play at Port Au Port Bay on the west coast of Newfoundland. What intrigues me about Shoal Point is the potential thickness of the shale formation here.

The Macasty shale on Anticosti Island has been known for years or decades – it is basically the same as the Utica Shale in Quebec, except the shale wasn’t buried as deep. The deeper shales are in the “gas window,” and the shallower ones are in the “oil window.”

The Macasty shale also sits on top of another formation that has been produced from before – the Trenton Black River (TBR). So the industry has drilled through the Macasty many times to get to the TBR.

“We always knew it was organic rich,” says Tom Martel, Ph.D and Chief Geologist for Corridor.

“We took a core of the Macasty as we drilled for the TBR. Since last summer we have been having that core analyzed by Weatherford.”

Martel says they take samples of the shale and put it in canister, and see how much gas is coming off rock. They test the porosity and permeability, and they extract the fluids in the rock – oil gas and water, and do a rock analysis, checking the Total Organic Content (TOC) and the “vitrinite reflectance.”

All these numbers came back with values that suggest the Macasty shale could be a productive zone for oil.

Martel says they took it to Winter NAPE (the North American Prospect Expo, an industry conference in Houston each February) and to London England, and people are excited about the play.

“We have very good results and there is a lot of oil in place on that island,” says Martel.

“You can see that there’s oil in the rock,” he adds, and says the shale is quite brittle which is good for fracking.

“Our next stage is getting a partner. (This play) is going to take some evaluation and some heavy lifting. We have to do some testing on these rocks; drill a horizontal well.” About 20 historical wells have intersected the Macasty on the island, so Corridor and Petrolia have a “fair idea” of what’s there, Martel says.

It has good aerial extent, and is only 1000 m depth. It varies but is roughly 40 m thick.

“There are no red flags yet, that’s why we’re excited,” Martel says. “For a piece of land that big and have no red flags is quite exciting.”

Petrolia has 50 million shares out and owns 50% of most of the 35 oil and gas exploration licenses, but only 25% on 6 of them. Corridor has 88 million shares out.

Corridor was/is the leader in shale plays in Atlantic Canada – but for gas, not oil. Their Frederick Brook Shale in New Brunswick has been independently assessed by GLJ Consultants to have a best estimate of 67 TCF (trillion cubic feet) of gas – a number so large it is off the charts for anything else discovered (that I’m aware of) in North America in such a small area. It is roughly 1100 metres thick between the upper and lower shales.

Apache Corp (APA-NYSE) has an option to earn 50% net working interest in the heart of the play – 58,000 acres – but it must commit the next $100 million in less than two months – June 1, 2011. Given the mediocre results in the second hole, that is not a sure bet.

There are several issues here – the first well was fracked with propane vs. water on the second, and used ceramic as proppant vs. sand on the second, and the first well was vertical vs. the second one as horizontal.

So – like any new shale play – it is taking several wells to run down the checklist of variables to find the optimum fracking method.

At Shoal Point, the management team there was looking over historical data on the Green Point play, which has been around for years and nobody thought much of – and realized something: “Historically, people were looking for deep conventional targets here,” says George Langdon, President. “So not much attention was paid to the shallow and intermediate hole data. We had a thorough look at that data and we realized it had good source rock potential.”

Readers, this is what is happening all over the world right now.

All the oil companies – the juniors, intermediates and seniors – are dusting off all their old files and scouring them for any mention of data that could now be interpreted to be shale or tight sand oil formations.

Follow this link for Part 2: How to play Canada’s Oil Shale Companies, where I share more insights into Shoal Point, along with another company’s developing play in New Brunswick.

– Keith